The Canadian Tire-Hudson's Bay Merger: Implications And Future Outlook

Table of Contents

Financial Implications and Synergies

The Canadian Tire-Hudson's Bay merger holds significant financial implications. The combined entity anticipates substantial cost savings through economies of scale in purchasing, logistics, and marketing. By leveraging their complementary strengths, the companies aim for increased market share and revenue generation. Canadian Tire's robust automotive and home improvement sectors synergize well with Hudson's Bay's established department store presence, creating a powerful retail conglomerate.

- Potential for economies of scale in purchasing and logistics: Combined purchasing power will allow for significant discounts from suppliers, leading to lower costs and improved profit margins. Streamlined logistics through shared distribution networks will further enhance efficiency.

- Expansion into new markets or customer demographics: The merger allows for cross-selling opportunities, expanding the reach of both brands to new customer segments. Canadian Tire can leverage Hudson's Bay's urban presence, while HBC can benefit from Canadian Tire's strong rural market penetration.

- Increased brand recognition and customer loyalty programs: Combining loyalty programs creates a larger, more engaged customer base, fostering increased brand loyalty and repeat business.

- Risk of integration challenges and potential financial losses during transition: Merging two large organizations is complex and fraught with potential challenges. Integration difficulties, such as IT system compatibility issues and employee restructuring, could lead to unforeseen financial losses during the transition period.

Impact on the Canadian Retail Landscape

The Canadian Tire-Hudson's Bay merger significantly alters the Canadian retail landscape. Other major players, including Walmart and Loblaws, will face increased competition, particularly in overlapping sectors like home goods and apparel. The merger could trigger changes in pricing strategies, product offerings, and store locations across the country.

- Increased competition for other retailers in overlapping sectors: Existing retailers will need to adapt their strategies to compete with the combined buying power and expanded product offerings of the merged entity.

- Potential for store closures or consolidation: To optimize efficiency and reduce redundancies, some store closures or consolidations are likely, impacting employment and community retail landscapes.

- Shift in consumer shopping habits: Consumers might adjust their shopping habits based on the combined entity's offerings, pricing, and convenience, leading to shifts in market share across the board.

- Impact on employment within the retail sector: While some job losses may result from consolidation, new opportunities might arise in areas such as management, technology, and integrated operations.

Consumer Experience and Brand Perception

The merger's impact on consumer experience is multifaceted. A unified loyalty program is anticipated, simplifying rewards and benefits for customers. However, there's a potential for a dilution of unique brand identities. While consumers might benefit from a wider product selection and more convenient shopping experiences (potentially including an improved online presence), they may also experience a loss of the distinct brand characteristics that previously attracted them to each retailer individually.

- Changes to loyalty programs and rewards systems: A consolidated loyalty program offers advantages like simplified points accumulation and redemption. However, the transition could be challenging for existing members accustomed to separate programs.

- Potential for improved in-store and online shopping experiences: The merger offers an opportunity to create a superior omnichannel experience, blending online and in-store shopping seamlessly.

- Impact on customer service and product quality: Maintaining consistent customer service and product quality across a larger, more integrated organization presents a key challenge for the combined entity.

- Consumer response to the combined brand identity and offerings: How consumers react to the merged brand identity and the integration of product offerings will be crucial to the merger's long-term success.

Regulatory and Legal Considerations

The Canadian Tire-Hudson's Bay merger is subject to regulatory scrutiny. The Competition Bureau will assess potential anti-trust concerns, reviewing the impact on market competition before granting final approval. The approval process may involve conditions imposed by regulatory bodies to mitigate potential negative impacts on consumers.

- Competition Bureau review and approval: Thorough review by the Competition Bureau is essential to ensure fair competition in the Canadian retail sector.

- Potential antitrust concerns and remedies: Addressing potential antitrust concerns, such as reduced competition in specific product categories, might require remedies like divesting certain assets.

- Impact of government regulations on the merger process: Government regulations and policies relating to mergers and acquisitions will play a significant role in shaping the final outcome of the merger.

Conclusion: The Future of the Canadian Tire-Hudson's Bay Merger

The Canadian Tire-Hudson's Bay merger presents a complex interplay of financial opportunities, competitive pressures, consumer impacts, and regulatory considerations. While potential synergies and cost savings are significant, successful integration is critical for realizing these benefits. The combined entity will need to navigate the challenges of integrating two distinct corporate cultures and address potential consumer concerns regarding brand identity and service quality. Ongoing monitoring of the merger's progress and its impact on the Canadian retail industry is crucial. Stay informed about the unfolding developments related to the Canadian Tire-Hudson's Bay merger and its future impact on the Canadian retail market. Share this article using #CanadianTire #HudsonsBay #RetailMerger #CanadianRetail.

Featured Posts

-

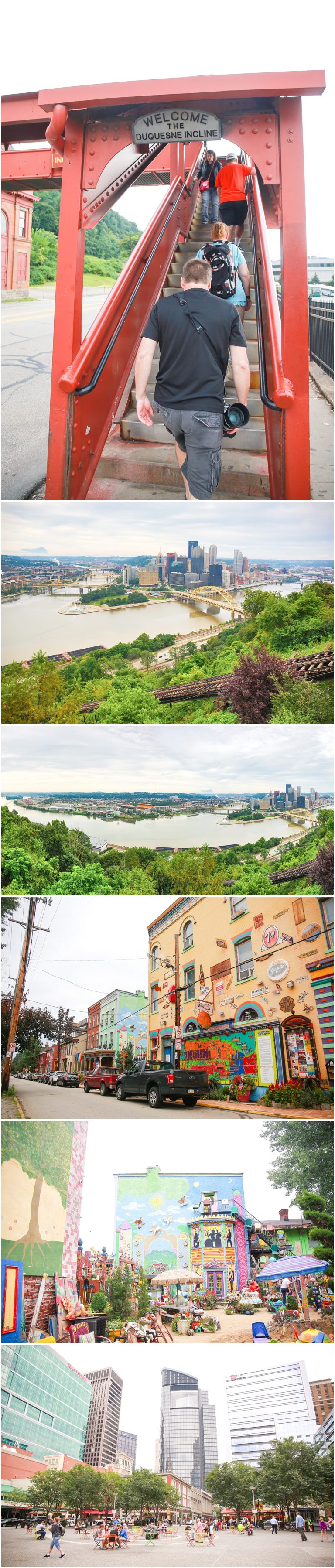

Padres Embark On Extensive Road Trip Starting In Pittsburgh

May 28, 2025

Padres Embark On Extensive Road Trip Starting In Pittsburgh

May 28, 2025 -

Analyzing The Seattle Mariners Future Lineup Projections For 2025 And 2026 Post Raleigh

May 28, 2025

Analyzing The Seattle Mariners Future Lineup Projections For 2025 And 2026 Post Raleigh

May 28, 2025 -

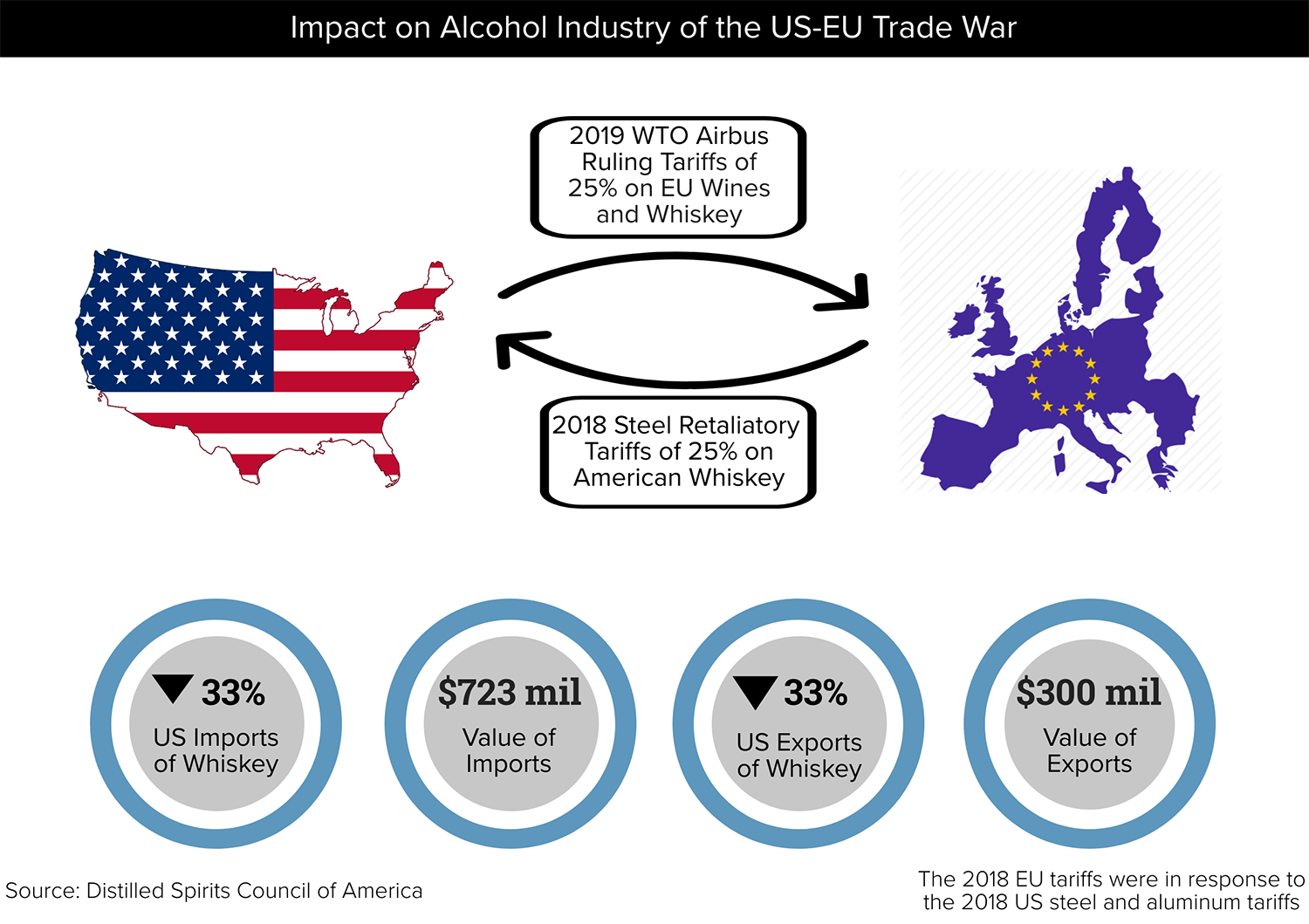

Eu Tariffs Trump Pushes Back Deadline To July 9th

May 28, 2025

Eu Tariffs Trump Pushes Back Deadline To July 9th

May 28, 2025 -

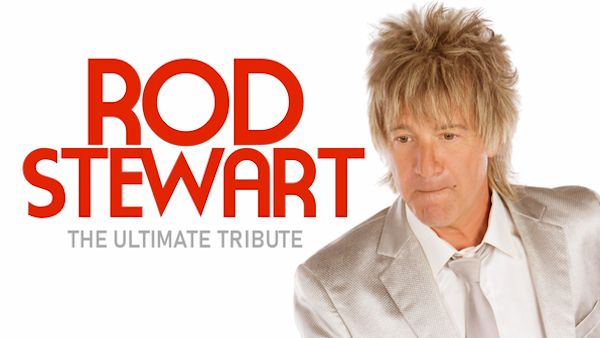

Lifetime Achievement Award For Music Icon Rod Stewart

May 28, 2025

Lifetime Achievement Award For Music Icon Rod Stewart

May 28, 2025 -

Nov Film Na Ues Andersn S Benisio Del Toro Prvi Treylr

May 28, 2025

Nov Film Na Ues Andersn S Benisio Del Toro Prvi Treylr

May 28, 2025

Latest Posts

-

Today In Liverpool E360 Million Cruise Ship

May 29, 2025

Today In Liverpool E360 Million Cruise Ship

May 29, 2025 -

Mein Schiff Relax A New Era In Cruising Begins

May 29, 2025

Mein Schiff Relax A New Era In Cruising Begins

May 29, 2025 -

Cruise News Mein Schiff Relax Sets Sail

May 29, 2025

Cruise News Mein Schiff Relax Sets Sail

May 29, 2025 -

Buying Nike Air Jordan 9 Retro Cool Grey Online Price Comparison And Retailers

May 29, 2025

Buying Nike Air Jordan 9 Retro Cool Grey Online Price Comparison And Retailers

May 29, 2025 -

Giant E360 Million Cruise Liner At Liverpool Port

May 29, 2025

Giant E360 Million Cruise Liner At Liverpool Port

May 29, 2025