Student Loans: GOP's Proposed Changes To Pell Grants, Repayment, And More

Table of Contents

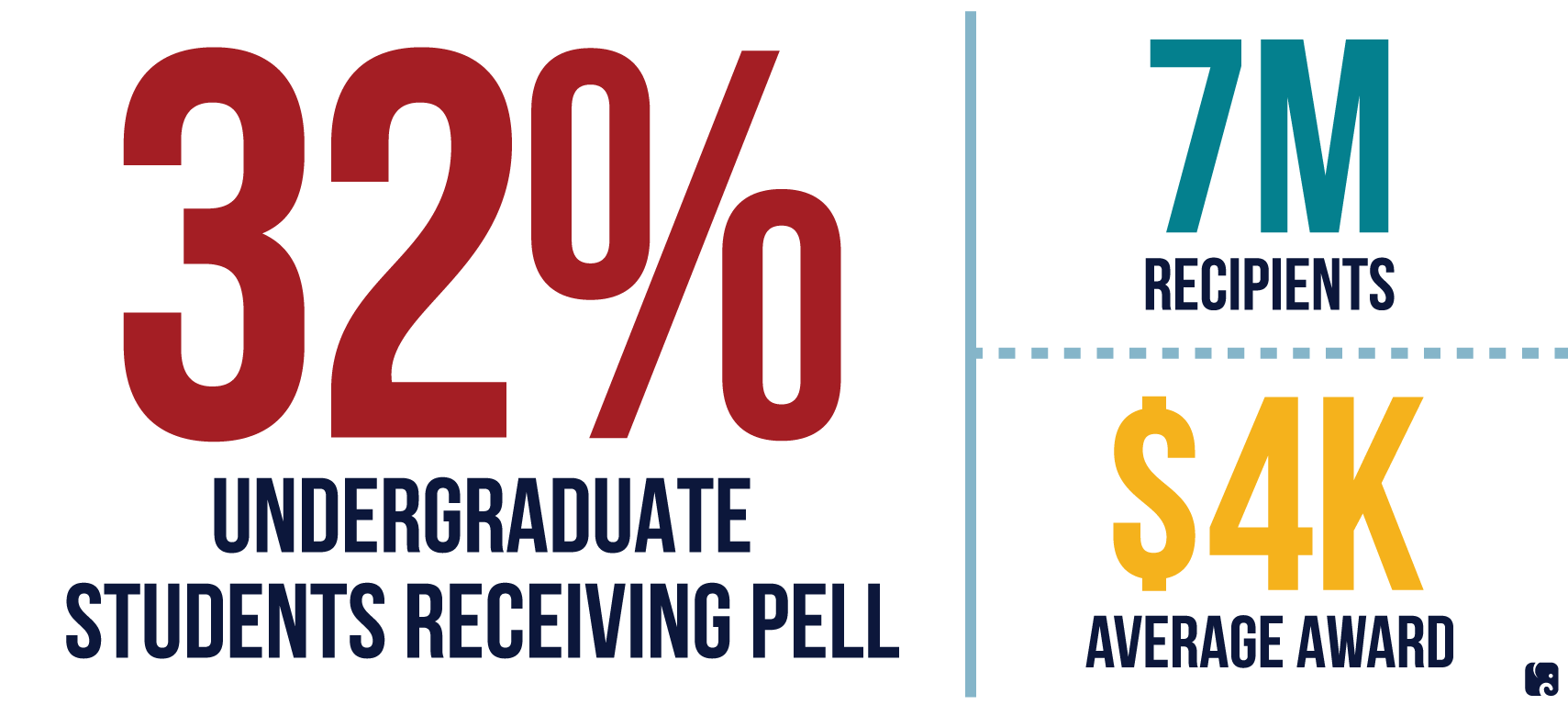

Proposed Changes to Pell Grants

The GOP's proposed reforms to Pell Grants could significantly alter the landscape of higher education financing. Keywords like Pell Grant reform and GOP Pell Grant proposals are central to understanding these potential shifts. Proposed changes might include:

-

Increased Eligibility Requirements: The GOP may propose stricter eligibility criteria, potentially requiring higher GPAs or limiting eligibility to specific majors deemed more aligned with workforce needs. This could exclude many students currently benefiting from Pell Grants.

-

Reduced Funding Amounts: Decreased funding amounts per grant could make college less affordable for many students, forcing them to rely more heavily on other forms of borrowing, increasing their overall student loan debt.

-

Changes to the Application Process: Streamlining or complicating the application process could create barriers for students, particularly those from lower-income backgrounds or with limited access to resources. This could lead to a decrease in Pell Grant applications and ultimately limit access to higher education.

-

Potential Limitations on Pell Grant Renewal Eligibility: Restricting the number of years a student can receive Pell Grants could significantly impact students pursuing longer degree programs, such as medical school or doctoral programs. This could increase the reliance on loans, adding to the student loan burden.

Repayment Plan Reforms

Proposed adjustments to existing income-driven repayment (IDR) plans are another key aspect of the GOP's student loan reform. Understanding keywords such as student loan repayment, income-driven repayment, and GOP student loan repayment plans is critical. These reforms may include:

-

Changes to IDR Plan Calculations: Higher payment amounts calculated under revised IDR plans could create significant financial hardship for borrowers, especially those with lower incomes. This could lead to increased loan defaults and negatively impact credit scores.

-

Limitations on Forgiveness Programs: Shorter forgiveness periods or stricter eligibility requirements for loan forgiveness programs could leave many borrowers with substantial remaining debt, even after years of repayment. This would increase the long-term student loan debt burden.

-

Introduction of New Repayment Plans: The introduction of new repayment plans, while potentially offering some benefits, could also create confusion and complexity for borrowers. Understanding the nuances of each plan will be crucial for making informed decisions.

-

Impact on Borrowers with Different Income Levels: The proposed changes may disproportionately affect low-income borrowers, exacerbating existing inequalities in access to higher education. Careful analysis is needed to understand the distributional consequences of these proposals.

Other Significant Proposals

Beyond Pell Grants and repayment plans, the GOP's student loan policy may encompass other significant changes. Understanding keywords like GOP student loan policy, student loan interest rates, and student loan forgiveness is important. These could include:

-

Changes to Interest Rates on Federal Student Loans: Increases in interest rates would directly increase the cost of borrowing, making college even more expensive and potentially further burdening students with already high student loan debt.

-

Proposals Related to Student Loan Forgiveness Programs: The potential elimination or significant modification of existing student loan forgiveness programs could leave millions of borrowers facing substantial debt for many years. The potential loss of this safety net needs careful consideration.

-

Changes to the Process of Applying for Federal Student Loans: Making the application process more difficult or less accessible could disproportionately affect students from underserved communities, reducing their access to higher education funding.

-

Impact on Private Student Loans: While the focus is often on federal student loans, changes to the overall regulatory environment could indirectly impact private student loan markets, potentially altering interest rates and repayment options.

Potential Impact on Borrowers

The proposed GOP student loan changes will have a significant impact on borrowers. Keywords such as student loan debt, student loan burden, and impact of GOP student loan proposals highlight the key concerns. The consequences could include:

-

Impact on Low-Income Borrowers: Low-income borrowers would likely bear the brunt of many proposed changes, facing increased debt burdens and reduced access to higher education.

-

Impact on Students from Minority Groups: These proposals could disproportionately affect minority students, exacerbating existing inequalities in access to higher education.

-

Impact on Students Pursuing Specific Fields of Study: Changes to Pell Grant eligibility or repayment plans could discourage students from pursuing certain fields, potentially impacting the workforce in those areas.

-

Long-Term Consequences of These Proposals: The long-term effects of these proposals on individual borrowers and the overall economy could be significant and far-reaching. Careful evaluation is crucial.

Conclusion

The GOP's proposed changes to Pell Grants, repayment plans, and other aspects of the student loan system have the potential to reshape the landscape of higher education financing. These proposals could lead to both positive and negative impacts, significantly altering access to education and the burden of student loan debt for millions of borrowers. Understanding the potential ramifications of GOP student loan reform is vital. Stay informed about the evolving landscape of student loan policy and the ongoing debate surrounding these proposals. Continue to research student loans and engage in discussions surrounding GOP student loan reform to make informed decisions about your financial future.

Featured Posts

-

75 Million Gift To Build New U Of U Hospital In West Valley

May 17, 2025

75 Million Gift To Build New U Of U Hospital In West Valley

May 17, 2025 -

From Scatological Documents To Podcast Gold An Ai Driven Approach

May 17, 2025

From Scatological Documents To Podcast Gold An Ai Driven Approach

May 17, 2025 -

The Ultimate Guide To Creatine Benefits Risks And Dosage

May 17, 2025

The Ultimate Guide To Creatine Benefits Risks And Dosage

May 17, 2025 -

The 2016 Election Analyzing The Influence Of Donald Trumps Scandals On Voter Behavior

May 17, 2025

The 2016 Election Analyzing The Influence Of Donald Trumps Scandals On Voter Behavior

May 17, 2025 -

Real Money Online Casinos Why 7 Bit Casino Reigns Supreme

May 17, 2025

Real Money Online Casinos Why 7 Bit Casino Reigns Supreme

May 17, 2025

Latest Posts

-

De Volta Aos Gramados Ex Vasco Conquista Camisa 10 E Mira Copa 2026 Nos Emirados Arabes

May 17, 2025

De Volta Aos Gramados Ex Vasco Conquista Camisa 10 E Mira Copa 2026 Nos Emirados Arabes

May 17, 2025 -

Camisa 10 Nos Emirados Arabes Ex Jogador Do Vasco Sonha Com A Copa De 2026

May 17, 2025

Camisa 10 Nos Emirados Arabes Ex Jogador Do Vasco Sonha Com A Copa De 2026

May 17, 2025 -

Nos Emirados Arabes Ex Jogador Do Vasco Conquista Camisa 10 E Almeja Copa 2026

May 17, 2025

Nos Emirados Arabes Ex Jogador Do Vasco Conquista Camisa 10 E Almeja Copa 2026

May 17, 2025 -

Brasilien Und Die Emirate Chancen Und Risiken Von Investitionen In Favelas

May 17, 2025

Brasilien Und Die Emirate Chancen Und Risiken Von Investitionen In Favelas

May 17, 2025 -

Favelas Als Investitionsobjekt Die Strategie Der Emirate In Brasilien

May 17, 2025

Favelas Als Investitionsobjekt Die Strategie Der Emirate In Brasilien

May 17, 2025