Tesla Stock Fall And Tariffs: Elon Musk's Net Worth Plunges Under $300 Billion

Table of Contents

The Plunge in Tesla Stock Price

Tesla's stock price has experienced a significant downturn, raising concerns among investors. Several factors have contributed to this decline.

Impact of Rising Interest Rates

The Federal Reserve's aggressive interest rate hikes have significantly impacted growth stocks like Tesla.

- Increased borrowing costs: Higher interest rates make borrowing more expensive, increasing the cost of capital for Tesla's expansion plans and potentially impacting its profitability.

- Reduced investor appetite for risk: Rising interest rates often lead investors to shift towards safer, less volatile investments, reducing demand for growth stocks with inherently higher risk profiles, such as Tesla.

- Impact on future profitability projections: Increased borrowing costs and a potential slowdown in economic growth can negatively affect future profitability projections, leading to downward revisions in Tesla's valuation by analysts.

Concerns Regarding Production and Delivery

Concerns about Tesla's production capacity and ability to meet delivery targets have also weighed on the stock price.

- Factory shutdowns: Periodic factory shutdowns for upgrades or maintenance have impacted production output and potentially delayed deliveries.

- Supply chain issues: Like many other manufacturers, Tesla has faced disruptions to its supply chain, impacting the availability of crucial components and slowing down production.

- Competition from other EV manufacturers: The electric vehicle market is becoming increasingly competitive, with established automakers and new entrants launching compelling EVs, putting pressure on Tesla's market share.

Market Sentiment and Investor Confidence

Negative market sentiment and declining investor confidence have further fueled the sell-off in Tesla stock.

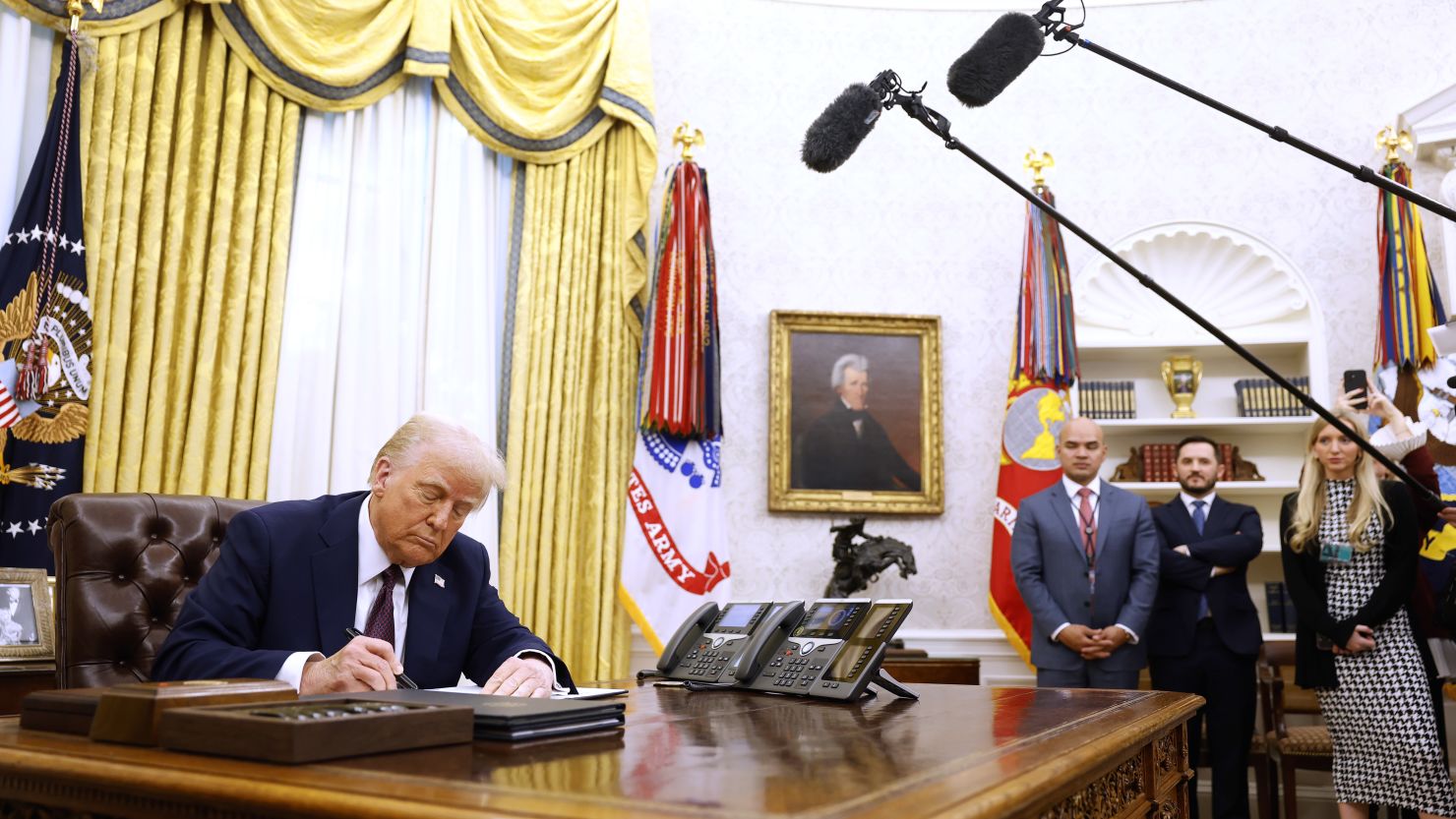

- Elon Musk's Twitter activity: Musk's controversial tweets and unpredictable behavior have at times unsettled investors and raised concerns about his leadership and the company's overall direction.

- Concerns about autonomous driving technology development: Progress on Tesla's full self-driving (FSD) technology has faced skepticism, impacting investor confidence in the long-term value proposition of Tesla vehicles.

- General market volatility: The overall volatility in the stock market, influenced by global economic uncertainty and geopolitical events, has contributed to the decline in Tesla's stock price.

The Role of Tariffs on Tesla's Performance

Rising tariffs have added another layer of complexity to Tesla's financial performance and its future prospects.

Increased Import Costs

Tariffs imposed on imported goods have increased Tesla's costs, impacting both its profitability and competitiveness.

- Higher prices for consumers: Increased import costs are often passed on to consumers, making Tesla vehicles more expensive and potentially reducing demand.

- Reduced competitiveness: Higher prices due to tariffs make Tesla less competitive compared to other EV manufacturers, particularly those with localized production in key markets.

- Impact on profitability margins: Increased costs, without a corresponding increase in pricing, can significantly squeeze Tesla's profit margins.

Geopolitical Risks and Trade Wars

Global trade tensions and geopolitical risks create further uncertainty for Tesla's international operations.

- Impact on supply chains: Trade wars and geopolitical instability can disrupt supply chains, impacting the availability of crucial components and increasing production costs.

- Potential for future tariff increases: The risk of future tariff increases adds to the uncertainty surrounding Tesla's future profitability and long-term planning.

- Market uncertainty: Geopolitical risks create market uncertainty, leading to increased volatility in Tesla's stock price.

Elon Musk's Net Worth and its Implications

Elon Musk's net worth is heavily tied to Tesla's stock performance, making him particularly vulnerable to its recent decline.

Calculation of Net Worth and Stock Ownership

A large portion of Musk's net worth is directly attributable to his significant ownership stake in Tesla.

- Percentage of Tesla stock owned: Musk's substantial ownership in Tesla means that fluctuations in the stock price directly and proportionally impact his personal wealth.

- Impact of stock price fluctuations on personal wealth: The recent drop in Tesla's stock price has translated into a considerable decrease in Musk's net worth.

Impact on Business Decisions and Future Investments

The decrease in Musk's net worth could influence Tesla's future strategies and investment decisions.

- Potential for reduced risk-taking: A decline in personal wealth might lead to a more cautious approach to business decisions, potentially impacting Tesla's innovation and expansion plans.

- Impact on innovation and expansion plans: Reduced investment in research and development or new ventures could hamper Tesla's long-term growth potential.

Conclusion

The significant drop in Tesla's stock price, compounded by the effects of rising tariffs and broader economic factors, has resulted in a substantial decrease in Elon Musk's net worth. This situation highlights the inherent volatility of the stock market and the interconnectedness of global economic factors. Understanding these challenges is crucial for investors and stakeholders alike. Stay informed about the ongoing developments in the Tesla stock and the electric vehicle market to make informed decisions regarding your investments. Keep an eye on news related to Tesla stock, Elon Musk's net worth, and the impact of tariffs on the electric vehicle industry.

Featured Posts

-

Melanie Eiffel Une Influence Determinante Sur Gustave Et Son Uvre A Dijon

May 10, 2025

Melanie Eiffel Une Influence Determinante Sur Gustave Et Son Uvre A Dijon

May 10, 2025 -

The Trump Administrations Transgender Military Ban Examining The Rhetoric And Reality

May 10, 2025

The Trump Administrations Transgender Military Ban Examining The Rhetoric And Reality

May 10, 2025 -

Trump Executive Orders And Their Impact On Transgender Individuals Your Experiences Matter

May 10, 2025

Trump Executive Orders And Their Impact On Transgender Individuals Your Experiences Matter

May 10, 2025 -

Uk Citys Housing Struggle The Rise Of Caravan Communities And Public Outcry

May 10, 2025

Uk Citys Housing Struggle The Rise Of Caravan Communities And Public Outcry

May 10, 2025 -

Sensex Live Market Gains Momentum Nifty Surges Past 17 950

May 10, 2025

Sensex Live Market Gains Momentum Nifty Surges Past 17 950

May 10, 2025