Sustainable Business Funding: Helping SMEs Thrive Ecologically

Table of Contents

Understanding the Need for Sustainable Business Funding

The world is shifting. Environmental, social, and governance (ESG) factors are no longer niche concerns; they're central to investment decisions and consumer choices. Investors are increasingly prioritizing companies demonstrating a commitment to sustainability, recognizing the long-term financial benefits. For SMEs, adopting sustainable practices translates to reduced operational costs through energy efficiency and waste reduction, attracting environmentally conscious consumers, and improving brand reputation – all leading to enhanced profitability.

However, accessing sustainable business funding for these initiatives presents unique challenges. Many SMEs lack awareness of available funding opportunities, while others find the application processes stringent and complex. Overcoming these hurdles is key to unlocking the potential of green initiatives.

- Increased consumer demand: Eco-conscious consumers are willing to pay a premium for sustainably produced goods and services.

- Government regulations and incentives: Governments worldwide are implementing regulations and offering incentives to promote sustainable business practices.

- Investor interest in ESG: Impact investors and venture capitalists are actively seeking opportunities to invest in ESG-compliant companies.

- Reduced operational costs: Implementing energy-efficient technologies and waste reduction strategies can significantly lower operational expenses.

Exploring Funding Options for Sustainable SMEs

Fortunately, a growing number of funding options cater specifically to the needs of sustainable businesses. Let's explore some key avenues for securing sustainable business funding:

Green Loans and Credit Lines

Green financing offers a tailored approach to sustainable business funding. These loans and credit lines are specifically designed to support environmentally friendly projects. They often come with attractive features:

- Lower interest rates: Incentivizing environmentally responsible investments.

- Longer repayment periods: Providing greater flexibility for SMEs.

- Eligibility criteria focused on environmental impact: Ensuring funds are used for sustainable purposes.

- Examples: Many banks and financial institutions now offer dedicated green loan programs. Research organizations like the European Investment Bank and the Green Climate Fund can also provide guidance.

Grants and Subsidies

Governments at various levels often offer grants and subsidies to encourage sustainable business practices. These can significantly reduce the financial burden of implementing eco-friendly initiatives.

- Energy efficiency upgrades: Funding for improvements like insulation, energy-efficient equipment, and renewable energy sources.

- Renewable energy installations: Support for solar panels, wind turbines, and other renewable energy technologies.

- Waste reduction and recycling programs: Funding for implementing waste management systems and recycling initiatives.

- Resources: Government websites and dedicated sustainability agencies are excellent resources for finding relevant grants and subsidies.

Impact Investing and Venture Capital

Impact investors and venture capitalists are increasingly focusing on businesses with a positive social and environmental impact. They look beyond purely financial returns, seeking investments that align with their ESG principles.

- Dual focus: These investors prioritize both financial returns and social/environmental impact.

- Innovative technologies: They often invest in companies developing cutting-edge sustainable technologies and business models.

- Mentorship and expertise: Impact investors often provide valuable mentorship and guidance to their portfolio companies.

- Examples: Numerous impact investment firms and venture capital funds specialize in sustainable businesses.

Crowdfunding and Social Lending

Crowdfunding and peer-to-peer lending platforms offer alternative avenues for securing sustainable business funding. These platforms allow businesses to reach a wider audience of environmentally conscious investors.

- Wider investor base: Access to a broader network of potential investors interested in supporting sustainable initiatives.

- Brand building: Crowdfunding campaigns can significantly enhance brand awareness and community engagement.

- Flexibility: These platforms provide flexibility in funding amounts and timelines.

- Platforms: Numerous platforms specialize in crowdfunding and social lending for sustainable businesses.

Developing a Compelling Sustainable Business Plan

Securing sustainable business funding requires a well-structured business plan that clearly articulates your company's sustainability goals and strategies. A compelling plan will demonstrate your commitment to environmental responsibility and the financial viability of your initiatives.

- Clear sustainability targets: Define specific, measurable, achievable, relevant, and time-bound (SMART) sustainability goals, such as carbon emissions reduction targets.

- Detailed implementation plan: Outline the specific sustainable practices and technologies you intend to implement.

- Financial projections: Demonstrate the financial viability of your sustainability initiatives, including cost savings and potential revenue increases.

- Positive impact: Highlight the positive social and environmental impact your business will create.

Conclusion: Securing Sustainable Business Funding for Growth

Securing sustainable business funding is achievable with the right approach. By exploring the various funding options outlined above—green loans, grants, impact investing, and crowdfunding—and by developing a strong business plan that showcases your commitment to sustainability, your SME can access the resources needed to thrive. Remember, adopting sustainable practices isn't just an ethical imperative; it's a smart business decision that leads to long-term financial and environmental benefits. Start exploring your options for sustainable business funding today and pave the way for a greener and more prosperous future for your SME!

Featured Posts

-

Breaking Mlb Rumors Luis Robert Jr Trade Pirates Pursuit And Arenados Contract Situation

May 19, 2025

Breaking Mlb Rumors Luis Robert Jr Trade Pirates Pursuit And Arenados Contract Situation

May 19, 2025 -

Turtsiya Vyvedet Voyska S Kipra Diskussiya Na Haqqin Az Prodolzhaetsya

May 19, 2025

Turtsiya Vyvedet Voyska S Kipra Diskussiya Na Haqqin Az Prodolzhaetsya

May 19, 2025 -

Cannes 2025 Emotional Response To Kristen Stewarts Film Debut

May 19, 2025

Cannes 2025 Emotional Response To Kristen Stewarts Film Debut

May 19, 2025 -

Contentious Ufc 313 Prelims Fight Fighters Admission Of Defeat

May 19, 2025

Contentious Ufc 313 Prelims Fight Fighters Admission Of Defeat

May 19, 2025 -

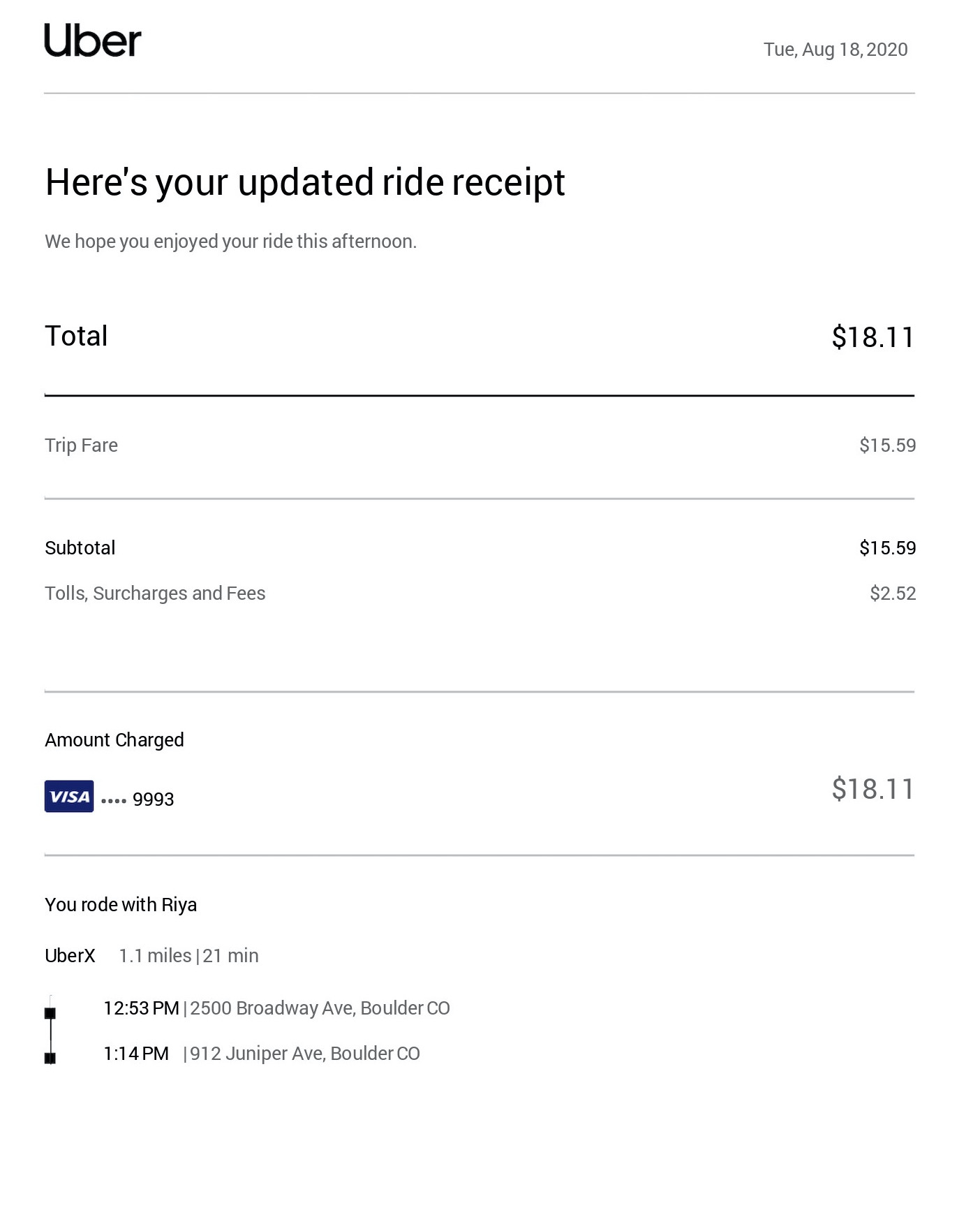

Delhi And Mumbai Get Uber Pet Convenient Pet Travel Options

May 19, 2025

Delhi And Mumbai Get Uber Pet Convenient Pet Travel Options

May 19, 2025