Stock Market Valuations: BofA's Reasons For Investor Calm

Table of Contents

BofA's Perspective on Current Price-to-Earnings Ratios (P/E Ratios)

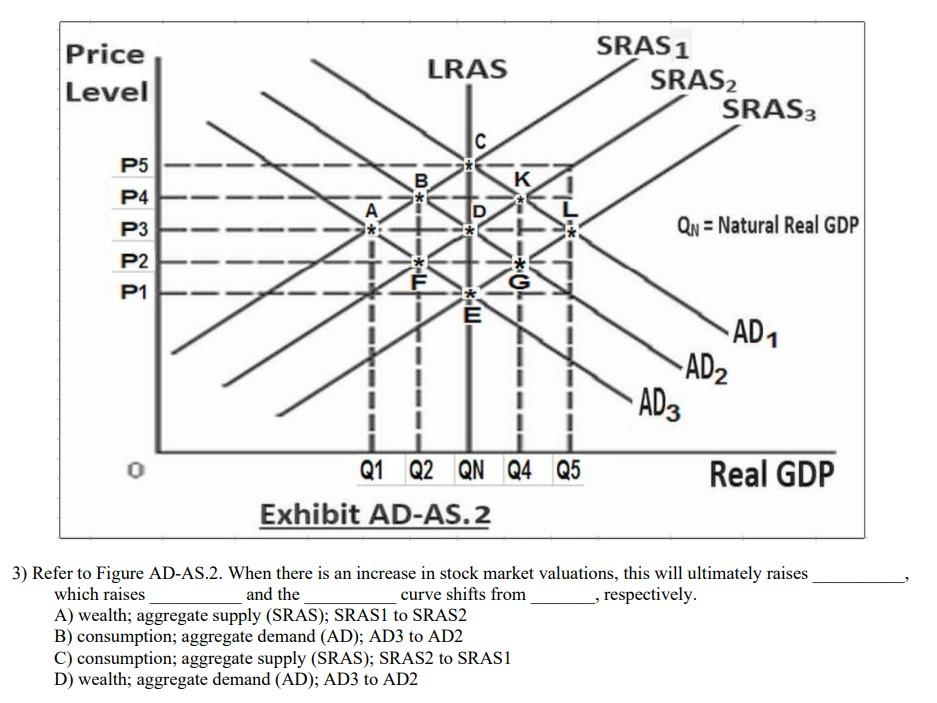

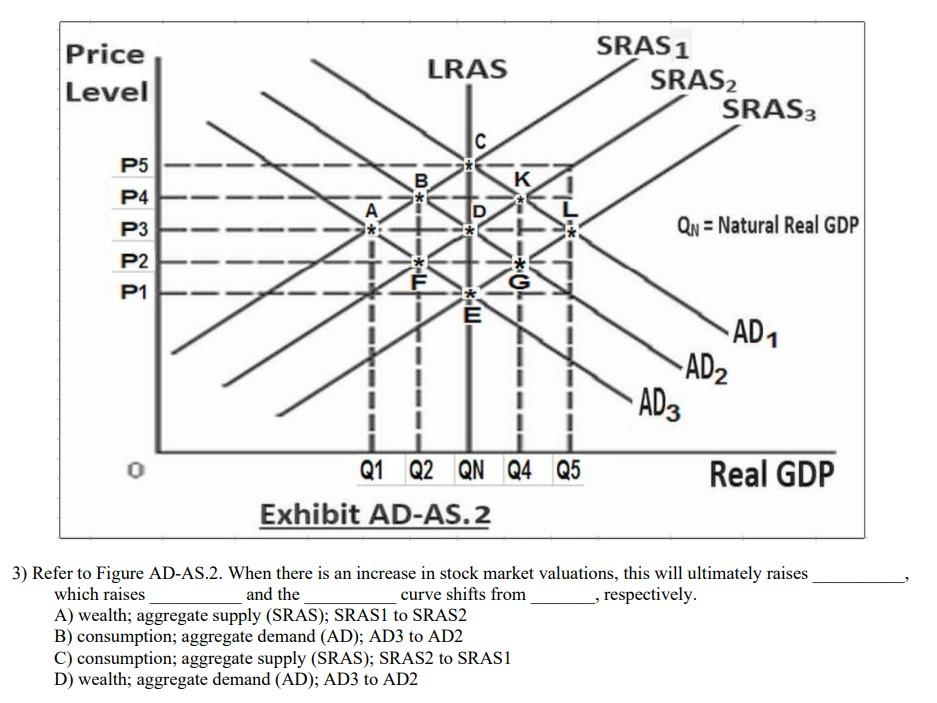

BofA's assessment of current stock market valuations hinges significantly on their analysis of Price-to-Earnings ratios (P/E ratios). A thorough understanding of these ratios is essential for evaluating whether the market is overvalued or undervalued.

Historical Context of P/E Ratios

Comparing current P/E ratios to historical averages provides valuable context. BofA likely considers both trailing P/E ratios (based on past earnings) and forward P/E ratios (based on projected future earnings).

- Comparison to Previous Market Cycles: BofA's analysis likely compares current P/E ratios to those observed during previous bull and bear markets. High P/E ratios during past bull markets might indicate potential overvaluation, while lower ratios during bear markets suggest undervaluation. However, it's important to remember that past performance is not necessarily indicative of future results.

- BofA's Specific Data and Analysis: While precise internal BofA data is not publicly available, their research likely incorporates a detailed analysis of sector-specific P/E ratios, considering variations across different industries and their sensitivity to economic cycles.

- Visual Representation: (Ideally, this section would include a chart or graph visually comparing current P/E ratios to historical averages. This could be a line graph showing the trajectory of P/E ratios over time, clearly marking key market events.)

Considering Forward Earnings Estimates

BofA doesn't solely rely on past performance. They also factor in future earnings projections to arrive at a more nuanced assessment of stock market valuations.

- Importance of Forward-Looking P/E Ratios: Forward P/E ratios, which use projected earnings for the next 12 months, are crucial because they account for expected growth. These ratios provide a more forward-looking valuation metric, anticipating future performance.

- BofA's Projections: BofA's analysts likely have specific forecasts for future earnings growth across different sectors. These projections would account for macroeconomic factors (discussed later) influencing company profitability.

- Risks and Uncertainties: It's critical to acknowledge the inherent uncertainty in earnings projections. Unexpected economic downturns, geopolitical instability, or unforeseen company-specific issues could significantly impact future earnings and, consequently, stock valuations.

The Role of Interest Rates in Stock Market Valuations

Interest rates play a significant role in shaping stock market valuations. BofA carefully considers their impact on investor behavior and corporate profitability.

Impact of Rising Interest Rates

Rising interest rates generally exert downward pressure on stock valuations.

- Inverse Relationship with Bond Yields: Higher interest rates make bonds more attractive, diverting investment away from stocks. This inverse relationship between bond yields and stock valuations is a key consideration in BofA's analysis.

- Accounting for Interest Rate Hikes: BofA's valuation models likely incorporate various interest rate scenarios, factoring in the potential impact on corporate borrowing costs, investor sentiment, and the overall economy.

- Interest Rate Forecasts: BofA's analysis relies heavily on their internal interest rate forecasts, predicting future central bank actions and their subsequent effects on market valuations.

Balancing Interest Rate Risk with Growth Potential

BofA's analysis carefully balances the risks associated with higher interest rates against the potential for future corporate growth.

- Interest Rate Sensitive Sectors: Sectors like real estate and utilities, which rely heavily on borrowing, are more sensitive to interest rate changes. BofA likely identifies and analyzes these sectors separately.

- Resilient Sectors: Other sectors, such as technology or companies with strong cash flows, might be less vulnerable to rising interest rates. BofA's analysis would highlight these more resilient sectors.

- Growth Offset: Strong corporate earnings growth can potentially offset the negative impact of higher interest rates. BofA's analysis likely evaluates the potential for such growth to mitigate interest rate risks.

Macroeconomic Factors and their Influence on Stock Market Valuations

Beyond P/E ratios and interest rates, macroeconomic factors significantly influence stock market valuations. BofA meticulously incorporates these elements into their assessment.

Inflation's Impact on Valuation Models

Inflation directly impacts corporate earnings and investor sentiment, affecting stock valuations.

- Impact on Corporate Earnings: Inflation increases input costs for businesses, potentially squeezing profit margins. BofA's analysis must account for this impact on corporate earnings.

- Inflation Projections: BofA’s inflation projections are integral to their valuation models. These projections shape their assessments of future earnings and investor behavior.

- Adjusting for Inflationary Pressures: BofA's valuation models likely employ techniques to adjust for inflationary pressures, ensuring a realistic appraisal of underlying asset values.

Geopolitical Risks and their Influence

Geopolitical events introduce uncertainty, potentially impacting stock valuations.

- Impact of Geopolitical Events: Wars, trade disputes, or political instability can significantly affect market sentiment and corporate performance. BofA carefully considers these risks.

- Incorporating Geopolitical Risks: BofA employs scenario planning and stress testing to incorporate geopolitical risks into their valuation models. This helps them assess the potential impact of various events on market valuations.

- Contingency Plans: Based on their assessment of geopolitical risks, BofA likely adjusts its investment strategies and makes contingency plans to mitigate potential negative impacts.

Conclusion

BofA's cautiously optimistic outlook on current stock market valuations stems from a comprehensive analysis that considers several key factors. Their assessment incorporates a detailed review of P/E ratios, both historical and forward-looking, carefully weighs the impact of rising interest rates, and thoroughly accounts for the influence of macroeconomic factors such as inflation and geopolitical risks. While their analysis provides valuable insight, it's crucial to remember that stock market valuations are complex and dynamic.

Call to Action: While BofA’s analysis offers a helpful perspective on current stock market valuations, conducting your own thorough research and consulting with a qualified financial advisor is essential before making any investment decisions. Stay informed about changes in stock market valuations and their underlying drivers to make informed choices.

Featured Posts

-

Amsterdam Bike Thefts Surge New Record High For Dutch Cities

May 13, 2025

Amsterdam Bike Thefts Surge New Record High For Dutch Cities

May 13, 2025 -

Big Issue Names Winner Of Childrens Competition

May 13, 2025

Big Issue Names Winner Of Childrens Competition

May 13, 2025 -

Eva Longoria In Alexander And The Terrible Horrible No Good Very Bad Day A Road Trip Comedy

May 13, 2025

Eva Longoria In Alexander And The Terrible Horrible No Good Very Bad Day A Road Trip Comedy

May 13, 2025 -

Sir Ian Mc Kellen The Coronation Street Cameo That Defined His Career Path

May 13, 2025

Sir Ian Mc Kellen The Coronation Street Cameo That Defined His Career Path

May 13, 2025 -

Nhl Draft Lottery Islanders Win Top Selection Sharks Second

May 13, 2025

Nhl Draft Lottery Islanders Win Top Selection Sharks Second

May 13, 2025

Latest Posts

-

Zdrajcy 2 Analiza Konfliktow Po Zadaniu 1 Materialy Dodatkowe

May 14, 2025

Zdrajcy 2 Analiza Konfliktow Po Zadaniu 1 Materialy Dodatkowe

May 14, 2025 -

Zdrajcy 2 Odcinek 1 Konflikty Graczy Po Pierwszym Zadaniu Materialy Extra

May 14, 2025

Zdrajcy 2 Odcinek 1 Konflikty Graczy Po Pierwszym Zadaniu Materialy Extra

May 14, 2025 -

Mlb Season Update Analyzing The Top Performers And Underachievers 2025

May 14, 2025

Mlb Season Update Analyzing The Top Performers And Underachievers 2025

May 14, 2025 -

Mlb Power Rankings Winners And Losers At The 30 Game Mark 2025

May 14, 2025

Mlb Power Rankings Winners And Losers At The 30 Game Mark 2025

May 14, 2025 -

Mlb 2025 Season Biggest Winners And Losers After 30 Games

May 14, 2025

Mlb 2025 Season Biggest Winners And Losers After 30 Games

May 14, 2025