The Broadcom VMware Deal: An Extreme Price Increase Of 1,050%

Table of Contents

Analyzing the 1,050% Price Increase: A Deep Dive into Valuation

The 1050% price increase in the Broadcom VMware deal is a complex issue stemming from multiple interconnected factors. Let's break down the key elements driving this unprecedented valuation.

VMware's Strategic Value

VMware holds a dominant position in the virtualization and cloud computing market. Its technological leadership, coupled with a robust customer base and recurring revenue streams, significantly contributed to its high valuation in the Broadcom acquisition.

- Technological Leadership: VMware's key technologies, including vSphere, vSAN, and NSX, are industry standards, providing a strong foundation for its market dominance.

- Strong Customer Base: VMware boasts a vast and loyal customer base, generating predictable and recurring revenue streams. High customer retention rates further solidify its value proposition.

- Recent Innovations: Continuous innovation and strategic partnerships have expanded VMware's capabilities and market reach, enhancing its attractiveness to potential acquirers like Broadcom. Their advancements in cloud-native technologies and multi-cloud management further boosted their appeal.

- Market Share: VMware consistently holds significant market share in virtualization and related technologies, demonstrating its enduring strength and competitiveness. (Insert relevant market share statistics here, sourced from reputable market research firms).

Broadcom's Acquisition Strategy

Broadcom's history of strategic acquisitions, coupled with its financial prowess, played a crucial role in the 1050% price increase reflected in the Broadcom VMware deal.

- Acquisition History: Broadcom has a proven track record of successfully integrating acquired companies, expanding its market reach and product portfolio.

- Financial Strength: Broadcom's considerable financial resources allowed them to comfortably afford such a substantial acquisition, making a competitive offer possible. (Insert relevant financial data on Broadcom's market capitalization and revenue here).

- Synergies with VMware: The acquisition creates significant synergies, combining Broadcom's existing infrastructure software portfolio with VMware's virtualization and cloud technologies. This integration promises enhanced offerings and greater market penetration.

- Strategic Portfolio Expansion: The Broadcom VMware deal allows Broadcom to significantly expand its presence in the rapidly growing enterprise software market, strengthening their position against major competitors.

Market Conditions and Competition

Several market conditions influenced the valuation of the Broadcom VMware deal, contributing to the substantial 1,050% price increase.

- Consolidation Trend: The ongoing trend of consolidation in the tech industry fueled the price, reflecting the premium placed on established players with dominant market positions.

- High Demand for Infrastructure Software: The increasing reliance on cloud computing and the digital transformation of businesses have created a significant demand for robust infrastructure software solutions, increasing VMware's value.

- Economic Factors: While factors like inflation and interest rates can impact valuations, the strategic value of VMware outweighed these concerns in this case. (Insert relevant economic data here, citing reputable sources).

- Competitive Landscape: The competitive landscape within the enterprise software market also played a role, with Broadcom seeking to solidify its position against rivals through this strategic acquisition.

Implications of the Broadcom VMware Deal: A Shifting Tech Landscape

The Broadcom VMware deal has far-reaching implications for VMware customers, the tech industry, and the regulatory landscape.

Impact on VMware Customers

The acquisition raises questions about the future for VMware customers. While Broadcom has pledged to maintain VMware's independence, changes are likely.

- Potential Pricing Changes: Customers may experience changes in licensing agreements and pricing structures following the integration of VMware into Broadcom.

- Product Roadmap: The product roadmap and future development of VMware's offerings could shift based on Broadcom's strategic priorities.

- Customer Support: While Broadcom has committed to maintaining current service levels, customers should monitor for any changes in customer support resources and response times.

- Integration Challenges: The successful integration of two large organizations will be a significant undertaking and may present some initial challenges.

Industry-Wide Effects

The Broadcom VMware deal signifies a pivotal moment in the tech industry, setting a precedent for future mergers and acquisitions.

- Increased Consolidation: The deal is likely to accelerate the trend of consolidation in the enterprise software sector, prompting further mergers and acquisitions.

- Impact on Competition: The combined entity of Broadcom and VMware will create a powerful competitor, potentially impacting competition and innovation in the market.

- Changes in Market Dynamics: This acquisition will reshape the dynamics of the enterprise software market, affecting strategies of other players and influencing future industry trends.

- Innovation Concerns: Some analysts express concerns that the acquisition might stifle innovation due to reduced competition.

Regulatory Scrutiny and Antitrust Concerns

The Broadcom VMware deal is subject to regulatory scrutiny and potential antitrust concerns.

- Regulatory Approvals: The deal requires regulatory approvals from various jurisdictions worldwide, and potential challenges from competition authorities are anticipated.

- Antitrust Investigations: Antitrust authorities will investigate the potential impact on competition and market dominance. (Insert details about any ongoing investigations here).

- Potential Remedies: Depending on the outcome of regulatory reviews, remedies such as divestitures might be imposed to mitigate any anti-competitive effects.

- Legal Challenges: The possibility of legal challenges from competitors or other stakeholders cannot be ruled out.

Conclusion: Understanding the Broadcom VMware Deal's 1,050% Price Tag

The 1,050% price increase in the Broadcom VMware deal is a result of VMware's strong market position, Broadcom's strategic acquisition strategy, and prevailing market conditions. This acquisition has profound implications for VMware customers, altering the competitive landscape of the tech industry and potentially leading to increased consolidation. The regulatory scrutiny and potential antitrust concerns highlight the importance of this deal for the future of the enterprise software market. Stay updated on the ongoing impact of the Broadcom VMware deal and its 1050% price increase by following reputable tech news sources and industry analysts. Understanding this transformative Broadcom acquisition is crucial for anyone involved in the enterprise software sector.

Featured Posts

-

Women And Alcohol A Health Crisis Doctors Are Addressing

May 16, 2025

Women And Alcohol A Health Crisis Doctors Are Addressing

May 16, 2025 -

Pimblett Addresses Criticism Post Ufc 314 Win Over Chandler

May 16, 2025

Pimblett Addresses Criticism Post Ufc 314 Win Over Chandler

May 16, 2025 -

Butler Disregards Miami Ahead Of Key Matchup

May 16, 2025

Butler Disregards Miami Ahead Of Key Matchup

May 16, 2025 -

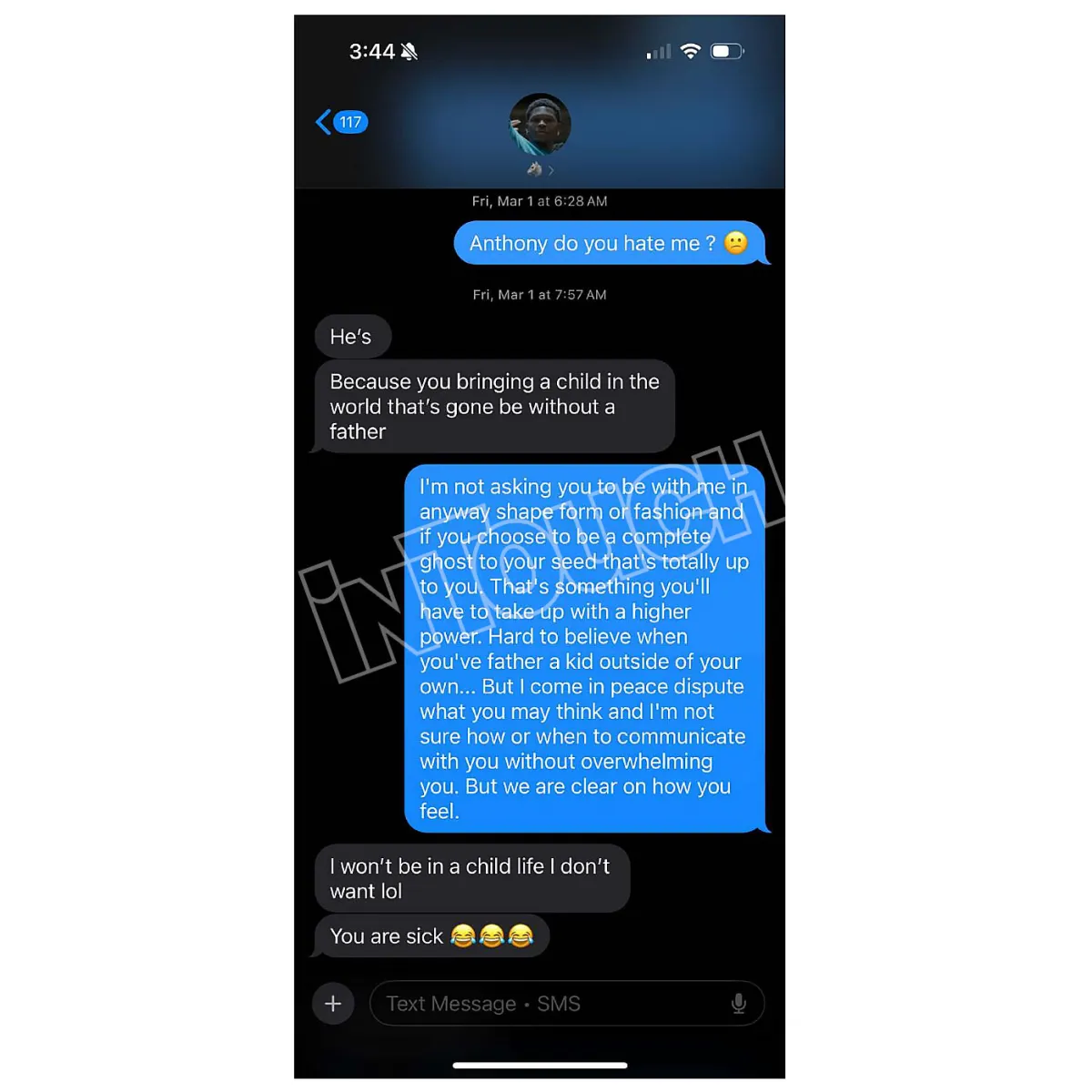

Anthony Edwards Paternity Case Concludes Custody Decision Announced

May 16, 2025

Anthony Edwards Paternity Case Concludes Custody Decision Announced

May 16, 2025 -

The Impact Of Congos Cobalt Export Ban On Global Supply Chains

May 16, 2025

The Impact Of Congos Cobalt Export Ban On Global Supply Chains

May 16, 2025

Latest Posts

-

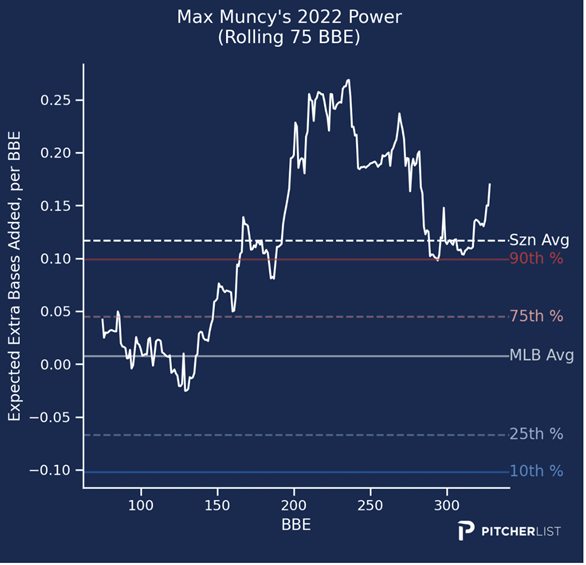

As Baseball Muncy In The Lineup At Second Base

May 16, 2025

As Baseball Muncy In The Lineup At Second Base

May 16, 2025 -

Oakland As Roster Update Muncys Addition And Starting Role

May 16, 2025

Oakland As Roster Update Muncys Addition And Starting Role

May 16, 2025 -

Anthony Edwards Facing Backlash Baby Mama Drama Takes Over Twitter

May 16, 2025

Anthony Edwards Facing Backlash Baby Mama Drama Takes Over Twitter

May 16, 2025 -

Los Angeles Dodgers Muncy Now An Oakland Athletic

May 16, 2025

Los Angeles Dodgers Muncy Now An Oakland Athletic

May 16, 2025 -

Twitter Meltdown The Anthony Edwards Baby Mama Saga

May 16, 2025

Twitter Meltdown The Anthony Edwards Baby Mama Saga

May 16, 2025