The Cobalt Market's Reaction To Congo's Export Ban And The Upcoming Quota Announcement

Table of Contents

Immediate Market Reaction to the Export Ban

The DRC's sudden export ban triggered immediate and significant reactions within the cobalt market. Understanding these initial responses is key to predicting future trends and mitigating potential risks.

Price Volatility and Speculation

The announcement led to immediate price spikes. While precise figures fluctuate depending on the source and timing, reports from reputable market analysts like Benchmark Mineral Intelligence showed a sharp increase in cobalt prices in the days following the ban. This volatility reflects increased speculation and uncertainty among investors.

- Increased speculation and uncertainty among investors: The unexpected nature of the ban created a climate of fear and uncertainty, leading to speculative trading and price inflation.

- Short-term gains for some cobalt producers: Companies with existing stockpiles benefited from the sudden price surge, experiencing short-term profits.

- Analysis of trading volume changes: Trading volumes likely increased significantly as investors reacted to the news and attempted to adjust their positions. This surge in trading activity further contributed to price volatility.

- Potential manipulation or hoarding: Concerns emerged regarding potential market manipulation through hoarding of cobalt supplies to further inflate prices. Regulatory bodies are likely to scrutinize trading activity to detect and deter such practices.

Supply Chain Disruptions

The ban's impact extends far beyond the immediate price fluctuations, significantly disrupting supply chains for downstream industries reliant on Congolese cobalt.

- Delays in EV production: Electric vehicle (EV) manufacturers face potential production delays due to cobalt shortages, impacting their production schedules and potentially delaying the global transition to electric mobility.

- Increased production costs for battery manufacturers: Battery producers, heavily reliant on cobalt for lithium-ion batteries, are facing increased input costs, squeezing profit margins and potentially raising the final price of EVs and other battery-powered devices.

- Search for alternative suppliers and diversification strategies: Companies are actively seeking alternative cobalt sources and implementing diversification strategies to mitigate future supply chain disruptions. This involves exploring mines in Australia, Canada, and other countries.

- Potential for legal challenges to the ban: International companies impacted by the ban may explore legal avenues to challenge its implementation, potentially leading to protracted legal battles and further market uncertainty.

Analyzing the Upcoming Quota Announcement

The upcoming quota announcement by the DRC will be a crucial determinant of the long-term trajectory of the cobalt market. Different quota levels will have significantly different impacts.

Potential Impacts of Different Quota Levels

The DRC's decision on quota levels will directly affect cobalt supply and price stability.

- Low quotas leading to continued price increases and supply shortages: Restricted quotas will likely perpetuate price increases and exacerbate existing supply chain disruptions.

- Moderate quotas potentially stabilizing the market: A moderate quota could help stabilize the market, allowing for a more gradual adjustment to the new supply reality.

- High quotas possibly leading to price decreases and easing supply chain pressures: High quotas might lead to price decreases and alleviate supply chain pressures, but this depends on the market's ability to absorb the increased supply.

- Uncertainty regarding the transparency and enforcement of quotas: Transparency and effective enforcement of quotas are crucial for market stability. Lack of transparency could fuel speculation and exacerbate volatility.

Geopolitical Implications and Diversification Efforts

The DRC's decision also carries significant geopolitical implications, sparking a global scramble for alternative cobalt sources.

- Increased investment in cobalt mining in other countries (e.g., Australia, Canada): Countries with significant cobalt reserves are seeing increased investment and exploration activity.

- Focus on sustainable and ethically sourced cobalt: The focus on ethical sourcing is intensifying, with growing demand for cobalt mined under responsible and sustainable practices.

- Technological advancements in battery chemistries to reduce cobalt dependence: Research and development into alternative battery chemistries, such as those with reduced or no cobalt content, are gaining momentum.

- Potential for trade disputes and diplomatic tensions: The DRC's policies could trigger trade disputes and diplomatic tensions with countries heavily reliant on Congolese cobalt.

Long-Term Outlook for the Cobalt Market

The long-term outlook for the cobalt market hinges on several key factors: sustainable sourcing practices and technological advancements.

Sustainability and Ethical Sourcing

Ethical and responsible cobalt sourcing is gaining paramount importance.

- Increased scrutiny of mining practices in the DRC: International organizations and NGOs are increasing scrutiny of mining practices in the DRC to ensure responsible sourcing.

- Demand for certified cobalt from responsible sources: Consumers and businesses increasingly demand cobalt certified as ethically and sustainably sourced.

- The role of international organizations and NGOs in promoting ethical mining: International organizations and NGOs play a significant role in promoting responsible mining practices and combating unethical labor practices.

Technological Innovations and Battery Chemistry Alternatives

Technological innovation offers a potential pathway to reduce reliance on cobalt.

- Development of cobalt-free or low-cobalt batteries: Research and development into alternative battery chemistries are ongoing, with the goal of developing batteries that require less or no cobalt.

- Research and development in alternative battery technologies: Exploring alternative battery technologies beyond lithium-ion batteries is also underway.

- The long-term impact of these innovations on cobalt demand: The success of these innovations could significantly impact future cobalt demand, potentially reducing its importance in the battery industry.

Conclusion

The DRC's export ban and upcoming quota announcement have created significant uncertainty within the cobalt market. Immediate price volatility and supply chain disruptions are evident. The long-term impact will depend heavily on the final quota levels, the success of diversification efforts, and technological advancements in battery chemistry. Understanding these factors is crucial for businesses and investors navigating the evolving cobalt market. Staying informed about future announcements regarding cobalt production and quotas is essential for mitigating risk and capitalizing on opportunities in this dynamic sector. Further research into sustainable and ethical cobalt sourcing strategies will be critical for the industry's future.

Featured Posts

-

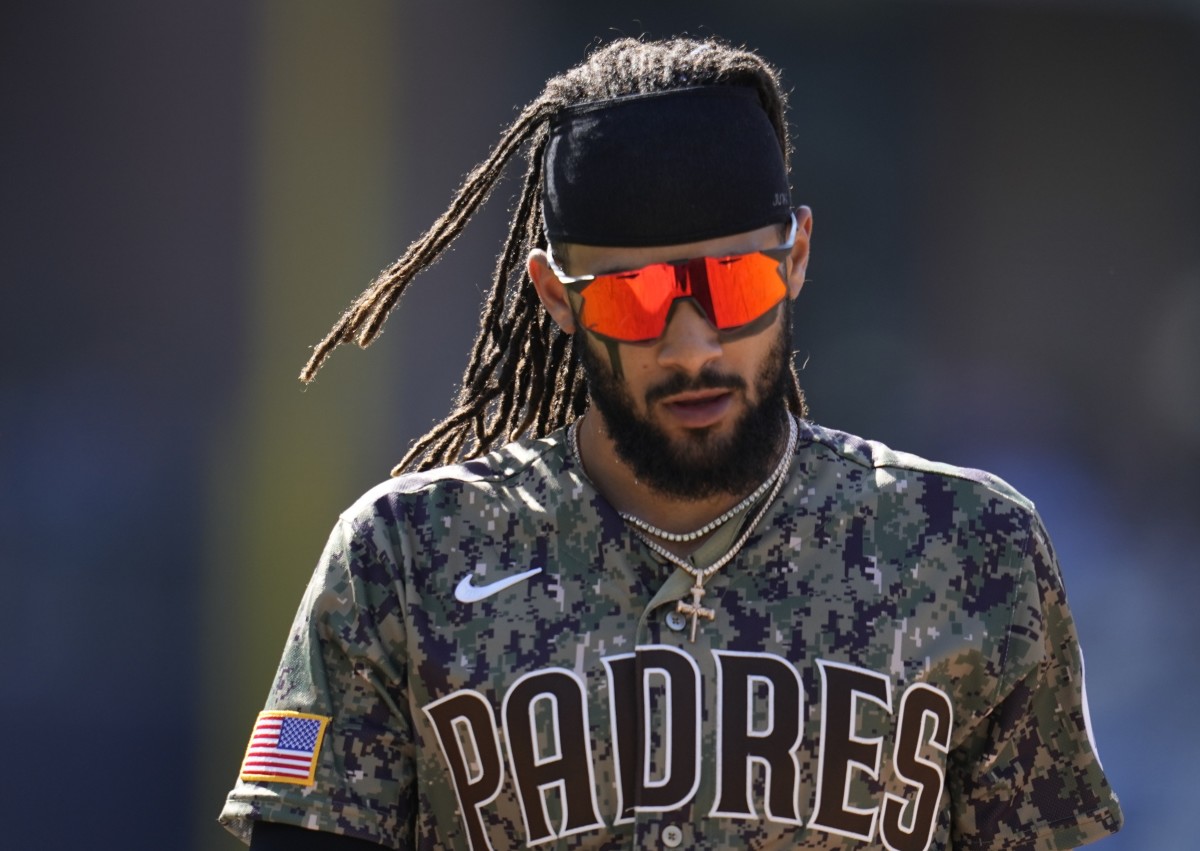

Padres Clinch Series Win Over Cubs

May 15, 2025

Padres Clinch Series Win Over Cubs

May 15, 2025 -

Toezichthouder Npo En Bruins Bespreken Kwestie Hamer En Leeflang

May 15, 2025

Toezichthouder Npo En Bruins Bespreken Kwestie Hamer En Leeflang

May 15, 2025 -

Middle Management A Vital Link In The Chain Of Success

May 15, 2025

Middle Management A Vital Link In The Chain Of Success

May 15, 2025 -

Paddy Pimblett Suffers Stunning 35 Second Knockout Loss

May 15, 2025

Paddy Pimblett Suffers Stunning 35 Second Knockout Loss

May 15, 2025 -

Analysis The Gop Mega Bills Provisions And Predicted Political Fallout

May 15, 2025

Analysis The Gop Mega Bills Provisions And Predicted Political Fallout

May 15, 2025

Latest Posts

-

Goats Backing Paddy Pimbletts Road To Ufc 314 Victory

May 15, 2025

Goats Backing Paddy Pimbletts Road To Ufc 314 Victory

May 15, 2025 -

Israel Adesanya On Paddy Pimblett A Dominant Performance Leading To A Chandler Matchup

May 15, 2025

Israel Adesanya On Paddy Pimblett A Dominant Performance Leading To A Chandler Matchup

May 15, 2025 -

Ufc 314 Will Paddy Pimblett Become Champion With Goat Support

May 15, 2025

Ufc 314 Will Paddy Pimblett Become Champion With Goat Support

May 15, 2025 -

Paddy Pimbletts Impressive Victory Adesanyas High Praise And Upcoming Chandler Bout

May 15, 2025

Paddy Pimbletts Impressive Victory Adesanyas High Praise And Upcoming Chandler Bout

May 15, 2025 -

Paddy Pimbletts Ufc 314 Fight A Champion In The Making

May 15, 2025

Paddy Pimbletts Ufc 314 Fight A Champion In The Making

May 15, 2025