Stock Market Valuations: BofA's Reassuring Analysis For Investors

Table of Contents

H2: BofA's Key Findings on Stock Market Valuations

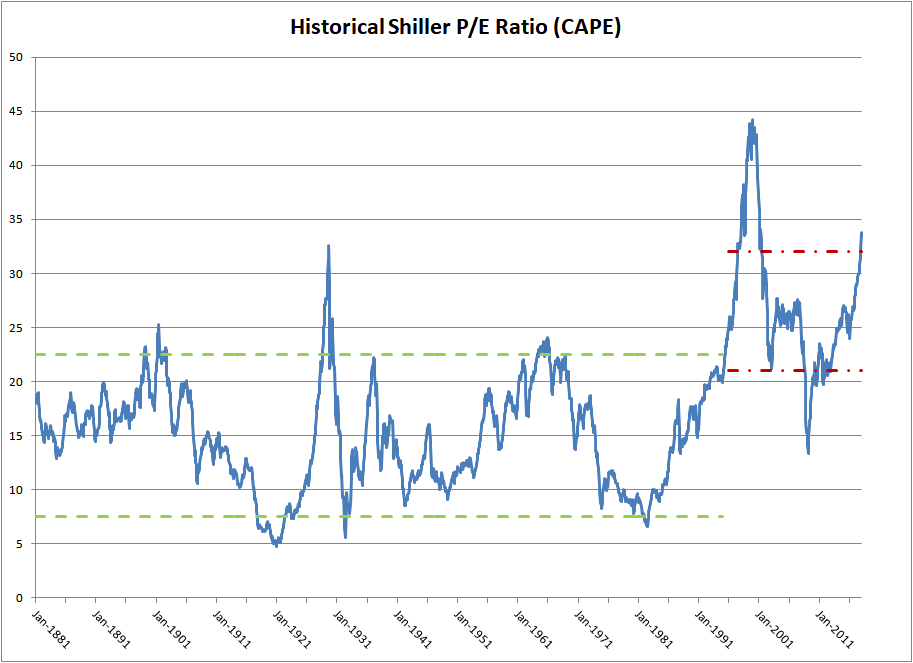

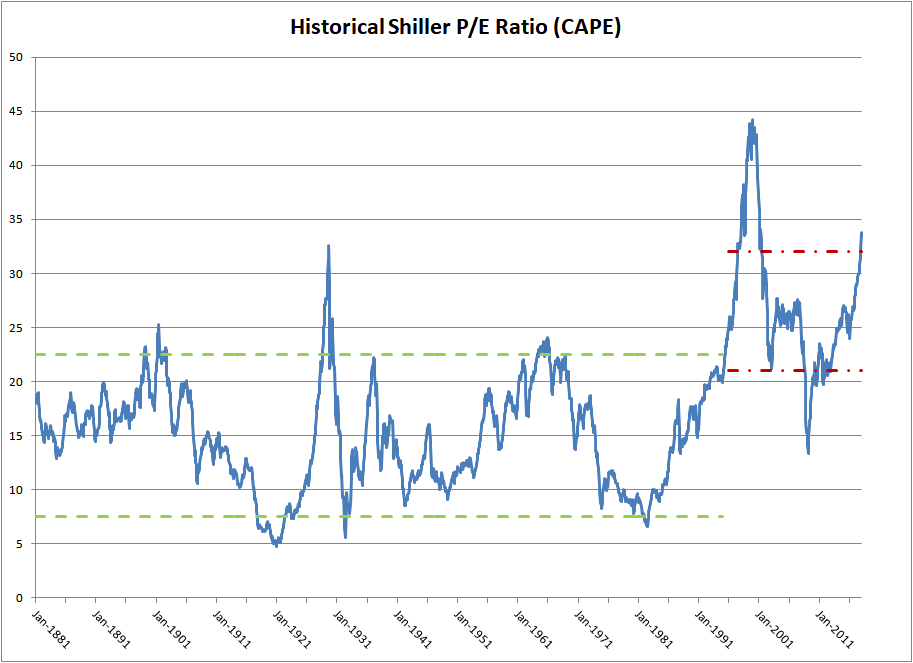

BofA's recent analysis suggests a nuanced view of current stock market valuations. While acknowledging the challenges presented by the macroeconomic environment, their conclusion isn't one of outright overvaluation. Instead, they highlight a degree of fair valuation in certain sectors, with pockets of undervaluation depending on specific metrics. Their analysis relies heavily on a combination of traditional and more nuanced valuation methods.

- Specific valuation metrics: BofA employed a multifaceted approach, utilizing metrics such as Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, and discounted cash flow (DCF) analysis. They also considered industry-specific metrics where appropriate.

- Key sectors/industries: The report highlighted technology, healthcare, and consumer staples as sectors worthy of particular attention. Specific companies within those sectors were flagged as potential investment opportunities based on their relative valuation compared to peers and historical trends.

- BofA's outlook: BofA projects moderate growth in the coming year, cautioning against overly optimistic forecasts. Their valuation analysis suggests selective opportunities exist for investors willing to carefully analyze individual company performance and prospects.

BofA's methodology involved a combination of quantitative analysis, using various valuation ratios, and qualitative assessment, considering macroeconomic factors and company-specific fundamentals. Their DCF analysis, for instance, took into account projected future cash flows, adjusted for risk and the time value of money. This comprehensive approach provides a more robust assessment than relying on single valuation metrics alone.

H2: Factors Influencing BofA's Stock Market Valuation Analysis

BofA's stock market valuation analysis wasn't conducted in a vacuum. Their conclusions are significantly shaped by a range of macroeconomic factors and geopolitical events.

- Impact of interest rate hikes: Rising interest rates increase borrowing costs for companies, potentially impacting their profitability and thus lowering valuations. BofA factored this into their discounted cash flow models, adjusting for higher discount rates to reflect the increased risk.

- Influence of inflation: Inflation erodes purchasing power and impacts company earnings. BofA's analysis considered the potential for inflation to squeeze profit margins, affecting their valuation calculations. They examined the pricing power of different companies and sectors to gauge their resilience to inflationary pressures.

- BofA's assessment of future economic growth: BofA’s outlook on economic growth significantly influenced their assessment of future earnings and, therefore, their valuation conclusions. A more optimistic outlook would translate to higher valuations, and vice-versa.

Geopolitical events, including trade tensions and political instability in key regions, were also considered. These factors can introduce uncertainty and volatility, impacting investor sentiment and influencing stock valuations. BofA's report acknowledged these uncertainties and incorporated them into their overall risk assessment.

H2: Implications for Investors Based on BofA's Stock Market Valuation Analysis

BofA's analysis translates into actionable advice for investors. While not advocating for a wholesale market buy or sell, their findings suggest a more nuanced approach.

- Investment strategies: The report subtly suggests a strategy of selective investment, focusing on fundamentally strong companies within sectors exhibiting relative undervaluation. Sector rotation, focusing on specific sectors with attractive valuations, may be a prudent approach.

- Risk assessment: BofA’s analysis emphasizes the importance of a thorough risk assessment before making any investment decision. Investors should understand the inherent risks associated with any investment, particularly in the current uncertain market environment.

- Importance of diversification: Given the ongoing market volatility, BofA underscores the significance of diversification to mitigate risk. Spreading investments across different asset classes and sectors reduces the overall portfolio’s exposure to any single factor or event.

It's crucial to acknowledge that BofA’s analysis, like any valuation model, has limitations. Unforeseen economic shocks or geopolitical events could significantly alter the market outlook. This analysis shouldn't be taken as definitive investment advice, but rather as one important piece of information in a comprehensive investment strategy.

H2: Comparing BofA's Analysis with Other Market Perspectives

To gain a more comprehensive understanding, it's vital to compare BofA's analysis with the viewpoints of other prominent financial institutions. For example, Goldman Sachs and Morgan Stanley have also published reports on stock market valuations. While there are areas of overlap, differences exist in their emphasis on particular sectors and their outlook on future economic growth. These discrepancies often stem from differing methodologies and assumptions regarding macroeconomic factors and company-specific forecasts. Comparing these reports helps investors synthesize different perspectives and form a more balanced view.

- Other key financial institutions: Goldman Sachs, Morgan Stanley, and JP Morgan Chase frequently offer their own perspectives on market valuations.

- Areas of agreement/disagreement: While general consensus suggests the market is not wildly overvalued, differences emerge concerning the speed and direction of future growth and the relative valuations of certain sectors.

- Reasons for differences: These differing perspectives often stem from varying assumptions about future economic growth, inflation rates, and interest rate trajectories.

3. Conclusion: Making Informed Decisions about Stock Market Valuations

BofA's analysis provides a valuable perspective on current stock market valuations, suggesting a more nuanced picture than simply "overvalued" or "undervalued." Their emphasis on a multi-faceted approach to valuation, incorporating macroeconomic factors and geopolitical risks, offers investors a robust framework for decision-making. Understanding stock market valuations remains paramount for investment success.

Stay informed about stock market valuations by regularly reviewing financial analysis from reputable sources like BofA. Use BofA's insights, along with other research, to refine your stock market valuation strategy and make informed investment decisions. Remember to conduct your own thorough research and consider seeking professional financial advice before making any significant investment choices. [Insert Link to BofA's Report Here, if available].

Featured Posts

-

Cissokho And Kavaliauskas Clash In Crucial Wbc Title Eliminator

May 12, 2025

Cissokho And Kavaliauskas Clash In Crucial Wbc Title Eliminator

May 12, 2025 -

Cassidy Hutchinsons January 6th Testimony A Memoir In The Works

May 12, 2025

Cassidy Hutchinsons January 6th Testimony A Memoir In The Works

May 12, 2025 -

Eurovision 2025 Sissal Danmarks Hab

May 12, 2025

Eurovision 2025 Sissal Danmarks Hab

May 12, 2025 -

Thomas Muellers Afscheid Een Bitter Einde Voor Bayern Muenchen

May 12, 2025

Thomas Muellers Afscheid Een Bitter Einde Voor Bayern Muenchen

May 12, 2025 -

Experiences With Shane Lowry Stories And Insights

May 12, 2025

Experiences With Shane Lowry Stories And Insights

May 12, 2025

Latest Posts

-

Remembering A Life Lost Funeral For 15 Year Old

May 13, 2025

Remembering A Life Lost Funeral For 15 Year Old

May 13, 2025 -

Efl Highlights Relive The Action

May 13, 2025

Efl Highlights Relive The Action

May 13, 2025 -

School Stabbing Victims Funeral A Community Grieves

May 13, 2025

School Stabbing Victims Funeral A Community Grieves

May 13, 2025 -

Funeral Services For Teenager Killed In School Stabbing

May 13, 2025

Funeral Services For Teenager Killed In School Stabbing

May 13, 2025 -

Unmissable Efl Highlights Dont Miss A Moment

May 13, 2025

Unmissable Efl Highlights Dont Miss A Moment

May 13, 2025