The Bitcoin Rebound: Long-Term Implications And Future Outlook

Table of Contents

Factors Driving the Bitcoin Rebound

Several key factors are contributing to the recent Bitcoin rebound. Understanding these drivers is crucial for assessing its sustainability and long-term impact.

Institutional Adoption

Institutional investors are increasingly embracing Bitcoin, a trend significantly impacting its price stability and overall market perception.

- Examples: MicroStrategy's substantial Bitcoin holdings, Tesla's initial investment (and subsequent partial divestment), and the growing involvement of various hedge funds and asset management firms demonstrate a shift towards institutional Bitcoin investment.

- Impact on Price Stability: Large-scale institutional buying provides a considerable level of support, reducing volatility compared to periods dominated by retail investors. This influx of capital helps absorb sell-offs and creates a more stable price floor.

- Institutional Investment Strategies: Many institutions see Bitcoin as a hedge against inflation and a potential diversification tool within their portfolios. Their long-term investment strategies indicate a belief in Bitcoin's long-term value proposition. Keywords: Institutional Bitcoin investment, corporate Bitcoin adoption, hedge fund Bitcoin holdings.

Regulatory Clarity (or Lack Thereof)

The regulatory landscape surrounding Bitcoin remains complex and evolving, significantly influencing market sentiment and adoption rates.

- Supportive Regulations: Some jurisdictions are adopting frameworks designed to foster innovation while mitigating risks, leading to increased confidence and investment. Examples include El Salvador's adoption of Bitcoin as legal tender (although this has faced challenges).

- Restrictive Regulations: Conversely, stricter regulations or outright bans in certain regions can dampen enthusiasm and limit market growth. The ongoing debate around Bitcoin regulation globally demonstrates this ongoing tension.

- Regulatory Uncertainty: The lack of clear, consistent global regulations remains a significant concern, creating uncertainty and impacting investor decisions. Keywords: Bitcoin regulation, cryptocurrency regulation, regulatory uncertainty, Bitcoin legal status.

Growing Adoption in Emerging Markets

Bitcoin's adoption is accelerating in developing economies, where it's increasingly seen as a hedge against inflation and currency devaluation.

- High Adoption Rates: Countries experiencing high inflation or political instability are seeing increased Bitcoin adoption as citizens seek alternative stores of value.

- Reasons for Increased Adoption: Bitcoin offers a decentralized alternative to traditional financial systems, often perceived as unreliable or corrupt. Its accessibility and potential for financial independence are significant drivers.

- Impact on Bitcoin's Global Reach: This widespread adoption in emerging markets significantly expands Bitcoin's user base and solidifies its position as a global asset. Keywords: Bitcoin adoption, emerging markets Bitcoin, Bitcoin inflation hedge, developing economies cryptocurrency.

Technological Advancements

Continuous advancements in Bitcoin's underlying technology are enhancing its scalability and efficiency, addressing past limitations.

- The Lightning Network: This second-layer solution significantly improves transaction speeds and reduces fees, making Bitcoin more practical for everyday use.

- Impact on Transaction Speed and Cost: The Lightning Network facilitates near-instantaneous, low-cost transactions, overcoming the limitations of the Bitcoin blockchain's original design.

- Potential for Wider Adoption: These technological improvements are crucial for wider adoption, as they address key concerns around scalability and usability. Keywords: Bitcoin Lightning Network, Bitcoin scalability, Bitcoin transaction fees, Bitcoin technology upgrades.

Long-Term Implications of the Bitcoin Rebound

A sustained Bitcoin rebound has several far-reaching implications for the cryptocurrency market and the global financial system.

Increased Market Capitalization

A prolonged uptrend in Bitcoin's price will lead to a substantial increase in its overall market capitalization.

- Potential Market Cap Projections: While precise predictions are impossible, a sustained rebound could push Bitcoin's market cap to significantly higher levels, potentially surpassing current estimations.

- Comparison to Other Cryptocurrencies: This increase would further solidify Bitcoin's dominance within the broader cryptocurrency market, potentially impacting the valuations of altcoins.

- Influence on Market Sentiment: A rising market cap reinforces positive market sentiment and attracts further investment. Keywords: Bitcoin market cap, cryptocurrency market capitalization, Bitcoin market dominance.

Mainstream Acceptance

A sustained Bitcoin rebound will likely accelerate its mainstream acceptance as a legitimate asset class.

- Increased Media Coverage: Positive price action generally results in increased media attention, further normalizing Bitcoin and making it more familiar to the general public.

- Growing Number of Bitcoin-Related Services: More businesses and financial institutions are likely to offer Bitcoin-related services, further integrating it into the mainstream financial landscape.

- Potential Integration into Traditional Financial Systems: Increased acceptance may lead to deeper integration of Bitcoin into traditional financial systems, blurring the lines between traditional finance and decentralized finance (DeFi). Keywords: Bitcoin acceptance, mainstream adoption of Bitcoin, Bitcoin as an asset class.

Impact on the Global Financial System

A rising Bitcoin price has the potential to significantly alter the global financial landscape.

- Potential Challenges to Traditional Financial Institutions: The continued growth of Bitcoin and other cryptocurrencies could present challenges to traditional banking and financial systems.

- Implications for Monetary Policy: The rise of Bitcoin could have implications for central banks and their ability to control monetary policy.

- Potential for Decentralized Finance (DeFi) Growth: A stronger Bitcoin ecosystem could fuel the growth of DeFi, providing alternative financial services outside of traditional institutions. Keywords: Bitcoin and finance, decentralized finance, Bitcoin impact on global economy.

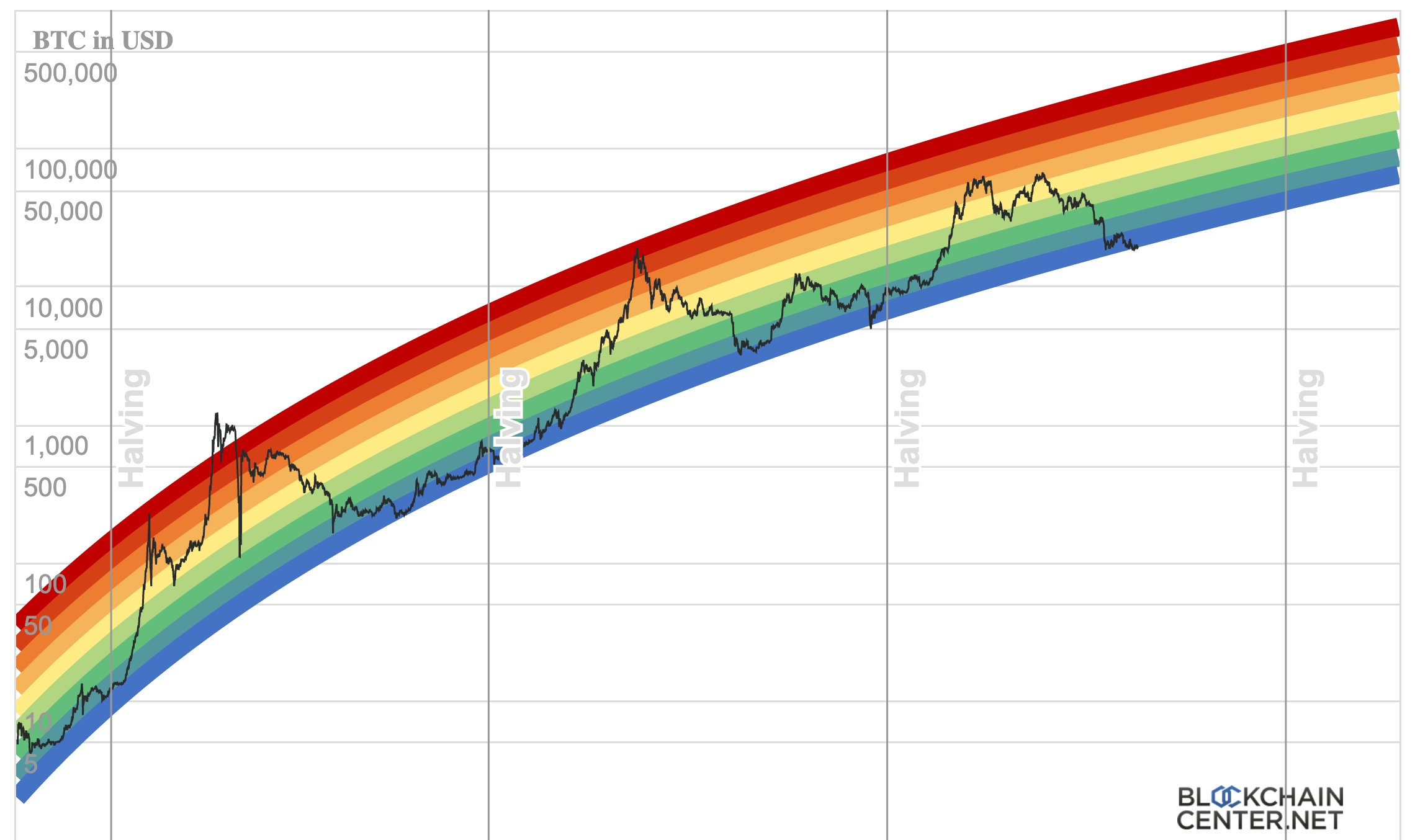

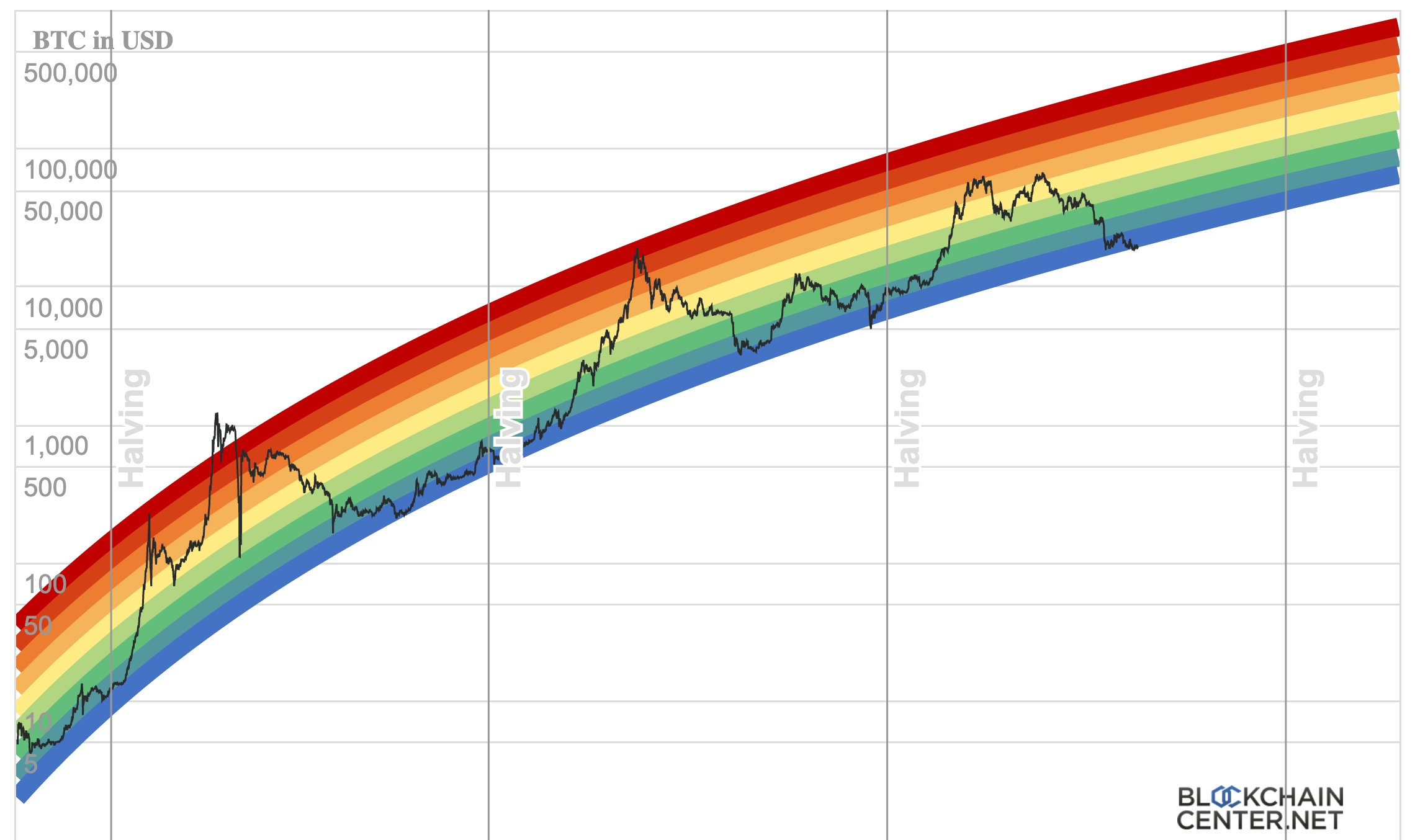

Future Outlook and Price Predictions (with caveats)

Predicting Bitcoin's future price is inherently speculative and fraught with uncertainty. The cryptocurrency market is known for its volatility.

- Factors Influencing Future Price: Several factors, including regulatory changes, technological advancements, macroeconomic conditions, and overall market sentiment, will influence Bitcoin's future price.

- Potential Bullish and Bearish Scenarios: Both bullish and bearish price scenarios are plausible, depending on the interplay of these various factors.

- Importance of Diversification: Investors should always diversify their portfolios and never invest more than they can afford to lose. Keywords: Bitcoin price prediction, Bitcoin future price, Bitcoin volatility, cryptocurrency investment.

Conclusion

The Bitcoin rebound presents both exciting opportunities and significant challenges. Understanding the factors driving this resurgence – institutional adoption, regulatory developments, technological advancements, and emerging market growth – is crucial for navigating the future of this leading cryptocurrency. While predicting the future price of Bitcoin is speculative, a sustained rebound could have profound implications for the global financial system and the broader acceptance of cryptocurrencies. Stay informed on the latest developments and continue to research the potential of Bitcoin and other cryptocurrencies to make informed investment decisions. Remember to conduct thorough due diligence before investing in Bitcoin or any other cryptocurrency. Learn more about the ongoing Bitcoin rebound and its potential long-term implications.

Featured Posts

-

Solve The Nyt Strands Crossword April 6 2025 Answers And Strategies

May 09, 2025

Solve The Nyt Strands Crossword April 6 2025 Answers And Strategies

May 09, 2025 -

Mulher Presa Na Inglaterra Suspeita De Perseguir Pais De Madeleine Mc Cann

May 09, 2025

Mulher Presa Na Inglaterra Suspeita De Perseguir Pais De Madeleine Mc Cann

May 09, 2025 -

Hills Stellar Performance Golden Knights Beat Blue Jackets

May 09, 2025

Hills Stellar Performance Golden Knights Beat Blue Jackets

May 09, 2025 -

Car Crash At Jennifer Anistons Home Leads To Felony Charges

May 09, 2025

Car Crash At Jennifer Anistons Home Leads To Felony Charges

May 09, 2025 -

Oilers Fall To Lightning 4 1 Kucherovs Impact Decisive

May 09, 2025

Oilers Fall To Lightning 4 1 Kucherovs Impact Decisive

May 09, 2025