Stock Market Volatility: Dow Futures And China's Economic Response

Table of Contents

Stock market volatility refers to the degree of price fluctuation in the market. High volatility means prices are changing rapidly and significantly, creating both opportunities and risks for investors. Dow Futures, contracts representing the future value of the Dow Jones Industrial Average, provide a crucial barometer of this volatility, offering insights into investor sentiment and expected market direction. This article aims to analyze the impact of China's economic policies and actions on Dow Futures and overall market volatility, equipping investors with knowledge to navigate this complex landscape. We will explore key factors contributing to volatility, analyze the correlation between Dow Futures and China's economy, and discuss effective investment strategies for mitigating risk. Keywords relevant to this discussion include: stock market volatility, Dow Futures, China economy, economic response, market fluctuations, investment strategies, risk management.

China's Economic Slowdown and its Global Ripple Effects

China's economic slowdown is a significant factor contributing to global stock market volatility. Several key factors have contributed to this slowdown, including a protracted real estate crisis, the lingering impact of the zero-COVID policy, and weakening global demand. These issues have created significant uncertainty in the market.

The impact extends far beyond China's borders. The slowdown has disrupted global supply chains, leading to:

- Decreased demand for raw materials: Reduced Chinese consumption affects the prices of commodities, impacting businesses worldwide.

- Disruptions to manufacturing and exports: Supply chain bottlenecks and reduced production capacity ripple through global manufacturing and export sectors.

- Impact on multinational corporations with significant Chinese operations: Companies heavily reliant on the Chinese market face decreased revenues and potential profit losses.

- Increased uncertainty for investors: This uncertainty translates into increased market volatility as investors react to shifting economic conditions.

These factors directly influence Dow Futures contracts. Reduced Chinese demand can depress prices of goods impacting US companies, leading to downward pressure on Dow Futures. Similarly, supply chain disruptions can negatively impact US businesses, further affecting Dow Futures.

Analyzing the Correlation between Dow Futures and China's Economic Policies

The relationship between Dow Futures and China's economic performance is complex but demonstrable. Historically, strong GDP growth in China has often correlated with positive sentiment in US markets, reflected in higher Dow Futures prices. Conversely, periods of economic weakness or policy uncertainty in China have often led to declines in Dow Futures.

Government policy decisions play a pivotal role. Stimulus packages aimed at boosting economic growth can positively influence market sentiment, leading to increases in Dow Futures. Conversely, policy tightening, such as interest rate adjustments, can dampen investor enthusiasm and negatively affect Dow Futures.

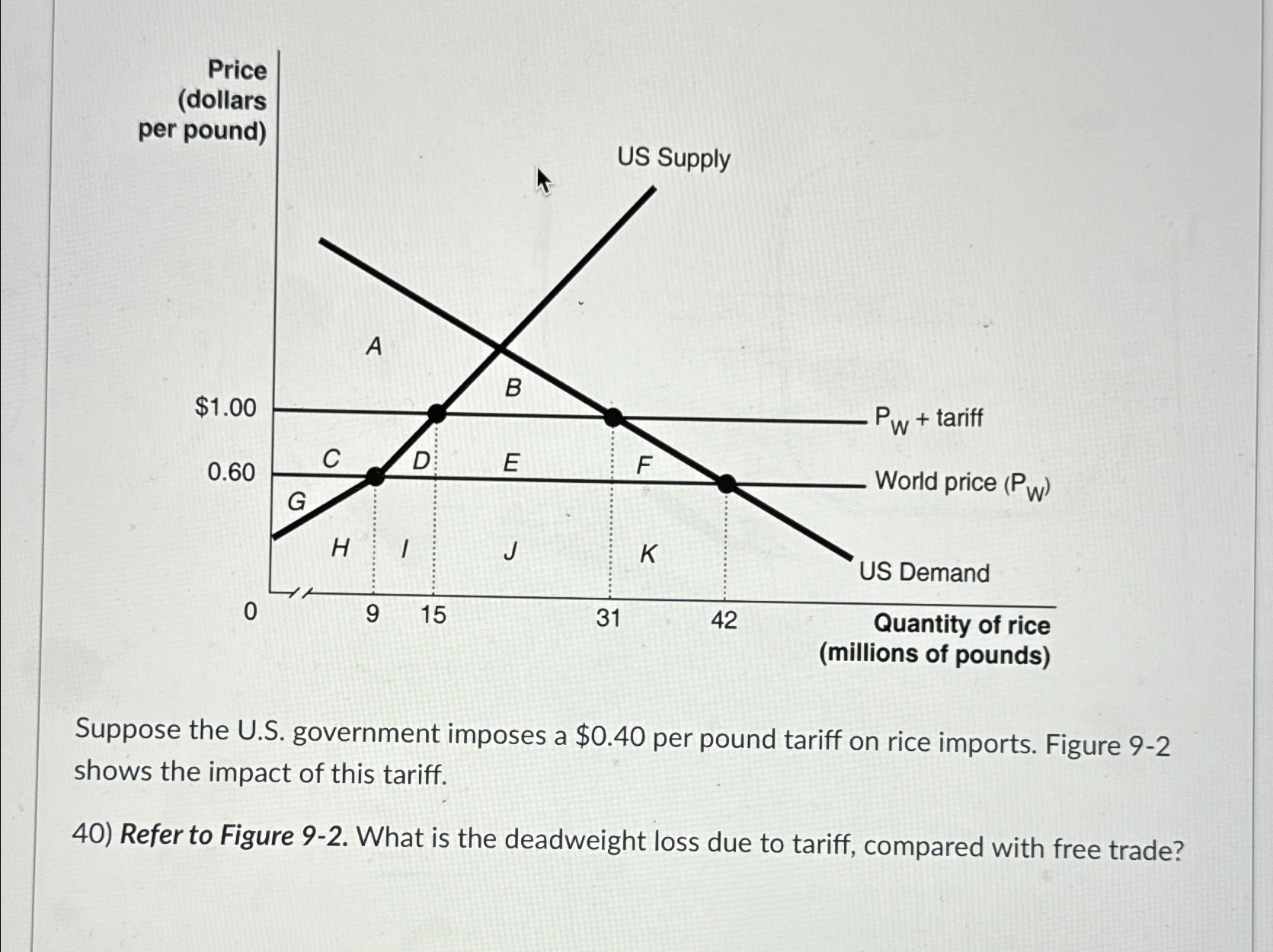

(Insert chart or graph here illustrating the correlation between key Chinese economic indicators and Dow Futures prices, if data is available.)

- Examples of past policy decisions and their effect on Dow Futures: Analyzing past instances of Chinese economic policy changes and their subsequent impact on Dow Futures can reveal valuable insights.

- Discussion of leading economic indicators and their predictive power: Key indicators like China's Purchasing Managers' Index (PMI) and consumer spending data can offer insights into the future direction of the Chinese economy and its impact on Dow Futures.

- Analysis of investor sentiment and its reflection in Dow Futures prices: Monitoring investor sentiment towards China's economic prospects can provide clues about potential future movements in Dow Futures.

Strategies for Navigating Stock Market Volatility Amidst China's Economic Response

Navigating stock market volatility requires a proactive approach to risk management and a well-defined investment strategy. The uncertainty stemming from China's economic response necessitates careful consideration of diversification and risk mitigation techniques.

- Importance of diversification across different asset classes: Diversifying your portfolio across various asset classes (stocks, bonds, real estate, etc.) can help reduce the overall impact of volatility.

- Strategies for hedging against market downturns: Hedging strategies, such as using options or futures contracts, can help protect your portfolio from potential losses during periods of increased market volatility.

- Importance of staying informed about global economic news: Keeping abreast of developments in the Chinese economy and its global impact is critical for making informed investment decisions.

- Recommendations for long-term vs. short-term investment strategies: A long-term investment strategy, with a focus on consistent growth rather than short-term gains, can help mitigate the impact of market fluctuations.

Conclusion: Understanding Stock Market Volatility – A Long-Term Perspective

The relationship between China's economic response and Dow Futures volatility is undeniable. China's economic policies and actions significantly impact global markets, creating both opportunities and risks for investors. Informed decision-making and proactive risk management are essential to navigate this environment successfully.

This situation is dynamic and requires continuous monitoring. China's economic policies are constantly evolving, and their global impact continues to unfold. Therefore, staying informed is paramount. We encourage you to continue your research into stock market volatility and Dow Futures. Thorough due diligence is essential before making any investment decisions. Further research into China's economic response and its global implications will provide a deeper understanding of the forces shaping today’s markets. Develop robust investment strategies to mitigate market fluctuations and protect your portfolio.

Featured Posts

-

Colgates Sales And Profits Fall 200 Million Tariff Impact

Apr 26, 2025

Colgates Sales And Profits Fall 200 Million Tariff Impact

Apr 26, 2025 -

California Surpasses Japan Now The Worlds Fourth Largest Economy

Apr 26, 2025

California Surpasses Japan Now The Worlds Fourth Largest Economy

Apr 26, 2025 -

Osimhens Price Tag Too Steep For Man United

Apr 26, 2025

Osimhens Price Tag Too Steep For Man United

Apr 26, 2025 -

Whos The Biggest Love Island Nepo Baby A Definitive Ranking

Apr 26, 2025

Whos The Biggest Love Island Nepo Baby A Definitive Ranking

Apr 26, 2025 -

Trumps Tariffs Ceos Warn Of Negative Impact On Economy And Consumer Sentiment

Apr 26, 2025

Trumps Tariffs Ceos Warn Of Negative Impact On Economy And Consumer Sentiment

Apr 26, 2025

Latest Posts

-

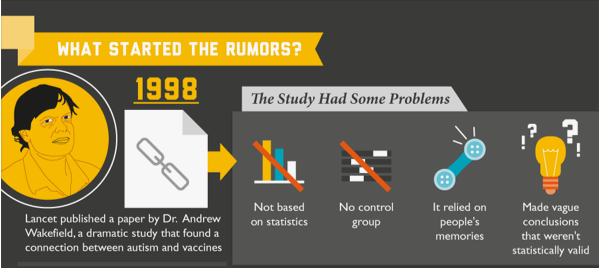

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025 -

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025 -

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025 -

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025