Stock Market Valuations: BofA Explains Why Investors Shouldn't Panic

Table of Contents

BofA's Analysis of Current Stock Market Valuations

BofA's assessment of current stock market valuations is multifaceted, going beyond simple headline figures. They employ a range of analytical tools to understand the true picture.

Understanding Price-to-Earnings (P/E) Ratios

One of the most crucial metrics in assessing stock market valuations is the Price-to-Earnings (P/E) ratio. This ratio compares a company's stock price to its earnings per share, providing a sense of how much investors are willing to pay for each dollar of earnings. A high P/E ratio generally suggests that investors are optimistic about future growth, while a low P/E ratio may indicate skepticism or undervaluation. BofA likely analyzes current P/E ratios against historical averages and industry benchmarks to determine whether current valuations are justified.

- Examples: BofA might point to technology stocks with high P/E ratios, reflecting investor confidence in future innovation and growth, while contrasting them with more mature sectors exhibiting lower P/E ratios. They might also distinguish between short-term and long-term P/E ratios, considering the impact of cyclical earnings fluctuations. Understanding these nuances is key to interpreting the overall picture of stock market valuations.

Assessing the Impact of Interest Rates

Rising interest rates significantly influence stock market valuations. Higher rates increase the cost of borrowing for companies, potentially impacting future earnings. Furthermore, they influence the discount rate used in discounted cash flow (DCF) models, a critical tool for valuing companies based on their projected future cash flows. BofA's analysis likely incorporates projections of future interest rate increases and their potential dampening effect on earnings growth.

- Impact on Borrowing Costs: Higher interest rates increase the cost of debt financing for companies, reducing profitability and potentially impacting future stock valuations.

- BofA's Data: BofA’s analysis would likely include specific data points on projected interest rate hikes and their anticipated impact on various sectors, allowing for a more granular understanding of how these changes affect stock market valuations.

The Role of Inflation in Stock Market Valuations

Inflation plays a crucial role in shaping stock market valuations. High inflation erodes purchasing power, potentially reducing consumer spending and impacting company earnings. Conversely, controlled inflation can support economic growth. BofA's assessment likely weighs the impact of inflation on both the numerator (earnings) and denominator (stock price) of valuation ratios, considering the interplay between inflation expectations and future earnings growth.

- Inflation's Dual Impact: Inflation affects both the earnings a company generates and the present value of future earnings, impacting valuation calculations. BofA's analysis would likely incorporate various inflation scenarios and their potential effects on stock prices.

- BofA's Inflation Predictions: Their analysis might include specific predictions about future inflation rates and their implications for different sectors, offering valuable insight into how these macroeconomic factors translate into valuation adjustments.

Why Investors Shouldn't Panic – BofA's Key Arguments

Despite the current volatility, BofA offers compelling reasons why investors shouldn't succumb to panic selling.

Long-Term Growth Potential

BofA's analysis likely points to long-term economic growth potential as a key counterpoint to short-term market fluctuations. This optimism might be underpinned by several factors.

- Key Economic Indicators: Positive indicators like sustained employment growth, technological advancements, and government infrastructure investments can bolster long-term growth predictions.

- Technological Advancements: Technological innovation continues to drive productivity and create new opportunities, contributing to long-term economic expansion.

- Demographic Trends: Certain demographic shifts, such as an aging population in developed countries, can influence growth patterns and investment opportunities. These trends would be crucial aspects of BofA’s analysis.

Opportunities Within the Current Market

Market corrections often create buying opportunities for astute investors. BofA's analysis likely highlights specific sectors or investment strategies that look promising despite the market's volatility.

- Undervalued Sectors: Certain sectors might be undervalued relative to their long-term potential, offering attractive entry points for investors. BofA's research might point to specific sectors showing promising recovery potential.

- Investment Strategies: BofA might suggest strategies like value investing, focusing on companies trading below their intrinsic value, or growth investing, targeting companies with high growth potential.

Historical Context and Market Cycles

Market corrections are a normal part of the economic cycle. BofA's analysis likely incorporates historical data to demonstrate that market downturns are temporary and often followed by significant rebounds.

- Past Market Corrections: By examining past market corrections, BofA can provide a context for the current situation, reassuring investors that market volatility is not necessarily a harbinger of long-term decline.

- Long-Term Investment Strategy: The key takeaway from this historical perspective is the importance of adopting a long-term investment strategy, weathering short-term fluctuations to reap the benefits of long-term market growth.

Conclusion

BofA's analysis suggests that while current stock market valuations warrant careful consideration, they don't necessarily signal an impending market crash. By examining P/E ratios, interest rate impacts, and inflation's influence, BofA highlights the long-term growth potential and identifies opportunities within the current market. The historical context further underscores the cyclical nature of market corrections and the importance of a long-term investment strategy. Therefore, instead of panic selling, investors should conduct thorough due diligence, consider BofA's analysis, and make informed decisions based on their individual risk tolerance and long-term investment goals. Learn more about managing your stock market valuations effectively and making sound investment choices.

Featured Posts

-

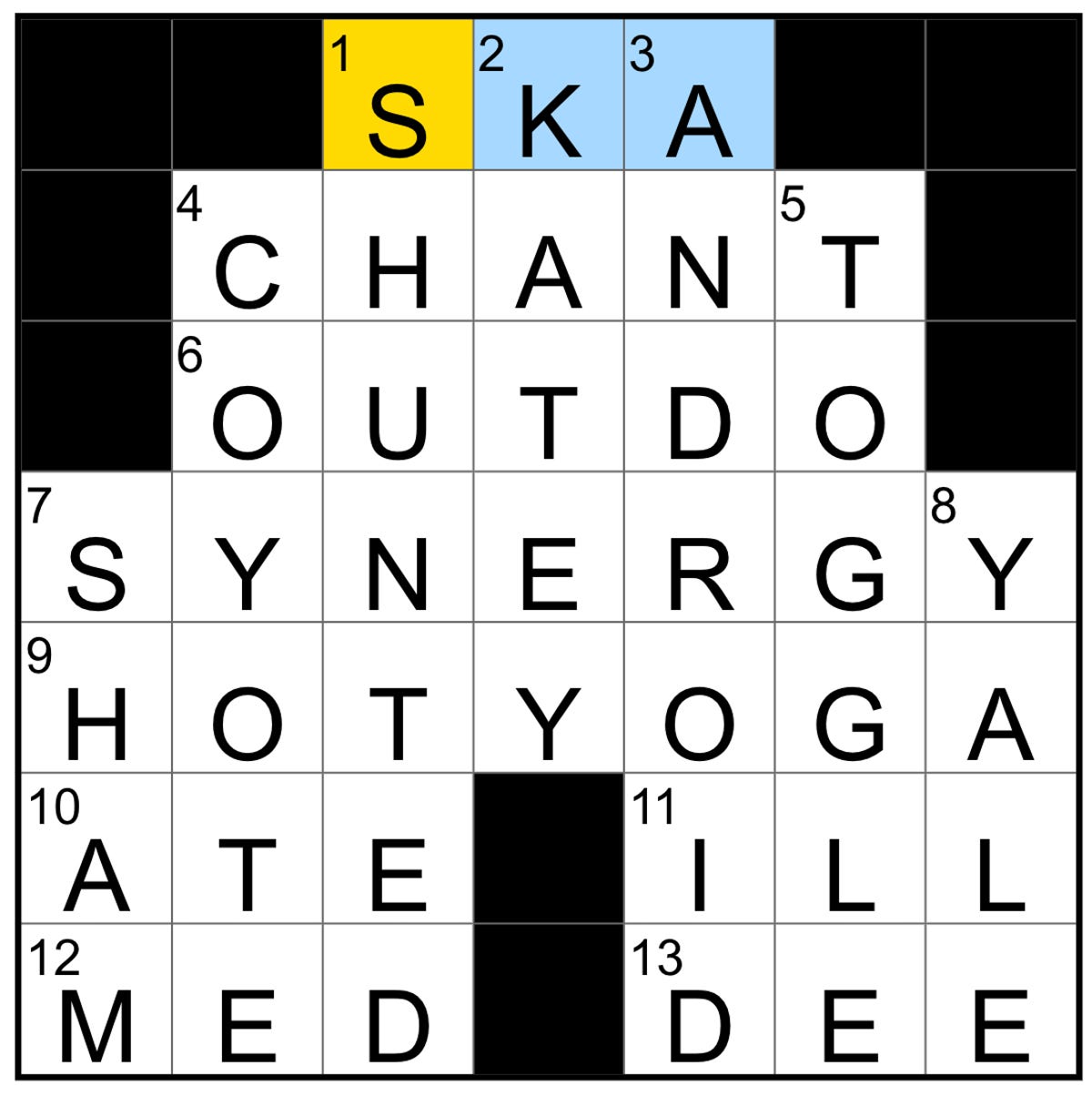

Nyt Mini Crossword Hints Clues And Answers For April 8 2025 Tuesday

May 19, 2025

Nyt Mini Crossword Hints Clues And Answers For April 8 2025 Tuesday

May 19, 2025 -

Eurovision Mascot Lumo Is He A Success Or A Failure

May 19, 2025

Eurovision Mascot Lumo Is He A Success Or A Failure

May 19, 2025 -

Court Decision Cancels Park Music Festivals Lawyers React

May 19, 2025

Court Decision Cancels Park Music Festivals Lawyers React

May 19, 2025 -

Section 230 And Banned Chemicals New Legal Precedent Set For Online Marketplaces

May 19, 2025

Section 230 And Banned Chemicals New Legal Precedent Set For Online Marketplaces

May 19, 2025 -

Melodifestivalen 2024 Dlaczego Mans Zelmerloew Nie Wroci Na Eurowizje

May 19, 2025

Melodifestivalen 2024 Dlaczego Mans Zelmerloew Nie Wroci Na Eurowizje

May 19, 2025