Tesla's Response To Shareholder Lawsuits: The Musk Compensation Fallout

Table of Contents

The Nature of the Shareholder Lawsuits

The core arguments in the various shareholder lawsuits against Tesla center on the alleged unfairness and illegality of Elon Musk's compensation package. Plaintiffs contend that the board of directors acted improperly in approving a compensation structure that they believe is excessively generous and not aligned with shareholder interests. These lawsuits allege a breach of fiduciary duty by the board, arguing that they failed to adequately protect shareholder value.

- Allegations of Excessive Compensation: Lawsuits claim Musk's compensation far exceeds industry norms for similar roles, irrespective of Tesla's performance. Specific points of contention often involve the structure of stock options and the potential for massive payouts even in the absence of exceptional company performance.

- Claims of Board Mismanagement and Lack of Oversight: Plaintiffs allege that the Tesla board lacked the independence necessary to properly evaluate and negotiate Musk's compensation package. Accusations include insufficient due diligence, conflicts of interest, and a lack of robust oversight mechanisms.

- Arguments about the Impact on Shareholder Value: The lawsuits argue that Musk's compensation package, even if seemingly performance-based, ultimately diluted shareholder value and unjustly enriched the CEO at the expense of investors. They highlight the potential opportunity cost of such significant resources allocated to executive compensation.

- Specific Lawsuits and Status: Several lawsuits have been filed, some consolidated, some dismissed, and others still ongoing. The outcomes of these legal battles will significantly impact Tesla's future and the precedent set for executive compensation practices. Close monitoring of these cases is crucial for understanding their impact.

Tesla's Defense Strategies

Tesla and its legal team have employed various strategies to defend against these shareholder lawsuits. Central to their defense is the argument that Musk's compensation is justified by his exceptional contributions to the company's unprecedented growth and success.

- Emphasis on Musk's Contributions to Tesla's Success: Tesla's defense highlights Musk's pivotal role in transforming Tesla from a fledgling automaker to a global industry leader. This argument positions his compensation as commensurate with his transformative impact.

- Highlighting the Performance-Based Nature of the Compensation Package: Tesla emphasizes that Musk's compensation is heavily tied to the achievement of specific, challenging performance goals, arguing that the structure incentivizes exceptional results that directly benefit shareholders.

- Arguments Regarding the Independence and Diligence of the Board: The company insists that its board acted independently and with due diligence in approving Musk's compensation, citing processes and expert advice that support the decision-making process.

- Discussion of Expert Testimony and Evidence: Tesla’s defense relies on expert testimony from financial analysts and compensation consultants to justify the structure and value of Musk’s compensation package, positioning it within an appropriate range given Tesla's exceptional performance and industry context.

Financial Implications of the Lawsuits

The Tesla shareholder lawsuits carry significant potential financial implications for the company. The legal costs associated with defending against these lawsuits, along with potential settlements or judgments, could substantially impact Tesla’s bottom line.

- Estimated Legal Fees: The ongoing legal battles are incurring substantial legal fees, impacting the company’s profitability and potentially diverting resources from other strategic initiatives.

- Potential Settlement Amounts: The potential for substantial settlements to resolve these lawsuits represents a significant financial risk, potentially reaching hundreds of millions or even billions of dollars depending on the outcomes.

- Impact on Tesla's Stock Price: The uncertainty surrounding the lawsuits has created volatility in Tesla’s stock price, potentially impacting investor confidence and shareholder value.

- Effect on Investor Confidence: Negative publicity surrounding the lawsuits could erode investor confidence, potentially making it more challenging to raise capital and impacting future valuations.

The Broader Context of Executive Compensation

The Musk compensation case has far-reaching implications for corporate governance and executive pay practices, sparking a wider debate about the appropriate balance between rewarding innovation and preventing excessive executive compensation.

- Comparison to Executive Compensation at Similar Companies: Analyzing Musk's compensation in comparison to CEOs at other major automotive and technology companies allows for a more comprehensive understanding of the scale of the issue and the potential for anomalies in executive compensation packages.

- Discussion of Regulatory Responses to Excessive Executive Pay: The case highlights the need for stronger regulatory frameworks and more stringent oversight of executive compensation to ensure alignment with shareholder interests and prevent future controversies.

- The Impact of Public Opinion and Media Scrutiny: The intense media coverage surrounding this case highlights the growing public awareness and scrutiny of executive compensation practices and their impact on society.

- The Role of Shareholder Activism: The lawsuits underscore the increasing power of shareholder activism and its potential to influence corporate decision-making regarding executive compensation.

Conclusion

Tesla's response to the shareholder lawsuits stemming from Elon Musk's compensation package reveals a complex interplay of legal strategies, financial risks, and broader implications for corporate governance. The significant financial and reputational risks involved underscore the importance of understanding these developments. The ongoing legal battles highlight the challenges of balancing the reward of exceptional leadership with the protection of shareholder interests. Follow the ongoing saga of Tesla shareholder lawsuits and stay updated on the latest developments in Tesla's response to shareholder litigation to understand the impact of the Musk compensation fallout on Tesla’s future. Understanding these issues is crucial for anyone interested in corporate governance, executive compensation, and the future of Tesla.

Featured Posts

-

Eurovision 2025 Guest Performer The Damiano David Speculation

May 18, 2025

Eurovision 2025 Guest Performer The Damiano David Speculation

May 18, 2025 -

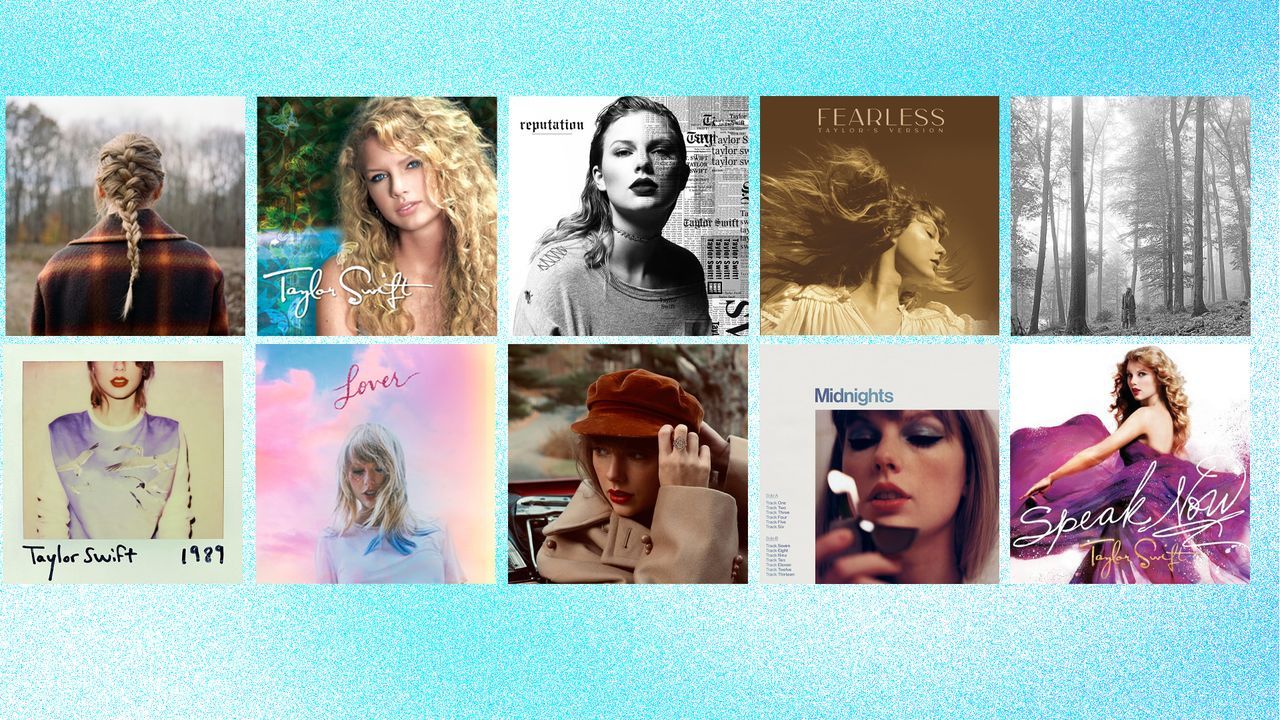

Every Taylor Swift Taylors Version Album Ranked A Critical Review

May 18, 2025

Every Taylor Swift Taylors Version Album Ranked A Critical Review

May 18, 2025 -

Maneskins Jimmy Kimmel Live Appearance Damiano Davids Show Stopping Performance Radio 94 5

May 18, 2025

Maneskins Jimmy Kimmel Live Appearance Damiano Davids Show Stopping Performance Radio 94 5

May 18, 2025 -

Decoding The Chinese Market Why Bmw And Porsche Face Headwinds

May 18, 2025

Decoding The Chinese Market Why Bmw And Porsche Face Headwinds

May 18, 2025 -

Next Summer Damiano Davids Reflective Solo Debut Outside Maneskin

May 18, 2025

Next Summer Damiano Davids Reflective Solo Debut Outside Maneskin

May 18, 2025

Latest Posts

-

220 Million Lawsuit Filed Against Mohawk Council By Kahnawake Casino Owners

May 18, 2025

220 Million Lawsuit Filed Against Mohawk Council By Kahnawake Casino Owners

May 18, 2025 -

Meta Monopoly Trial Ftcs Defense And Shifting Priorities

May 18, 2025

Meta Monopoly Trial Ftcs Defense And Shifting Priorities

May 18, 2025 -

Amazon Syndicat Des Travailleurs Devant Le Tribunal Du Travail Du Quebec Concernant La Fermeture D Entrepots

May 18, 2025

Amazon Syndicat Des Travailleurs Devant Le Tribunal Du Travail Du Quebec Concernant La Fermeture D Entrepots

May 18, 2025 -

The Canada Post Report A Critical Analysis Of Financial Stability And Mail Service

May 18, 2025

The Canada Post Report A Critical Analysis Of Financial Stability And Mail Service

May 18, 2025 -

Kahnawake Casino Lawsuit 220 Million Claim Against Mohawk Council And Grand Chief

May 18, 2025

Kahnawake Casino Lawsuit 220 Million Claim Against Mohawk Council And Grand Chief

May 18, 2025