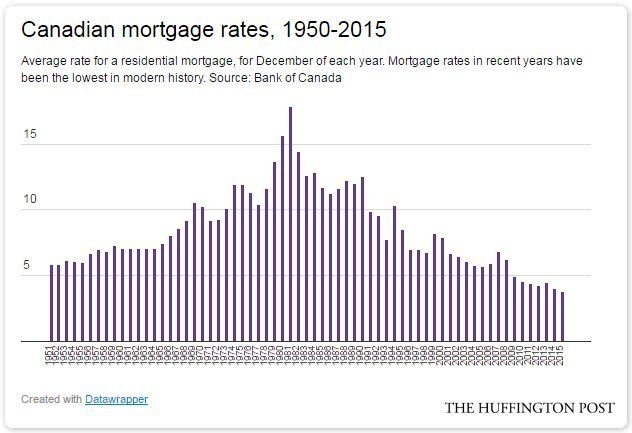

The Impact Of 3% Mortgage Rates On Canada's Real Estate

Table of Contents

Increased Buyer Demand and Competition

The allure of 3% mortgage rates in Canada is undeniable. Such low rates significantly increase affordability, sparking a surge in buyer demand across the country.

Affordability Surge

Lower monthly payments translate directly into increased purchasing power for potential homebuyers. This means:

- Lower monthly payments increase purchasing power: Buyers can afford more expensive properties than with higher interest rates. A 3% mortgage allows for a significantly larger loan amount compared to a 5% or 6% rate.

- First-time homebuyers enter the market in greater numbers: The reduced financial barrier to entry makes homeownership a realistic goal for many first-time buyers who were previously priced out of the market. This influx of new buyers adds considerable pressure to an already competitive market.

- More buyers compete for limited inventory, driving up prices: Increased demand, especially when paired with a limited housing supply, leads to intense competition and bidding wars. This ultimately pushes prices upward.

Impact on Different Buyer Segments

The impact of 3% mortgage rates isn't uniform across all buyer segments. We see significant effects on:

- First-time homebuyers: This segment experiences the most significant benefit, enabling greater participation but also potentially leading to higher bidding wars and increased pressure to secure a property.

- Move-up buyers: With lower borrowing costs, move-up buyers have enhanced ability to upgrade to larger properties or more desirable neighbourhoods. This further intensifies competition in various market segments.

- Investors: Attractive returns on investment become more attainable with lower borrowing costs, driving increased investor activity and potentially exacerbating the price increases. The lower cost of borrowing makes rental properties more lucrative.

Price Increases and Market Volatility

The combination of increased buyer demand and constrained supply inevitably leads to escalating home prices.

Increased Home Prices

High demand outpacing supply is a recipe for increased home prices across many Canadian markets. We can expect:

- Bidding wars become more common, pushing prices beyond asking prices: Properties are frequently selling for significantly above the asking price, reflecting the intense competition among buyers.

- Potential for rapid price appreciation in specific regions: Certain regions, particularly those with already limited inventory, may see particularly sharp price increases. Hot markets will become even hotter.

- Impact on affordability for those with tighter budgets: While 3% mortgage rates improve affordability overall, the rapid price escalation can still price out some buyers with more limited financial resources.

Market Instability Risks

The rapid price appreciation driven by 3% mortgage rates in Canada creates several risks:

- Increased risk of overvaluation in specific markets: A significant risk is the potential for a housing bubble where prices become detached from underlying fundamentals.

- Potential for future interest rate hikes to curb inflation, impacting market stability: If inflation increases significantly, the Bank of Canada may raise interest rates, potentially cooling the market and causing a correction.

- Importance of careful market analysis before investment decisions: Both buyers and investors should proceed cautiously, carefully analyzing market conditions and seeking professional financial advice before making large investments.

Impact on the Construction Industry

The surge in demand should naturally stimulate the construction industry.

Increased Construction Activity

Increased affordability and higher demand should lead to:

- Increased demand for new housing projects: Builders will see increased demand for both single-family homes and multi-unit residential developments.

- Potential for a surge in employment within the construction sector: The uptick in construction activity should translate into job creation across various construction trades.

- Increased pressure on material supply chains: The sudden increase in demand may strain existing supply chains, leading to potential material shortages and delays.

Challenges in Meeting Demand

Despite the increased activity, challenges remain:

- Potential for delays in project completion due to material shortages or labor limitations: Finding skilled labor and securing construction materials may become a bottleneck, delaying the completion of new housing projects.

- Continued pressure on construction costs, impacting the final sale price of homes: The increased demand for materials and labor can push construction costs higher, potentially offsetting some of the benefits of lower interest rates.

- The need for greater investment and streamlining within the construction sector: The industry needs to adapt to meet the increased demand efficiently, requiring investment in infrastructure, technology, and skilled workforce development.

Economic Implications

The impact of 3% mortgage rates extends beyond the housing market, affecting the broader Canadian economy.

Stimulus to the Economy

A booming housing market is a significant stimulus to the economy:

- Job creation across various industries related to real estate: Jobs are created not only in construction but also in real estate sales, mortgage lending, and related services.

- Growth in related sectors such as furniture, appliances and home improvement: Increased home sales lead to increased demand for goods and services related to home furnishing and improvement.

- Increased tax revenue for the government: The increase in real estate transactions translates to increased tax revenue for both federal and provincial governments.

Risk of Inflation

The rapid price increases in the housing market carry a risk of contributing to broader inflation:

- Potential for the Bank of Canada to increase interest rates to curb inflation: To combat inflation, the Bank of Canada may raise interest rates, potentially negating some of the benefits of the initial 3% rate.

- Impact of inflation on other aspects of the economy, such as consumer spending: Higher inflation can erode purchasing power, impacting consumer spending and overall economic growth.

- The importance of balanced economic policies to mitigate the risks of rapid inflation: The government needs to implement policies that promote sustainable economic growth without fueling excessive inflation.

Conclusion

The impact of 3% mortgage rates on Canada's real estate market is multifaceted and far-reaching. While it offers increased affordability and stimulates economic growth, it also presents potential risks such as increased market volatility and price inflation. Understanding the dynamics of this low-interest-rate environment is crucial for both buyers and investors. Stay informed about potential changes and consult with financial professionals before making significant real estate decisions in this dynamic market fueled by 3% mortgage rates in Canada. Make informed decisions by staying up-to-date on the latest news regarding 3% mortgage rates and their impact on the Canadian real estate market.

Featured Posts

-

Analyzing The Cubs Performance Game 25 Of The 2025 Season

May 13, 2025

Analyzing The Cubs Performance Game 25 Of The 2025 Season

May 13, 2025 -

Konflikt Ili Prosto Rukopozhatie Kostyuk I Kasatkina Na Korte

May 13, 2025

Konflikt Ili Prosto Rukopozhatie Kostyuk I Kasatkina Na Korte

May 13, 2025 -

Finansovaya Pomosch Veteranam V Eao V Chest 80 Letiya Pobedy

May 13, 2025

Finansovaya Pomosch Veteranam V Eao V Chest 80 Letiya Pobedy

May 13, 2025 -

Commodities Teams Refine Focus Walleye Cuts Credit Impact

May 13, 2025

Commodities Teams Refine Focus Walleye Cuts Credit Impact

May 13, 2025 -

Leonardo Di Caprio Es A Heroinfueggoseg 30 Evnyi Kuezdelem

May 13, 2025

Leonardo Di Caprio Es A Heroinfueggoseg 30 Evnyi Kuezdelem

May 13, 2025