Stock Market Valuations: BofA's Argument For Investor Calm

Table of Contents

BofA's Key Valuation Metrics and Their Interpretation

BofA's analysis relies on several key valuation metrics to assess the current state of the stock market. Understanding these metrics and their interpretations is crucial to grasping the bank's overall outlook. Key metrics include the Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (CAPE), and the dividend yield. Let's examine BofA's findings:

-

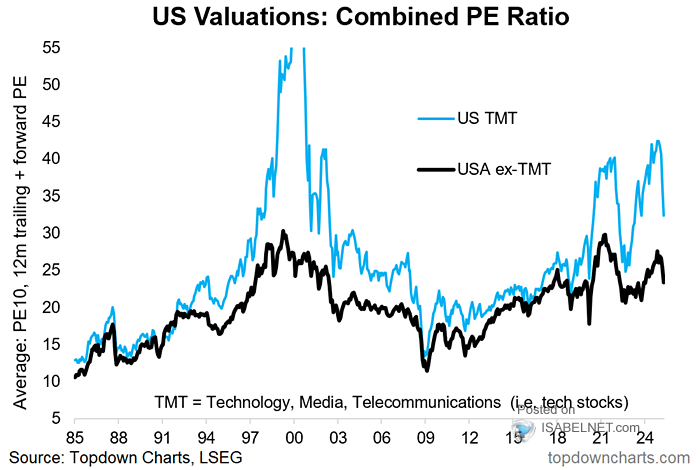

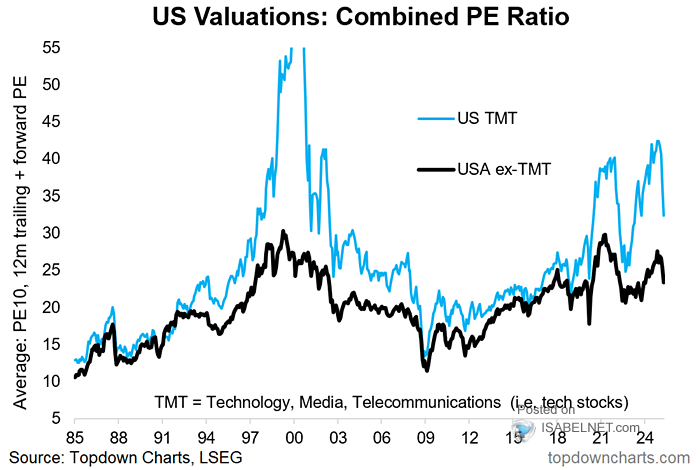

Price-to-Earnings Ratio (P/E): BofA's analysis shows current P/E ratios are slightly above historical averages, but not excessively so. This suggests that while stocks might be somewhat pricey, they are not at bubble levels seen in previous market crashes. The P/E ratio, a widely used metric, compares a company's stock price to its earnings per share. A higher P/E suggests investors are paying more for each dollar of earnings.

-

Cyclically Adjusted Price-to-Earnings Ratio (CAPE): The CAPE ratio, developed by Robert Shiller, smooths out short-term earnings fluctuations to provide a longer-term perspective. BofA's report indicates that CAPE ratios suggest some overvaluation, but less extreme than during previous market peaks. This offers a degree of reassurance, suggesting that while some overvaluation exists, it’s not at crisis levels.

-

Dividend Yield: BofA highlights the relatively attractive dividend yields compared to bond yields. This provides a counterbalance to potential capital losses. For income-focused investors, this aspect is a significant positive in a high-interest-rate environment. High dividend yields offer a cushion against market downturns. This is an important factor in BofA's overall assessment.

-

Market Capitalization: BofA's analysis likely includes consideration of overall market capitalization, providing context to the valuations of individual companies and sectors within the market.

Considering the Impact of Inflation and Interest Rates

BofA's valuation analysis doesn't ignore the significant headwinds of inflation and rising interest rates. The Federal Reserve's monetary policy plays a critical role in shaping stock market valuations.

-

Impact of Higher Interest Rates: BofA acknowledges the impact of higher interest rates on discount rates used in valuation models. Higher interest rates increase the cost of borrowing, impacting corporate investments and ultimately affecting future earnings.

-

Anticipated Interest Rate Hikes: BofA's assessment likely incorporates anticipated interest rate hikes into their valuation models. They may argue that current valuations already reflect these expected increases, to some degree.

-

Inflation's Long-Term Effects: The analysis likely includes a thorough assessment of inflation's long-term effects on corporate earnings and their impact on stock prices. Managing inflation expectations is a key aspect of BofA's outlook.

BofA's Outlook on Corporate Earnings and Future Growth

BofA's assessment of stock market valuations is intrinsically linked to their predictions for future corporate earnings and economic growth. Their stance on recession risk is particularly crucial.

-

Earnings Growth Projections: BofA's projections for earnings growth in the coming quarters and years are central to their valuation conclusions. These projections reflect their assessment of the overall economic environment.

-

Recession Risk Assessment: Their assessment of the likelihood of a recession and its potential impact on stock prices is a crucial element of their analysis. They likely present scenarios for different economic outcomes.

-

Influence of Earnings Forecasts: The bank's earnings forecasts directly influence their valuation conclusions. Stronger earnings forecasts support higher valuations, and vice-versa.

Strategic Investment Implications Based on BofA's Analysis

Based on BofA's findings, investors can derive actionable strategic implications for their portfolios.

-

Diversification and Quality: BofA likely recommends maintaining a well-diversified portfolio and focusing on quality companies with strong fundamentals and robust balance sheets.

-

Long-Term Perspective: They advise against panic selling and suggest a long-term investment horizon. A long-term perspective can mitigate the impact of short-term market volatility.

-

Selective Investing: BofA may suggest specific sectors or asset classes they consider strategically advantageous, given their outlook. This might involve sector rotation based on their assessment of growth potential.

Conclusion

BofA's report on stock market valuations offers a relatively optimistic outlook despite current volatility. The bank's analysis, incorporating key metrics like P/E ratios, CAPE ratios, and dividend yields, suggests that while some overvaluation exists, it's not at alarming levels. Their consideration of inflation, interest rates, and future earnings growth provides a nuanced perspective. The key takeaway is the importance of a long-term investment perspective and strategic asset allocation. Don't let market volatility shake your confidence. Carefully consider BofA's analysis of stock market valuations and develop a sound investment strategy that aligns with your long-term goals. Understanding stock market valuations is crucial for navigating the current market landscape.

Featured Posts

-

Utah State Gymnastics A Historic Mountain West Championship Win

May 29, 2025

Utah State Gymnastics A Historic Mountain West Championship Win

May 29, 2025 -

Six Year Old Kidnapped Sold South African Mothers Conviction

May 29, 2025

Six Year Old Kidnapped Sold South African Mothers Conviction

May 29, 2025 -

Real Madrids Pursuit Of Kylian Mbappe Will He Deliver

May 29, 2025

Real Madrids Pursuit Of Kylian Mbappe Will He Deliver

May 29, 2025 -

Mhtat Mhmt Fy Msyrt Ndal Alastqlal

May 29, 2025

Mhtat Mhmt Fy Msyrt Ndal Alastqlal

May 29, 2025 -

Jwnathan Tah Yqtrb Mn Alandmam Ila Bayrn Mywnykh

May 29, 2025

Jwnathan Tah Yqtrb Mn Alandmam Ila Bayrn Mywnykh

May 29, 2025