The Chinese Automotive Market: Headwinds For BMW, Porsche, And Premium Brands

Table of Contents

Intensifying Competition from Domestic Brands

The rise of powerful domestic automotive brands is arguably the biggest challenge facing premium foreign players in the Chinese automotive market. This intensified competition is driven by two key factors: the explosive growth of Chinese electric vehicle (EV) manufacturers and the remarkable improvement in the quality and brand perception of domestic brands in general.

Rise of Domestic Electric Vehicle (EV) Manufacturers

The rapid ascent of Chinese EV startups, such as BYD, NIO, and Xpeng, is dramatically reshaping the market. These companies aren't just offering electric vehicles; they are offering compelling alternatives to established luxury brands.

- BYD's success in both hybrid and fully electric vehicles demonstrates the shift towards domestically produced alternatives. BYD's market dominance showcases the capability and technological prowess of Chinese EV manufacturers.

- NIO's focus on premium EVs and comprehensive charging infrastructure is attracting younger, tech-savvy consumers. This targeted approach directly challenges the traditional premium market segment.

- Government subsidies and incentives further bolster the competitiveness of Chinese EV manufacturers. These policies are actively encouraging the adoption of domestic EVs, making them even more attractive to consumers.

Improved Quality and Brand Perception of Domestic Brands

Gone are the days when Chinese brands were automatically perceived as inferior. Significant investments in research and development, design, and manufacturing have dramatically improved vehicle quality, pushing premium brands to step up their game.

- Enhanced build quality and advanced features are eroding the price premium associated with foreign brands. Consumers are increasingly finding comparable quality and features in domestically produced vehicles at lower price points.

- Strong marketing campaigns and celebrity endorsements are contributing to a more positive brand perception. Chinese brands are skillfully building brand equity and loyalty through targeted marketing efforts.

- Increased brand loyalty within the domestic market presents a major challenge for foreign brands. This shift in consumer allegiance is a significant hurdle for premium foreign automakers.

Shifting Consumer Preferences in China

Understanding evolving consumer preferences is crucial for success in the Chinese automotive market. Two major shifts are impacting the luxury segment: a growing demand for electric and hybrid vehicles and an increasing focus on technology and connectivity.

Growing Demand for Electric and Hybrid Vehicles

The Chinese government's strong push for electrification, coupled with increasingly stringent emission regulations, is driving a massive shift towards EVs and hybrids. Premium brands must adapt swiftly to offer compelling options to stay competitive.

- Government incentives for EV purchases are boosting adoption rates. These subsidies make EVs more financially accessible to a larger segment of the population.

- Concerns about air quality are increasing consumer preference for electric vehicles. Environmental awareness is a key driver of EV adoption in China.

- Premium brands need to invest heavily in their EV portfolios to remain competitive. Failure to offer competitive EVs will result in losing significant market share.

Focus on Technology and Connectivity

Chinese consumers are technologically sophisticated and place a high value on advanced in-car technology, seamless connectivity, and autonomous driving capabilities. Premium brands must incorporate cutting-edge technology to capture this demographic.

- Advanced driver-assistance systems (ADAS) are becoming increasingly important for consumers. Features like lane keeping assist and adaptive cruise control are highly valued.

- Seamless smartphone integration and in-car entertainment systems are key differentiators. A superior infotainment experience is crucial for attracting tech-savvy consumers.

- Investment in artificial intelligence and autonomous driving technology is crucial for long-term success. The future of the automotive market is intertwined with advanced technology.

Economic and Geopolitical Headwinds

Beyond the competitive landscape and shifting consumer preferences, broader economic and geopolitical factors are creating further challenges for premium automakers in China.

Economic Slowdown

China's economic growth has moderated in recent years, impacting consumer spending and the automotive market as a whole. This slowdown particularly affects luxury vehicle sales.

- Reduced consumer confidence leads to lower demand for premium vehicles. Economic uncertainty makes consumers more hesitant to make large purchases.

- Price sensitivity is increasing as consumers become more cautious with their spending. Value for money is becoming a more critical factor in purchasing decisions.

- Premium brands need to offer competitive financing options and attractive packages. Flexible payment plans and attractive deals can help stimulate demand.

Geopolitical Uncertainty

Trade tensions and geopolitical uncertainties add another layer of complexity for foreign automakers operating in China.

- Trade tariffs and regulations can impact profitability. Uncertainties surrounding trade policies create risks for businesses.

- Political instability can create uncertainty and risk for businesses. Geopolitical factors can influence market stability and investment decisions.

- Effective risk management and strategic planning are vital for navigating these complexities. Companies need robust strategies to mitigate these risks.

Conclusion

The Chinese automotive market presents a formidable yet potentially rewarding challenge for premium brands like BMW and Porsche. The intense competition from domestic manufacturers, evolving consumer demands, and significant economic and geopolitical headwinds require a proactive and adaptable approach. To thrive in this dynamic market, premium brands must aggressively invest in electric vehicle technology, enhance their digital offerings, and develop comprehensive strategies to navigate the inherent risks. Understanding the nuances of the Chinese Automotive Market is not just beneficial; it is crucial for long-term success and profitability. Ignoring these headwinds risks significant market share erosion and ultimately, failure in this critical market.

Featured Posts

-

Bet Mgm Rotobg 150 150 Bonus For Tonights Warriors Rockets Game

May 01, 2025

Bet Mgm Rotobg 150 150 Bonus For Tonights Warriors Rockets Game

May 01, 2025 -

Ameliorer Vos Thes Dansants Grace A L Accompagnement Numerique

May 01, 2025

Ameliorer Vos Thes Dansants Grace A L Accompagnement Numerique

May 01, 2025 -

Rare Seabird Research Insights From The Te Ipukarea Society

May 01, 2025

Rare Seabird Research Insights From The Te Ipukarea Society

May 01, 2025 -

The Future Of Phones Nothings Modular Approach

May 01, 2025

The Future Of Phones Nothings Modular Approach

May 01, 2025 -

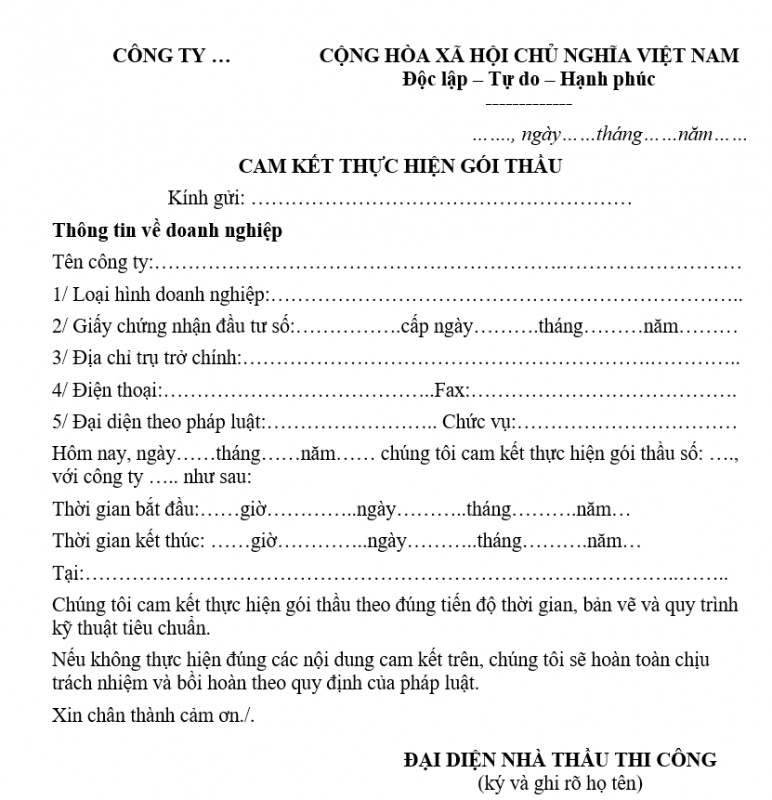

Tam Hop Chien Thang Vuot 6 Doi Thu Gianh Goi Thau Cap Nuoc Gia Dinh

May 01, 2025

Tam Hop Chien Thang Vuot 6 Doi Thu Gianh Goi Thau Cap Nuoc Gia Dinh

May 01, 2025

Latest Posts

-

Dagskra Fyrir Meistaradeildina Og Nba Leiki I Bonusdeildinni

May 01, 2025

Dagskra Fyrir Meistaradeildina Og Nba Leiki I Bonusdeildinni

May 01, 2025 -

Bonusdeildin Dagskra Yfir Meistaradeildina Og Nba Leiki

May 01, 2025

Bonusdeildin Dagskra Yfir Meistaradeildina Og Nba Leiki

May 01, 2025 -

Meistaradeildin Og Nba Bonusdeild Dagskra Og Upplysingar

May 01, 2025

Meistaradeildin Og Nba Bonusdeild Dagskra Og Upplysingar

May 01, 2025 -

Dagskrain Meistaradeildin Og Nba Stjoernukapp I Bonusdeildinni

May 01, 2025

Dagskrain Meistaradeildin Og Nba Stjoernukapp I Bonusdeildinni

May 01, 2025 -

Bet Mgm Rotobg 150 150 Bonus For Tonights Warriors Rockets Game

May 01, 2025

Bet Mgm Rotobg 150 150 Bonus For Tonights Warriors Rockets Game

May 01, 2025