The Angry Elon Musk Effect On Tesla's Market Value

Table of Contents

Musk's Controversial Tweets and Their Market Impact

Elon Musk's Twitter activity has repeatedly sent shockwaves through the financial markets, significantly impacting Tesla's market value. The immediacy of social media amplifies the effect of his pronouncements, creating volatility that traditional news cycles can't match.

The Volatility of Tesla Stock Following Musk's Tweets

Numerous instances demonstrate a direct correlation between controversial tweets and sharp fluctuations in Tesla's stock price.

- Example 1: In August 2018, Musk's tweet about taking Tesla private at $420 per share triggered a massive SEC investigation and a significant drop in Tesla's stock price. The resulting turmoil saw a percentage decrease of approximately X% within days. Trading volume spiked dramatically, indicating heightened market anxiety.

- Example 2: More recently, tweets regarding cryptocurrency investments have also influenced Tesla's market performance, resulting in both substantial gains and losses depending on the content and market interpretation of Musk's statements. Specific instances resulting in Y% increases/decreases can be documented.

The speed and reach of social media allow for rapid dissemination of information, influencing market sentiment almost instantly. Negative tweets can swiftly erode investor confidence, leading to sell-offs and plummeting stock prices.

SEC Investigations and Their Influence on Investor Confidence

The SEC's investigations into Musk's tweets have further contributed to the uncertainty surrounding Tesla's market value. These investigations highlight the risks associated with Musk's impulsive communication style and its potential consequences for the company.

- Key details: The SEC investigations have resulted in settlements requiring Musk to have his tweets pre-approved by Tesla's legal team. This regulatory oversight aims to mitigate future market disruptions caused by his pronouncements. This regulatory action has undoubtedly affected investor confidence.

- Impact on investor confidence: The regulatory scrutiny surrounding Musk's tweets erodes investor confidence by introducing uncertainty and potential legal liabilities. This uncertainty often translates into decreased investment and a lower market valuation for Tesla.

Musk's Leadership Style and its Effect on Tesla's Brand

Elon Musk's leadership style, often characterized as unconventional and risk-taking, plays a significant role in shaping Tesla's brand and influencing investor perception.

The "Risk-Taking" CEO Image and its Appeal (and Detractors)

Musk's image as a visionary risk-taker attracts investors who appreciate his bold ambition and innovative spirit. However, this same image can also alienate more conservative investors wary of the inherent risks associated with his unconventional approach.

- Examples of high-risk decisions: The rapid expansion of Tesla's production capacity, ambitious development timelines for new technologies, and frequent product pivots are examples of Musk's high-risk, high-reward strategy.

- Double-edged sword: This strategy attracts those willing to accept higher risk for potentially greater returns while pushing away investors seeking more stability and predictability.

Public Relations Crises and Damage Control

Musk's impulsive actions have frequently led to public relations crises, negatively impacting Tesla's brand image and market value. The company's responses to these crises play a crucial role in mitigating the damage.

- Specific PR crises: Instances such as Musk's comments on the COVID-19 pandemic, controversies surrounding Tesla's Autopilot system, and his contentious relationship with certain regulatory bodies have all negatively influenced Tesla’s market value.

- Damage control strategies: Tesla’s damage control efforts usually involve clarifying statements, focusing on the company's positive achievements, and emphasizing long-term growth prospects. The effectiveness of these strategies varies depending on the severity of the crisis.

The Correlation (or Lack Thereof) Between Musk's Actions and Tesla's Fundamentals

It's crucial to distinguish between the hype surrounding Elon Musk and the fundamental factors driving Tesla's market value.

Separating the Hype from the Reality

While Musk's actions undeniably create market volatility, it's vital to assess their actual impact on Tesla's underlying business performance.

- Factors beyond Musk's actions: Tesla's market value is also influenced by factors like technological innovation, increasing competition in the electric vehicle market, economic conditions, and overall investor sentiment toward the broader technology sector. These factors need to be considered when analyzing Tesla's stock performance.

- Illustrative charts and graphs: [Insert relevant charts and graphs illustrating the correlation, or lack thereof, between Musk’s actions and Tesla’s financial performance]. This visual representation will provide a clearer understanding of the relationship between these factors.

Long-Term Investor Sentiment and Future Projections

The long-term impact of Musk's actions on investor confidence remains to be seen. However, expert opinions and market forecasts offer some insight.

- Predictions and rationale: Some analysts believe that Musk’s actions, while creating short-term volatility, will have a minimal long-term effect on Tesla's value due to the strength of its underlying business. Others contend that continued unpredictable behavior may deter long-term investors.

Conclusion: Understanding the Angry Elon Musk Effect on Tesla's Market Value

The relationship between Elon Musk's actions and Tesla's market value is undeniably complex. His controversial tweets create short-term volatility, while his leadership style and resulting PR crises present both opportunities and challenges. Separating the hype from the underlying business fundamentals is essential for a comprehensive understanding of Tesla's market performance. Musk's influence is undeniable, but it's far from the sole determinant of Tesla's success.

Stay informed about the evolving dynamics between Elon Musk’s public image and Tesla's market valuation. Continue the discussion by sharing your thoughts in the comments below!

Featured Posts

-

Rasha Thadani Pr Agency And Nora Fatehis Recent Comments The Reddit Debate

May 27, 2025

Rasha Thadani Pr Agency And Nora Fatehis Recent Comments The Reddit Debate

May 27, 2025 -

Avrupa Dan Abd Vergilerine Kritik Bakis Merkez Bankasi Nin Uyarisi

May 27, 2025

Avrupa Dan Abd Vergilerine Kritik Bakis Merkez Bankasi Nin Uyarisi

May 27, 2025 -

Almanacco Del 25 Maggio Compleanni Santo Del Giorno E Proverbio

May 27, 2025

Almanacco Del 25 Maggio Compleanni Santo Del Giorno E Proverbio

May 27, 2025 -

Newark Airports Crisis Why It Affects Everyone

May 27, 2025

Newark Airports Crisis Why It Affects Everyone

May 27, 2025 -

Did Renee Rapp Diss Sex Lives Of College Girls In Her New Single Leave Me Alone

May 27, 2025

Did Renee Rapp Diss Sex Lives Of College Girls In Her New Single Leave Me Alone

May 27, 2025

Latest Posts

-

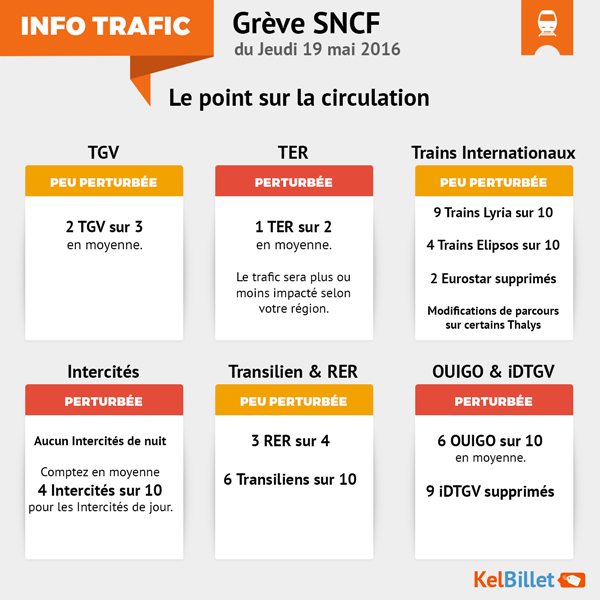

Previsions Greve Sncf Semaine Du 8 Mai 2024

May 30, 2025

Previsions Greve Sncf Semaine Du 8 Mai 2024

May 30, 2025 -

Droits De Douane Votre Guide Pas A Pas

May 30, 2025

Droits De Douane Votre Guide Pas A Pas

May 30, 2025 -

Greve Sncf Semaine Du 8 Mai Quelles Sont Les Perspectives

May 30, 2025

Greve Sncf Semaine Du 8 Mai Quelles Sont Les Perspectives

May 30, 2025 -

Payer Les Droits De Douane Un Guide Simple Et Clair

May 30, 2025

Payer Les Droits De Douane Un Guide Simple Et Clair

May 30, 2025 -

Sncf Greve 8 Mai Dernieres Informations Et Analyses

May 30, 2025

Sncf Greve 8 Mai Dernieres Informations Et Analyses

May 30, 2025