Student Loan Payments & Credit Score: What You Need To Know

Table of Contents

How Student Loan Payments Affect Your Credit Score

Your student loan repayment behavior significantly influences your credit score. On-time payments are essential for building a positive credit history and achieving a high credit score. Consistent, timely payments demonstrate responsible borrowing behavior to credit bureaus.

- Improved Credit Utilization Ratio: Making on-time payments contributes to a lower credit utilization ratio (the amount of credit you use compared to your total available credit). A lower ratio generally boosts your credit score.

- Increased Credit History Length: A longer credit history, built through years of responsible student loan repayment, positively impacts your credit score. Lenders appreciate seeing a track record of consistent payments.

- Demonstration of Responsible Borrowing Behavior: Consistently paying your student loans on time shows lenders and credit bureaus that you're a reliable borrower, increasing your creditworthiness.

Conversely, late or missed student loan payments can severely damage your credit score. The consequences can be far-reaching and long-lasting.

- Significant Drop in Credit Score: Even one missed payment can lead to a substantial drop in your credit score, making it harder to secure future loans or credit cards at favorable interest rates.

- Potential for Debt Collection Agencies: Repeated late payments can result in your debt being sent to collections, further damaging your credit and potentially leading to legal action.

- Difficulty Securing Loans or Credit Cards in the Future: A poor credit score due to missed student loan payments can make it extremely difficult—and expensive—to obtain future loans, credit cards, or even rent an apartment.

Maintaining a good payment history on your student loans is paramount for building and preserving a healthy credit score. Consistent, on-time student loan repayment is key to long-term financial well-being.

Types of Student Loans and Their Impact on Credit

Understanding the differences between federal and private student loans is essential. Both impact your credit score, but in potentially different ways.

Federal student loans are disbursed by the U.S. government and are typically reported to credit bureaus. Private student loans are offered by banks and other private lenders; these are also typically reported. However, the reporting practices and the consequences of default can differ.

- Federal Loan Forgiveness Programs and Their Impact on Credit: While federal loan forgiveness programs can provide relief, their impact on your credit report may vary. It's crucial to understand how these programs affect your credit history before applying.

- Private Loan Default and Its Consequences: Defaulting on a private student loan can have severe repercussions, including damage to your credit score, wage garnishment, and legal action.

- The Importance of Understanding Your Loan Terms: Carefully reviewing your loan agreement for both federal and private student loans is critical to understand repayment schedules, interest rates, and potential penalties for late payments. Understanding these terms is vital for managing your student loan debt effectively. This understanding is crucial for protecting your credit score.

Strategies for Managing Student Loan Payments and Protecting Your Credit

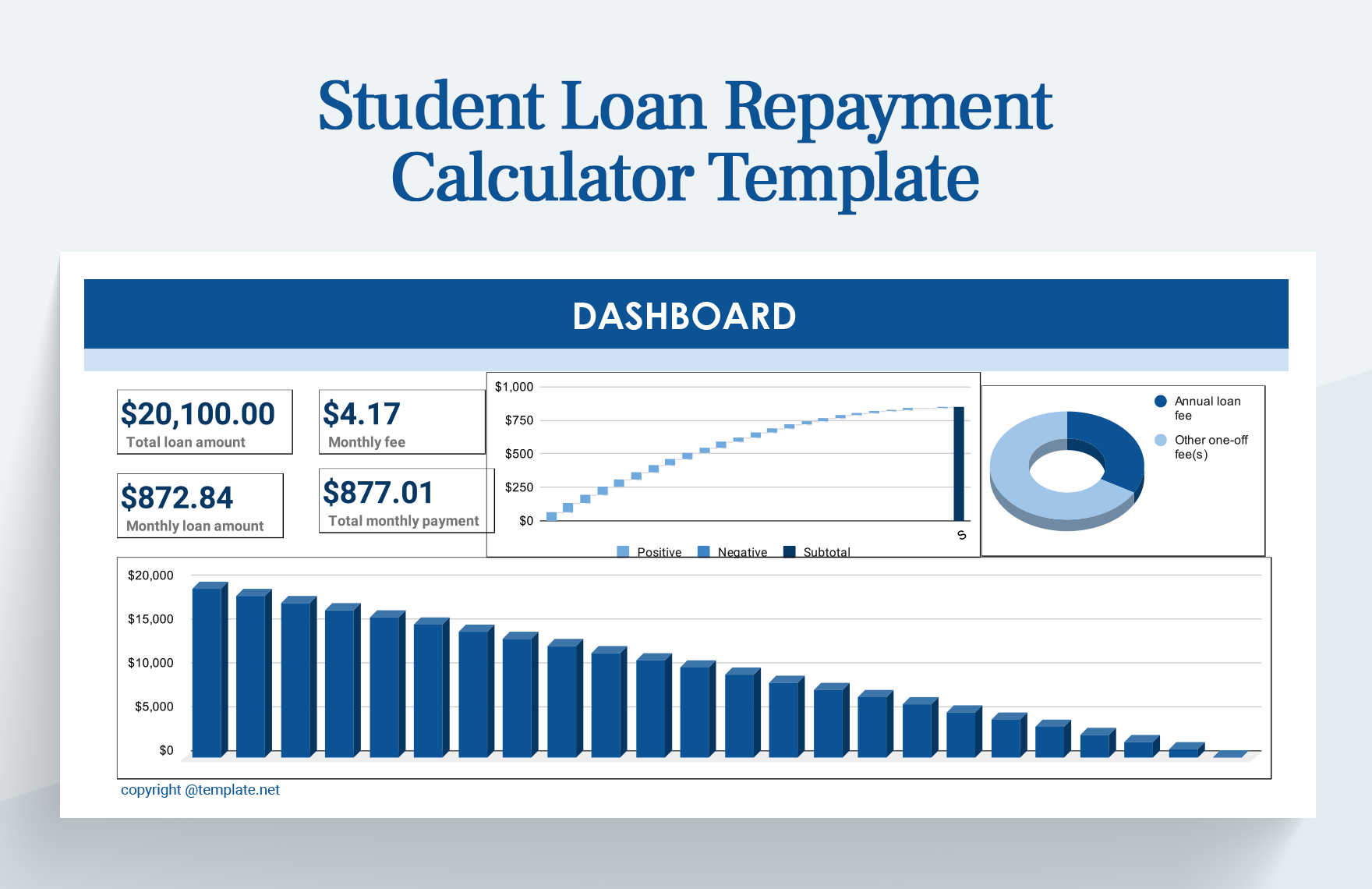

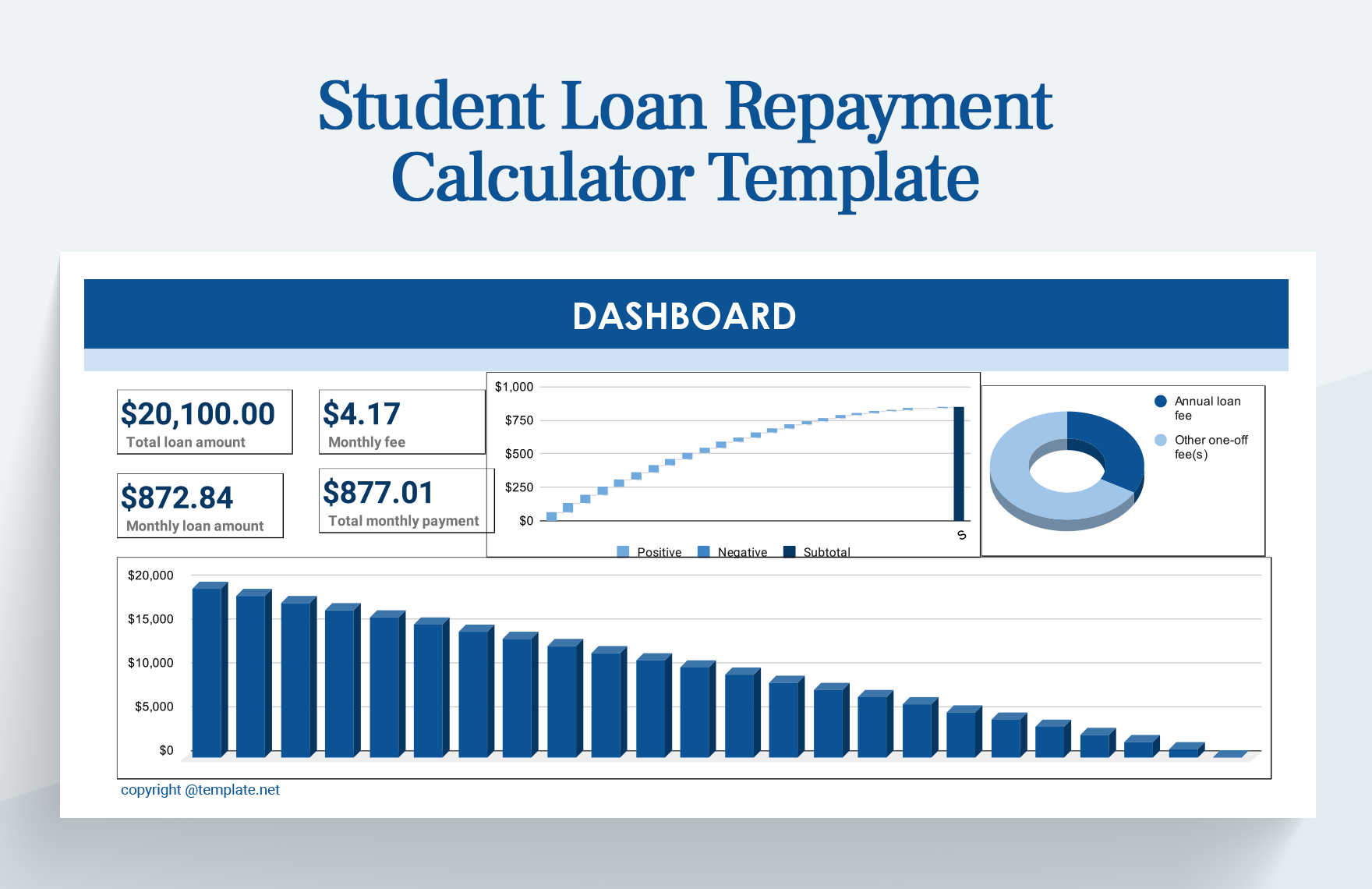

Effective student loan repayment strategies are vital for protecting your credit score. Several repayment plans are available to suit different financial situations.

- Standard Repayment Plan: This plan involves fixed monthly payments over a set period.

- Income-Driven Repayment Plans: These plans adjust your monthly payments based on your income and family size.

- Graduated Repayment Plan: Payments start low and gradually increase over time.

Proactive communication with your lenders is also key. Contacting them early if you anticipate difficulties making payments can often prevent more severe consequences.

- Setting up Automatic Payments: Automating your payments ensures on-time payments, preventing late fees and negative impacts on your credit score.

- Budgeting and Financial Planning for Loan Repayments: Creating a realistic budget that includes your student loan payments is crucial for avoiding missed payments.

- Exploring Loan Consolidation or Refinancing Options: Consolidating or refinancing your loans may simplify payments and potentially lower your interest rate, making repayment easier.

Regularly monitoring your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) is crucial for identifying and addressing any errors or potential issues.

The Importance of Credit Scores Beyond Student Loans

A good credit score is essential for far more than just managing student loan payments. It impacts numerous aspects of your financial life.

- Higher Interest Rates on Future Loans: A poor credit score translates to higher interest rates on mortgages, auto loans, and other forms of credit, significantly increasing the overall cost of borrowing.

- Difficulty Renting an Apartment: Many landlords check credit scores before approving rental applications; a poor score may hinder your ability to secure housing.

- Challenges Securing Employment in Certain Fields: Some employers conduct credit checks, particularly in financial or security-related positions. A poor credit score could negatively impact your job prospects.

Maintaining good long-term credit health is an ongoing process that requires consistent financial responsibility and proactive management.

Student Loan Payments & Credit Score: Key Takeaways and Next Steps

Successfully managing your student loan payments is directly linked to maintaining a healthy credit score. Consistent on-time payments build positive credit history, while late or missed payments can significantly harm your creditworthiness. Understanding your loan types and exploring various repayment strategies are crucial steps in protecting your financial future.

Start monitoring your credit score today and take control of your student loan payments. Learn more about effective student loan repayment strategies and protect your financial future. Don't let student loan debt negatively impact your credit score; take proactive steps towards a brighter financial future by carefully managing your student loan payments and credit score.

Featured Posts

-

Giants Vs Mariners Injury Report April 4 6 Series Preview

May 17, 2025

Giants Vs Mariners Injury Report April 4 6 Series Preview

May 17, 2025 -

How Late Student Loan Payments Impact Your Credit

May 17, 2025

How Late Student Loan Payments Impact Your Credit

May 17, 2025 -

Best Online Casinos Canada 2025 Is 7 Bit Casino The Top Choice

May 17, 2025

Best Online Casinos Canada 2025 Is 7 Bit Casino The Top Choice

May 17, 2025 -

Previsiones Deportivas Semanales Analisis Y Predicciones De Prensa Latina

May 17, 2025

Previsiones Deportivas Semanales Analisis Y Predicciones De Prensa Latina

May 17, 2025 -

Meet Ali Marks Brunson Wife Of Nba Star Jalen Brunson

May 17, 2025

Meet Ali Marks Brunson Wife Of Nba Star Jalen Brunson

May 17, 2025

Latest Posts

-

The 10 Most Memorable Sherlock Holmes Quotes

May 17, 2025

The 10 Most Memorable Sherlock Holmes Quotes

May 17, 2025 -

End Of The Valley A March Viewing Guide For The Listener

May 17, 2025

End Of The Valley A March Viewing Guide For The Listener

May 17, 2025 -

The Listener March Viewing Guide End Of The Valley With Temuera Morrison

May 17, 2025

The Listener March Viewing Guide End Of The Valley With Temuera Morrison

May 17, 2025 -

Doctor Who Christmas Special A Festive Future

May 17, 2025

Doctor Who Christmas Special A Festive Future

May 17, 2025 -

The End Of The Doctor Who Christmas Special Tradition

May 17, 2025

The End Of The Doctor Who Christmas Special Tradition

May 17, 2025