Tech Billionaire Losses Since Trump Inauguration: A $194 Billion Analysis

Table of Contents

The Impact of Policy Changes on Tech Giants

Increased Regulatory Scrutiny

Increased antitrust investigations and regulatory actions under the Trump administration, and continuing into subsequent administrations, significantly impacted the valuations of tech giants like Google, Facebook, and Amazon. This intensified regulatory scrutiny created uncertainty and led to decreased investor confidence.

- Examples: The Department of Justice's antitrust lawsuit against Google, FTC investigations into Facebook's monopolistic practices, and ongoing scrutiny of Amazon's market dominance all contributed to decreased valuations. These actions resulted in substantial fines and legal costs for these companies.

- Keywords: Antitrust laws, regulatory hurdles, tech regulation, government intervention, monopolistic practices, DOJ lawsuit, FTC investigation.

Trade Wars and Global Uncertainty

The Trump administration's trade wars and imposition of tariffs significantly impacted tech companies' global operations and supply chains. Increased costs associated with tariffs, coupled with global supply chain disruptions, reduced profitability.

- Examples: Tariffs on imported components impacted manufacturing costs for companies like Apple and Dell. Trade tensions with China led to disruptions in the supply of crucial components and affected production timelines, impacting profits and share prices.

- Keywords: Trade war, tariffs, global supply chain, international trade, import tariffs, supply chain disruptions, China trade.

Shifting Market Dynamics and Investor Sentiment

The Rise and Fall of Tech Stocks

Fluctuations in the tech stock market played a significant role in the wealth shifts experienced by tech billionaires. While the tech sector had seen explosive growth in the years leading up to the Trump inauguration, market corrections, investor anxieties, and shifts in sentiment towards growth stocks contributed to significant losses.

- Examples: The NASDAQ Composite Index, a key benchmark for tech stocks, experienced periods of both significant growth and sharp decline during this period. Investor anxieties about future growth, interest rate hikes, and geopolitical instability all played a role in these market swings.

- Keywords: Stock market volatility, tech stock performance, investor confidence, market capitalization, NASDAQ, market correction, growth stocks.

Competition and Innovation

Increased competition from new entrants and disruptive technologies also contributed to the reduced valuations of established tech giants. The emergence of innovative companies and technologies challenged the dominance of older players, leading to decreased market share and profitability.

- Examples: The rise of cloud computing companies challenged established software giants. The growth of social media platforms beyond Facebook eroded its market share. New entrants in electric vehicles challenged Tesla's dominance.

- Keywords: Disruptive technologies, competition, market share, innovation, cloud computing, electric vehicles, market disruption.

The Role of Specific Tech Billionaires in the Losses

Case Studies of Individual Billionaires

Examining individual billionaires reveals diverse experiences. While some experienced significant wealth declines, others maintained or even increased their net worth through diversification and strategic decisions.

- Mark Zuckerberg: Facebook's market capitalization experienced substantial fluctuations impacted by regulatory scrutiny and competition.

- Jeff Bezos: Amazon's stock price experienced volatility linked to various factors, including increased competition and market corrections.

- Elon Musk: Tesla's stock experienced dramatic swings, partly due to market sentiment and Musk's public pronouncements.

- Keywords: Mark Zuckerberg, Jeff Bezos, Elon Musk, Net worth, wealth fluctuations, Facebook stock, Amazon stock, Tesla stock.

Diversification and Risk Management

Diversification and risk management strategies played a critical role. Billionaires with diversified portfolios were better positioned to weather market downturns.

- Examples: Billionaires with investments beyond tech companies were less impacted by the tech sector's decline. Successful risk management strategies involved hedging against potential losses.

- Keywords: Risk management, diversification, portfolio management, hedging, investment strategy.

Conclusion

The $194 billion loss in tech billionaire wealth since the Trump inauguration highlights the complex interplay of policy changes, market forces, and individual decisions. Increased regulatory scrutiny, trade wars, market corrections, and increased competition all contributed to this significant wealth shift. Understanding the interplay of these factors is crucial for navigating the ever-changing landscape of the tech industry. Continue learning about the complex dynamics of Tech Billionaire Losses Since Trump Inauguration and their broader economic consequences by researching further into the specific regulations, market trends, and individual company performance mentioned above.

Featured Posts

-

Palantir Technologies Pltr Stock A Current Market Evaluation

May 09, 2025

Palantir Technologies Pltr Stock A Current Market Evaluation

May 09, 2025 -

Massive Fentanyl Bust In Us Bondi Announces Unprecedented Seizure

May 09, 2025

Massive Fentanyl Bust In Us Bondi Announces Unprecedented Seizure

May 09, 2025 -

Post Tour Boost Beyonces Cowboy Carter Streams Explode

May 09, 2025

Post Tour Boost Beyonces Cowboy Carter Streams Explode

May 09, 2025 -

Examining Apples Ai A Path To Innovation Or Decline

May 09, 2025

Examining Apples Ai A Path To Innovation Or Decline

May 09, 2025 -

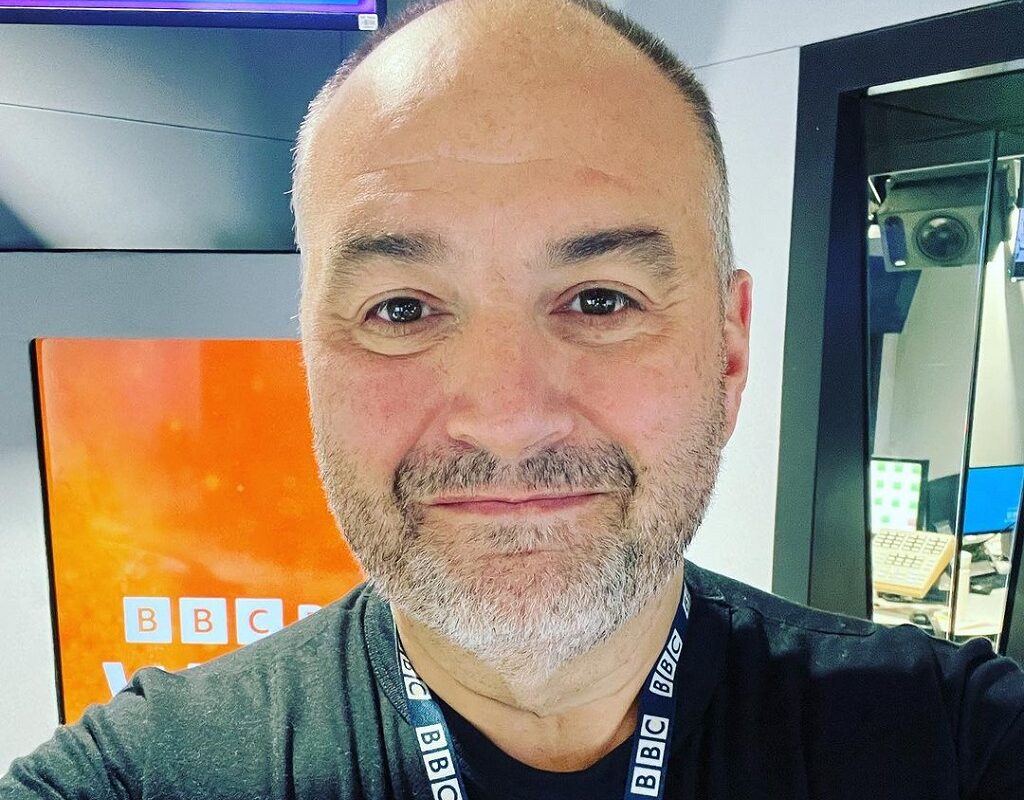

Wynne Evans Health Scare Recovery And Possible Stage Comeback

May 09, 2025

Wynne Evans Health Scare Recovery And Possible Stage Comeback

May 09, 2025