Strong Earnings Result In Increased Payout For Vodacom (VOD)

Table of Contents

Vodacom's Robust Financial Performance

Vodacom's FY2023 financial results showcase impressive growth across key metrics, solidifying its position as a dominant player in the South African telecommunications sector. The company demonstrated significant progress in revenue, profitability, and subscriber growth, setting the stage for the enhanced dividend payout.

- Significant Revenue Increase: Vodacom reported a substantial increase in revenue compared to the previous financial year, exceeding expectations. This growth was driven by strong performance across various segments, including mobile data and digital services.

- Improved EBITDA Margin: The company's EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margin improved significantly, reflecting enhanced operational efficiency and cost management strategies. This indicates a healthier and more profitable business model.

- Strong Subscriber Growth: Vodacom experienced robust growth in its subscriber base across its key markets, demonstrating the increasing demand for its services and the success of its market penetration strategies. This expansion underscores the company's ability to attract and retain customers.

- Positive Future Outlook: Based on current market trends and the company's strategic initiatives, Vodacom projects continued growth and positive momentum in the coming financial year, offering a promising outlook for investors.

Increased Dividend Payout – A Reward for Shareholders

The highlight of Vodacom's FY2023 results is the substantial increase in its dividend payout. This reflects the company's strong financial performance and its commitment to returning value to its shareholders.

- Percentage Increase: The dividend per share increased by X% compared to the previous year's payout, representing a significant boost for shareholders' returns. (Note: Replace X% with the actual percentage increase).

- Dividend per Share: The increased dividend translates to an amount of ZAR Y per share. (Note: Replace ZAR Y with the actual amount).

- Dividend Yield Implications: This increase positively impacts the dividend yield, making Vodacom an even more attractive investment for income-seeking investors.

- Competitive Dividend Payouts: Compared to its competitors in the South African telecommunications market, Vodacom's dividend payout remains highly competitive, further enhancing its appeal to investors.

Factors Contributing to Vodacom's Success

Vodacom's remarkable financial success is attributable to several key factors, including strategic investments, innovative product offerings, and effective market strategies.

- 5G Rollout Success: The successful rollout and adoption of Vodacom's 5G network have significantly contributed to revenue growth, particularly in data services. This investment in cutting-edge technology positions Vodacom for future growth.

- Data Revenue Growth: Increased mobile data consumption across the country has driven significant growth in data revenue, a key contributor to Vodacom's overall financial performance. This trend is expected to continue.

- Successful Digital Services Launch: The launch of several new digital services has expanded Vodacom's product portfolio and attracted a wider customer base. These services cater to evolving consumer needs.

- Effective Cost Management: Vodacom's effective cost-cutting measures have improved its operational efficiency and profitability, contributing to the overall strong financial results.

Future Outlook and Investment Implications

Vodacom's strong earnings and increased dividend payout have significant implications for its future stock performance and attractiveness to investors.

- Vodacom Stock Price Performance: The positive financial results are likely to have a positive impact on Vodacom's stock price, making it an attractive investment opportunity.

- Impact on Investor Sentiment: The increased dividend payout is likely to boost investor confidence and attract new investment in the company.

- Future Growth Prospects: Vodacom's strong performance and future growth prospects make it a promising long-term investment opportunity for investors seeking exposure to the South African telecommunications sector.

- Industry Comparison: Compared to industry trends and the performance of its competitors, Vodacom is positioned for continued success and market leadership.

Conclusion

Vodacom's strong FY2023 earnings have resulted in a significant increase in its dividend payout, rewarding shareholders and showcasing the company's robust financial health. The company's success is driven by a combination of factors, including strategic investments in 5G technology, strong data revenue growth, and effective cost management. The positive outlook for Vodacom, based on its recent performance and future growth prospects, makes it a compelling investment opportunity. Learn more about Vodacom's investment opportunities by visiting their investor relations page [link to investor relations page]. Stay updated on Vodacom's future dividend payouts and financial results by subscribing to their investor alerts.

Featured Posts

-

The Goldbergs Comparing The Show To Real Life 80s Experiences

May 21, 2025

The Goldbergs Comparing The Show To Real Life 80s Experiences

May 21, 2025 -

The Goldbergs Character Profiles And Relationships

May 21, 2025

The Goldbergs Character Profiles And Relationships

May 21, 2025 -

Antiques Roadshow American Couples Arrest Following Uk Episode

May 21, 2025

Antiques Roadshow American Couples Arrest Following Uk Episode

May 21, 2025 -

Madrid Tennis Sabalenka And Zverev Secure Next Round Spots

May 21, 2025

Madrid Tennis Sabalenka And Zverev Secure Next Round Spots

May 21, 2025 -

Abn Group Victoria Chooses Half Dome For Specific Service

May 21, 2025

Abn Group Victoria Chooses Half Dome For Specific Service

May 21, 2025

Latest Posts

-

Coldplay Delivers Powerful Message Of Love Through Music And Light Show

May 22, 2025

Coldplay Delivers Powerful Message Of Love Through Music And Light Show

May 22, 2025 -

Coldplays Top Performance Blending Music Light And Powerful Messages

May 22, 2025

Coldplays Top Performance Blending Music Light And Powerful Messages

May 22, 2025 -

Coldplay Concert Review Music Lights And A Message Of Love

May 22, 2025

Coldplay Concert Review Music Lights And A Message Of Love

May 22, 2025 -

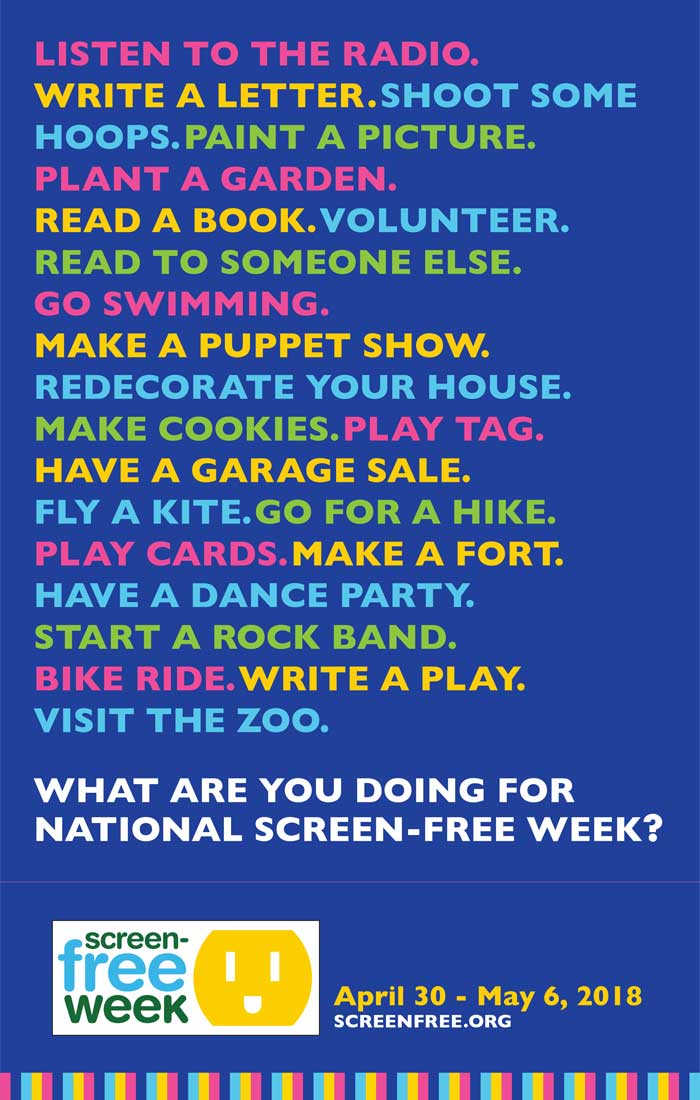

Your Plan For A Successful Screen Free Week With Kids

May 22, 2025

Your Plan For A Successful Screen Free Week With Kids

May 22, 2025 -

A Parents Guide To A Successful Screen Free Week

May 22, 2025

A Parents Guide To A Successful Screen Free Week

May 22, 2025