The Dark Side Of Private Equity: Insights From Four Key Books

Table of Contents

The Predatory Practices of Private Equity: Exploiting Vulnerable Businesses

Private equity firms often employ aggressive strategies that prioritize short-term gains over long-term sustainability, leading to detrimental consequences for businesses and their employees.

Debt-fueled acquisitions and their impact on businesses

The use of excessive debt in leveraged buyouts (LBOs) is a hallmark of private equity's "dark side." This financial engineering can cripple businesses, leading to:

- Increased leverage: Heavily indebted companies become vulnerable to economic downturns, increasing the risk of bankruptcy.

- Job losses: Cost-cutting measures, often implemented to service debt, frequently result in significant layoffs.

- Reduced investment in R&D: Funds are diverted from research and development to pay down debt, hindering innovation and long-term competitiveness.

- Asset stripping: Valuable assets may be sold off to generate cash flow, leaving the company weakened and less capable of future growth.

[Insert specific examples from the chosen books illustrating these practices, citing book titles and authors. For example: "As detailed in 'Barbarians at the Gate,' the RJR Nabisco LBO exemplifies how excessive debt burdens can lead to drastic cost-cutting measures and ultimately, the dismantling of a once-successful company."] This demonstrates the predatory nature of some private equity practices, utilizing techniques like corporate raiding and aggressive debt financing to maximize short-term returns.

Short-term focus over long-term sustainability

Private equity's focus on quick profits often overshadows the need for long-term growth and employee well-being. This short-termism manifests in:

- Focus on quick profits: Maximizing returns in a short timeframe often takes precedence over sustainable growth strategies.

- Neglecting long-term growth: Investments in infrastructure, employee training, and research and development are often sacrificed for immediate financial gains.

- Compromised employee well-being: Layoffs and reduced benefits are common consequences of the pursuit of short-term profits.

[Insert examples from the books that showcase this short-sighted approach, citing book titles and authors. For example: " 'The Looting of America' provides numerous case studies illustrating how private equity firms prioritize value extraction over the long-term health and stability of acquired companies."] This profit maximization strategy, driven by value extraction, is a core element of the dark side of private equity.

The Ethical Dilemmas of Private Equity: Social Responsibility and Corporate Governance

Beyond the financial practices, the ethical implications of private equity operations raise significant concerns.

Lack of transparency and accountability

Private equity firms often operate with a lack of transparency, making it difficult to assess their impact and hold them accountable.

- Difficulty in accessing information: Private equity transactions often lack public disclosure, limiting scrutiny of their operations.

- Limited regulatory oversight: The relatively light regulatory framework governing private equity allows for practices that might not be tolerated in publicly traded companies.

[Insert examples from the books illustrating the lack of transparency and the need for regulatory reform. For example: "The opaque nature of private equity transactions, as discussed in [Book Title], makes it challenging to assess their true social and environmental impact."] This financial opacity hinders effective corporate governance and accountability.

The social impact of private equity investments

Private equity's pursuit of profit can have far-reaching social and environmental consequences.

- Negative consequences on communities: Job losses, factory closures, and reduced local investment can negatively affect communities.

- Potential for environmental damage: The focus on short-term profits may lead to environmental degradation and unsustainable practices.

- Exploitation of workers: Cost-cutting measures can result in reduced wages, benefits, and unsafe working conditions.

[Insert examples from the books highlighting the social and environmental costs of private equity investments, citing book titles and authors. For instance: "[Book Title] provides compelling evidence of the negative social impacts of private equity's focus on cost-cutting and asset stripping."] This underscores the importance of ESG investing and considering the broader social impact in evaluating private equity activities.

The Power Dynamics of Private Equity: Influence and Lobbying

The influence of private equity extends beyond its financial activities, shaping political landscapes and market dynamics.

The influence of private equity on political processes

Private equity firms wield considerable political influence through:

- Lobbying efforts: They actively lobby to shape regulations that favor their interests.

- Access to political networks: Their connections with politicians and policymakers provide them with significant influence.

[Insert examples from the books showing the influence of private equity on policy-making. For example: "[Book Title] details how private equity firms leverage their political connections to influence regulatory decisions."] This regulatory capture can create an uneven playing field.

The concentration of power in the hands of a few firms

The private equity industry is characterized by a high degree of concentration, raising concerns about market manipulation.

- Oligopolistic nature of the industry: A small number of large firms control a significant share of the market.

- Potential for market manipulation: This concentrated power can lead to anti-competitive practices and manipulation of markets.

[Insert examples from the books supporting the argument of concentrated power and its potential consequences, citing book titles and authors. For example: "The oligopolistic structure of the private equity industry, as described in [Book Title], raises concerns about market power and potential anti-competitive behavior."] This market concentration warrants attention from antitrust authorities.

Alternative Perspectives and Potential Solutions: Examining the Nuances of Private Equity

While the preceding sections have highlighted the "dark side" of private equity, it's important to acknowledge the industry's potential positive contributions.

Acknowledging the positive contributions of private equity

Private equity firms can play a positive role in:

- Investment in struggling businesses: They can provide capital and expertise to revitalize underperforming companies.

- Provision of capital to smaller companies: Private equity can offer funding to smaller firms that may struggle to access traditional financing.

[Explore the arguments presented in the books that acknowledge the positive aspects of private equity. For instance: "[Book Title] presents a more nuanced perspective, acknowledging the potential positive contributions of private equity in certain contexts."] Business rescue and capital investment are key roles that some firms fulfill.

Potential reforms to mitigate the negative aspects

Several reforms can help mitigate the negative aspects of private equity:

- Increased regulatory scrutiny: Greater transparency and oversight are crucial to ensure responsible investment practices.

- Stricter ethical guidelines: Implementing stricter ethical codes of conduct can help curb predatory practices.

- Promoting greater transparency: Mandating more comprehensive disclosure of private equity transactions can enhance accountability.

[Discuss the recommendations suggested in the books for reforming the industry. For example: "[Book Title] suggests several regulatory reforms aimed at increasing transparency and accountability in the private equity industry."] Ethical investment and sustainable finance are crucial for future responsible practices.

Conclusion: Understanding and Addressing the Dark Side of Private Equity

The four books examined in this article reveal a complex picture of the private equity industry. While some firms contribute positively to the economy, many engage in practices that raise serious ethical and societal concerns. The "dark side" of private equity, characterized by predatory practices, lack of transparency, and undue political influence, demands critical analysis and action. Understanding these issues is crucial to mitigating the negative consequences and promoting more responsible investment practices. Further research into the dark side of private equity is crucial to ensuring responsible investment practices and fostering a more equitable and sustainable financial system. Let's continue the conversation and advocate for meaningful reforms to address this critical issue.

Featured Posts

-

Mission Impossible Dead Reckoning Whos Who In The New Movie

May 27, 2025

Mission Impossible Dead Reckoning Whos Who In The New Movie

May 27, 2025 -

Nostalgia Trip Recreating Janet Jacksons Most Memorable Outfits

May 27, 2025

Nostalgia Trip Recreating Janet Jacksons Most Memorable Outfits

May 27, 2025 -

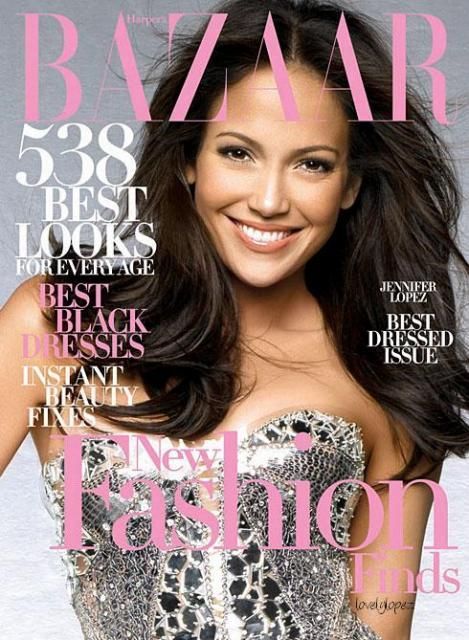

Jennifer Lopez And Janet Jackson A Powerful Support System

May 27, 2025

Jennifer Lopez And Janet Jackson A Powerful Support System

May 27, 2025 -

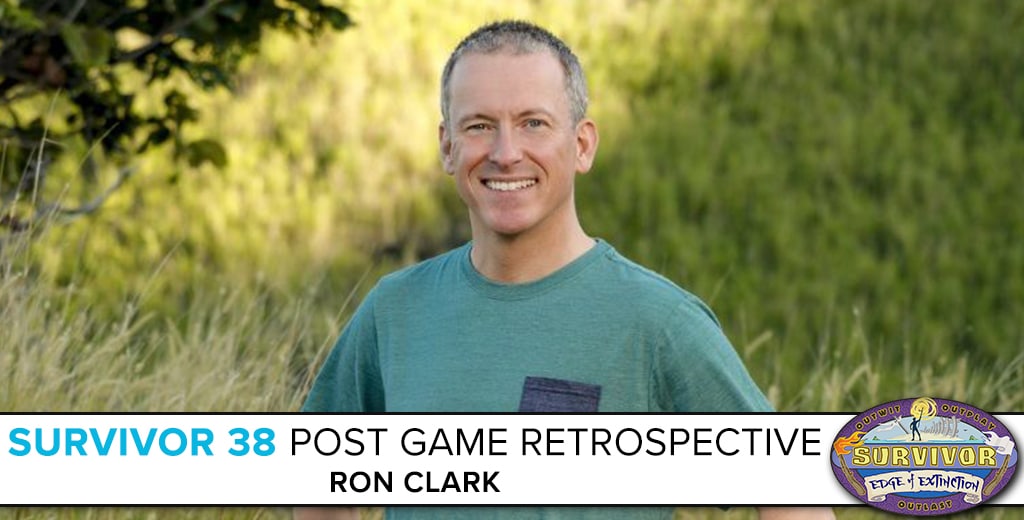

Ron Clark Survivor Season 38 Throws Massive School Party

May 27, 2025

Ron Clark Survivor Season 38 Throws Massive School Party

May 27, 2025 -

Where To Stream Mob Land Season 1 Featuring Pierce Brosnan Tom Hardy And Helen Mirren

May 27, 2025

Where To Stream Mob Land Season 1 Featuring Pierce Brosnan Tom Hardy And Helen Mirren

May 27, 2025

Latest Posts

-

Casper Ruuds Knee Problem Costs Him French Open 2025 Match

May 30, 2025

Casper Ruuds Knee Problem Costs Him French Open 2025 Match

May 30, 2025 -

El Legado Del Ex Numero 3 La Frase Impactante Para Marcelo Rios

May 30, 2025

El Legado Del Ex Numero 3 La Frase Impactante Para Marcelo Rios

May 30, 2025 -

French Open 2025 Ruuds Knee Injury Leads To Loss Against Borges

May 30, 2025

French Open 2025 Ruuds Knee Injury Leads To Loss Against Borges

May 30, 2025 -

Marcelo Rios Y La Frase De Un Ex Top 3

May 30, 2025

Marcelo Rios Y La Frase De Un Ex Top 3

May 30, 2025 -

Ex Numero 3 Del Mundo La Frase Que Inspiro A Marcelo Rios

May 30, 2025

Ex Numero 3 Del Mundo La Frase Que Inspiro A Marcelo Rios

May 30, 2025