Stocks Look To Finish Strong: Dow Futures And Market Analysis

Table of Contents

Analyzing Dow Futures: A Key Indicator of Market Sentiment

Dow Futures contracts are agreements to buy or sell the Dow Jones Industrial Average at a specific price on a future date. They serve as a powerful predictor of overall market sentiment and short-term price movements. Currently, Dow Futures trends indicate a positive outlook, with prices showing sustained upward momentum. This suggests investor confidence and a potential for continued market growth.

- Recent Dow Futures Movements: Over the past week, Dow Futures have consistently shown gains, reacting positively to strong economic data releases and positive corporate earnings reports. For example, the recent surge following the better-than-expected jobs report significantly boosted investor sentiment.

- Technical Indicators: Technical analysis tools, such as moving averages and the Relative Strength Index (RSI), also support this positive trend. The 50-day and 200-day moving averages are converging, suggesting a potential breakout. The RSI is above 50, indicating bullish momentum.

- News Events Influencing Dow Futures: Positive news regarding inflation easing and corporate profit margins have significantly contributed to the upward trend in Dow Futures. However, geopolitical uncertainties remain a potential headwind.

Key Economic Indicators Pointing Towards a Strong Market Finish

Robust economic indicators are reinforcing the notion that stocks look to finish strong. Positive data across various fronts points towards a healthy and expanding economy.

- Positive Economic Indicators: Recent employment reports have shown strong job growth, exceeding expectations. Consumer confidence remains high, indicating increased spending. GDP growth also continues to be positive, signaling continued economic expansion. These factors are all bullish for the stock market.

- Potential Risks and Headwinds: While the outlook is generally positive, potential risks remain. Inflation, although easing, could still pose a challenge. Further interest rate hikes by the Federal Reserve could also impact market performance. Geopolitical instability continues to be a wildcard.

- Relationship Between Indicators and Market Strength: Strong economic indicators generally translate to increased corporate profits, higher investor confidence, and ultimately, higher stock prices. Conversely, weak indicators can lead to market corrections.

Sector-Specific Analysis: Identifying Top Performing Stocks

While the overall market looks promising, certain sectors are poised to outperform others. A deeper dive into sector-specific analysis can help investors identify potential winners.

- High-Performing Sectors: The technology sector, fueled by AI advancements and strong earnings, continues to be a significant driver of market growth. The healthcare sector also shows strong potential, particularly companies involved in innovative treatments and pharmaceuticals. Renewable energy companies are also experiencing significant growth due to increasing focus on sustainability.

- Top Performing Stocks: Within these sectors, specific stocks are showing remarkable strength. (Note: This section would ideally include specific stock examples, but providing specific financial advice is beyond the scope of this article. Readers should conduct their own research before making investment decisions).

- Relevant Financial Metrics: To assess the potential of specific stocks, investors should analyze relevant financial metrics such as Price-to-Earnings (P/E) ratio, earnings growth, and revenue growth. These figures provide valuable insights into a company's financial health and growth potential.

Understanding Potential Risks and Volatility

While the market outlook appears positive, it’s crucial to acknowledge potential risks and volatility. No market prediction is foolproof.

- Market Risks: Inflationary pressures, unexpected interest rate changes, geopolitical events (e.g., war, trade disputes), and unforeseen economic downturns could all negatively impact the market.

- Risk Mitigation Strategies: Diversification is key to mitigating risk. Spreading investments across different asset classes and sectors reduces the impact of any single sector's underperformance. Hedging strategies can also help protect against potential losses.

- Staying Informed: Staying informed about market news and economic events is crucial. Regularly monitoring financial news sources and conducting your own thorough research can help you make informed decisions and react quickly to changing market conditions.

Stocks Look to Finish Strong – Your Next Steps

In conclusion, several indicators suggest that stocks look to finish strong. Positive Dow Futures trends, strong economic data, and robust performance in certain sectors all contribute to this optimistic outlook. However, it's crucial to remember that inherent risks and volatility remain. To capitalize on this potential, track the Dow Futures, monitor economic indicators to capitalize on the potential for stocks to finish strong, and learn more about investing in stocks. Conduct your own thorough research, and consider consulting a qualified financial advisor before making any investment decisions. Remember that this is not financial advice. Investing in the stock market always involves risk.

Featured Posts

-

Stockholm Stadshotell Krogkommissionens Omdoeme Och Vart

Apr 26, 2025

Stockholm Stadshotell Krogkommissionens Omdoeme Och Vart

Apr 26, 2025 -

Shedeur Sanders And The New York Giants A Winning Combination

Apr 26, 2025

Shedeur Sanders And The New York Giants A Winning Combination

Apr 26, 2025 -

Analyzing Gavin Newsoms Recent Actions And Statements

Apr 26, 2025

Analyzing Gavin Newsoms Recent Actions And Statements

Apr 26, 2025 -

Hungary Central Bank Fraud Allegations Index Report Details

Apr 26, 2025

Hungary Central Bank Fraud Allegations Index Report Details

Apr 26, 2025 -

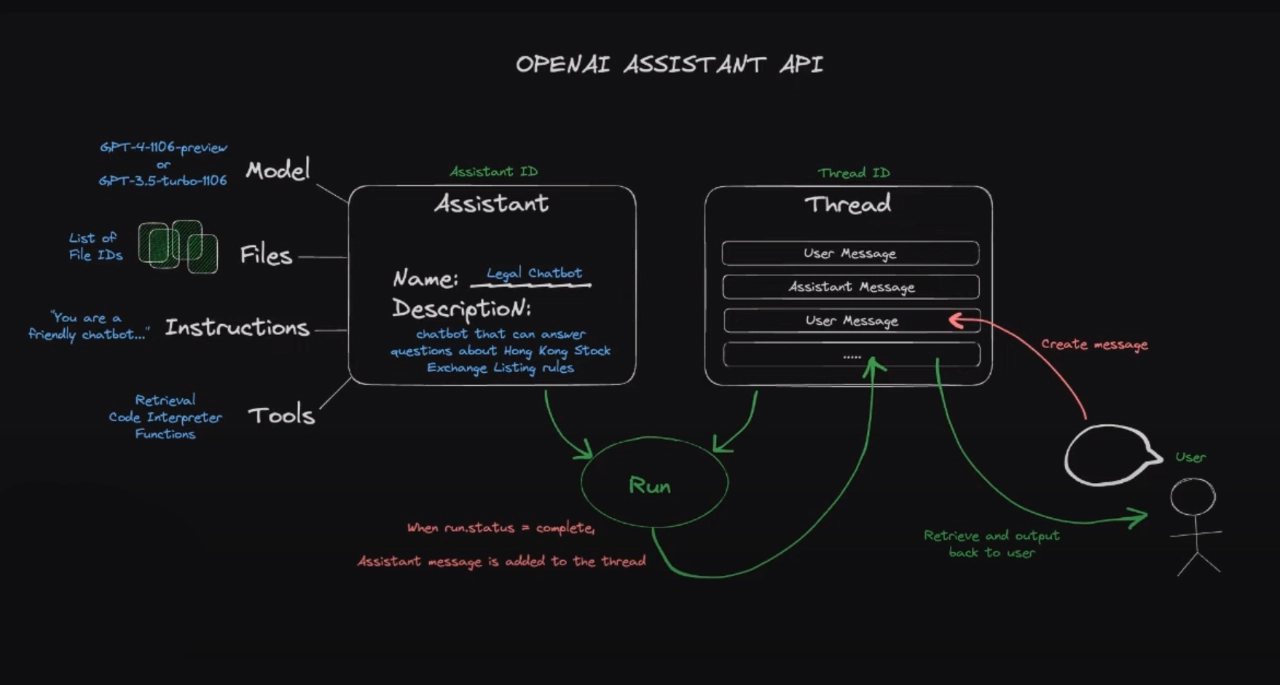

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcement

Apr 26, 2025

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcement

Apr 26, 2025

Latest Posts

-

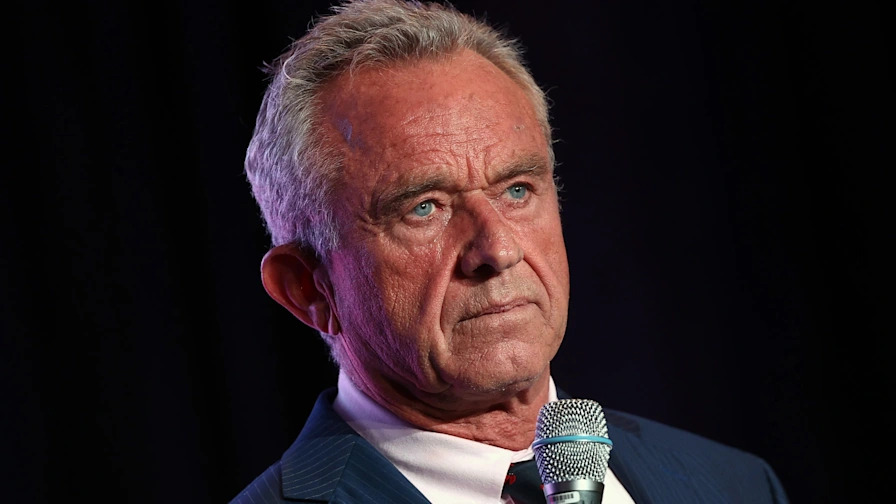

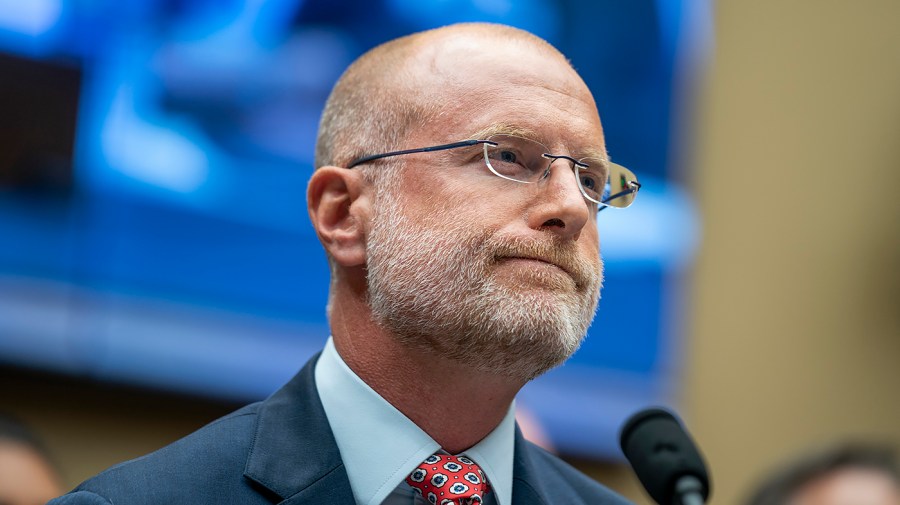

Hhss Decision To Hire Vaccine Skeptic David Geier Analysis Of Vaccine Studies Under Scrutiny

Apr 27, 2025

Hhss Decision To Hire Vaccine Skeptic David Geier Analysis Of Vaccine Studies Under Scrutiny

Apr 27, 2025 -

Controversy Erupts Hhs Appoints Vaccine Skeptic David Geier

Apr 27, 2025

Controversy Erupts Hhs Appoints Vaccine Skeptic David Geier

Apr 27, 2025 -

David Geiers Vaccine Review Hhs Appointment Sparks Controversy

Apr 27, 2025

David Geiers Vaccine Review Hhs Appointment Sparks Controversy

Apr 27, 2025 -

Hhs Hires Vaccine Skeptic David Geier To Review Vaccine Studies

Apr 27, 2025

Hhs Hires Vaccine Skeptic David Geier To Review Vaccine Studies

Apr 27, 2025 -

Controversial Appointment Hhs And The Debunked Autism Vaccine Connection

Apr 27, 2025

Controversial Appointment Hhs And The Debunked Autism Vaccine Connection

Apr 27, 2025