The Growing Financial Strain Of Public Sector Pensions On Taxpayers

Table of Contents

The Rising Cost of Public Sector Pension Schemes

The escalating cost of public sector pension schemes is a multifaceted problem driven by several interconnected factors. Understanding these factors is crucial to developing effective strategies for managing this growing financial strain.

Escalating Pension Liabilities

One of the primary drivers of the increasing cost is the substantial growth in unfunded pension liabilities. Several factors contribute to this:

- Increased Life Expectancy: People are living longer, meaning pension payouts stretch over a longer period, increasing the overall cost.

- Generous Benefit Packages: Many public sector pension plans offer significantly more generous benefits compared to private sector equivalents, leading to higher payouts.

- Underfunding: Past underfunding of pension schemes has created a significant shortfall, requiring larger contributions now to cover the gap.

For example, several European countries are grappling with massive pension deficits. Projections from the OECD suggest that unfunded liabilities will continue to grow significantly in the coming decades, posing a major threat to public finances. A comparison of public sector pension costs to private sector schemes reveals a considerable disparity in many developed nations, highlighting the scale of the challenge.

The Impact of Demographic Shifts

The demographic shift towards an aging population and declining birth rates is exacerbating the financial strain on public sector pension systems. This trend is global, with significant implications for the sustainability of these schemes.

- Aging Populations: The proportion of retirees relative to the working-age population is increasing dramatically in many countries. This increases the dependency ratio, meaning fewer workers are supporting a larger number of retirees.

- Declining Birth Rates: Lower birth rates mean a smaller pool of future taxpayers to contribute to the pension system, further straining resources.

- Impact on Tax Revenue: To meet the rising pension obligations, governments are forced to increase taxes, potentially hindering economic growth and creating further societal pressures.

The Burden on Taxpayers

The rising cost of public sector pensions directly translates into increased tax burdens for citizens, impacting both their disposable income and the availability of other public services.

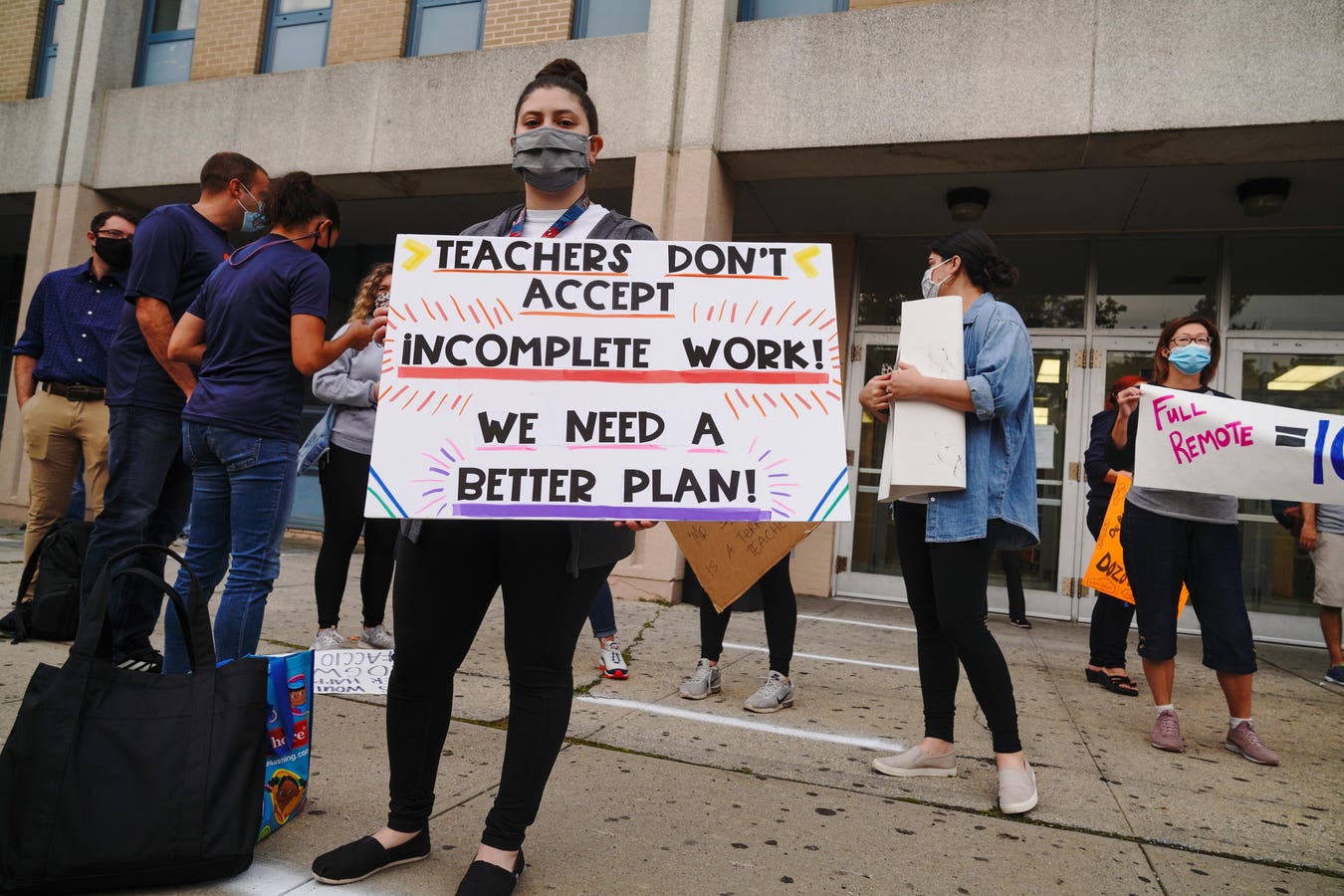

Increased Tax Rates & Reduced Public Services

The direct link between rising pension costs and increased taxes is undeniable. Governments are often forced to raise taxes to fund these escalating liabilities. This leads to:

- Higher Taxes: Taxpayers face increased income tax, sales tax, or other forms of taxation to cover the pension shortfall.

- Reduced Public Services: Increased pension spending often comes at the expense of other essential public services such as education, healthcare, and infrastructure. This creates a trade-off that necessitates difficult choices for governments. For instance, many countries are now faced with cuts to public services in order to meet their pension obligations.

A comparative analysis of tax burdens across different countries clearly demonstrates the financial impact of differing pension systems.

Intergenerational Equity Concerns

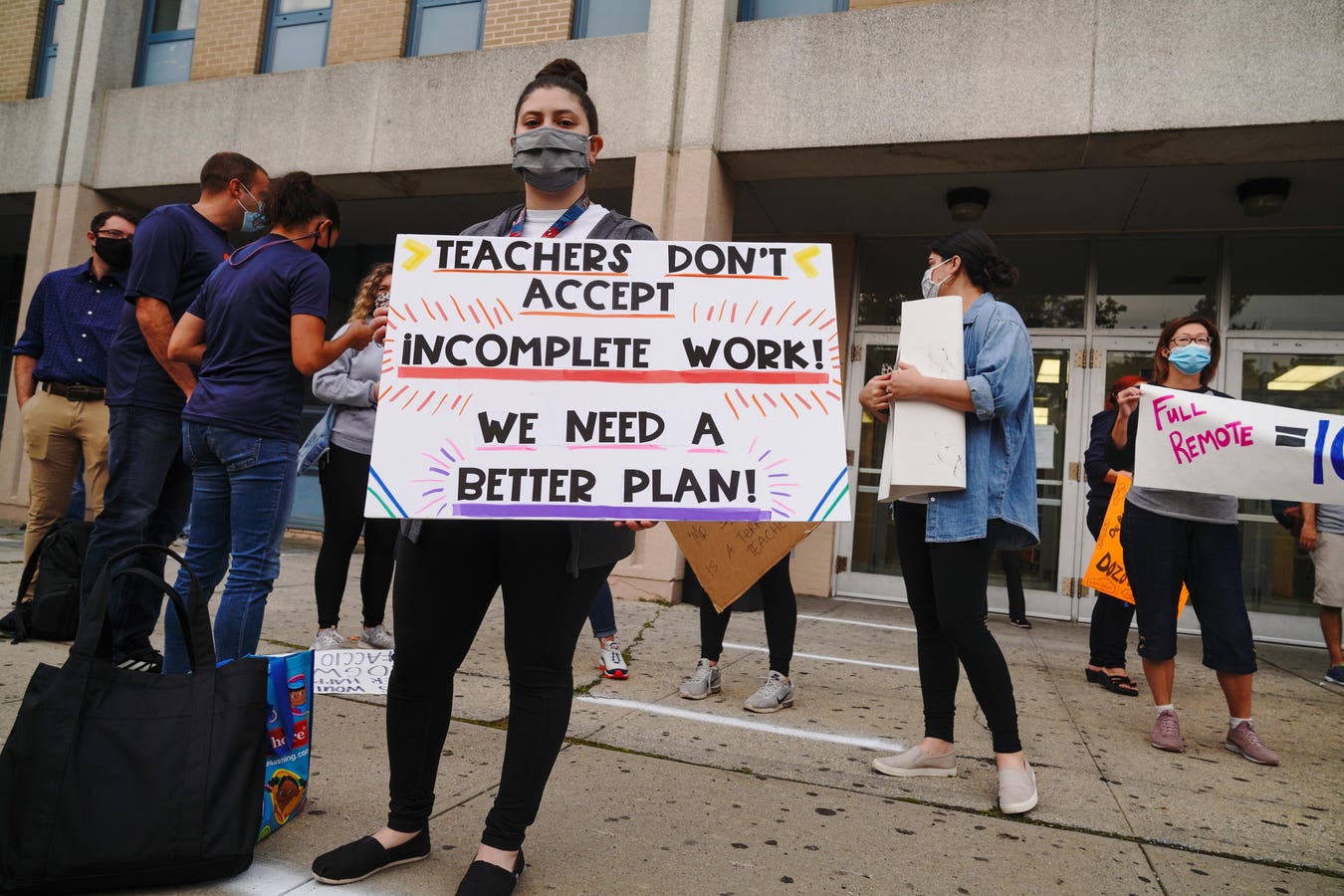

The current model of public sector pensions raises serious concerns about intergenerational equity. The burden of funding pensions for current retirees falls disproportionately on younger generations who may face significantly higher taxes throughout their working lives.

- Generational Equity: The fairness of current systems is questionable when considering the significant financial burden placed on younger generations.

- Intergenerational Conflict: The rising cost of pensions could lead to increased intergenerational conflict, with younger generations feeling unfairly burdened to support the retirement of previous generations.

- Alternative Funding Models: Exploring alternative funding models, such as defined contribution plans, could help alleviate this issue and improve long-term sustainability.

Potential Solutions and Reforms

Addressing the growing financial strain of public sector pensions requires a multifaceted approach involving both immediate and long-term solutions.

Pension Reform Strategies

Several reform strategies can be implemented to mitigate the financial burden on taxpayers:

- Raising the Retirement Age: Gradually increasing the retirement age can reduce the duration of pension payments.

- Reducing Benefits: Adjusting benefit levels, particularly for high earners, can help control costs.

- Increasing Contributions: Raising employee and/or employer contributions can help fund the existing liabilities.

- Alternative Investment Strategies: Investing pension funds more effectively can improve returns and reduce the overall liability.

Several countries have successfully implemented pension reforms, demonstrating the feasibility and potential benefits of these strategies. However, each reform has its own advantages and disadvantages, and the political feasibility of implementing these reforms varies significantly depending on the specific context.

The Role of Government Transparency and Accountability

Transparency and accountability in pension accounting and management are vital to ensure responsible use of taxpayer funds. Improved transparency and accountability can help build public trust and support for necessary reforms.

- Improving Transparency: Governments should publish clear and comprehensive information on pension liabilities, funding levels, and investment strategies.

- Strengthening Oversight Mechanisms: Independent bodies should oversee pension funds to ensure responsible investment and management.

- Best Practices: Adopting best practices in pension management from other countries can improve efficiency and reduce costs.

Conclusion

The financial strain of public sector pensions on taxpayers is a significant and growing concern, impacting fiscal sustainability and the provision of essential public services. Addressing this challenge requires a concerted effort involving the implementation of effective pension reform strategies, increased transparency and accountability in pension management, and a commitment to intergenerational equity. We urge readers to engage with this critical issue. Contact your elected officials, support pension reform initiatives, and stay informed about the ongoing debate surrounding public sector pensions to help address the strain of public sector pensions, reform public sector pension systems, and effectively manage the financial burden of public sector pensions.

Featured Posts

-

Higher Wage Trends Among Minnesotas Immigrant Population Recent Study Findings

Apr 29, 2025

Higher Wage Trends Among Minnesotas Immigrant Population Recent Study Findings

Apr 29, 2025 -

7 The Points Guide To Memorable Movie Quotes And Ballot Casting

Apr 29, 2025

7 The Points Guide To Memorable Movie Quotes And Ballot Casting

Apr 29, 2025 -

Wrexham Promoted Ryan Reynolds And Rob Mc Elhenney Celebrate Historic Win

Apr 29, 2025

Wrexham Promoted Ryan Reynolds And Rob Mc Elhenney Celebrate Historic Win

Apr 29, 2025 -

New Research Highlights The Link Between Adhd Autism And Intellectual Disability

Apr 29, 2025

New Research Highlights The Link Between Adhd Autism And Intellectual Disability

Apr 29, 2025 -

Adhd And Driving Key Findings From Vehicle Safety Research

Apr 29, 2025

Adhd And Driving Key Findings From Vehicle Safety Research

Apr 29, 2025