Stocks Power Global Risk Rally Amidst U.S.-China Truce

Table of Contents

The U.S.-China Truce: A Catalyst for Global Market Growth

The easing of trade tensions between the U.S. and China has acted as a significant catalyst for global market growth, significantly reducing uncertainty and boosting investor sentiment. This perceived truce, whether a formal trade deal or simply a pause in escalating tariffs, dramatically improves the outlook for global economic growth. Several key factors contributed to this positive shift:

-

Reduced Geopolitical Risk: The decrease in trade war rhetoric lessened the considerable geopolitical risk that had been weighing heavily on investor confidence. This reduction in uncertainty translated into a higher risk appetite, prompting investors to move into higher-yielding assets like stocks.

-

Improved Global Economic Outlook: A potential trade deal between the world's two largest economies signals a brighter outlook for global trade and economic growth. This positive sentiment rippled through various sectors, boosting overall market performance.

-

Analysis of Past Negotiations: Examining past market reactions to U.S.-China trade negotiations reveals a pattern: periods of heightened tension correlate with market downturns, while periods of détente or progress towards agreements coincide with rallies. This historical context underscores the significance of the current perceived truce.

-

Lingering Uncertainties: It's crucial to acknowledge that despite the positive sentiment, uncertainties remain. The truce might be temporary, and the potential for future trade disputes still exists. This necessitates a cautious approach to investment strategies.

Impact on Specific Sectors: Winners and Losers of the Risk Rally

The global risk rally didn't impact all sectors equally. Some experienced significant gains, while others saw more muted effects or even experienced losses. Understanding these sector-specific variations is critical for developing effective investment strategies:

-

Technology Stocks: Technology stocks, particularly those heavily reliant on international trade, were among the biggest beneficiaries. Reduced trade barriers facilitated smoother supply chains and increased market access.

-

Emerging Markets: Emerging markets, often highly sensitive to global risk sentiment, also saw a considerable boost. The improved outlook for global growth increased investor interest in these higher-growth regions.

-

Potential Losers: Some sectors, however, might have been negatively affected. For example, certain defense contractors who benefited from heightened geopolitical tensions during the trade war might experience reduced demand as tensions ease.

-

Portfolio Diversification: The varied impact across sectors highlights the importance of portfolio diversification. Investors should carefully assess their holdings and adjust their strategies accordingly to capitalize on opportunities while mitigating risks.

-

Specific Stock Performance: Analyzing the performance of individual stocks during this period can offer valuable insights. For example, technology giants like Apple and companies with significant exposure to the Chinese market witnessed substantial gains.

Assessing the Sustainability of the Global Risk Rally

While the current global risk rally is promising, investors need to critically evaluate its sustainability. Several factors could influence the long-term trajectory of the market:

-

Economic Indicators: Closely monitoring key economic indicators, such as inflation rates, interest rate changes, and GDP growth, is crucial for predicting future market trends. Any significant negative shifts in these indicators could dampen the rally's momentum.

-

Market Volatility: The inherent volatility of the stock market should not be overlooked. Even with the positive developments, unexpected events could trigger market corrections. Investors must be prepared for potential fluctuations.

-

Interest Rate Changes: Changes in interest rates significantly impact investment decisions and market sentiment. Rising interest rates could draw investment away from stocks and into bonds, potentially slowing the rally.

-

Long-Term Investment Strategies: Despite the short-term optimism, long-term investment strategies should remain focused on fundamental analysis and diversification. The current rally shouldn't overshadow the importance of sound, long-term investment planning.

-

Expert Opinions: Seeking expert opinions from economists and financial analysts can provide valuable insights into the likely long-term implications of the U.S.-China truce on global markets.

Conclusion

The recent global risk rally, primarily driven by a perceived U.S.-China truce, has instilled renewed optimism in the stock market. However, investors should cautiously consider underlying economic factors and the potential for future volatility before making investment decisions. Understanding the nuanced sector-specific performance within this rally is crucial for effective portfolio management.

Call to Action: Stay informed about the ongoing developments in the U.S.-China relationship and global economic indicators to make well-informed stock investment decisions. Understanding the dynamics of the global risk rally and its impact on various sectors is key to navigating the complexities of the current market. Continue to research and analyze the market to capitalize on opportunities presented by the evolving global risk landscape and learn more about mitigating risks in your investment portfolio amid shifts in the global stock market. Don't underestimate the importance of continuous monitoring and adaptation in this dynamic environment.

Featured Posts

-

Captain America Brave New World Disney Streaming Premiere Date

May 14, 2025

Captain America Brave New World Disney Streaming Premiere Date

May 14, 2025 -

Broadcoms V Mware Acquisition A 1 050 Price Hike Sparks Outrage

May 14, 2025

Broadcoms V Mware Acquisition A 1 050 Price Hike Sparks Outrage

May 14, 2025 -

The Post Stalemate Playbook Options For Startups Beyond The Ipo

May 14, 2025

The Post Stalemate Playbook Options For Startups Beyond The Ipo

May 14, 2025 -

Federal Charges Millions Made From Executive Office365 Inboxes

May 14, 2025

Federal Charges Millions Made From Executive Office365 Inboxes

May 14, 2025 -

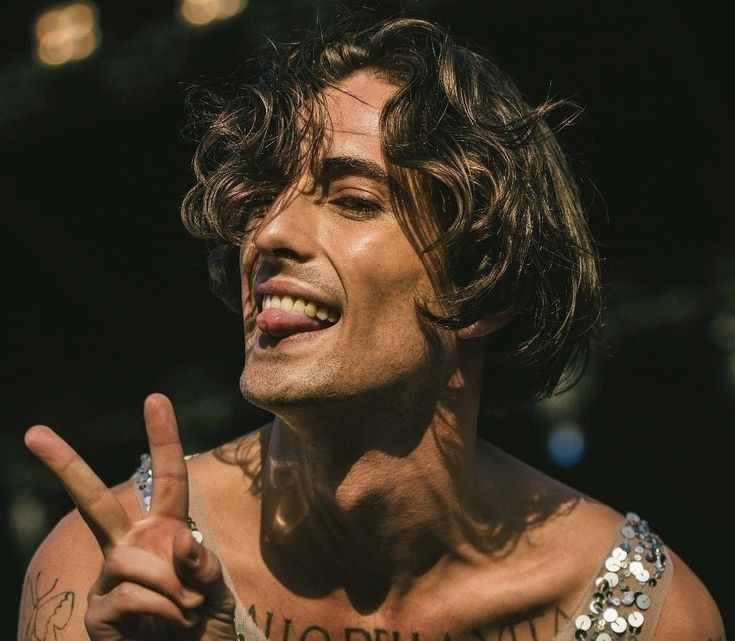

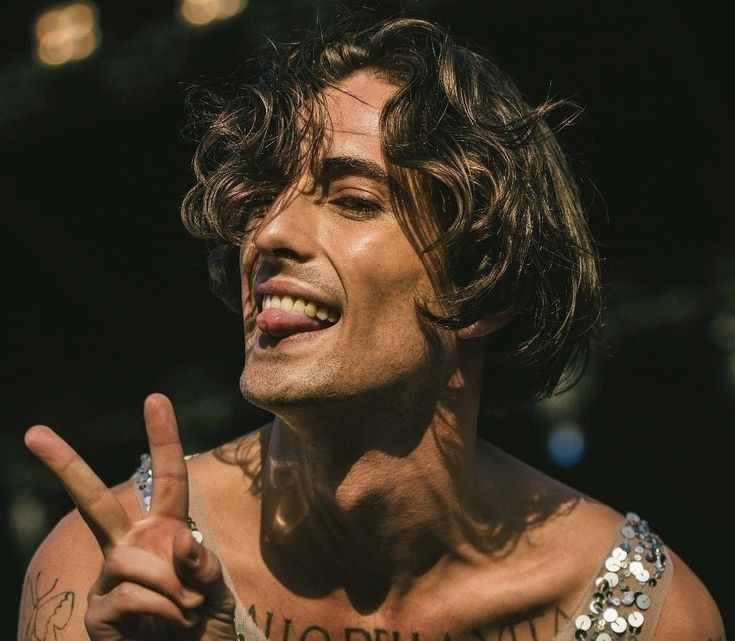

Damiano David Ta Yevrobachennya Scho Chekaye Nas U Maybutnomu

May 14, 2025

Damiano David Ta Yevrobachennya Scho Chekaye Nas U Maybutnomu

May 14, 2025

Latest Posts

-

Damiano David Perspektivi Uchasti U Nastupnomu Yevrobachenni

May 14, 2025

Damiano David Perspektivi Uchasti U Nastupnomu Yevrobachenni

May 14, 2025 -

Obgovorennya Povernennya Damiano Davida Na Stsenu Yevrobachennya

May 14, 2025

Obgovorennya Povernennya Damiano Davida Na Stsenu Yevrobachennya

May 14, 2025 -

Prognoz Chi Pobachimo Damiano Davida Na Yevrobachenni Znovu

May 14, 2025

Prognoz Chi Pobachimo Damiano Davida Na Yevrobachenni Znovu

May 14, 2025 -

Povernennya Damiano Davida Na Yevrobachennya Analiz Situatsiyi

May 14, 2025

Povernennya Damiano Davida Na Yevrobachennya Analiz Situatsiyi

May 14, 2025 -

Damiano David Ta Yevrobachennya Scho Chekaye Nas U Maybutnomu

May 14, 2025

Damiano David Ta Yevrobachennya Scho Chekaye Nas U Maybutnomu

May 14, 2025