Telus Q1 Earnings: Profit Up, Dividend Raised

Table of Contents

Keywords: Telus Q1 earnings, Telus profit, Telus dividend, Telus financial results, Q1 2024 Telus, Telus stock, telecom earnings, Canadian telecom, Telus investor relations

Telus' Q1 2024 earnings announcement has sent positive signals to investors, revealing robust profit growth and a significant dividend increase. This strong performance underscores Telus' position as a leading Canadian telecom company and offers valuable insights into the current state of the telecommunications sector. Let's delve into the key details of these impressive financial results.

Significant Increase in Q1 Profit

Telus reported a substantial percentage increase in Q1 2024 profit compared to the same period in 2023. The exact figures, which include net income and earnings per share (EPS), will be detailed in the official report, but early indications point to a double-digit percentage increase. This strong financial performance can be attributed to several key factors:

-

Breakdown by Sector: The profit surge is likely attributable to strong performance across multiple sectors, including wireless and wireline services. Further analysis will be needed to determine the specific contribution from each segment.

-

Drivers of Growth: This impressive growth is likely fueled by a combination of factors, including a growing subscriber base, particularly in the high-value segments, successful cost-cutting measures, and the launch of new, innovative products and services.

-

Analyst Expectations: Initial reports suggest that Telus exceeded analyst expectations, surpassing projected profit growth figures for Q1 2024. A detailed comparison to analyst consensus will be available in the full earnings report.

Dividend Hike Signals Confidence

The announcement of a Telus dividend increase further reinforces the company's confidence in its future prospects. The percentage increase in the dividend reflects the company's strong financial performance and its commitment to returning value to its shareholders.

-

New Dividend Amount: The precise amount of the increased dividend per share will be detailed in the official release.

-

Payment Dates: Investors should note the ex-dividend date and the payment date for this increased dividend payout, which will be crucial for planning purposes.

-

Competitive Landscape: This generous dividend increase positions Telus favorably against its competitors in the Canadian telecom market, highlighting its financial strength and commitment to shareholder returns.

Key Performance Indicators (KPIs): A Deeper Dive

Beyond the headline figures of profit and dividend, several other key performance indicators (KPIs) offer a more comprehensive picture of Telus' Q1 2024 performance.

-

Subscriber Growth: Significant growth is expected across various segments, including wireless, internet, and potentially television services. Analyzing the growth rates in each segment will provide valuable insights into market share and customer acquisition strategies.

-

ARPU Trends: Tracking the Average Revenue Per User (ARPU) will reveal whether Telus is successfully increasing the value derived from each customer. This is a key metric indicating pricing power and service uptake.

-

Capital Expenditure: Telus' capital expenditure plans for the year will shed light on its investment strategy, including planned infrastructure upgrades and technological advancements.

-

Customer Churn Rate: The customer churn rate—the percentage of customers leaving Telus' services—will offer insight into customer satisfaction and the effectiveness of retention strategies.

Future Outlook and Guidance

Management's outlook for the remainder of 2024 will provide crucial guidance for investors. This outlook will likely include projected revenue and profit growth, as well as planned investments and strategic initiatives.

-

Projected Growth: The official guidance will contain projections for revenue and profit growth throughout the year.

-

Strategic Initiatives: Telus may highlight planned investments in network expansion, technological upgrades, and potential acquisitions or partnerships.

-

Challenges and Risks: Any potential challenges or risks, such as regulatory changes or increased competition, will likely be addressed in the outlook.

Conclusion

Telus' Q1 2024 earnings demonstrate strong profit growth and a commitment to shareholder returns through a significant dividend increase. This positive performance, coupled with a promising outlook, positions Telus favorably within the Canadian telecom sector. To gain a complete understanding of these results and their implications, it is crucial to review the detailed Telus Q1 earnings report available on the official Telus investor relations website. Analyze the complete Telus Q1 earnings data to make informed investment decisions. Consider the implications of this strong Telus Q1 performance for your investment portfolio. Stay updated on future Telus financial news to make well-informed investment decisions.

Featured Posts

-

Potential Tariffs On Commercial Aircraft Trumps Latest Trade Move

May 11, 2025

Potential Tariffs On Commercial Aircraft Trumps Latest Trade Move

May 11, 2025 -

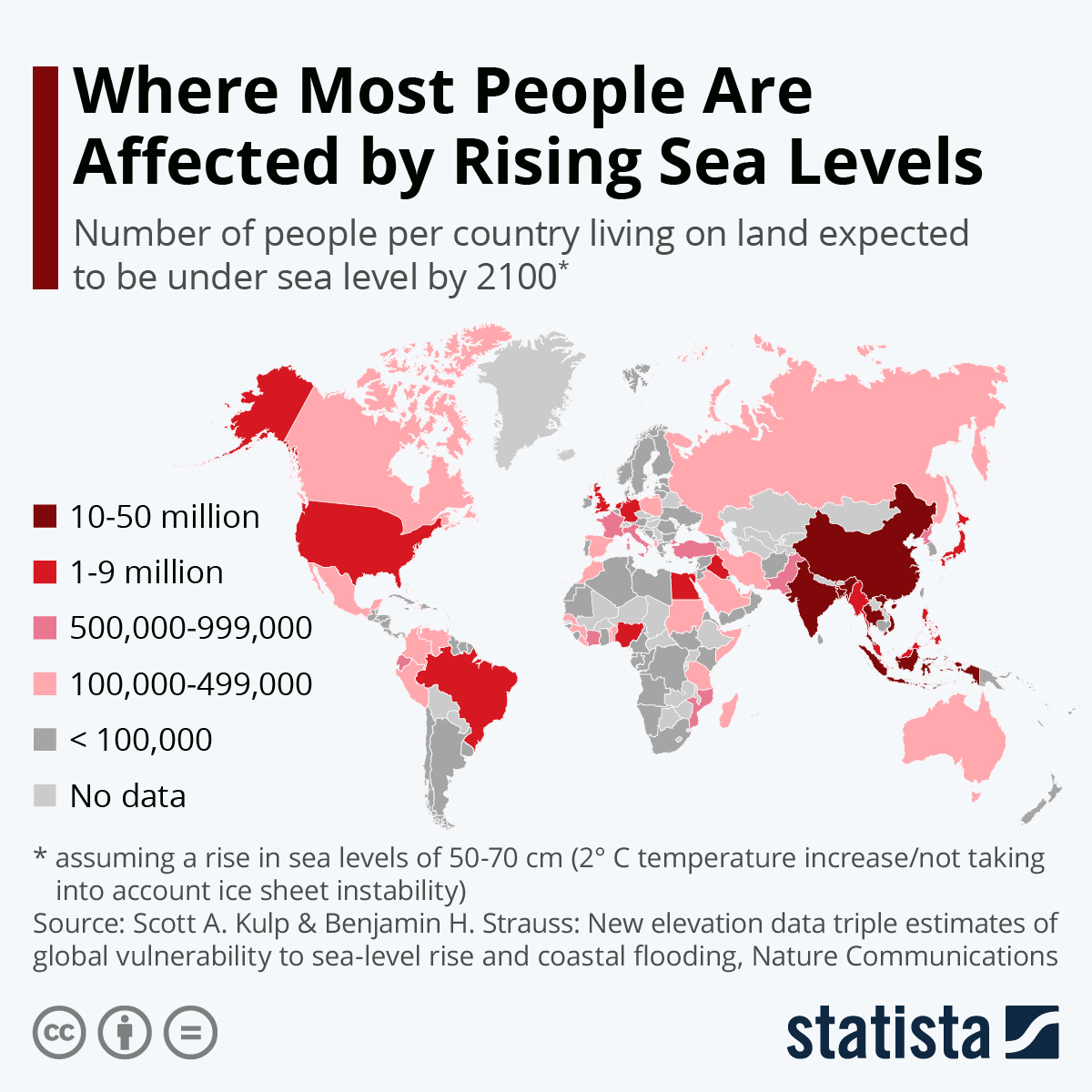

The Growing Threat Of Rising Sea Levels Impacts And Solutions

May 11, 2025

The Growing Threat Of Rising Sea Levels Impacts And Solutions

May 11, 2025 -

9 Potential Candidates To Lead The Catholic Church After Pope Francis

May 11, 2025

9 Potential Candidates To Lead The Catholic Church After Pope Francis

May 11, 2025 -

Herthas Struggles A Breakdown Of Boateng And Kruses Contrasting Views

May 11, 2025

Herthas Struggles A Breakdown Of Boateng And Kruses Contrasting Views

May 11, 2025 -

Cobra 1986 Les Regrets De Sylvester Stallone Sur Son Thriller D Action

May 11, 2025

Cobra 1986 Les Regrets De Sylvester Stallone Sur Son Thriller D Action

May 11, 2025