The 2025 BigBear.ai (BBAI) Stock Drop: Causes And Potential Recovery

Table of Contents

Key Factors Contributing to the BBAI Stock Drop in 2025

Several interconnected factors contributed to the significant drop in BBAI stock price in 2025. Understanding these factors is crucial to assessing the potential for future recovery.

Disappointing Financial Performance

One of the most significant factors driving the BBAI stock drop was the company's disappointing financial performance throughout 2025. Missed earnings expectations and lower-than-projected revenue became recurring themes.

- Missed Earnings: Several quarters showed significant deviations from projected earnings, leading to investor concern about the company's ability to meet its financial targets. These shortfalls were often accompanied by explanations citing slower-than-anticipated contract awards and increased competition.

- Revenue Decline: The company's revenue growth failed to keep pace with expectations, indicating challenges in securing and executing large-scale contracts, particularly within the highly competitive government contracting sector.

- Quarterly Reports: Analysis of the quarterly reports revealed a consistent pattern of underperformance, eroding investor confidence and contributing to the downward pressure on BBAI stock. Keywords: BBAI earnings, revenue decline, financial results, quarterly report, investor sentiment.

Macroeconomic Headwinds

The broader macroeconomic environment also played a significant role in the BBAI stock decline. The prevailing economic conditions created substantial headwinds for many growth-oriented tech stocks, including BBAI.

- Interest Rate Hikes: The aggressive interest rate hikes implemented by central banks to combat inflation had a chilling effect on the stock market, particularly impacting companies with high valuations and growth-dependent business models.

- Inflationary Pressures: Soaring inflation rates impacted consumer and government spending, reducing demand for AI-powered solutions and further impacting BBAI's revenue streams.

- Market Volatility: The overall market volatility created a climate of uncertainty, leading to risk-averse investors selling off growth stocks like BBAI. Keywords: macroeconomic factors, interest rates, inflation, market volatility, recession fears.

Competitive Landscape and Market Saturation

The AI and government contracting sectors are becoming increasingly competitive. This intense competition posed a substantial challenge to BBAI, impacting its market share and growth trajectory.

- Increased Competition: The emergence of new players with innovative AI solutions and aggressive pricing strategies intensified competition for contracts and market share.

- Market Saturation: In certain niche markets, signs of market saturation began to appear, reducing the potential for significant growth and potentially impacting BBAI's expansion plans.

- Competitive Advantage: The company needed to demonstrate a clear and sustained competitive advantage to differentiate itself in a crowded market. Keywords: AI competition, government contracting, market share, competitive advantage, industry analysis.

Negative News and Investor Sentiment

Negative news, both real and perceived, significantly impacted investor sentiment and contributed to the BBAI stock drop.

- Negative Media Coverage: Unfavorable media coverage, highlighting concerns about financial performance or strategic direction, further eroded investor confidence.

- Analyst Downgrades: Negative revisions to earnings estimates by financial analysts led to a sell-off as investors reassessed their valuation of BBAI.

- Investor Confidence: The cumulative effect of negative news and financial underperformance severely damaged investor confidence, triggering a significant sell-off. Keywords: investor confidence, negative news, media coverage, analyst ratings, stock market sentiment.

Potential Paths to BBAI Stock Recovery

Despite the challenges, several potential pathways exist for BBAI to recover and regain investor trust.

Strategic Initiatives and Business Development

BBAI needs to implement a robust strategic plan focused on growth and innovation to overcome its challenges.

- New Contract Wins: Securing significant new contracts, particularly within the government and national security sectors, is crucial for revenue growth.

- Product Innovation: Developing new and innovative AI-powered solutions can attract new customers and create a stronger competitive advantage.

- Mergers & Acquisitions: Strategic acquisitions could expand BBAI's market reach and technology portfolio. Keywords: strategic plan, business development, new contracts, product innovation, cost reduction.

Improving Financial Performance and Transparency

Restoring investor confidence necessitates a demonstrable improvement in financial performance and greater transparency.

- Financial Turnaround: Implementing cost-cutting measures and improving operational efficiency are crucial to achieving a financial turnaround.

- Transparent Communication: Open and honest communication with investors about financial results and future projections is vital to rebuilding trust.

- Strong Financials: Consistently strong quarterly and annual financial reports will demonstrate the effectiveness of implemented strategies. Keywords: financial turnaround, transparency, investor relations, improved profitability, strong financials.

Market Trends and Technological Advancements

Leveraging emerging market trends and technological advancements is essential for BBAI's long-term growth.

- AI Technology: Staying at the forefront of AI technology advancements and adapting its solutions to meet evolving market needs is critical.

- Market Trends: Identifying and capitalizing on emerging market trends within the AI and government contracting sectors.

- Future Growth: Investing in research and development to ensure future growth and competitiveness. Keywords: AI technology, market trends, technological innovation, future growth, emerging technologies.

Investor Confidence and Sentiment Shift

A positive shift in investor sentiment is critical for a sustained BBAI stock price recovery.

- Positive News: Positive news, such as significant contract wins, successful product launches, or improved financial results, can help to rebuild investor confidence.

- Market Rebound: A general market rebound, creating a more favorable investment environment, could also benefit BBAI stock.

- Bullish Outlook: A change in analyst ratings to a more bullish outlook can influence investor sentiment and lead to increased demand for BBAI stock. Keywords: investor sentiment, stock price recovery, positive news, market rebound, bullish outlook.

Conclusion: BigBear.ai (BBAI) Stock: Looking Ahead

The 2025 drop in BigBear.ai (BBAI) stock was a result of a combination of factors including disappointing financial performance, macroeconomic headwinds, intense competition, and negative investor sentiment. While the company faces significant challenges, potential pathways to recovery exist, focusing on improving financial performance, implementing strategic initiatives, and leveraging technological advancements to regain market share and investor confidence. However, the future of BBAI stock remains uncertain, and the company needs to demonstrate significant and consistent improvement to regain investor trust. While the future of BBAI stock remains uncertain, understanding the factors affecting its performance is crucial for informed investment decisions. Conduct thorough research and consult a financial advisor before investing in BigBear.ai (BBAI) stock. Keywords: BigBear.ai, BBAI stock, stock recovery, AI investment, tech investment, market analysis.

Featured Posts

-

Dexter Funko Pop Vinyls Release Date And Where To Buy

May 21, 2025

Dexter Funko Pop Vinyls Release Date And Where To Buy

May 21, 2025 -

Occasionverkoop Abn Amro Flink Gestegen Door Meer Autobezitters

May 21, 2025

Occasionverkoop Abn Amro Flink Gestegen Door Meer Autobezitters

May 21, 2025 -

Unexpected Victory Tigers Defeat Rockies 8 6

May 21, 2025

Unexpected Victory Tigers Defeat Rockies 8 6

May 21, 2025 -

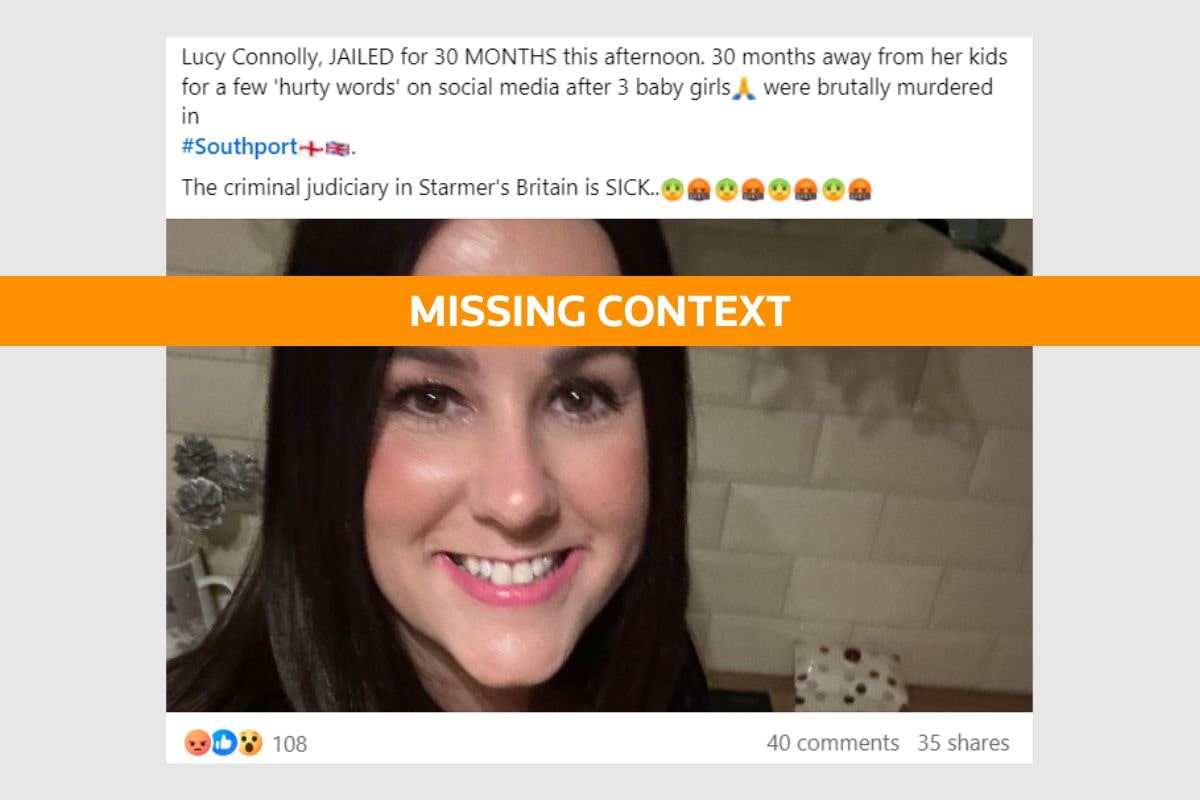

Southport Stabbing Mums Tweet Jail Term And Subsequent Homelessness

May 21, 2025

Southport Stabbing Mums Tweet Jail Term And Subsequent Homelessness

May 21, 2025 -

Beenie Man Announces New York Domination What Does It Mean For It A Stream

May 21, 2025

Beenie Man Announces New York Domination What Does It Mean For It A Stream

May 21, 2025

Latest Posts

-

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025 -

Southport Stabbing Mothers Tweet Imprisonment And Housing Struggle

May 22, 2025

Southport Stabbing Mothers Tweet Imprisonment And Housing Struggle

May 22, 2025 -

Lucy Connolly Loses Appeal In Racial Hatred Case

May 22, 2025

Lucy Connolly Loses Appeal In Racial Hatred Case

May 22, 2025 -

Jail Time And Homelessness For Mother After Southport Stabbing Tweet

May 22, 2025

Jail Time And Homelessness For Mother After Southport Stabbing Tweet

May 22, 2025 -

Detroit Tigers Impressive 8 6 Win Against The Rockies

May 22, 2025

Detroit Tigers Impressive 8 6 Win Against The Rockies

May 22, 2025