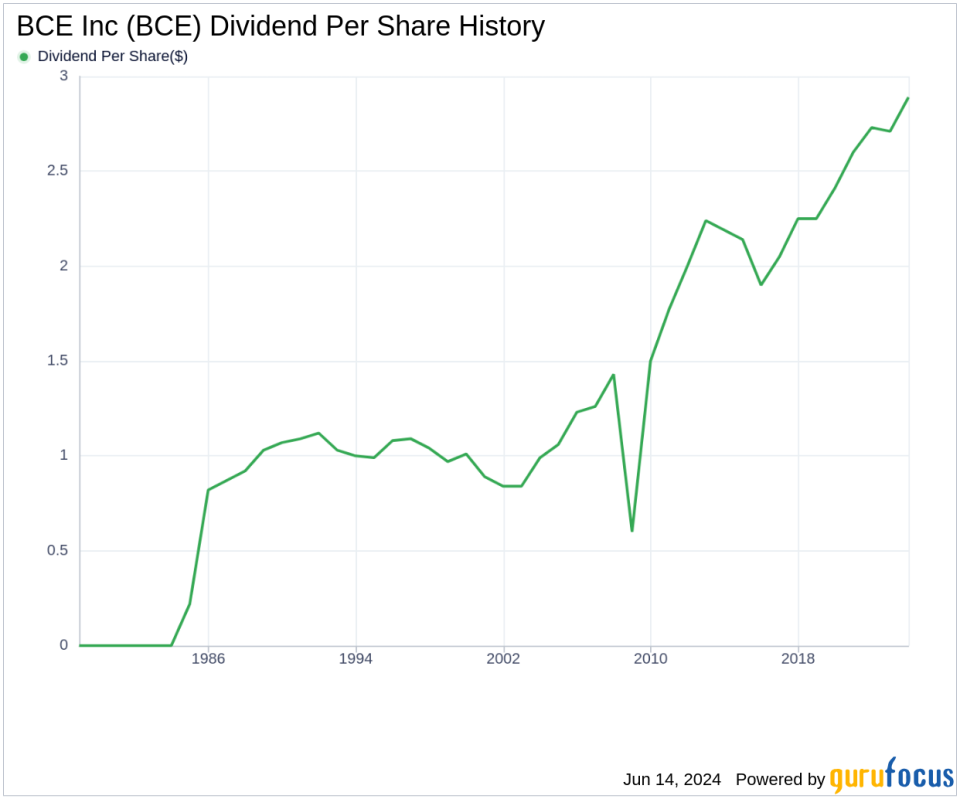

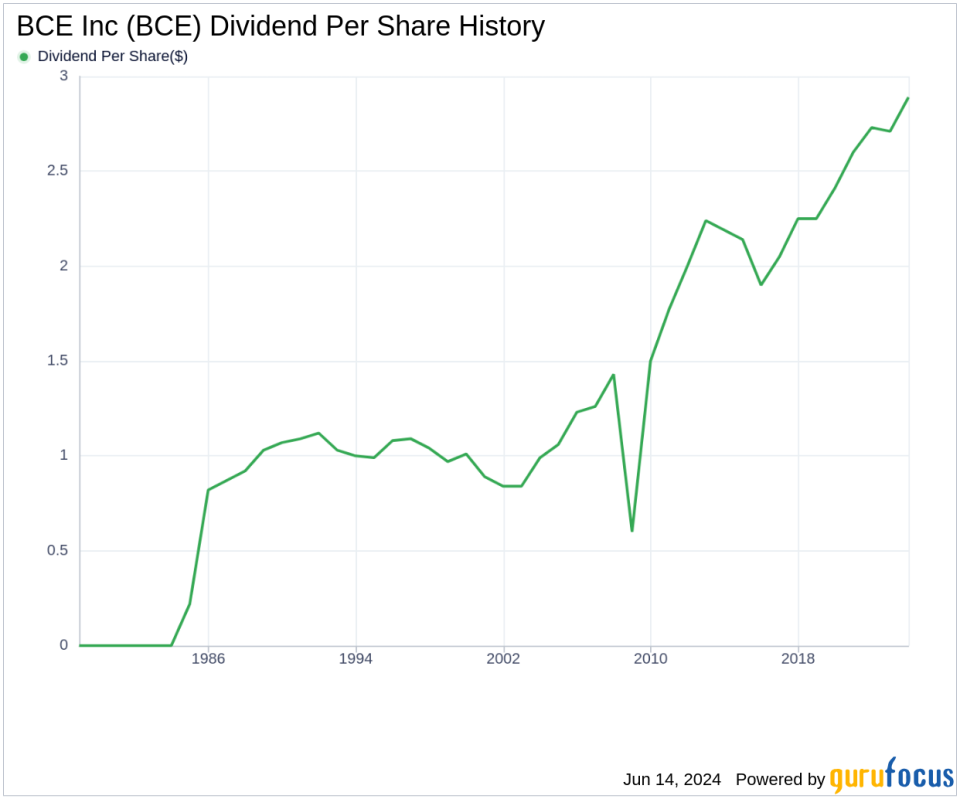

The BCE Inc. Dividend Cut: What It Means For Your Investment Strategy

Table of Contents

H2: Reasons Behind the BCE Inc. Dividend Cut

The BCE Inc. dividend cut, a significant event for Canadian investors, stems from a confluence of factors impacting the company's financial health and long-term strategic goals. Understanding these reasons is key to assessing the future of your BCE stock holdings and adjusting your investment strategy accordingly.

H3: Increased Debt and Capital Expenditures

BCE's recent financial statements reveal a notable increase in debt levels, coupled with substantial capital expenditures. These investments, crucial for maintaining a competitive edge in the telecom industry, are putting pressure on short-term profitability.

- Debt Increase: BCE's debt has increased by X% in the last Y years (replace X and Y with actual figures from BCE's financial reports). This increase is partly attributed to financing major infrastructure projects.

- Capital Expenditure Plans: Significant investments are being made in expanding the 5G network and upgrading the fiber optic network infrastructure. These are long-term investments expected to yield returns in the future, but they impact current profitability and dividend payouts. The projected capital expenditure for the next fiscal year is Z dollars (replace Z with actual figure).

- Impact on Profitability: The combination of increased debt servicing costs and substantial capital expenditures has reduced BCE's short-term profitability, leading to the difficult decision to cut the dividend. This is a strategic move aimed at long-term growth, even if it means short-term pain for shareholders. Keywords: BCE debt, BCE capital expenditure, 5G investment, fiber optic network

H3: Impact of the Pandemic and Economic Uncertainty

The COVID-19 pandemic and subsequent economic uncertainty significantly affected BCE's revenue streams and profitability. While BCE proved relatively resilient compared to some other sectors, the pandemic’s impact on subscriber growth and overall economic conditions contributed to the decision to adjust the dividend.

- Revenue Changes: BCE experienced a slight decrease in revenue during the peak of the pandemic (insert specific data if available), impacting their ability to maintain previous dividend levels.

- Impact on Subscriber Growth: While subscriber growth remained relatively stable, the competitive landscape and economic slowdown affected the overall revenue generation. The telecom industry saw increased competition during this period.

- Competitive Pressures: The pandemic intensified competition within the Canadian telecom sector, impacting pricing strategies and overall profitability. Keywords: BCE revenue, pandemic impact on BCE, telecom industry competition

H3: Long-Term Investment Strategy Shifts

BCE's revised long-term strategy emphasizes continued investment in infrastructure upgrades to maintain its market leadership. This strategic shift implies a focus on future growth potential, potentially at the expense of short-term dividend payouts.

- Details of BCE’s Strategic Plans: BCE's strategic plan prioritizes long-term growth by investing heavily in its network infrastructure to prepare for future technologies and increasing customer demand.

- Future Investment Priorities: Future investments will likely focus on 5G expansion, fiber optic network enhancements, and the development of new technologies.

- Anticipated Timelines: The company anticipates that these investments will position them for long-term growth and improved profitability in the years to come. The timeline for a potential dividend increase is not yet specified but is tied to the successful completion and return on investment from these capital expenditures. Keywords: BCE long-term strategy, BCE future dividend, BCE investment outlook

H2: Impact on Your Investment Portfolio

The BCE Inc. dividend cut necessitates a reassessment of your investment strategy. It's crucial to re-evaluate your investment thesis for BCE stock and consider the potential impact on your overall portfolio.

H3: Re-evaluating Your Investment Thesis

The dividend cut may necessitate a reconsideration of your initial investment rationale for holding BCE stock. The question becomes: is the long-term growth potential of BCE sufficient to justify holding the stock despite the reduced dividend?

- Pros of Holding BCE Stock: Potential for long-term capital appreciation as BCE’s investments bear fruit, continued stability in a relatively resilient sector.

- Cons of Holding BCE Stock: Lower immediate income from dividends, increased risk associated with the company’s debt load.

- Alternative Investment Options: Consider diversification by exploring other telecom stocks or alternative investment avenues that align with your risk tolerance and financial goals. Keywords: BCE stock analysis, BCE investment decision, alternative telecom stocks

H3: Tax Implications of the Dividend Cut

The reduced dividend will have tax implications for investors. Understanding these implications is crucial for effective financial planning.

- Explanation of Tax Implications: A lower dividend means a lower taxable income from this specific investment. However, the overall impact on your tax liability will depend on your individual tax bracket and other sources of income.

- Potential Strategies to Minimize Tax Burden: Consult with a financial advisor or tax professional to explore strategies for minimizing your tax burden, such as tax-loss harvesting (where applicable). Keywords: BCE dividend tax implications, Canadian dividend tax

H3: Diversification and Risk Management

The BCE dividend cut highlights the importance of portfolio diversification and robust risk management strategies.

- Strategies for Diversifying Investments: Diversification across different sectors and asset classes mitigates risk and reduces dependence on any single investment.

- Managing Risk Within a Portfolio: Regularly review your portfolio's risk profile and adjust it to reflect your changing financial circumstances and risk tolerance. Keywords: portfolio diversification, risk management, investment portfolio strategy

3. Conclusion

The BCE Inc. dividend cut presents a significant challenge for investors. Understanding the underlying reasons, carefully evaluating the impact on your portfolio, and adjusting your investment strategy accordingly is crucial. While the cut is a setback, it’s vital to assess BCE’s long-term prospects and consider its position within a diversified portfolio. Don't panic, but do reassess your BCE Inc. dividend investment strategy. Consider consulting a financial advisor to discuss your individual circumstances and create a plan for navigating this change effectively. Remember to regularly monitor BCE's financial performance and industry trends to make informed decisions regarding your BCE stock investment.

Featured Posts

-

Le Dechiffrage L Euro Resiste Aux Tensions

May 12, 2025

Le Dechiffrage L Euro Resiste Aux Tensions

May 12, 2025 -

John Wick 5 Keanu Reeves Update And The End Of The Franchise

May 12, 2025

John Wick 5 Keanu Reeves Update And The End Of The Franchise

May 12, 2025 -

Parliament Upholds Confidence In Asylum Minister Faber Amid No Confidence Vote

May 12, 2025

Parliament Upholds Confidence In Asylum Minister Faber Amid No Confidence Vote

May 12, 2025 -

Jeff Bezos Fan Poll Reveals The Next James Bond Frontrunner

May 12, 2025

Jeff Bezos Fan Poll Reveals The Next James Bond Frontrunner

May 12, 2025 -

Ufc 315 Shevchenko Vs Fiorot Predictions Picks And Betting Odds

May 12, 2025

Ufc 315 Shevchenko Vs Fiorot Predictions Picks And Betting Odds

May 12, 2025

Latest Posts

-

Braunschweiger Grundschule Alle Klar Signal Nach Alarm

May 13, 2025

Braunschweiger Grundschule Alle Klar Signal Nach Alarm

May 13, 2025 -

Entwarnung Keine Gefahr Mehr An Braunschweiger Grundschule

May 13, 2025

Entwarnung Keine Gefahr Mehr An Braunschweiger Grundschule

May 13, 2025 -

Karneval In Braunschweig Schoduvel 2025 Tv Und Livestream Guide

May 13, 2025

Karneval In Braunschweig Schoduvel 2025 Tv Und Livestream Guide

May 13, 2025 -

Der Braunschweiger Schoduvel Ein Umfassender Guide Zum Karnevalsumzug

May 13, 2025

Der Braunschweiger Schoduvel Ein Umfassender Guide Zum Karnevalsumzug

May 13, 2025 -

Entwarnung Nach Bombendrohung An Braunschweiger Grundschule Schueler Und Lehrer Sicher

May 13, 2025

Entwarnung Nach Bombendrohung An Braunschweiger Grundschule Schueler Und Lehrer Sicher

May 13, 2025