Tesla Stock Decline And Tariffs Contribute To Elon Musk's Reduced Net Worth

Table of Contents

Tesla Stock Performance and Market Volatility

The Rollercoaster Ride of TSLA

The recent volatility in Tesla's stock price (TSLA) has been nothing short of a rollercoaster. Significant drops have been directly correlated with shifts in market sentiment and broader economic trends. This volatility directly impacts Musk's net worth, as his wealth is heavily tied to Tesla's market capitalization.

- Q1 2023 Production Slowdown: News of slower-than-expected production in the first quarter of 2023 sent TSLA shares tumbling, impacting investor confidence.

- Price Wars and Increased Competition: Tesla's price cuts to remain competitive in the electric vehicle (EV) market triggered concerns about profit margins, leading to further stock price declines.

- Elon Musk's Twitter Acquisition: The controversies surrounding Musk's acquisition of Twitter and subsequent management decisions have also influenced investor sentiment regarding Tesla.

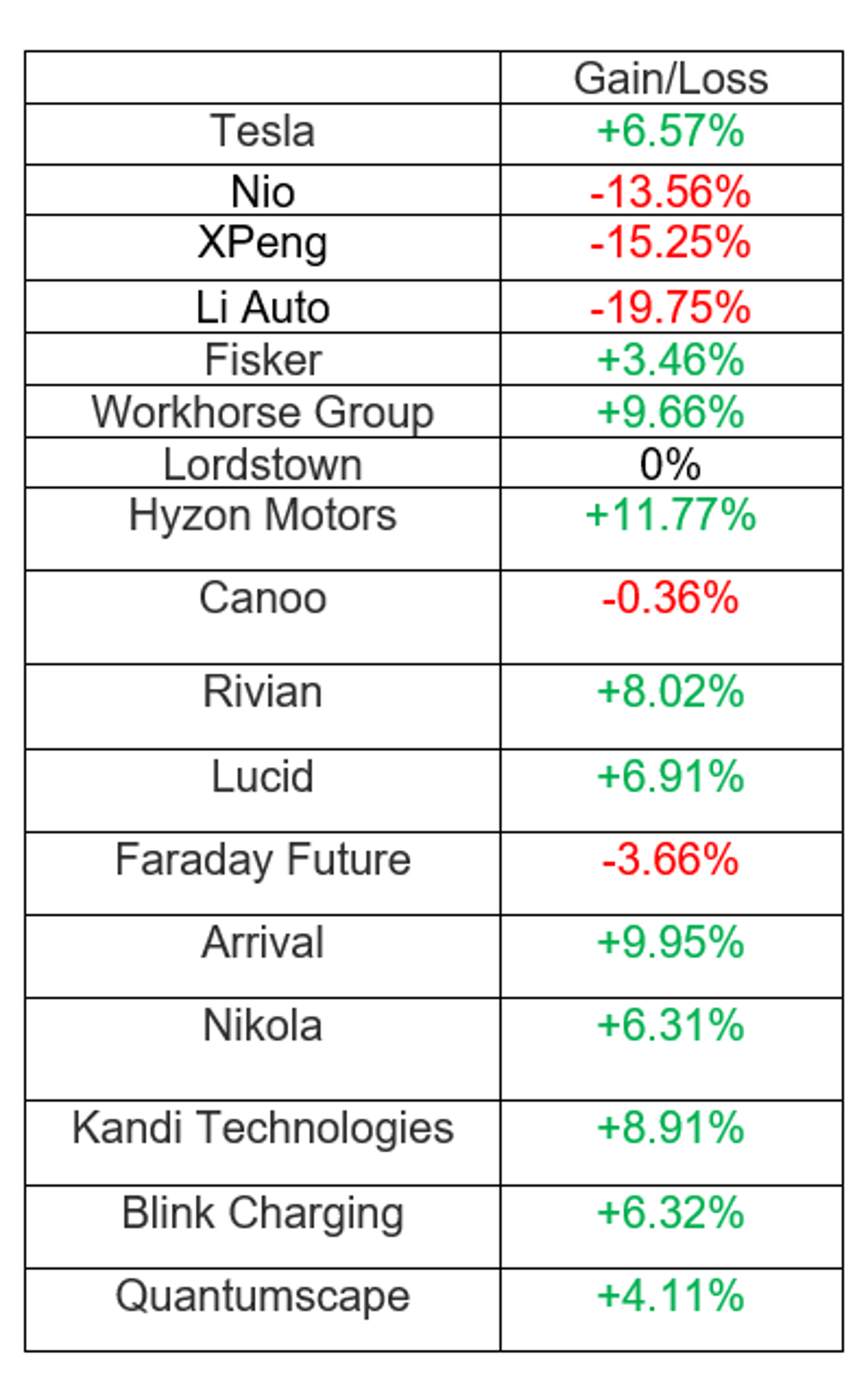

Competition in the EV Market

The electric vehicle market is rapidly evolving, and Tesla is facing increasingly fierce competition. This intensifying competition is putting pressure on Tesla's market share and stock valuation.

- BYD's Rapid Growth: BYD, a Chinese automaker, has rapidly gained market share, posing a significant challenge to Tesla's global dominance.

- Volkswagen's ID. Series: Volkswagen's ID. series of electric vehicles is gaining traction in Europe and other markets, further eroding Tesla's market share.

- Ford Mustang Mach-E and Rivian's R1T: The success of established automakers like Ford, with its Mustang Mach-E, and newer entrants like Rivian, with its R1T pickup truck, demonstrates the growing competition in the EV space. These competitors are challenging Tesla's innovative image and market leadership.

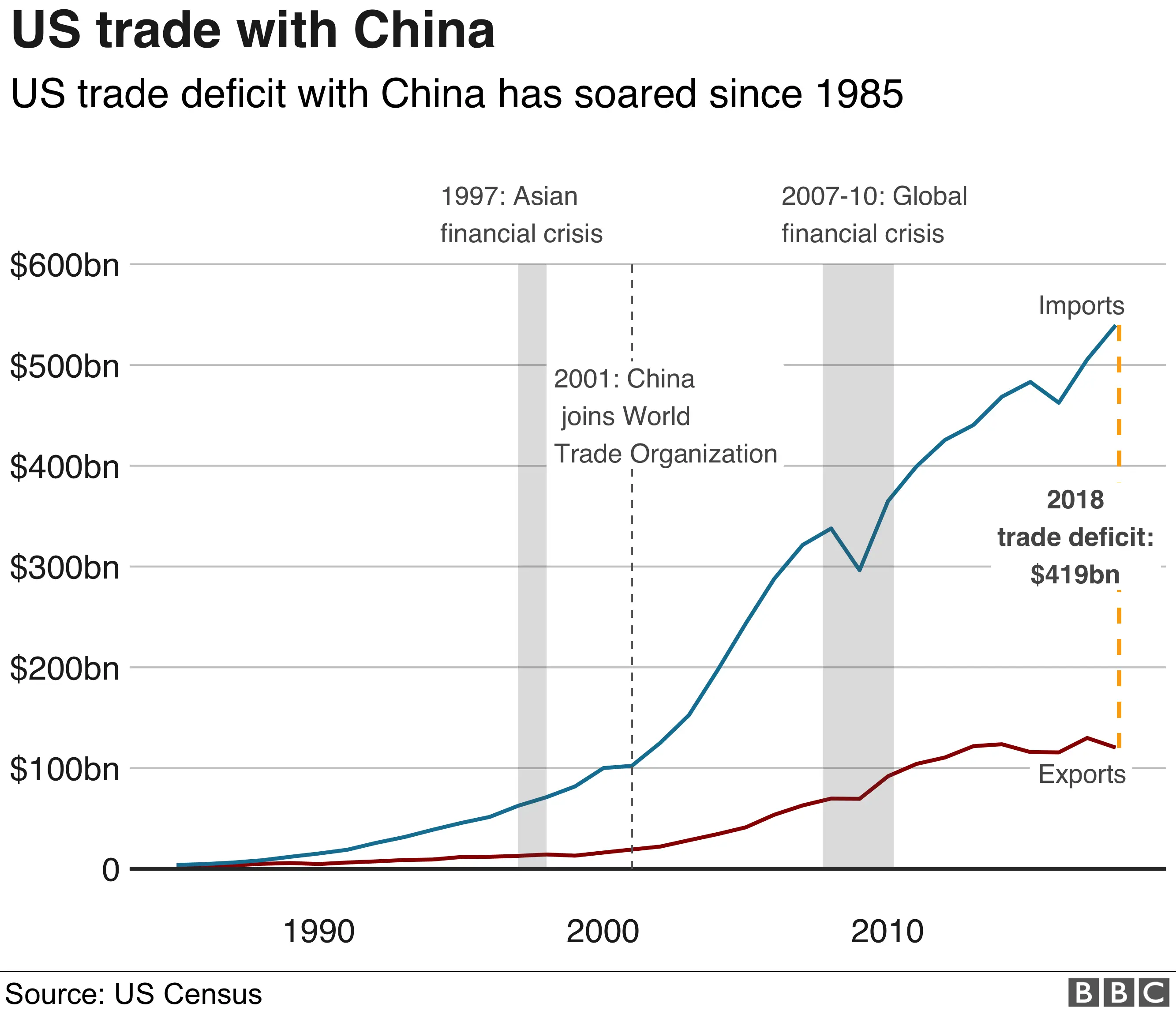

Impact of Tariffs and Global Economic Uncertainty

Trade Wars and Supply Chain Disruptions

International tariffs and trade disputes have significantly impacted Tesla's manufacturing costs and supply chains. These disruptions have, in turn, affected Tesla's profitability and stock valuation.

- Tariffs on Imported Components: Tariffs imposed on various imported components used in Tesla's vehicles have increased manufacturing costs, squeezing profit margins.

- Geopolitical Instability and Supply Chain Issues: Global events and geopolitical instability have created supply chain bottlenecks, impacting Tesla's production capacity and potentially delaying deliveries. These delays further affect investor confidence.

- Increased Shipping Costs: Fluctuations in global shipping costs, partly driven by trade tensions, also contribute to increased production costs for Tesla.

Inflation and Rising Interest Rates

Macroeconomic factors like inflation and rising interest rates are significantly impacting Tesla's valuation and investor behavior.

- Increased Production Costs: Inflation increases the cost of raw materials and manufacturing, directly impacting Tesla's profitability.

- Reduced Investor Appetite for Growth Stocks: Rising interest rates make bonds more attractive to investors, often reducing their appetite for riskier growth stocks like Tesla.

- Higher Borrowing Costs: Higher interest rates increase the cost of borrowing for Tesla, potentially impacting its expansion plans and overall financial health.

Elon Musk's Other Ventures and Their Influence

Diversification and Risk

Elon Musk's involvement in other significant ventures, notably SpaceX and Twitter, plays a role in shaping his overall net worth, independently of Tesla's stock performance.

- SpaceX's Success: While SpaceX is generally considered successful, its financial performance and future valuations don't directly offset Tesla's stock fluctuations.

- Twitter's Financial Challenges: The significant financial losses incurred by Twitter since Musk's acquisition have created negative media attention and have potentially negatively impacted investor confidence in Musk's overall business acumen.

- Investor Perception: Negative news related to any of Musk's ventures can influence investor perception of him and, consequently, affect the valuation of all his companies, including Tesla.

Conclusion

The decline in Elon Musk's net worth is a result of a complex interplay of factors. Tesla's stock performance, significantly impacted by market volatility, increasing EV competition, and production challenges, plays a central role. Furthermore, the impact of international tariffs, supply chain disruptions, and macroeconomic headwinds like inflation and rising interest rates have further contributed to this decline. Finally, the performance of Elon Musk's other ventures, especially Twitter, also influences investor perception and his overall net worth.

To better understand the future fluctuations in Elon Musk's net worth, it's crucial to stay informed about the latest developments in Tesla stock performance, global trade policies, macroeconomic conditions, and the ongoing evolution of the electric vehicle market. Closely following these interconnected factors is key to understanding the future of Tesla stock decline and Elon Musk's financial standing.

Featured Posts

-

Arctic Comic Con 2025 A Photo Gallery Characters Connections And Ectomobile

May 09, 2025

Arctic Comic Con 2025 A Photo Gallery Characters Connections And Ectomobile

May 09, 2025 -

Chief Justice Roberts Shares How He Handled Being Mistaken For Former Gop House Leader

May 09, 2025

Chief Justice Roberts Shares How He Handled Being Mistaken For Former Gop House Leader

May 09, 2025 -

Fox News Internal Dispute Trump Tariffs And The Financial Fallout

May 09, 2025

Fox News Internal Dispute Trump Tariffs And The Financial Fallout

May 09, 2025 -

Les Miserables Cast May Boycott Trumps Kennedy Center Appearance

May 09, 2025

Les Miserables Cast May Boycott Trumps Kennedy Center Appearance

May 09, 2025 -

Palantir Technologies Stock Should You Invest Before May 5th A Data Driven Analysis

May 09, 2025

Palantir Technologies Stock Should You Invest Before May 5th A Data Driven Analysis

May 09, 2025