Support For Sustainable SMEs: Navigating Funding Options

Table of Contents

Understanding Funding Needs for Sustainable Initiatives

Before exploring funding options, sustainable SMEs must clearly define their financial requirements. This involves a thorough assessment of their environmental and social impact, a detailed budget, and a compelling narrative showcasing their unique value proposition.

Assessing Environmental and Social Impact

Quantifying the environmental and social impact of your initiatives is crucial for attracting investors and securing funding. This involves conducting comprehensive assessments aligned with recognized sustainability reporting frameworks:

- Global Reporting Initiative (GRI): A widely used framework providing standardized guidelines for sustainability reporting.

- Sustainability Accounting Standards Board (SASB): Focuses on financially material environmental, social, and governance (ESG) issues.

- Other frameworks: Depending on your industry and region, other relevant frameworks may apply.

By accurately measuring your impact, you can demonstrate the positive contributions of your business and build a strong case for funding. This data strengthens your funding application significantly.

Defining Funding Requirements

Developing a precise budget outlining your funding needs is paramount. This should include:

- Capital Expenditure (CapEx): Investments in fixed assets like equipment and property crucial for sustainable operations (e.g., solar panels, energy-efficient machinery).

- Operational Costs (OpEx): Ongoing expenses like salaries, utilities, and marketing, specifically for your sustainability initiatives.

- Research and Development (R&D): Funding for innovation in sustainable technologies and processes.

A well-structured budget, clearly outlining each expense category, strengthens your credibility and demonstrates financial responsibility to potential funders.

Developing a Compelling Narrative

Your funding application should tell a story. Highlight your unique value proposition, your commitment to sustainability, and the positive social and environmental impact of your business. This involves:

- Storytelling: Craft a narrative that resonates with funders, emphasizing your mission, vision, and the problem your business solves.

- Unique Selling Proposition (USP): What sets your sustainable business apart from competitors? Clearly communicate this differentiator.

- Social Impact Measurement: Quantify the positive social impact of your operations (e.g., job creation, community engagement).

Effectively communicating your sustainability goals and their impact is vital for securing funding.

Exploring Diverse Funding Options for Sustainable SMEs

Sustainable SMEs have access to a variety of funding sources. Careful consideration of each option's advantages and disadvantages is essential for selecting the most suitable approach.

Grants and Subsidies for Sustainable Businesses

Many governments offer grants and subsidies specifically designed to support sustainable businesses. These often come with eligibility criteria and specific application processes. Researching relevant opportunities in your region is crucial.

- Government websites: Check your national and regional government websites for details on available grants and subsidies.

- Industry associations: Trade associations often provide information on funding opportunities for their members.

- Environmental agencies: Environmental protection agencies may offer grants for environmentally friendly projects.

Successful grant applications often highlight the positive environmental and social impact of the project and demonstrate strong financial management.

Green Loans and Sustainable Finance

Green loans and other forms of sustainable finance are gaining traction. These financing options often come with favorable interest rates and repayment terms, making them attractive for sustainable SMEs.

- Green loans: Loans specifically designed to fund environmentally friendly projects, often with lower interest rates than conventional loans.

- Impact investing: Investments made with the intention of generating positive social and environmental impact alongside a financial return.

- B Corp certification: Obtaining B Corp certification can enhance your credibility and attract investors interested in supporting sustainable businesses.

Understanding the nuances of green finance and securing the right certifications can significantly improve your chances of securing funding.

Crowdfunding and Impact Investing Platforms

Crowdfunding and impact investing platforms offer alternative avenues for securing funding. These platforms connect businesses with investors seeking social and environmental returns.

- Reward-based crowdfunding: Offers rewards to backers in return for their contributions.

- Equity-based crowdfunding: Gives investors a stake in the company in exchange for their funding.

- Donation-based crowdfunding: Relies on donations from individuals who support your mission.

- Impact investing platforms: Platforms that connect businesses with investors interested in generating positive social and environmental impact.

Developing a compelling campaign and engaging with potential investors is crucial for successful crowdfunding and impact investing initiatives.

Navigating the Application Process for Funding

Preparing a robust funding proposal, building relationships with potential funders, and effectively managing funds are crucial steps in the application process.

Preparing a Strong Funding Proposal

Your funding proposal is your sales pitch. It must be clear, concise, and compelling. Key components include:

- Executive summary: A brief overview of your business, its mission, and the funding request.

- Financial projections: Detailed financial forecasts demonstrating the viability of your business.

- Sustainability plan: A comprehensive plan outlining your sustainability goals and initiatives.

- Impact assessment: A quantification of the expected environmental and social impact of your project.

A well-structured proposal increases your chances of securing funding.

Building Relationships with Potential Funders

Networking is crucial. Building relationships with potential funders strengthens your chances of securing funding.

- Networking events: Attend industry events and conferences to meet potential funders.

- Online platforms: Utilize online platforms to connect with investors and funding organizations.

- Referrals: Leverage your network for referrals to potential funders.

Strong relationships can lead to increased opportunities for funding and mentorship.

Managing Funding and Reporting Requirements

Transparent financial management and accurate reporting are essential for maintaining credibility and securing future funding.

- Transparent financial management: Maintain accurate financial records and adhere to accounting best practices.

- Regular reporting: Provide regular updates to funders on your progress and financial performance.

- Compliance with funding agreements: Adhere to all terms and conditions outlined in your funding agreements.

Effective financial management ensures the long-term sustainability of your business.

Conclusion: Support for Sustainable SMEs: Securing Your Funding Future

Securing funding for your sustainable SME requires careful planning, a compelling narrative, and strong relationships with potential funders. We've explored various funding options, from government grants and green loans to crowdfunding and impact investing. Each option has its unique advantages and disadvantages, requiring a strategic approach based on your specific needs and circumstances. Remember, a strong funding proposal, effective communication, and transparent financial management are vital for success. Start exploring funding options for your sustainable SME today! Find the right support for your sustainable business journey and unlock the potential of your sustainable SME through strategic funding.

Featured Posts

-

Fallece Campeon Masters 1000 Hamburgo Nadal Confirma La Triste Noticia

May 19, 2025

Fallece Campeon Masters 1000 Hamburgo Nadal Confirma La Triste Noticia

May 19, 2025 -

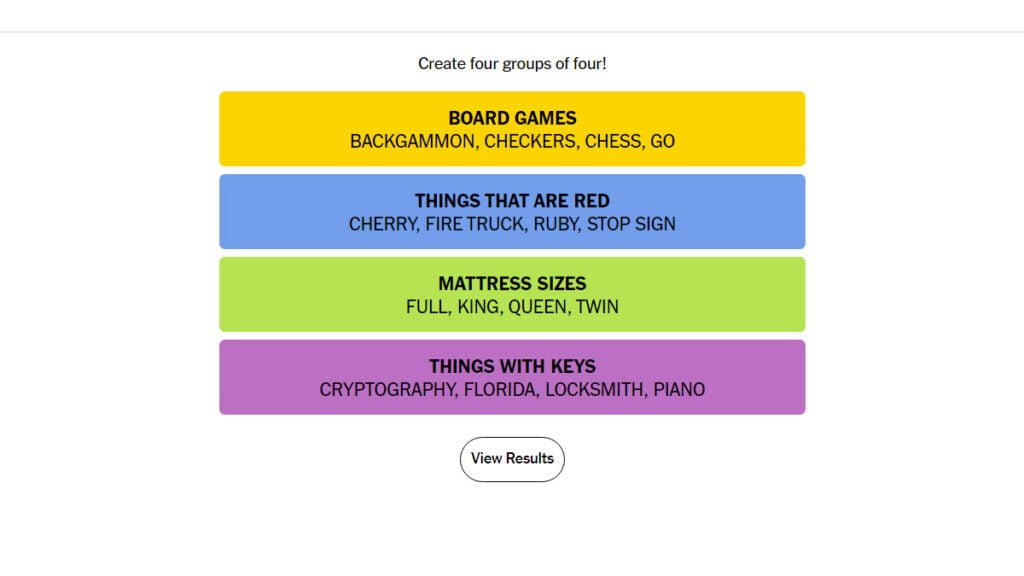

Nyt Connections Answers Puzzle 645 March 17

May 19, 2025

Nyt Connections Answers Puzzle 645 March 17

May 19, 2025 -

Oscar Winner Mark Rylance Protests London Park Music Festival Plans

May 19, 2025

Oscar Winner Mark Rylance Protests London Park Music Festival Plans

May 19, 2025 -

Rylan Clark Confirmed For Cinderella Pantomime At Cliffs Pavilion

May 19, 2025

Rylan Clark Confirmed For Cinderella Pantomime At Cliffs Pavilion

May 19, 2025 -

China And Pakistan A Deepening Space Cooperation Partnership

May 19, 2025

China And Pakistan A Deepening Space Cooperation Partnership

May 19, 2025