Tech Sector Propels US Stock Market Higher: Tesla's Impact

Table of Contents

Tesla's Influence on Market Sentiment

Tesla's remarkable performance has significantly impacted market sentiment, influencing investor confidence and driving stock market growth.

Record-breaking Sales and Production

Tesla's consistent exceeding of production targets and reporting of record-breaking sales figures have dramatically boosted investor confidence.

- In Q1 2024, Tesla delivered over 400,000 vehicles, a substantial increase year-over-year. [Link to financial news source]

- The company's expansion into new markets, including China and Europe, has further fueled growth.

- Anticipation surrounding the launch of the Cybertruck is generating significant excitement and contributing to positive market sentiment. [Link to relevant news article]

- Increased production at Gigafactories globally demonstrates Tesla’s ability to meet growing demand.

Innovation and Technological Advancements

Tesla's commitment to innovation in battery technology, autonomous driving, and energy solutions further fuels positive market perception.

- Advancements in battery technology, such as the 4680 cell, promise increased range and faster charging times for electric vehicles.

- The ongoing development of Full Self-Driving (FSD) capabilities is a key differentiator in the competitive EV market.

- Tesla's solar energy initiatives and energy storage solutions (Powerwall) are expanding the company's reach beyond the automotive sector.

- These advancements create a significant competitive advantage for Tesla within the EV industry and related sectors.

Elon Musk's Impact

Elon Musk's leadership, though often controversial, undeniably influences Tesla's stock price and market perception.

- His active presence on social media, while sometimes generating volatility, keeps Tesla in the public eye. [Link to relevant news analysis]

- His ventures in other sectors, such as SpaceX, can indirectly impact investor sentiment towards Tesla.

- Positive announcements and milestones from other Musk-led companies can boost overall confidence.

- However, controversial tweets or actions can lead to temporary market dips, highlighting the dual nature of his influence.

Broader Tech Sector Contributions

While Tesla's impact is significant, the broader tech sector's strength contributes significantly to the US stock market's upward trajectory.

Overall Tech Stock Performance

Beyond Tesla, other tech giants are demonstrating strong performance, bolstering the overall market upswing.

- Companies like Apple, Microsoft, Google (Alphabet), and Amazon continue to report strong earnings and positive growth forecasts. [Link to market index data]

- This robust performance across various tech sub-sectors indicates a broader trend of growth and confidence.

- The Nasdaq Composite, a key tech-heavy index, reflects this positive performance, reaching new highs.

Growth of the EV and Renewable Energy Sectors

Tesla's success is pulling up related sectors, creating a positive ripple effect across the broader economy.

- The growth of the EV industry is driving demand for battery technology, charging infrastructure, and rare earth minerals.

- The increased adoption of renewable energy solutions, including solar and wind power, further benefits related industries.

- This interconnected growth highlights the systemic impact of Tesla's success on multiple economic sectors.

Investor Confidence in Future Tech Growth

Strong investor confidence in the future growth potential of technology is a pivotal driver of current market performance.

- Advancements in artificial intelligence (AI), machine learning, and other technological breakthroughs fuel this optimism.

- The ongoing digital transformation across various industries creates a continuous demand for technological solutions.

- This sustained confidence in long-term technological growth underpins the current market strength.

Potential Risks and Challenges

Despite the positive outlook, several factors could impact the tech sector's and the broader market's performance.

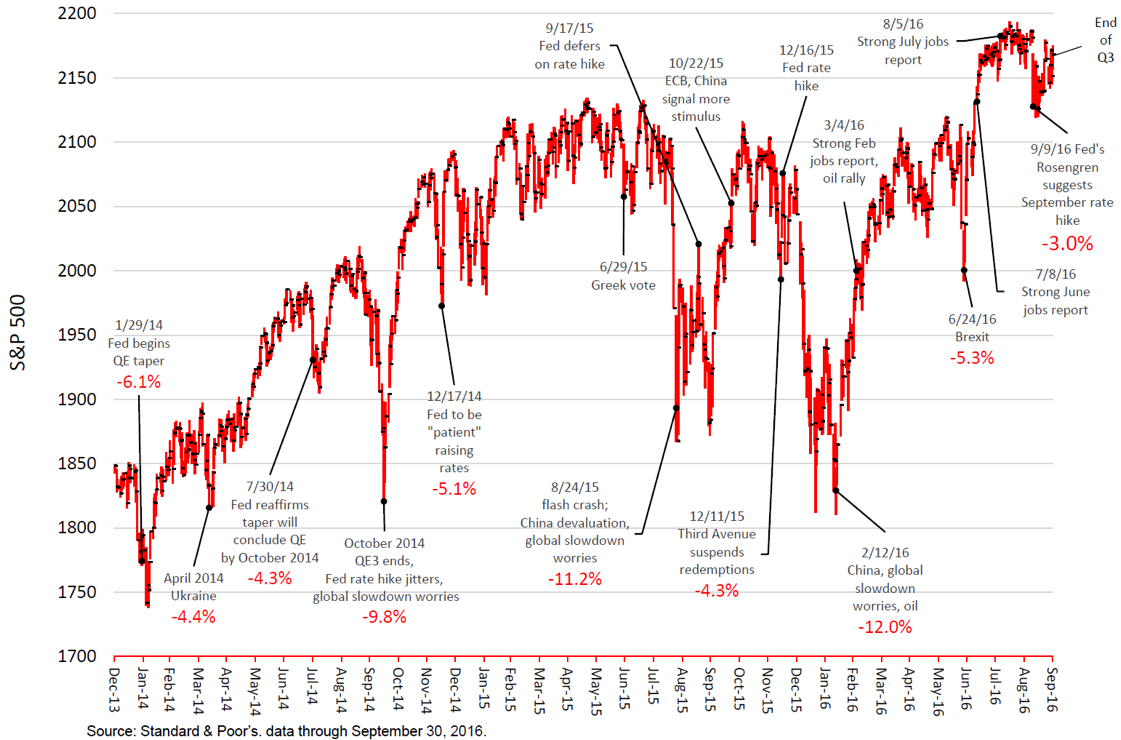

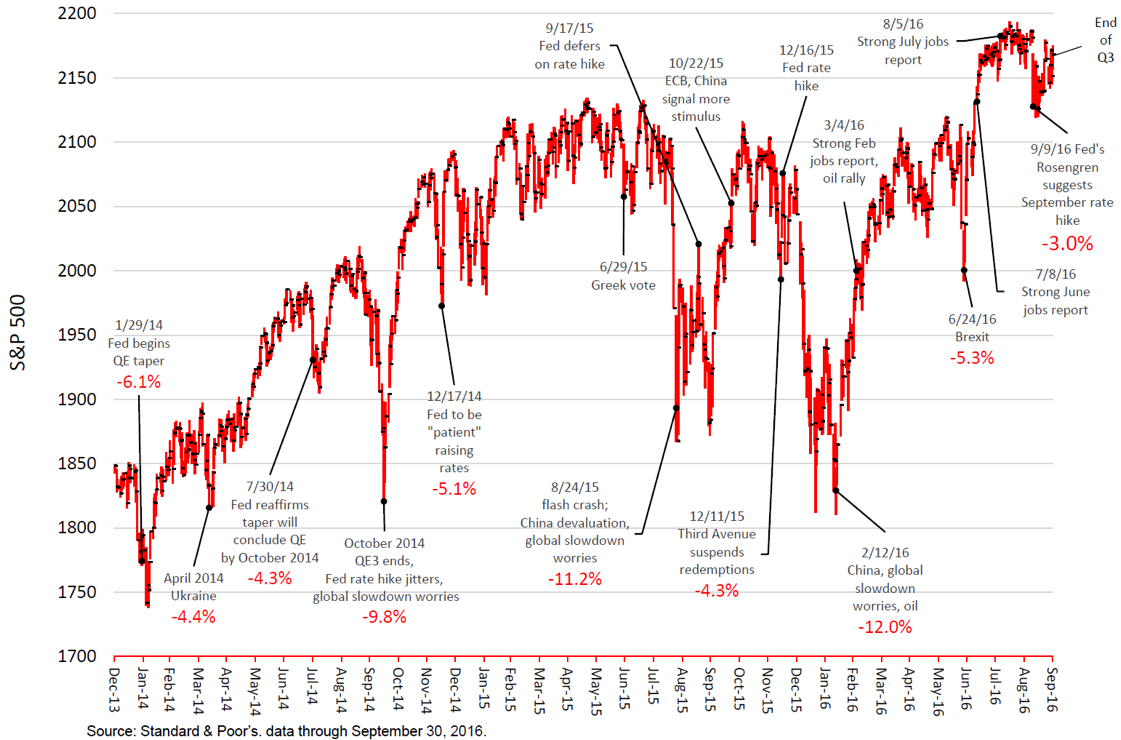

Market Volatility and Corrections

The stock market is inherently volatile, and corrections are a normal part of the market cycle.

- Economic headwinds such as inflation or interest rate hikes could negatively impact the tech sector's growth.

- Geopolitical instability and global uncertainties could also create market volatility.

- Understanding these potential risks is crucial for investors to manage their portfolios effectively.

Competition and Disruption

Tesla faces increasing competition in the electric vehicle market, posing a potential threat to its dominance.

- Established automakers are rapidly expanding their EV offerings, intensifying competition.

- Emerging EV startups are also vying for market share, introducing innovative technologies and business models.

- Maintaining its competitive edge will be crucial for Tesla's continued success.

Regulatory Hurdles and Geopolitical Factors

Government regulations and geopolitical events could negatively impact the tech sector's performance.

- Changes in environmental regulations or subsidies for electric vehicles could affect Tesla and the broader industry.

- Global supply chain disruptions and trade wars could negatively impact production and profitability.

- Navigating these potential challenges will be vital for maintaining sustainable growth.

Conclusion

The remarkable performance of the tech sector, significantly driven by Tesla's success, has undeniably propelled the US stock market higher. While acknowledging potential risks and the possibility of market corrections is crucial, the current trajectory suggests strong growth potential. Understanding the multifaceted factors influencing this growth, from Tesla's groundbreaking innovations to the broader tech sector's strength, is essential for investors. Stay informed about the latest developments in the tech sector and Tesla's impact to make well-informed investment decisions.

Featured Posts

-

Going For Goldblum London Fans Flock To See Jurassic Park Star

Apr 29, 2025

Going For Goldblum London Fans Flock To See Jurassic Park Star

Apr 29, 2025 -

Nyt Spelling Bee Answers For February 25 2025 Complete Guide

Apr 29, 2025

Nyt Spelling Bee Answers For February 25 2025 Complete Guide

Apr 29, 2025 -

Capital Summertime Ball 2025 How To Get Your Tickets

Apr 29, 2025

Capital Summertime Ball 2025 How To Get Your Tickets

Apr 29, 2025 -

911

Apr 29, 2025

911

Apr 29, 2025 -

April 24 28 Geary County Bookings Recent Arrest Photos

Apr 29, 2025

April 24 28 Geary County Bookings Recent Arrest Photos

Apr 29, 2025