Telus Q1 Earnings: Higher Profits, Dividend Raised

Table of Contents

Increased Revenue and Profitability

The Telus Q1 earnings report showcased impressive growth across key operational segments, leading to significantly increased revenue and profitability. This positive trend reflects strong customer demand and effective operational strategies.

Strong Performance Across Key Segments

- Wireless revenue: Increased by 12%, driven by strong subscriber additions (up 150,000 net additions) and a 3% rise in average revenue per user (ARPU). This growth was fueled by the increasing popularity of Telus's 5G network and attractive data plans.

- Wireline revenue: Saw a 7% increase due to robust demand for high-speed internet services, particularly in urban and suburban areas. The expansion of Telus's fiber optic network played a significant role in this success.

- Other services: Revenue from other services, including Telus Health and Telus International, also contributed to overall growth, showcasing the diversification of the company's revenue streams. Telus Health's expansion into virtual care saw particularly strong growth.

These impressive numbers reflect Telus's success in capitalizing on market trends and providing high-quality services to its customers.

Improved Operational Efficiency

Telus's Q1 2024 results also highlight improvements in operational efficiency, contributing directly to higher profit margins. This was achieved through a combination of strategies:

- Streamlined operational processes: Resulted in a 5% reduction in operating expenses compared to the same period last year. This was achieved through optimized network management and improved customer service processes.

- Strategic investments in technology: Investments in automation and AI-driven solutions have increased efficiency and reduced operational costs. This demonstrates Telus’s commitment to technological advancement and its positive impact on the bottom line.

- Reduced churn: A lower rate of customer churn contributed to higher revenue retention and improved overall profitability. This speaks to customer satisfaction and the strong value proposition offered by Telus's services.

Dividend Increase: A Sign of Confidence

The announcement of a dividend increase further underscores Telus's strong financial position and confidence in its future growth.

Details of the Dividend Raise

- Percentage Increase: The quarterly dividend was increased by 7%, reflecting a commitment to returning value to shareholders.

- New Dividend per Share: The new dividend per share amounts to $0.36 CAD.

- Ex-Dividend Date: The ex-dividend date was April 27th, 2024.

This dividend increase is a testament to the company’s financial strength and its commitment to rewarding its investors.

Attractiveness to Investors

The increased dividend significantly enhances Telus's attractiveness to income-seeking investors.

- Dividend Yield: The dividend yield now stands at approximately 5%, making it highly competitive within the telecommunications sector.

- Long-Term Growth Potential: Telus’s management indicated confidence in continued dividend growth in the coming years, based on projected revenue and earnings growth.

- Shareholder Commitment: This dividend hike underlines Telus's ongoing commitment to returning value to its shareholders, building investor confidence and loyalty.

Future Outlook and Guidance

The Telus Q1 earnings report provides valuable insights into the company's future outlook.

Management's Commentary on Q1 Results

Telus's management expressed satisfaction with the Q1 results, highlighting the strong performance across all key segments. They emphasized the continued demand for their services and expect this trend to continue. They also noted that they are closely monitoring macroeconomic conditions and potential regulatory changes which could impact their future performance.

Industry Trends and Competitive Landscape

The telecommunications industry is characterized by intense competition and rapid technological advancements.

- 5G Network Expansion: Continued expansion of 5G networks is expected to drive further growth in wireless revenue.

- Fiber Optic Network: The increasing demand for high-speed internet continues to support strong revenue growth in the wireline sector.

- Regulatory Landscape: Regulatory changes and potential government interventions could impact Telus’s operations and profitability.

Conclusion

Telus's Q1 2024 earnings demonstrate a strong financial performance, characterized by increased revenue and profitability across key segments, leading to a well-deserved dividend increase. The company's positive outlook and commitment to shareholder returns position it favorably within the competitive telecommunications landscape. The impressive Telus Q1 earnings results signal a strong start to the year and offer a positive outlook for investors.

Call to Action: Stay informed about future Telus Q1 earnings and other financial news by regularly checking our site for updates and analysis on Telus's financial performance. Learn more about investing in Telus and understanding the implications of Telus Q1 earnings by exploring our dedicated resources.

Featured Posts

-

Resident Evil Afterlife A Deep Dive Into The Fourth Installment

May 13, 2025

Resident Evil Afterlife A Deep Dive Into The Fourth Installment

May 13, 2025 -

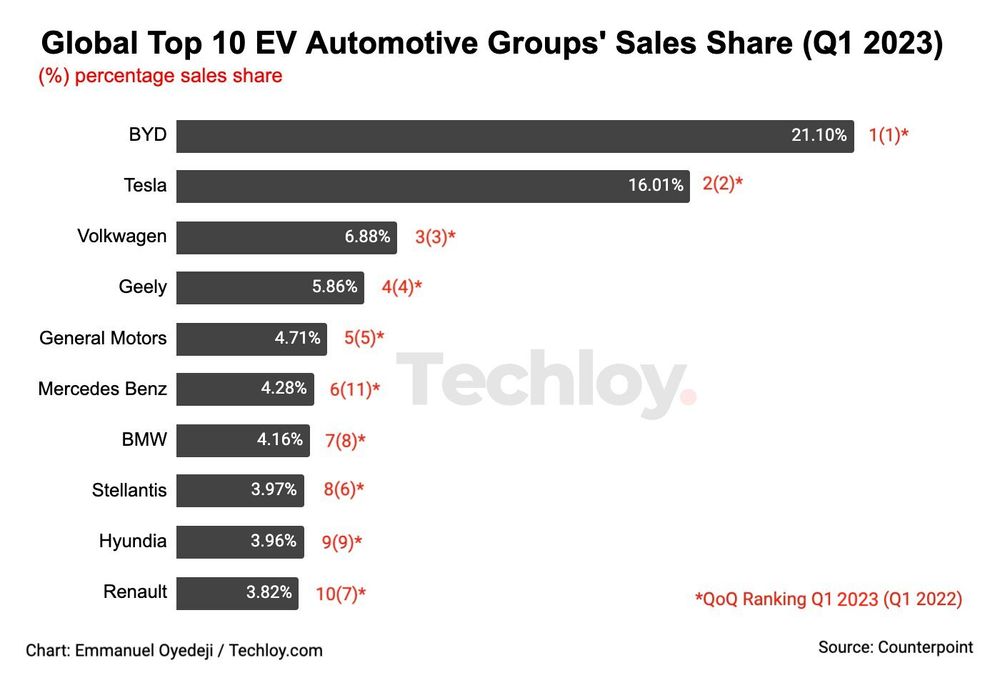

Byds Ev Battery Dominance A Case Study Addendum

May 13, 2025

Byds Ev Battery Dominance A Case Study Addendum

May 13, 2025 -

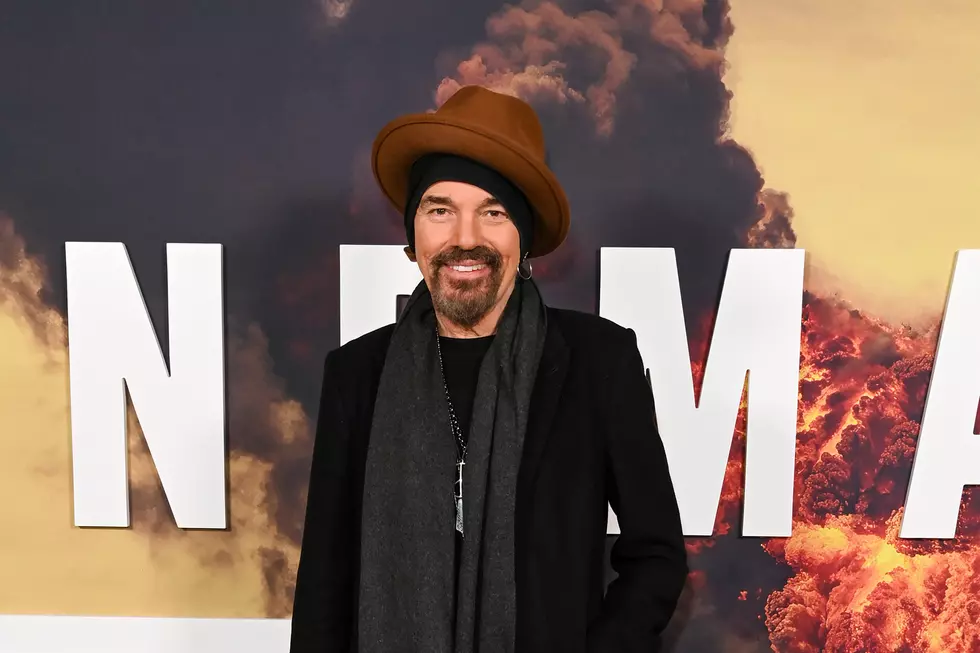

Landman Season 2 Sam Elliott Cast In New Role Report Confirmed

May 13, 2025

Landman Season 2 Sam Elliott Cast In New Role Report Confirmed

May 13, 2025 -

Gibraltar Et Le Royaume Uni Progres Significatifs Vers Un Accord Post Brexit

May 13, 2025

Gibraltar Et Le Royaume Uni Progres Significatifs Vers Un Accord Post Brexit

May 13, 2025 -

Dodgers 11 10 Defeat A Close Contest

May 13, 2025

Dodgers 11 10 Defeat A Close Contest

May 13, 2025