Thailand Inflation Turns Negative: More Rate Cuts On The Horizon?

Table of Contents

Understanding Negative Inflation in Thailand

Causes of Deflation

Several factors have contributed to Thailand's unexpected deflation. Weakening consumer demand, a consequence of both global and domestic economic uncertainties, plays a significant role. Low global commodity prices, particularly oil, have suppressed inflationary pressures. Furthermore, the relatively strong baht has made imports cheaper, further dampening domestic price increases.

- Reduced consumer spending: Uncertainty about future economic prospects has led to decreased consumer confidence and spending.

- Falling oil prices: Lower global oil prices have significantly impacted transportation and production costs across various sectors.

- Increased imports: A strong baht makes imports more affordable, leading to increased competition and downward pressure on domestic prices.

- Export slowdown: Reduced global demand has impacted Thailand's export-oriented industries, contributing to lower overall economic activity.

Recent data from the BOT shows consumer price index (CPI) falling by [insert percentage and date here], a clear indication of deflationary pressures. This is a marked change from the previous [insert period] where inflation was [insert data]. This dramatic shift underscores the need for a careful analysis of the economic situation and potential responses.

Impacts of Deflation on the Thai Economy

The effects of deflation on the Thai economy are multifaceted and potentially concerning. Consumers may delay purchases expecting further price drops, leading to a decrease in overall demand. This, in turn, negatively impacts businesses, reducing profits and potentially leading to bankruptcies. Moreover, deflation can lead to wage stagnation or even decreases, further hindering consumer spending and potentially creating a deflationary spiral.

- Delayed purchases: Consumers postpone purchases anticipating lower prices in the future, reducing immediate demand.

- Decreased business profits: Lower prices and reduced sales volumes squeeze profit margins for businesses.

- Potential for bankruptcies: Businesses unable to adapt to falling prices may face financial difficulties and potential closure.

- Wage stagnation: Deflation can lead to pressure on wages, reducing consumer purchasing power and exacerbating the deflationary spiral.

The Bank of Thailand's Response

Current Monetary Policy

The Bank of Thailand has historically responded to economic downturns with interest rate cuts. In the past [insert period], the BOT has implemented [insert number] rate cuts totaling [insert percentage]. However, the current situation presents unique challenges. The effectiveness of further rate cuts in stimulating demand during deflation is debatable, as lower interest rates may not incentivize borrowing and spending if consumers expect prices to fall further.

- Past interest rate cuts: The BOT's historical approach has involved reducing interest rates to stimulate economic activity.

- Quantitative easing measures (if applicable): Discuss if any quantitative easing measures have been or are being considered.

- Other policy tools: Mention other potential policy tools, such as government spending programs or regulatory changes.

Probability of Further Rate Cuts

Given the negative inflation figures, further interest rate cuts by the Bank of Thailand are highly probable. However, the central bank faces a complex balancing act. Cutting rates too aggressively could weaken the baht, impacting imports and potentially fueling inflation in the longer term. The BOT must carefully weigh the risks of deflation against the potential negative consequences of currency devaluation and its impact on the Thai economy.

- Inflation expectations: The BOT needs to manage inflation expectations to avoid a self-fulfilling prophecy of deflation.

- Economic growth forecasts: The BOT must consider the overall economic growth outlook when deciding on monetary policy.

- Exchange rate stability: Maintaining exchange rate stability is crucial to avoid negative impacts on imports and exports.

- Global economic conditions: Global economic trends and uncertainties must also be factored into the decision-making process.

Implications for Investors and Businesses in Thailand

Investment Strategies

Negative inflation presents both challenges and opportunities for investors in Thailand. A diversified investment portfolio is crucial, with a focus on assets that are less susceptible to deflationary pressures. Hedging strategies to mitigate risks associated with currency fluctuations are also important.

- Diversification: Spreading investments across various asset classes reduces overall risk.

- Asset allocation: Adjusting asset allocation to favor assets that perform well during deflation.

- Hedging strategies: Implementing hedging strategies to mitigate currency risk and other potential losses.

Business Strategies

Businesses in Thailand need to adapt their strategies to navigate the deflationary environment. Cost-cutting measures are crucial to maintain profitability. Businesses should also carefully review their pricing strategies, considering the potential impact on sales volume and market share. Supply chain management and effective marketing adjustments are vital for survival in a deflationary climate.

- Cost-cutting measures: Identifying and eliminating unnecessary expenses to improve profitability.

- Pricing strategies: Finding the right balance between maintaining profitability and attracting price-sensitive consumers.

- Marketing adjustments: Adapting marketing strategies to target consumers concerned about deflation.

- Supply chain management: Optimizing supply chains to minimize costs and enhance efficiency.

Conclusion

Thailand's negative inflation presents a significant challenge to the Thai economy. Weakening consumer demand, low global commodity prices, and a strong baht are contributing factors. The Bank of Thailand is likely to respond with further interest rate cuts, but this requires careful consideration of potential risks. Investors and businesses must adapt their strategies to navigate this challenging economic climate.

Call to Action: Stay informed about the evolving economic situation in Thailand and its impact on your investments and business. Monitor news and analysis regarding Thailand inflation and the Bank of Thailand’s future monetary policy decisions to make informed decisions. Keep up-to-date on the latest developments regarding Thailand inflation to effectively navigate this challenging economic climate.

Featured Posts

-

Simone Biles Como La Terapia Me Ayuda A Mantenerme Enfocada Y Segura

May 07, 2025

Simone Biles Como La Terapia Me Ayuda A Mantenerme Enfocada Y Segura

May 07, 2025 -

Multidao Dorme Nas Ruas Do Vaticano Em Homenagem Ao Papa Francisco

May 07, 2025

Multidao Dorme Nas Ruas Do Vaticano Em Homenagem Ao Papa Francisco

May 07, 2025 -

Yankees 2000 Season A Diary Entry Comeback Attempt Fails

May 07, 2025

Yankees 2000 Season A Diary Entry Comeback Attempt Fails

May 07, 2025 -

Who Wants To Be A Millionaire Contestants Slow Play Sparks Outrage

May 07, 2025

Who Wants To Be A Millionaire Contestants Slow Play Sparks Outrage

May 07, 2025 -

Tigers Opening Win 9 6 Triumph Against Mariners

May 07, 2025

Tigers Opening Win 9 6 Triumph Against Mariners

May 07, 2025

Latest Posts

-

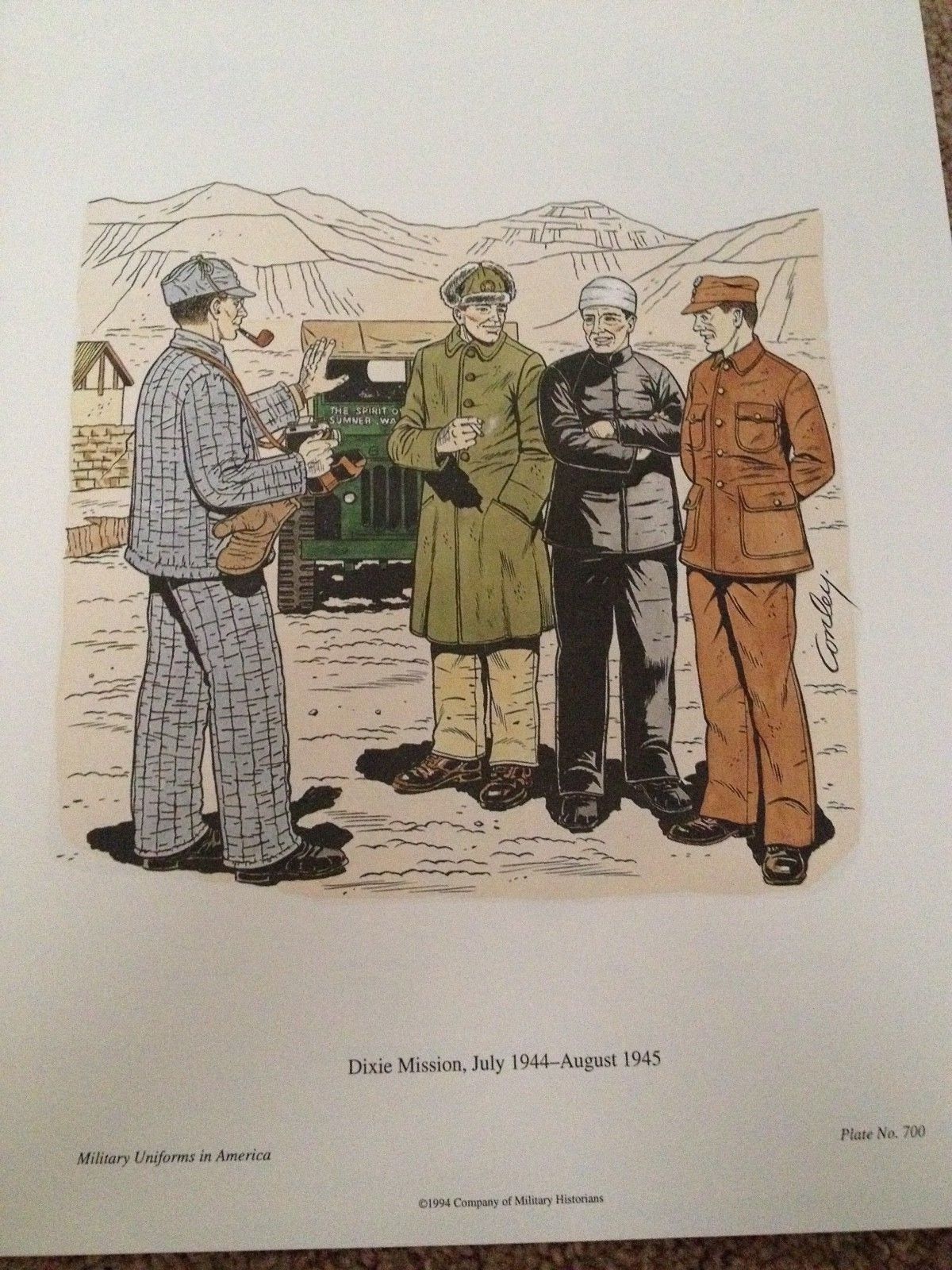

Is This Wwii Movie Better Than Saving Private Ryan A Military Historian Weighs In

May 08, 2025

Is This Wwii Movie Better Than Saving Private Ryan A Military Historian Weighs In

May 08, 2025 -

The 10 Most Memorable Characters In Saving Private Ryan

May 08, 2025

The 10 Most Memorable Characters In Saving Private Ryan

May 08, 2025 -

Saving Private Ryan An Unscripted Moment That Defined The Film

May 08, 2025

Saving Private Ryan An Unscripted Moment That Defined The Film

May 08, 2025 -

Ethereum Price Resilient Upside Break Imminent

May 08, 2025

Ethereum Price Resilient Upside Break Imminent

May 08, 2025 -

Realistic Wwii Movies Military Historians Top Picks Better Than Saving Private Ryan

May 08, 2025

Realistic Wwii Movies Military Historians Top Picks Better Than Saving Private Ryan

May 08, 2025