Sustainability Funding For SMEs: Accessing Resources For Green Growth

Table of Contents

Identifying Suitable Sustainability Funding Options for Your SME

Securing funding for your green initiatives requires a strategic approach. Understanding the various options available is the first crucial step. Let's explore some key avenues for sustainability funding for SMEs.

Grants and Subsidies

Grants and subsidies represent a highly attractive option, offering non-repayable financial assistance to support sustainable projects. These funds are often provided by governments and other public organizations to encourage the adoption of eco-friendly technologies and practices.

- Examples: Many governments offer grants for SMEs focused on:

- Renewable energy installations (solar panels, wind turbines)

- Energy efficiency upgrades (insulation, smart technologies)

- Waste reduction and recycling programs

- Sustainable supply chain initiatives

- Where to find them: Check your national and regional government websites for details. For example, in the US, the Small Business Administration (SBA) offers various loan programs that can indirectly support sustainability efforts. [Link to SBA website] The European Union also provides numerous funding opportunities for green initiatives under its various programs. [Link to EU funding portal]

- Eligibility and Application: Eligibility criteria vary widely depending on the grant and the funding body. Thoroughly review the guidelines and application process before submitting your proposal.

Green Loans and Financing

Green loans offer SMEs favorable terms compared to traditional business loans. These loans are specifically designed to finance environmentally friendly projects, often featuring lower interest rates, longer repayment periods, and flexible terms.

- Examples of lenders: Several banks and financial institutions are increasingly offering green loan products tailored for SMEs. [Link to example bank 1] [Link to example bank 2] These lenders often work with government agencies or sustainability organizations to provide additional support and resources.

- Importance of a Strong Business Plan: A well-structured business plan detailing the project's financial viability, environmental impact, and repayment strategy is crucial for securing a green loan. The plan should clearly demonstrate how the loan will be used and how the project will generate returns.

Equity Investment and Venture Capital

Impact investors and venture capitalists are actively seeking opportunities to invest in sustainable businesses. These investors are driven by both financial returns and positive social and environmental impact.

- Connecting with Impact Investors: Platforms and networks specializing in connecting sustainable businesses with impact investors are becoming increasingly prevalent. [Link to example platform 1] [Link to example platform 2]

- Implications of Equity Investment: It's important to understand that equity investment involves giving up a share of ownership in your company in exchange for funding. Carefully evaluate the terms and conditions before accepting any equity investment.

Navigating the Application Process for Sustainability Funding

Successfully securing funding requires careful planning and a thorough understanding of the application process.

Developing a Compelling Business Plan

A well-structured business plan is the cornerstone of any successful funding application. It should clearly articulate your project's financial viability, environmental impact, and sustainability strategy.

- Key Elements of a Strong Business Plan:

- Executive Summary

- Market Analysis

- Financial Projections (including revenue, expenses, and profitability)

- Sustainability Strategy (detailed description of the green initiative, its environmental benefits, and its alignment with your overall business strategy)

- Management Team

Meeting Eligibility Criteria

Each funding opportunity will have specific eligibility criteria. Thoroughly reviewing these criteria before applying is essential to avoid wasted time and effort.

- Common Eligibility Criteria:

- Business size (often defined by number of employees or annual turnover)

- Industry

- Project scope

- Environmental impact (quantifiable metrics)

- Location

Seeking Professional Guidance

Seeking expert advice can significantly increase your chances of success. Sustainability consultants or financial advisors experienced in securing green funding can provide invaluable support.

- Potential Sources of Expert Advice:

- Government agencies

- Business incubators

- Industry associations

- Private consultants specializing in sustainability finance

Exploring Alternative Funding Sources for Sustainability Initiatives

Beyond the traditional funding routes, several alternative options can provide support for your sustainability initiatives.

Crowdfunding Platforms

Crowdfunding platforms allow you to raise capital from a large number of individuals online. This option is particularly suitable for SMEs with a strong online presence and a compelling project narrative.

- Popular Crowdfunding Platforms: [Link to example platform 1] [Link to example platform 2]

Corporate Social Responsibility (CSR) Initiatives

Many large corporations are increasingly committed to CSR and actively seek partnerships with SMEs working on sustainable projects. These partnerships can provide funding, in-kind support, or access to valuable resources.

- Examples of Successful CSR Partnerships: [Insert examples of successful partnerships]

Leasing and Energy Performance Contracts

Leasing equipment or entering energy performance contracts can significantly reduce upfront capital expenditures. These contracts typically involve a third party financing and implementing the energy efficiency improvements, with payments spread over time based on realized energy savings.

- Examples and Benefits: [Insert examples and benefits]

Conclusion

Accessing sustainability funding for SMEs requires a multi-faceted approach. This involves exploring diverse funding options like grants, loans, equity investment, and alternative sources, developing a compelling business plan, thoroughly understanding eligibility criteria, and seeking expert advice where needed. By embracing sustainable practices and leveraging the available resources, SMEs can unlock significant growth opportunities, enhance their competitiveness, and contribute to a greener future. Start your journey towards green growth today! Research available sustainability funding for SMEs in your region and take the first step towards a more sustainable and profitable future. Don't hesitate to explore the various resources and options highlighted in this article to secure the funding you need for your green initiatives.

Featured Posts

-

Visit Orlando 2025 Pictures Highlight Travel And Tourism Event

May 19, 2025

Visit Orlando 2025 Pictures Highlight Travel And Tourism Event

May 19, 2025 -

Basel Finalen Svts Beredskap Foer Eurovision I Sverige

May 19, 2025

Basel Finalen Svts Beredskap Foer Eurovision I Sverige

May 19, 2025 -

Hoce Li Baby Lasagna Pobijediti Na Eurosongu

May 19, 2025

Hoce Li Baby Lasagna Pobijediti Na Eurosongu

May 19, 2025 -

Your Place In The Sun Navigating The Overseas Property Market

May 19, 2025

Your Place In The Sun Navigating The Overseas Property Market

May 19, 2025 -

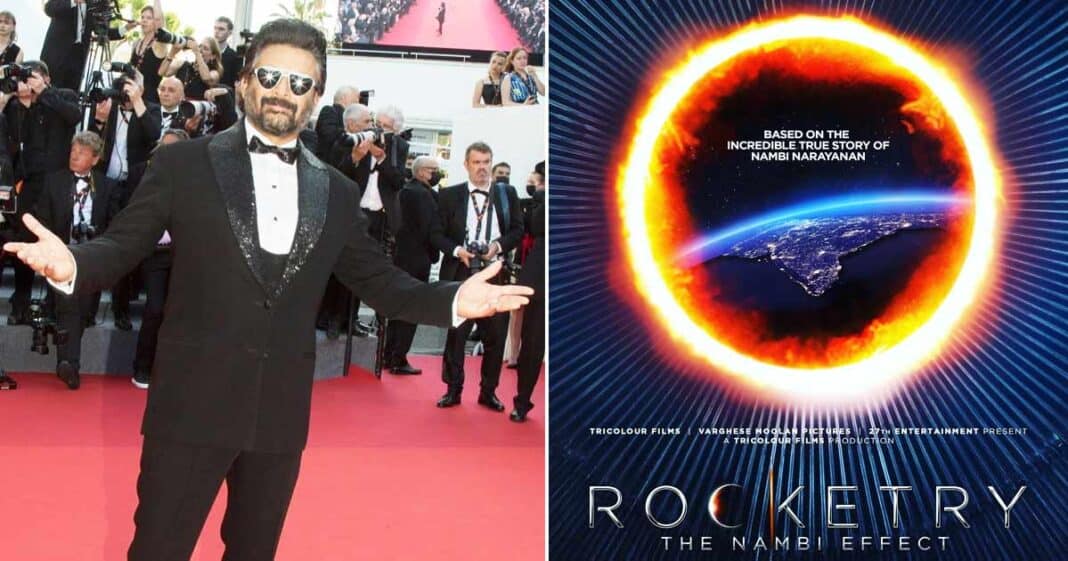

Kristen Stewarts Directorial Debut Standing Ovation At Cannes 2025

May 19, 2025

Kristen Stewarts Directorial Debut Standing Ovation At Cannes 2025

May 19, 2025