The Future Of Buy Canadian: Beauty Industry And Tariffs

Table of Contents

The Impact of Tariffs on Canadian Beauty Brands

Tariffs significantly impact Canadian beauty brands, creating both challenges and opportunities.

Increased Costs of Imported Ingredients

Tariffs on imported ingredients dramatically increase production costs. Many beauty products rely on imported fragrances, pigments, and other specialized ingredients.

- Fragrances: Synthetic and natural fragrances often originate outside Canada, leading to increased costs due to tariffs.

- Pigments: Micas, ultramarines, and other colorants frequently face tariff implications, impacting the cost of makeup and skincare products.

- Essential Oils: Many essential oils used in natural cosmetics are imported, resulting in higher prices for Canadian brands.

These tariff-driven cost increases force Canadian brands to either absorb the higher expenses, reducing profit margins, or pass them on to consumers, making their products less price-competitive. A recent industry report suggests that tariffs have increased the cost of imported beauty ingredients by an average of 15%, significantly impacting profitability.

Reduced Competitiveness in the Global Market

Tariffs make Canadian beauty products less competitive internationally compared to brands from countries with preferential trade agreements.

- Pricing: Canadian brands often face higher pricing than their competitors from countries with lower tariff barriers or free trade agreements.

- Export Opportunities: The increased costs associated with tariffs severely limit export opportunities for Canadian beauty brands, hindering their ability to reach international markets.

For example, Brand X, a Canadian skincare company, reported a 20% decrease in export sales following the implementation of new tariffs on key ingredients.

Opportunities for Domestic Ingredient Sourcing

The challenges presented by tariffs highlight the significant opportunity for Canadian beauty brands to source ingredients locally.

- Locally Grown Herbs and Botanicals: Canadian farms offer a wealth of herbs and botanicals suitable for cosmetic formulations.

- Sustainable Forestry Products: Ingredients derived from sustainably harvested Canadian forests offer an eco-friendly and tariff-free alternative.

- Canadian-Made Minerals: Several Canadian sources provide minerals used in cosmetics, reducing reliance on imports.

By emphasizing domestically sourced ingredients, Canadian brands can reduce their reliance on imports, mitigate the impact of tariffs, and support local farmers and suppliers. Companies like Brand Y have successfully transitioned to locally sourced ingredients, achieving both cost savings and enhanced brand storytelling.

Shifting Consumer Preferences and the "Buy Canadian" Movement

Consumer preferences are shifting towards locally made products, creating a fertile ground for Canadian beauty brands.

Growing Demand for Locally Made Products

Consumers are increasingly interested in supporting Canadian businesses, driven by:

- Sustainability: Buying local reduces the environmental impact of transportation and packaging.

- Ethical Concerns: Consumers want transparency and ethical practices in the production process.

- National Pride: Supporting domestic brands fosters a sense of national identity and community.

Recent surveys indicate that over 70% of Canadian consumers prefer to buy locally made products when possible, reflecting a significant shift in purchasing habits within the beauty sector.

Transparency and Ethical Sourcing

Transparency and ethical sourcing are crucial for attracting ethically-conscious consumers.

- Ingredient Disclosure: Clear and complete ingredient lists build trust and attract discerning buyers.

- Sustainable Packaging: Eco-friendly packaging is essential for environmentally aware consumers.

- Fair Labor Practices: Consumers increasingly demand transparency regarding labor practices throughout the supply chain.

Brands like Brand Z successfully leverage their transparent sourcing and ethical production methods in their marketing campaigns, attracting a loyal customer base.

Marketing Strategies to Leverage the "Buy Canadian" Trend

Effective marketing strategies can capitalize on the "Buy Canadian" trend.

- Highlighting Canadian Heritage: Showcase the brand's Canadian roots and values in marketing materials.

- Storytelling: Share compelling stories about the brand's journey, ingredients, and commitment to quality.

- Partnerships with Canadian Influencers: Collaborating with Canadian influencers can increase brand awareness and reach.

Utilizing authentic storytelling that resonates with Canadian values is key to successful marketing in this context.

Strategies for Canadian Beauty Brands to Thrive

Canadian beauty brands can employ several strategies to thrive in the current landscape.

Innovation and Product Differentiation

Innovation is key to standing out in a competitive market.

- Unique Formulations: Develop unique product formulations using locally sourced ingredients.

- Sustainable Packaging: Adopt innovative and sustainable packaging solutions.

- Personalized Products: Offer customized products tailored to individual customer needs.

By focusing on unique selling propositions, Canadian brands can differentiate themselves and attract a loyal customer base.

Strategic Partnerships and Collaboration

Collaborative efforts can strengthen the domestic beauty industry.

- Supplier Collaboration: Partnering with local ingredient suppliers ensures access to high-quality materials.

- Retailer Partnerships: Collaborating with Canadian retailers increases market reach and visibility.

- Industry Associations: Joining industry associations facilitates networking and knowledge sharing.

These collaborative efforts lead to cost reductions, enhanced market access, and increased consumer reach.

Government Support and Policy Initiatives

Government support can significantly impact the growth of Canadian beauty brands.

- Tariff Reduction Initiatives: Advocating for reduced tariffs on key ingredients can improve competitiveness.

- Investment in Research and Development: Government funding for research and development can foster innovation.

- Export Support Programs: Government programs supporting export activities can help Canadian brands reach international markets.

Actively engaging with government bodies to advocate for policies that support the industry is crucial.

Securing the Future of Buy Canadian in the Beauty Industry

The Canadian beauty industry faces challenges from tariffs, but the "Buy Canadian" movement presents significant opportunities. By focusing on local ingredient sourcing, transparent ethical practices, innovative product development, strategic partnerships, and advocating for supportive government policies, Canadian beauty brands can not only survive but thrive. The key takeaway is a proactive and strategic approach that embraces both the challenges and the opportunities presented by the evolving market. Support Canadian beauty brands today – visit [link to a directory of Canadian beauty brands] to discover high-quality, ethically sourced, and proudly Canadian products. Let's build a stronger, more sustainable, and competitive Canadian beauty industry together.

Featured Posts

-

High Ranking Admirals Fall Corruption Charges And Conviction

May 21, 2025

High Ranking Admirals Fall Corruption Charges And Conviction

May 21, 2025 -

Effectief Verkoop Van Abn Amro Kamerbrief Certificaten

May 21, 2025

Effectief Verkoop Van Abn Amro Kamerbrief Certificaten

May 21, 2025 -

The Allure Of Cassis Blackcurrant A Taste Of France

May 21, 2025

The Allure Of Cassis Blackcurrant A Taste Of France

May 21, 2025 -

Abn Amro Toenemende Vraag Naar Occasions Stimuleert Verkoopcijfers

May 21, 2025

Abn Amro Toenemende Vraag Naar Occasions Stimuleert Verkoopcijfers

May 21, 2025 -

Bp Ceo Pay Cut A 31 Decrease Explained

May 21, 2025

Bp Ceo Pay Cut A 31 Decrease Explained

May 21, 2025

Latest Posts

-

I Kakodaimonia Ton Sidirodromon Istoria Provlimata Kai Prooptikes

May 21, 2025

I Kakodaimonia Ton Sidirodromon Istoria Provlimata Kai Prooptikes

May 21, 2025 -

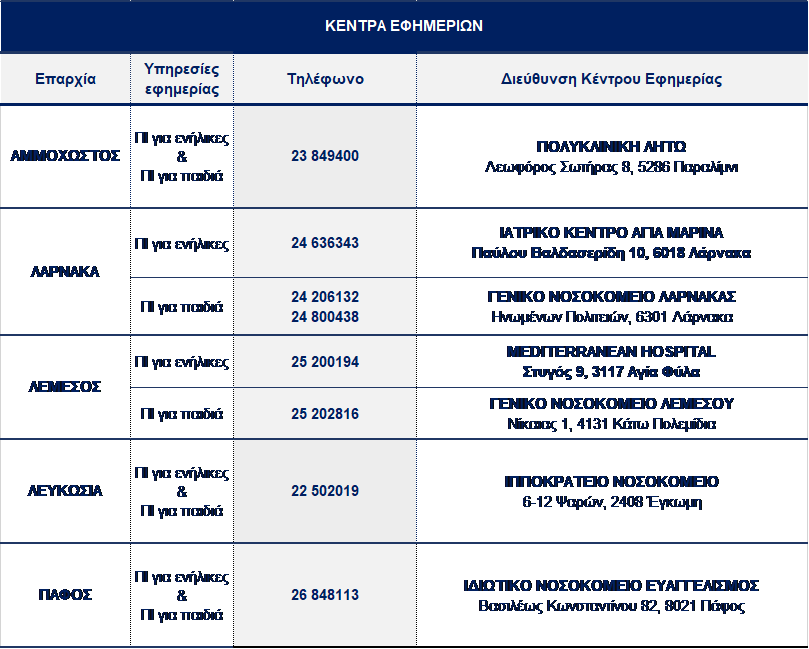

Efimereyontes Iatroi Stin Patra Savvatokyriako 10 And 11 Maioy

May 21, 2025

Efimereyontes Iatroi Stin Patra Savvatokyriako 10 And 11 Maioy

May 21, 2025 -

Patra Efimeries Iatron Savvatokyriako 10 11 Maioy

May 21, 2025

Patra Efimeries Iatron Savvatokyriako 10 11 Maioy

May 21, 2025 -

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Stin Dimokratiki Programma And Eisitiria

May 21, 2025

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Stin Dimokratiki Programma And Eisitiria

May 21, 2025 -

Breite Efimereyonta Giatro Stin Patra 10 And 11 Maioy

May 21, 2025

Breite Efimereyonta Giatro Stin Patra 10 And 11 Maioy

May 21, 2025