The Future Of Steel: Trump's Support For Nippon-U.S. Merger

Table of Contents

Trump's Trade Policies and Their Influence on Steel Mergers

The Trump administration's protectionist trade policies, characterized by significant steel tariffs, dramatically reshaped the global steel market. These tariffs, designed to protect domestic steel producers from foreign competition, aimed to revitalize the American steel industry and safeguard American jobs. However, their impact was far-reaching and complex.

The imposition of tariffs led to increased costs for steel importers and manufacturers reliant on foreign steel supplies. This, in turn, fueled a wave of industry consolidation, as companies sought to mitigate risks and enhance their competitiveness in a newly volatile market. A potential Nippon-U.S. steel merger could be viewed as a direct response to this environment of heightened uncertainty and increased pressure to consolidate.

- Impact of tariffs on domestic steel production: Initially, tariffs boosted domestic steel production and employment.

- Increased competition and consolidation within the industry: Companies were forced to adapt, leading to mergers and acquisitions to gain scale and market share.

- Potential benefits for American steelworkers: Increased domestic production led to job growth in certain sectors.

- Concerns about reduced international trade: Tariffs sparked retaliatory measures from other countries, disrupting global trade flows.

Analyzing the Potential Benefits of a Nippon-U.S. Steel Merger

A hypothetical merger between Nippon Steel and a major U.S. steel producer could offer significant advantages. The combined entity would enjoy substantial economies of scale, leading to cost reductions in production, distribution, and administration. Access to a broader range of technologies and expertise from both companies could accelerate innovation and boost overall efficiency.

- Enhanced research and development capabilities: Pooling resources would unlock greater investment in research and development, leading to the development of advanced steel products and manufacturing processes.

- Access to wider markets and distribution networks: A combined entity would benefit from a wider global reach, opening doors to new markets and streamlining supply chains.

- Improved resource allocation and cost reduction: Synergies in operations and supply chain management would lead to significant cost savings.

- Potential for creating a more resilient and competitive steel industry: A larger, more integrated entity could better weather economic downturns and compete more effectively in the global market.

Potential Drawbacks and Challenges of the Merger

While a Nippon-U.S. steel merger offers potential upsides, it also presents considerable challenges. Antitrust concerns are a significant hurdle, with regulators likely scrutinizing the potential for reduced competition and the impact on market prices. Job displacement is another key concern, particularly if there are overlaps in operations and production facilities.

- Regulatory approval processes and potential delays: The merger would require extensive regulatory review and approvals, potentially leading to significant delays.

- Job displacement concerns and the need for retraining programs: The merger could lead to job losses in both the U.S. and Japan, necessitating comprehensive retraining initiatives.

- Potential negative impact on consumers due to higher prices: Reduced competition could lead to higher steel prices for consumers.

- Concerns about the concentration of power within the steel industry: A merger could create a dominant player, potentially stifling innovation and harming smaller competitors.

The Long-Term Implications for the U.S. Steel Industry

The long-term impact of a Nippon-U.S. steel merger on the U.S. steel industry is multifaceted. While it could boost domestic production and enhance national security by strengthening the domestic supply chain, it also raises questions about long-term competitiveness and the potential for trade imbalances. The ripple effects would be felt across related industries, such as construction and automotive manufacturing.

- Increased domestic steel production and job creation: A merger could potentially lead to increased domestic production and related job creation.

- Enhanced national security through a more resilient domestic steel industry: A stronger domestic steel industry is crucial for national infrastructure and defense.

- Potential ripple effects on related industries like construction and automotive: Changes in the steel industry significantly impact downstream industries.

- Long-term implications for trade relations between the U.S. and Japan: The merger's success could influence future trade relations between the two countries.

Conclusion: The Future of Steel Hinges on Strategic Decisions

The potential Nippon-U.S. steel merger, viewed through the lens of Trump-era trade policies, presents a complex picture with both significant opportunities and potential pitfalls. While the merger could enhance the competitiveness and resilience of the U.S. steel industry, ensuring job security and addressing antitrust concerns are paramount. The future of steel requires careful consideration of these factors. Understanding the impact of this potential merger is crucial for policymakers, industry stakeholders, and consumers alike. Learn more about the complexities surrounding the future of steel and the Nippon-U.S. merger to contribute to a well-informed discussion on this critical issue.

Featured Posts

-

Raphael Enthoven Et Marine Le Pen Une Comparaison Audacieuse Avec Tariq Ramadan

May 26, 2025

Raphael Enthoven Et Marine Le Pen Une Comparaison Audacieuse Avec Tariq Ramadan

May 26, 2025 -

Hasil Fp 1 Moto Gp Inggris 2025 Jadwal Tayang Live Race Di Trans7

May 26, 2025

Hasil Fp 1 Moto Gp Inggris 2025 Jadwal Tayang Live Race Di Trans7

May 26, 2025 -

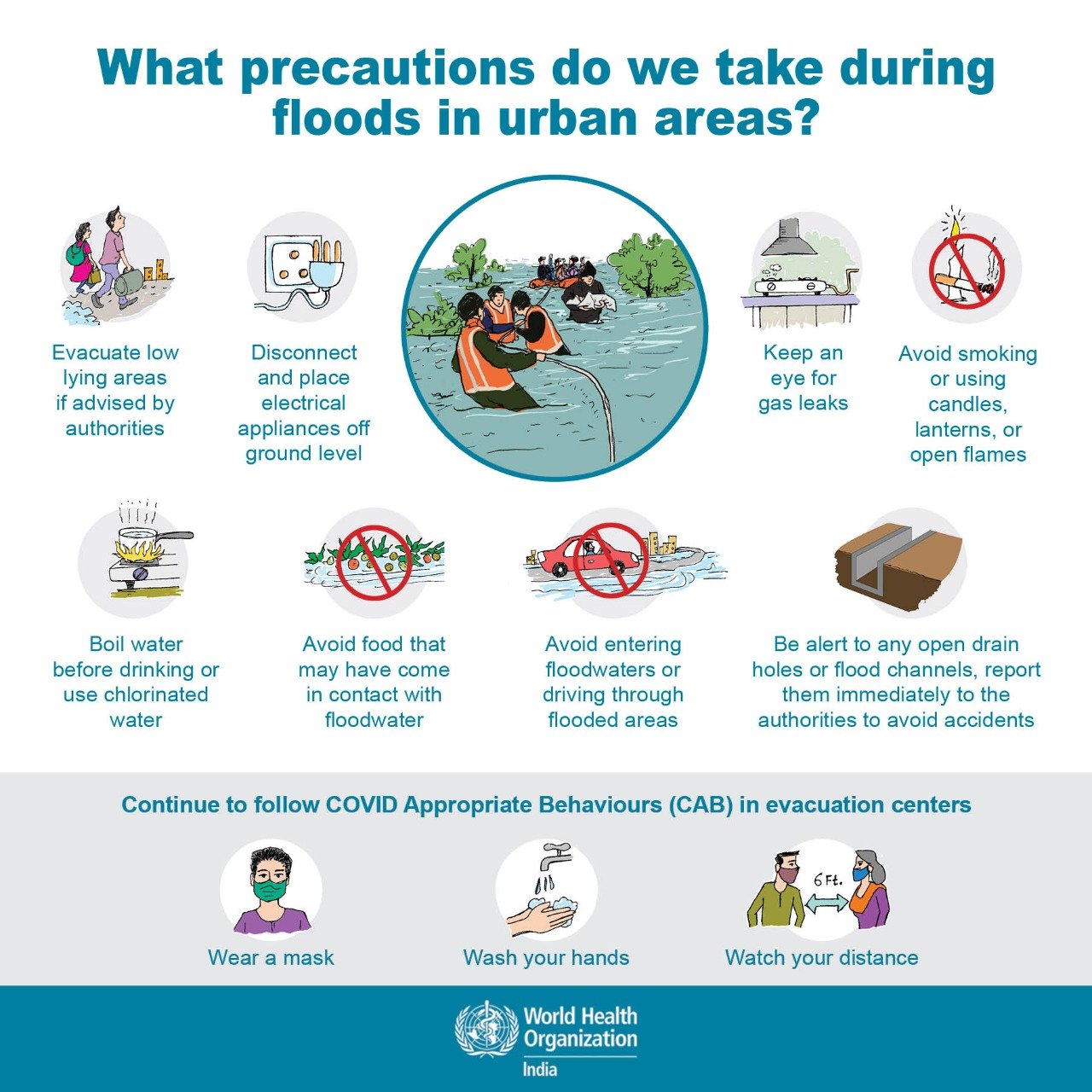

Flash Flood Emergency Causes Impacts And Safety Measures

May 26, 2025

Flash Flood Emergency Causes Impacts And Safety Measures

May 26, 2025 -

Quatre Ans De Prison Pour Le Pen L Appel Est Lance

May 26, 2025

Quatre Ans De Prison Pour Le Pen L Appel Est Lance

May 26, 2025 -

Live Streaming Moto Gp Argentina 2025 Jadwal And Link Nonton Balapan Dini Hari

May 26, 2025

Live Streaming Moto Gp Argentina 2025 Jadwal And Link Nonton Balapan Dini Hari

May 26, 2025