The 31% Reduction In BP's CEO's Salary: Reasons And Implications

Table of Contents

- Reasons Behind the 31% Salary Reduction

- Performance-Based Compensation

- Shareholder Pressure and Public Scrutiny

- Corporate Social Responsibility (CSR) Initiatives

- Implications of the 31% Salary Reduction

- Impact on Employee Morale and Compensation

- Signal to Other Corporations

- Long-Term Effects on BP's Brand and Reputation

- Conclusion: Understanding the Significance of the 31% BP CEO Salary Reduction

Reasons Behind the 31% Salary Reduction

Several intertwined factors likely contributed to the substantial 31% reduction in BP's CEO's salary. Let's examine the key drivers:

Performance-Based Compensation

A primary reason for the BP CEO pay cut could be linked to the company's financial performance during the relevant period. Performance-based compensation structures are increasingly common, tying executive pay directly to company results.

- Profit Margins: A decline in profit margins compared to previous years or industry benchmarks might have triggered the reduction. Specific data on BP's profit margins for the relevant period would be necessary for a definitive analysis. (Source needed here if analyzing specific financial data).

- Stock Price: Fluctuations in BP's stock price can significantly influence executive compensation. A period of underperformance in the stock market might have led to a reduction in the CEO's bonus or overall compensation. (Source needed here if analyzing specific stock price data).

- Missed Targets: Companies often set key performance indicators (KPIs) for their executives. Failure to meet predetermined targets, particularly those related to profitability, sustainability, or operational efficiency, could justify a salary reduction. (Source needed here if discussing specific missed targets).

Shareholder Pressure and Public Scrutiny

Growing shareholder activism and public concern over excessive CEO compensation played a significant role in the decision.

- Shareholder Resolutions: Activist investors often file resolutions advocating for changes in executive pay structures. The pressure exerted by these shareholders could have influenced BP's board to approve the salary reduction. (Source needed here if specific shareholder resolutions are referenced).

- Public Campaigns: Public awareness campaigns highlighting the disparity between CEO pay and average employee wages increasingly put pressure on corporations to justify their executive compensation packages. This public scrutiny might have prompted BP to take action. (Source needed here if referencing specific public campaigns).

- Industry Comparisons: Comparisons to executive pay in similar companies could have also influenced the decision. If BP's CEO salary was significantly higher than its competitors, the reduction could be seen as an attempt to align with industry norms. (Source needed here if specific industry comparisons are referenced).

Corporate Social Responsibility (CSR) Initiatives

The 31% BP CEO pay cut may be part of a broader corporate social responsibility (CSR) strategy.

- Environmental Sustainability: BP has pledged to reduce its carbon footprint and invest in renewable energy sources. A salary reduction, showcasing commitment to responsible resource allocation, could reinforce this commitment. (Source needed here if referencing specific BP CSR initiatives).

- Social Equity: Reducing executive pay can be presented as a gesture toward greater social equity within the company and the wider community. The saved funds could potentially be reinvested in employee programs or community initiatives. (Source needed here if referencing specific BP social equity programs).

- Ethical Governance: The decision reflects a commitment to ethical governance and responsible business conduct. Demonstrating restraint in executive compensation can enhance public trust and investor confidence. (Source needed here if referencing specific BP ethical governance initiatives).

Implications of the 31% Salary Reduction

The 31% reduction in BP's CEO's salary has far-reaching implications, affecting several aspects of the company and the broader business world.

Impact on Employee Morale and Compensation

The salary reduction may influence employee morale and perceptions of pay equity within BP.

- Pay Equity: Employees may question the fairness of the pay structure if the CEO's reduction isn't accompanied by adjustments to other employees' salaries. This could potentially lead to discontent and lower morale. (Source needed here if specific employee compensation data is discussed).

- Compensation Strategies: The decision may prompt a review of BP's overall compensation strategies, potentially leading to changes in bonus structures or performance-based incentives for all employees. (Source needed here if specific data on compensation strategy changes is discussed).

Signal to Other Corporations

The BP CEO pay cut could set a precedent for other corporations, especially within the energy sector.

- Industry Trends: This action might encourage other energy companies to re-evaluate their executive compensation practices, potentially leading to a broader trend toward more moderate executive pay. (Source needed here if discussing specific trends within the energy sector).

- Future Executive Compensation: The decision might influence future executive compensation negotiations and package design. Companies may be more cautious about offering extremely high salaries in the wake of the BP example. (Source needed here if discussing future compensation trends).

Long-Term Effects on BP's Brand and Reputation

The salary reduction could significantly impact BP's public image and brand perception.

- Investor Confidence: The decision might boost investor confidence by signaling responsible financial management and a commitment to long-term value creation. (Source needed here if specific investor confidence data is discussed).

- Consumer Trust: Consumers are increasingly considering corporate social responsibility when making purchasing decisions. The pay cut could improve BP's reputation and enhance consumer trust. (Source needed here if discussing specific consumer trust data).

- Media Coverage: The media's portrayal of the salary reduction will significantly influence public perception. Positive media coverage could strengthen BP's brand image, while negative coverage could damage it. (Source needed here if discussing specific media coverage).

Conclusion: Understanding the Significance of the 31% BP CEO Salary Reduction

The 31% reduction in BP's CEO's salary is a multifaceted event driven by performance-based compensation, shareholder pressure, and a growing emphasis on corporate social responsibility. The implications are significant, potentially influencing employee morale, industry practices, and BP's long-term brand image. This decision serves as a case study in the evolving landscape of executive compensation and corporate accountability. The long-term effects remain to be seen, but the initial impact clearly highlights the increasing pressure on corporations to justify and moderate executive pay.

What are your thoughts on the 31% reduction in BP's CEO's salary? Do you believe this will influence other companies to adjust their executive compensation packages? Share your opinions and insights in the comments section below. Let's continue the discussion about the future of executive compensation and corporate responsibility!

Is The Trans Australia Run World Record About To Fall

Is The Trans Australia Run World Record About To Fall

V Mware Pricing To Explode At And T Highlights Broadcoms Extreme Increase

V Mware Pricing To Explode At And T Highlights Broadcoms Extreme Increase

Espn Uncovers Key To Bruins Franchise Defining Offseason

Espn Uncovers Key To Bruins Franchise Defining Offseason

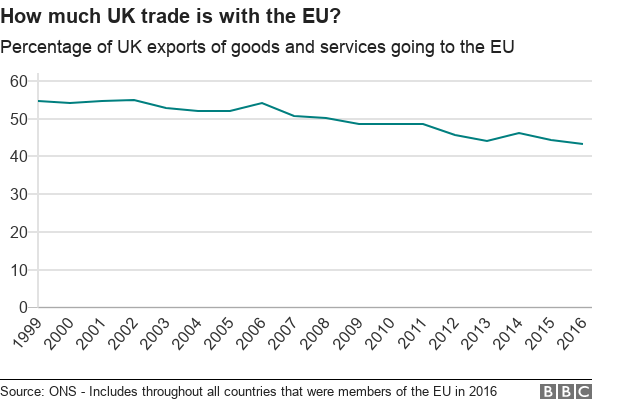

Brexits Impact Uk Luxury Goods Exports To The Eu

Brexits Impact Uk Luxury Goods Exports To The Eu

Juergen Klopp Un Doenuesue Duenya Devi Nin Yeni Lideri Mi

Juergen Klopp Un Doenuesue Duenya Devi Nin Yeni Lideri Mi