Successfully Navigating The Private Credit Job Market: 5 Key Strategies

Table of Contents

Mastering the Essential Skills for Private Credit Roles

Success in the private credit job market hinges on possessing a robust skillset. Employers seek candidates with a deep understanding of financial modeling, credit analysis, and the ability to build strong professional relationships.

Financial Modeling Proficiency

Advanced financial modeling skills are paramount. Prospective employees must demonstrate proficiency in building and interpreting complex models, accurately forecasting financial performance, and effectively communicating insights to stakeholders.

- Strong proficiency in building and interpreting financial models: This includes LBO modeling, discounted cash flow (DCF) analysis, and leveraged buyout (LBO) modeling.

- Accuracy and efficiency: Demonstrate the ability to build models quickly and accurately, minimizing errors and ensuring reliability.

- Effective communication: Clearly and concisely communicate model outputs, insights, and implications to both technical and non-technical audiences.

- Software proficiency: Mastery of Excel, Bloomberg Terminal, and Argus is crucial for many private credit roles.

Understanding Credit Analysis & Due Diligence

Thorough credit analysis and due diligence are cornerstones of private credit. Candidates must understand various credit analysis techniques and possess the ability to identify and mitigate potential risks.

- Ratio analysis: Demonstrate a solid understanding of key financial ratios and their implications for creditworthiness.

- Cash flow analysis: Proficiently analyze cash flow statements to assess a borrower's ability to repay debt.

- Risk assessment and mitigation: Identify and assess potential risks, developing strategies to mitigate these risks effectively.

- Due diligence: Conduct thorough due diligence investigations, including reviewing financial statements, legal documents, and conducting site visits when necessary.

Networking and Relationship Building

The private credit job market, like many specialized fields, relies heavily on networking. Building strong relationships with professionals in the industry can significantly enhance your job search prospects.

- Industry events and conferences: Actively attend conferences and networking events to connect with potential employers and industry leaders.

- Leveraging LinkedIn: Utilize LinkedIn to connect with professionals, join relevant groups, and engage in industry discussions.

- Informational interviews: Seek informational interviews to learn more about different roles and firms within the private credit sector. This helps you gain valuable insights and build relationships.

Targeting the Right Private Credit Firms

Strategic targeting of firms is crucial for success in the private credit job market. Understanding the nuances of different firms and aligning your application with their specific investment strategies is key.

Researching and Identifying Target Firms

Thorough research is vital. Identify firms that align with your career goals and whose investment strategies resonate with your interests and skills.

- Online resources: Utilize platforms such as PitchBook and Preqin to research private credit firms, understanding their investment strategies and track record.

- Firm culture and philosophy: Go beyond financial performance; research the firm's culture and investment philosophy to ensure alignment with your values and working style.

- Target alignment: Focus your efforts on firms where your skills and experience directly address their needs.

Tailoring Your Resume and Cover Letter

Generic applications rarely succeed. Customize your resume and cover letter for each firm, highlighting relevant experience and showcasing your understanding of their specific investment strategies.

- Highlight relevant experience: Emphasize skills and experience directly relevant to the firm's investment focus.

- Showcase understanding: Demonstrate knowledge of the firm's investment strategy and recent transactions.

- Express enthusiasm: Convey genuine interest in the firm and the private credit industry.

Acing the Private Credit Interview Process

The interview process is crucial. Preparation is key to successfully navigating behavioral and technical questions.

Preparing for Behavioral Questions

Behavioral questions assess your personality, work style, and problem-solving abilities. Practice using the STAR method (Situation, Task, Action, Result) to structure your answers effectively.

- STAR Method: Use the STAR method to provide structured and compelling answers to behavioral questions.

- Relevant examples: Showcase experiences that highlight key skills and accomplishments.

- Practice: Rehearse answering common behavioral questions aloud to build confidence and fluency.

Technical Interview Preparation

Technical interviews assess your financial modeling and credit analysis skills. Thorough preparation is essential.

- Review core concepts: Review fundamental financial concepts, including financial statement analysis, valuation, and credit risk assessment.

- Case study practice: Practice solving case studies related to private credit investments and transactions.

- Prepare questions: Prepare insightful questions to ask the interviewer, demonstrating your engagement and interest.

Leveraging Your Network and Building Relationships (Continued)

Networking remains a critical component of securing a position. Consistent effort in building and maintaining relationships within the industry will significantly increase your chances of success.

- Industry events and conferences: Continue attending industry events to expand your network and stay updated on market trends.

- Professional organizations: Join relevant professional organizations to connect with like-minded individuals and access valuable resources.

- LinkedIn engagement: Actively engage with professionals on LinkedIn, participating in discussions and sharing relevant content.

Continuously Learning and Staying Updated

The private credit job market is dynamic. Continuous learning is vital to stay competitive.

- Industry news: Follow industry news and publications to stay abreast of market trends and emerging opportunities.

- Relevant certifications: Consider pursuing relevant certifications, such as the Chartered Financial Analyst (CFA) or Chartered Alternative Investment Analyst (CAIA) designations.

- Workshops and webinars: Attend workshops and webinars to enhance your skills and knowledge in specific areas of private credit.

Conclusion

Successfully navigating the private credit job market requires a multifaceted approach. By mastering essential skills, targeting the right firms, acing the interview process, leveraging your network, and continuously learning, you can significantly increase your chances of securing a rewarding career. By applying these five strategies, you can significantly increase your chances of securing your dream role in the exciting and rewarding private credit job market. Remember, persistence and a proactive approach are key to unlocking opportunities in this dynamic and growing sector.

Featured Posts

-

Barstools Portnoy And Governor Newsom A Public Feud

Apr 26, 2025

Barstools Portnoy And Governor Newsom A Public Feud

Apr 26, 2025 -

Investor Concerns About Stock Market Valuations Bof As Response

Apr 26, 2025

Investor Concerns About Stock Market Valuations Bof As Response

Apr 26, 2025 -

The Unlikely Path Of Ahmed Hassanein Could He Be The First Egyptian In The Nfl

Apr 26, 2025

The Unlikely Path Of Ahmed Hassanein Could He Be The First Egyptian In The Nfl

Apr 26, 2025 -

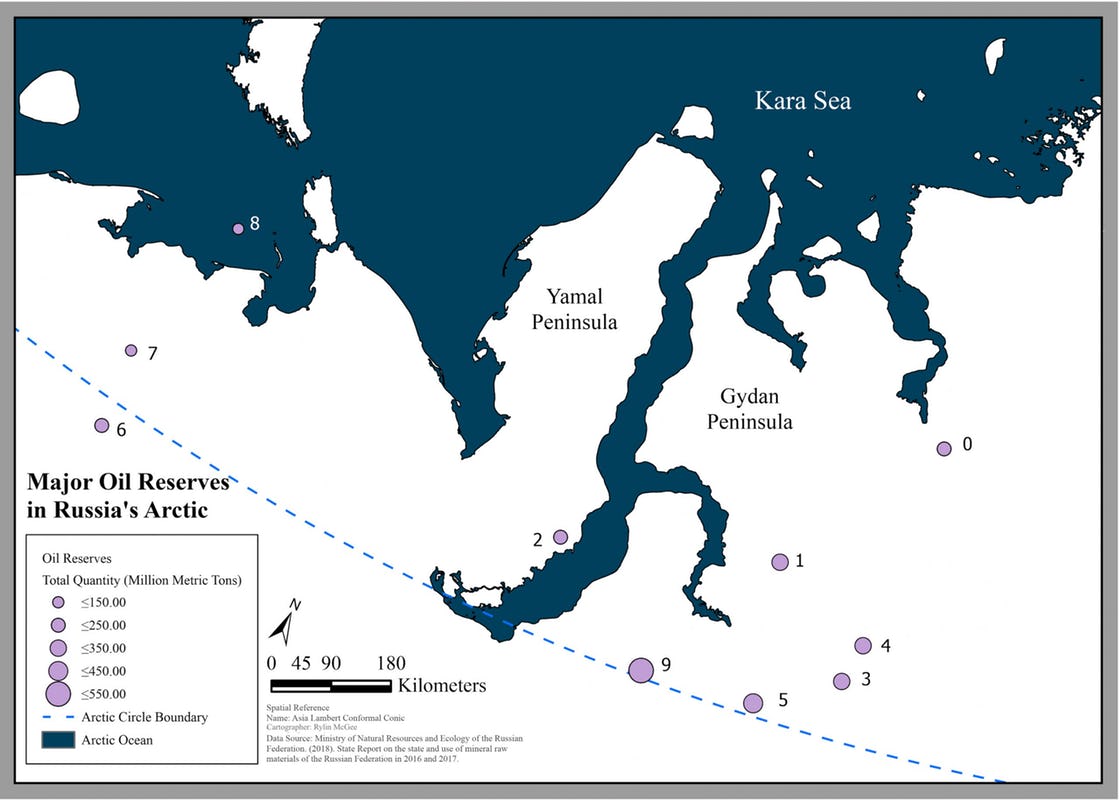

Investigating The Link Between European Shipyards And Russias Arctic Gas Trade

Apr 26, 2025

Investigating The Link Between European Shipyards And Russias Arctic Gas Trade

Apr 26, 2025 -

Unlocking Potential The Value Of Middle Management In The Modern Workplace

Apr 26, 2025

Unlocking Potential The Value Of Middle Management In The Modern Workplace

Apr 26, 2025

Latest Posts

-

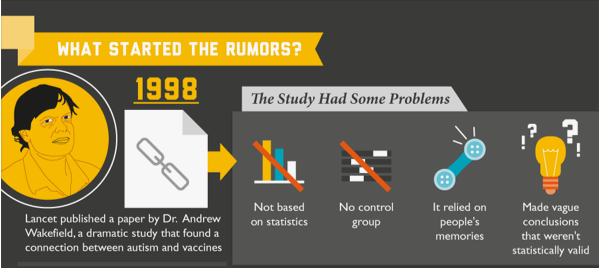

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025 -

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025 -

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025 -

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025