Stock Market Valuations: BofA's Reassuring Argument For Investors

Table of Contents

BofA's Key Arguments for Current Market Valuations

BofA's argument for current stock market valuations rests on several pillars, offering investors a counterpoint to prevailing anxieties. They suggest that several key factors support the current valuations despite recent economic headwinds. These factors indicate a degree of resilience in the market, and that a downturn may not be as imminent as some predict.

-

Strong Corporate Earnings Growth: BofA highlights robust corporate earnings growth as a primary justification for current valuations. This growth, they argue, offsets the impact of higher interest rates, a major concern for many investors. Strong earnings demonstrate underlying company strength and support higher price-to-earnings ratios.

-

Technological Innovation Driving Future Growth: Technological advancements continue to fuel innovation across numerous sectors, promising future growth and justifying premium valuations for companies at the forefront of this progress. This long-term growth potential is a key factor in BofA's positive assessment.

-

Resilient Consumer Spending: Despite inflationary pressures, consumer spending remains surprisingly resilient, supporting continued economic expansion. This robust consumer demand underpins corporate revenue and earnings growth, providing a further basis for current valuations.

-

Valuation Metrics in Context of Long-Term Growth: BofA emphasizes that valuation metrics, like P/E ratios, shouldn't be viewed in isolation. When considered alongside projected long-term growth prospects, current valuations appear less alarming. They advocate for considering future earnings potential rather than solely focusing on current metrics.

-

Global Economic Growth Remains Relatively Stable: BofA’s analysis also points to relatively stable global economic growth, mitigating concerns about a widespread recession. While there are challenges, the overall global picture is less dire than some forecasts suggest, contributing to their more optimistic outlook.

Addressing Concerns about High Valuations

While acknowledging legitimate concerns about high Price-to-Earnings (P/E) ratios and other valuation metrics, BofA offers counterarguments based on historical data and sector-specific analysis. The bank understands investor apprehension but aims to provide a more balanced perspective.

-

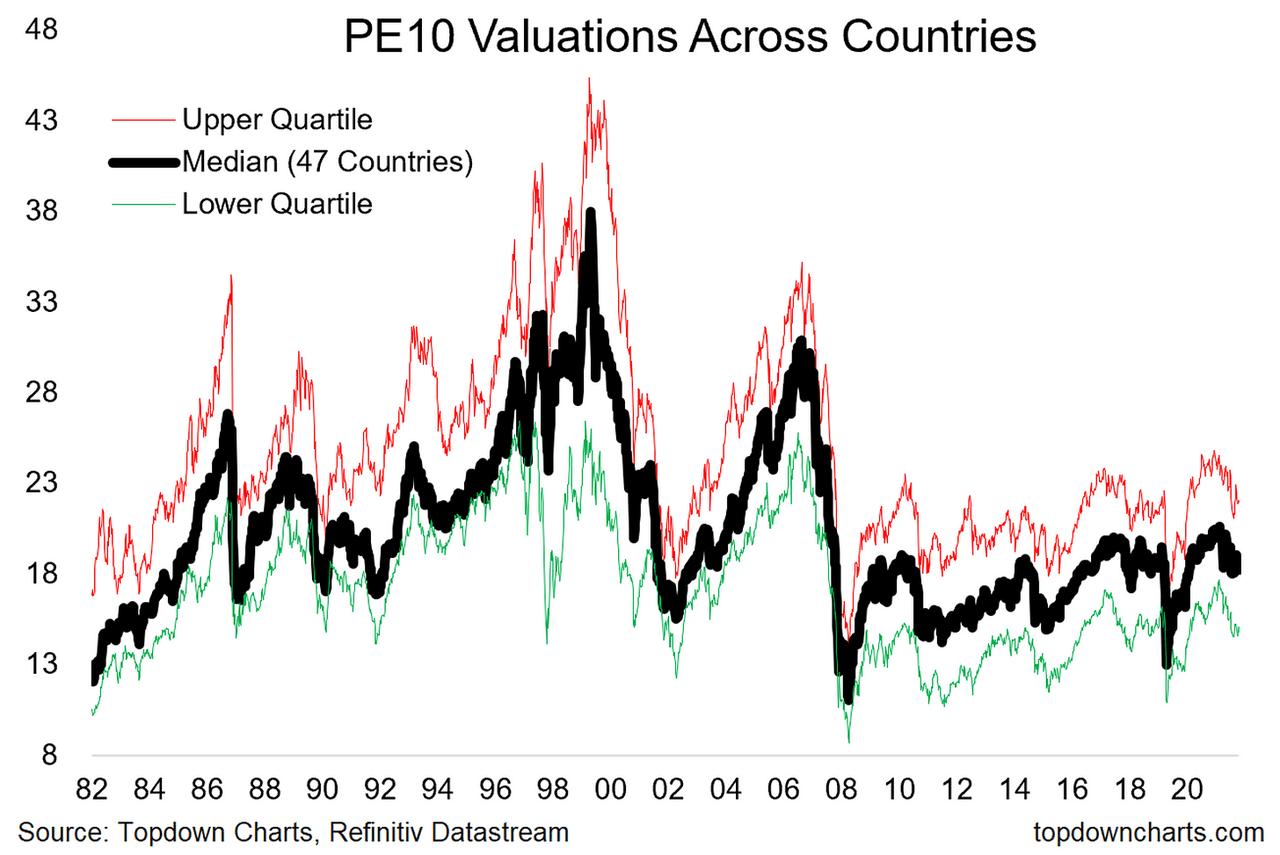

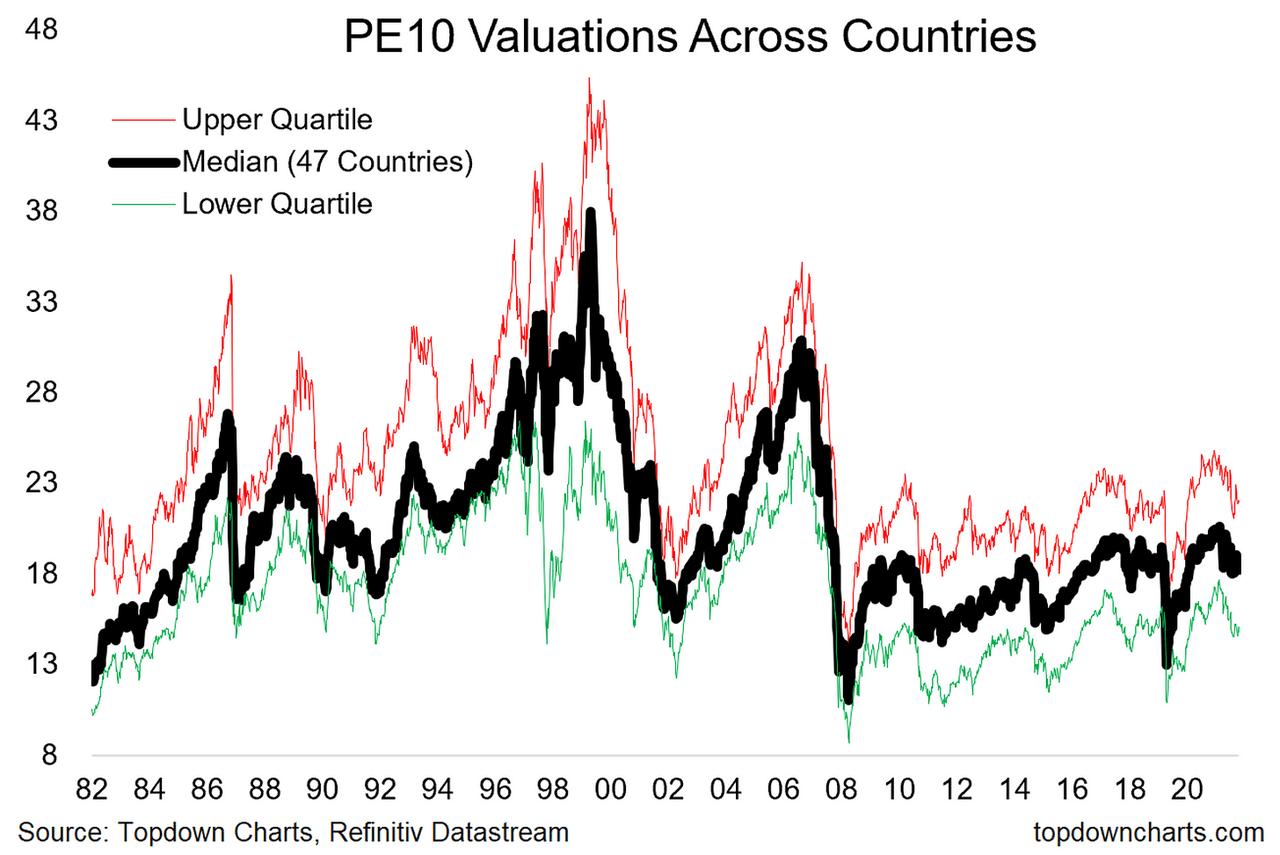

Refuting Market Crash Predictions: BofA's analysis refutes arguments suggesting an impending market crash solely based on elevated P/E ratios by comparing current valuations to historical averages across various market cycles. They show that current valuations, while high, aren't unprecedented in historical context.

-

Identifying Undervalued Sectors: The report highlights specific sectors, such as certain segments of the energy or consumer staples sectors, showing relatively lower valuations, presenting potentially attractive entry points for investors seeking value opportunities. This nuanced approach acknowledges valuation discrepancies within the overall market.

-

Emphasizing Long-Term Investment Strategies: BofA stresses the importance of long-term investment strategies over short-term market fluctuations. They advise against panicking due to short-term volatility and suggest maintaining a long-term perspective.

-

Inflation and Interest Rate Impact: BofA directly addresses concerns about inflation and interest rate hikes, acknowledging their impact on valuations. However, their analysis suggests that the current situation is manageable and that the positive factors mentioned earlier still outweigh the negative ones.

BofA's Investment Recommendations Based on Valuations

Based on their valuation analysis, BofA offers specific recommendations to guide investors' decisions. These recommendations are intended to mitigate risk and capitalize on opportunities identified in their analysis of stock market valuations.

-

Sector Recommendations: BofA suggests focusing on sectors positioned for continued growth, such as technology (specifically AI-related companies), healthcare (with a focus on innovative treatments and technologies), and consumer staples (companies offering essential goods and services).

-

Investment Strategies: The report recommends a blend of growth and value investing strategies. This balanced approach allows for participation in high-growth sectors while also securing positions in fundamentally strong, undervalued companies.

-

Portfolio Diversification: BofA emphasizes the critical role of portfolio diversification to mitigate risk. They recommend spreading investments across multiple sectors and asset classes to cushion against potential sector-specific downturns.

-

Cautionary Advice: The report does include cautionary advice, emphasizing the importance of conducting thorough due diligence and understanding the risks associated with each investment before committing capital.

Considering Alternative Valuation Metrics

BofA's analysis doesn't solely rely on P/E ratios. They employ a range of valuation metrics to ensure a comprehensive assessment of stock market valuations.

-

Alternative Metrics: Beyond P/E ratios, BofA incorporates metrics such as Price-to-Sales (P/S), Price-to-Book (P/B), and Price-to-Earnings-to-Growth (PEG) ratios. Each metric provides a unique perspective, allowing for a more nuanced understanding of valuation.

-

Metric Application: The report details how these alternative metrics are applied in their analysis, providing insights into the strengths and weaknesses of each metric in various market conditions.

-

Limitations of Single Metrics: BofA emphasizes the limitations of using any single valuation metric in isolation. They advocate for a holistic approach, considering multiple metrics simultaneously to derive a well-rounded picture.

Conclusion: Navigating Stock Market Valuations with BofA's Insights

BofA's analysis presents a reassuring perspective on current stock market valuations. By highlighting strong corporate earnings, technological innovation, and resilient consumer spending, they offer a counterpoint to prevailing anxieties. Their recommendations, encompassing sector selection, investment strategies, and portfolio diversification, provide a framework for navigating the current market landscape. While acknowledging the potential risks associated with high valuations, BofA's insights empower investors to develop a well-informed investment strategy based on their detailed analysis of stock market valuations. Stay informed on current stock market valuations by reviewing BofA's latest reports and develop a confident investment strategy today!

Featured Posts

-

Does Ai Truly Learn Debunking The Myth And Promoting Responsible Ai

May 31, 2025

Does Ai Truly Learn Debunking The Myth And Promoting Responsible Ai

May 31, 2025 -

Insacog Data Reveals New Covid 19 Variants Ba 1 And Lf 7 In India Public Health Implications

May 31, 2025

Insacog Data Reveals New Covid 19 Variants Ba 1 And Lf 7 In India Public Health Implications

May 31, 2025 -

30 Off Lavish Hotels This Spring Book Your Getaway Now

May 31, 2025

30 Off Lavish Hotels This Spring Book Your Getaway Now

May 31, 2025 -

Air Quality Alert Minnesota Suffers From Canadian Wildfire Smoke

May 31, 2025

Air Quality Alert Minnesota Suffers From Canadian Wildfire Smoke

May 31, 2025 -

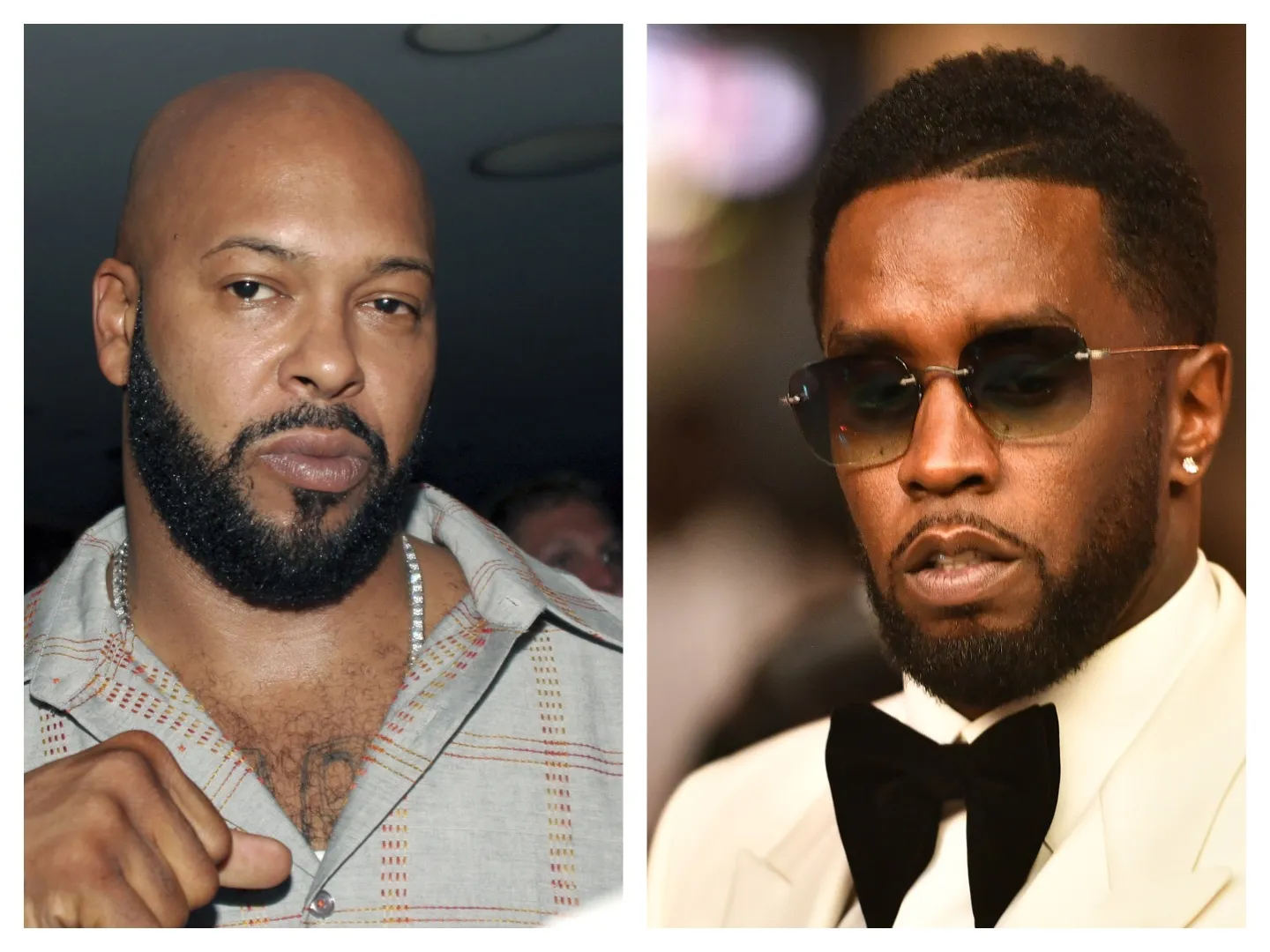

Suge Knight Calls On Sean Diddy Combs To Take The Stand

May 31, 2025

Suge Knight Calls On Sean Diddy Combs To Take The Stand

May 31, 2025