The GOP Tax Plan And The Deficit: A Fact-Based Assessment

Table of Contents

The GOP Tax Plan's Key Provisions and Their Projected Revenue Impact

The 2017 Tax Cuts and Jobs Act (TCJA) significantly altered the US tax code. Let's examine its key provisions and their projected revenue impact.

Individual Income Tax Cuts

The TCJA reduced individual income tax rates across the board. It also altered several deductions and credits.

- Standard Deduction Increase: The standard deduction was significantly increased, benefiting many lower and middle-income taxpayers. However, this also reduced the number of taxpayers itemizing deductions.

- Child Tax Credit Expansion: The Child Tax Credit was expanded, providing greater relief to families with children.

- Elimination of Personal and Dependent Exemptions: The elimination of personal and dependent exemptions offset some of the benefits of the increased standard deduction.

The Tax Policy Center estimated that these individual income tax cuts would reduce federal revenue by trillions of dollars over ten years. [cite source: Tax Policy Center report]. The impact varied significantly across income groups, with higher-income taxpayers receiving a disproportionately larger share of the tax cuts.

Corporate Tax Rate Reduction

The TCJA dramatically reduced the top corporate tax rate from 35% to 21%. Proponents argued this would boost business investment, leading to increased economic activity and ultimately offsetting the revenue loss.

- Increased Investment Argument: Supporters claimed the lower rate would incentivize companies to invest more, creating jobs and boosting economic growth. [cite source: Supporting economic study]

- Repatriation of Overseas Profits: The TCJA also included provisions designed to encourage repatriation of profits held overseas by US corporations.

- Projected Revenue Loss: The Congressional Budget Office (CBO) projected significant revenue losses from the corporate tax rate reduction. [cite source: CBO report]. However, the actual impact remains a subject of ongoing debate.

Revenue Projections and Shortfalls

Initial revenue projections for the TCJA proved overly optimistic.

- Discrepancies: Actual revenue collected fell short of the initial projections, contributing to a widening budget deficit. [cite source: Treasury Department data]

- Reasons for Shortfalls: Several factors contributed to these shortfalls, including slower-than-anticipated economic growth and potential loopholes in the tax code.

- (Insert Chart/Graph Here with appropriate alt text showing projected vs. actual revenue)

Economic Growth Arguments and Their Validity

The GOP tax plan was largely justified on the basis of supply-side economics.

Supply-Side Economics and the Laffer Curve

Supply-side economics posits that tax cuts incentivize increased investment and production, ultimately leading to higher tax revenue. The Laffer Curve is often cited to support this theory.

- Laffer Curve Critique: Critics argue that the Laffer Curve is simplistic and doesn't accurately reflect the complexities of the real-world economy. The optimal tax rate where revenue is maximized is highly debated and depends on many factors. [cite source: Critical economic analysis]

- Alternative Economic Models: Keynesian economics, for example, suggests that government spending, rather than tax cuts, is more effective in stimulating demand during economic downturns.

Empirical Evidence of Economic Growth Following Tax Cuts

Following the TCJA's enactment, there was some economic growth.

- GDP Growth and Job Creation: Data shows modest increases in GDP growth and job creation in the years following the tax cuts. [cite source: Bureau of Economic Analysis data]

- Correlation vs. Causation: It's crucial to differentiate between correlation and causation. While there was economic growth, it's difficult to definitively attribute it solely to the tax cuts. Other factors, such as monetary policy and global economic conditions, likely played a role. [cite source: Peer-reviewed study on economic growth factors]

The Impact on the National Deficit and Debt

The GOP tax plan had a significant impact on the national deficit and debt.

Increased Federal Debt

The tax cuts led to a substantial increase in the federal debt.

- Debt Before and After: [Insert chart/graph comparing national debt levels before and after the TCJA with appropriate alt text]. The increase reflects the reduced tax revenue combined with increased government spending. [cite source: Federal Reserve data]

Long-Term Fiscal Sustainability

The rising national debt raises concerns about long-term fiscal sustainability.

- Increased Interest Payments: A higher national debt necessitates increased interest payments, crowding out spending on other vital government programs.

- Credit Rating Downgrades: Persistently high levels of debt could lead to credit rating downgrades, increasing borrowing costs for the US government.

Alternative Policy Proposals to Address the Deficit

Alternative approaches to addressing the deficit could have been pursued.

- Spending Cuts: Targeted spending cuts could have reduced the deficit without relying solely on tax cuts.

- Increased Taxes on Higher Earners: Increasing taxes on higher-income earners could have generated additional revenue. [cite source: Proposals for alternative fiscal policy]

Conclusion: A Critical Look at the GOP Tax Plan and the Deficit

The 2017 GOP tax plan significantly impacted the US national deficit. While proponents argued that the tax cuts would stimulate economic growth, offsetting revenue losses, the actual results show a substantial increase in the national debt. The analysis presented here demonstrates the complexities of assessing the plan's true economic consequences. This assessment highlights the need for careful consideration of both short-term and long-term effects when implementing major tax policy changes. Understanding the complexities of the GOP tax plan and its effect on the deficit requires careful consideration of the evidence. Continue your research and become an informed participant in the conversation surrounding the GOP tax plan and deficit spending.

Featured Posts

-

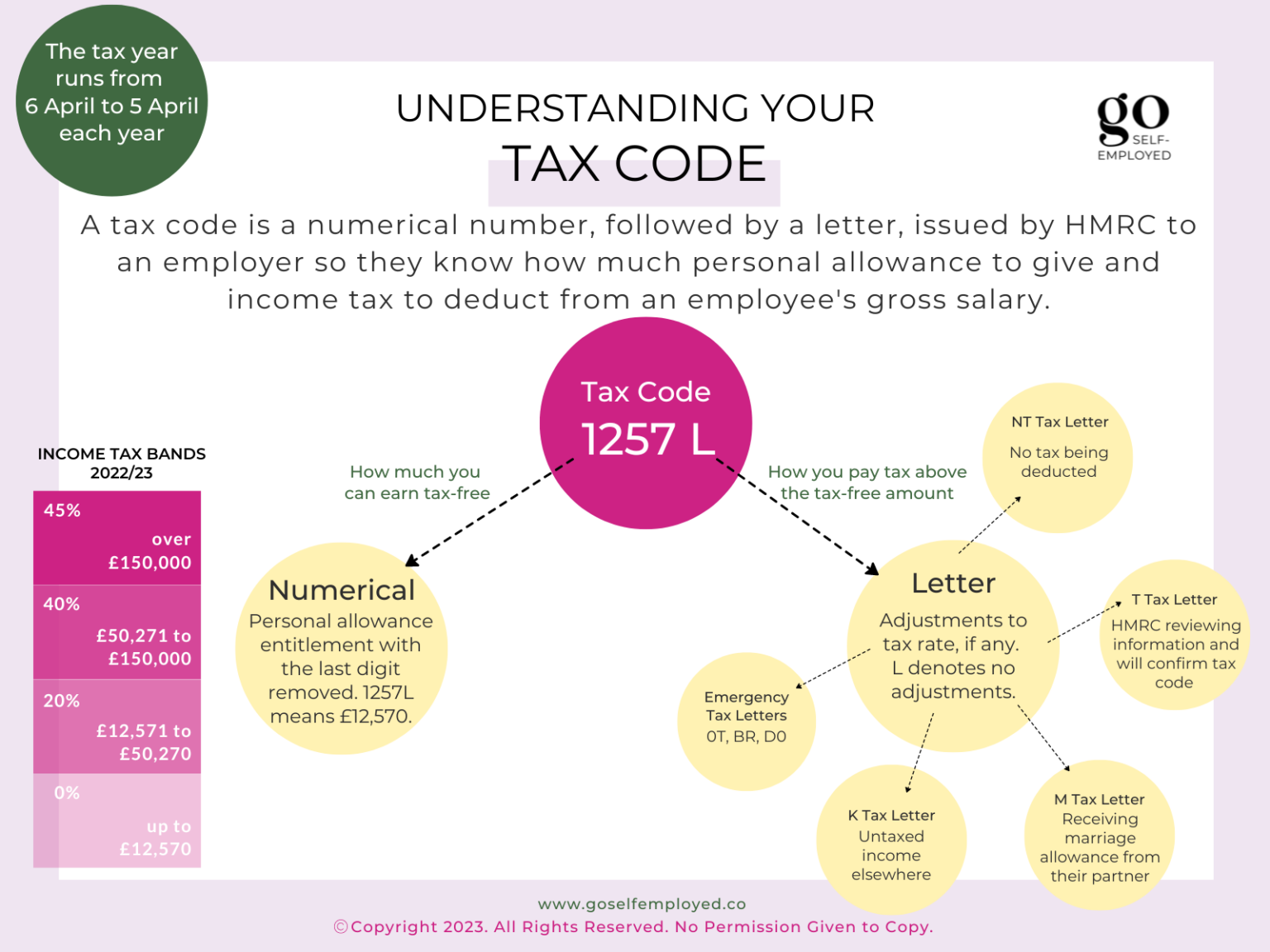

Hmrc Tax Codes Understanding Your New Code For Savings

May 20, 2025

Hmrc Tax Codes Understanding Your New Code For Savings

May 20, 2025 -

Ajax Fenerbahce Yildizini Kadrosuna Katiyor Transfer Detaylari

May 20, 2025

Ajax Fenerbahce Yildizini Kadrosuna Katiyor Transfer Detaylari

May 20, 2025 -

Public Works Ministrys 6 Billion Investment In Coastal Protection

May 20, 2025

Public Works Ministrys 6 Billion Investment In Coastal Protection

May 20, 2025 -

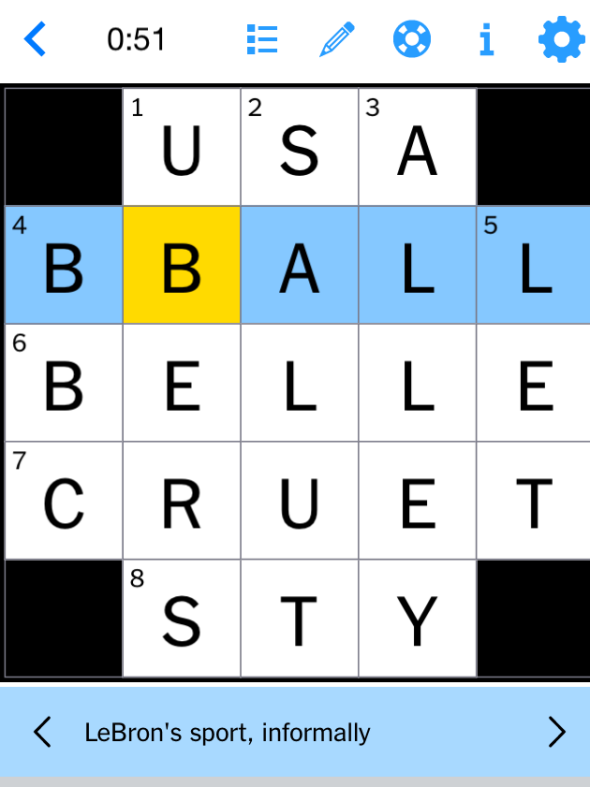

Solve The Nyt Mini Crossword March 13 Answers And Helpful Hints

May 20, 2025

Solve The Nyt Mini Crossword March 13 Answers And Helpful Hints

May 20, 2025 -

Delving Into The Psychology Of Agatha Christies Poirot

May 20, 2025

Delving Into The Psychology Of Agatha Christies Poirot

May 20, 2025

Latest Posts

-

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025 -

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025 -

Trump Tariffs Gretzky Loyalty And Canadas Statehood Debate A Complex Issue

May 20, 2025

Trump Tariffs Gretzky Loyalty And Canadas Statehood Debate A Complex Issue

May 20, 2025 -

Quick Facts About Wayne Gretzky A Concise Biography

May 20, 2025

Quick Facts About Wayne Gretzky A Concise Biography

May 20, 2025 -

Wayne Gretzky Fast Facts Key Moments And Milestones In His Career

May 20, 2025

Wayne Gretzky Fast Facts Key Moments And Milestones In His Career

May 20, 2025