Stock Market Valuations And Investor Confidence: BofA's Analysis

Table of Contents

BofA's Valuation Metrics and Methodology

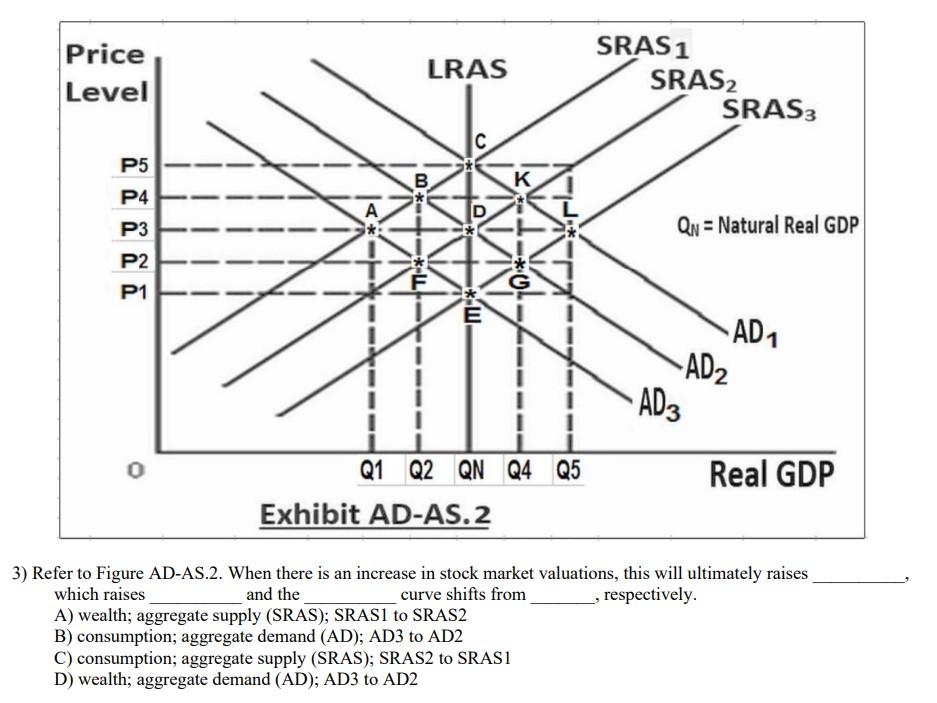

BofA employs a multifaceted approach to assessing market valuations, utilizing a range of established and proprietary metrics. Their analysis goes beyond simple price-to-earnings (P/E) ratios, incorporating more nuanced measures to provide a comprehensive picture of market health. They analyze various indices, including the S&P 500, specific sectors (e.g., technology, financials, healthcare), and even individual company valuations to identify potential overvaluation or undervaluation.

-

Detailed explanation of specific valuation ratios used: BofA frequently employs the cyclically adjusted price-to-earnings ratio (CAPE), which smooths out earnings fluctuations over a longer period (typically 10 years), providing a more stable valuation metric compared to the standard P/E ratio. They also utilize price-to-sales (P/S) ratios, particularly useful for valuing companies with inconsistent or negative earnings. Market capitalization, a key indicator of a company's overall size and value, is another critical metric considered in BofA's analysis.

-

Comparison of current valuations to historical averages: BofA's analysis invariably compares current valuation metrics to their historical averages. This helps determine whether current valuations are unusually high or low relative to past market performance, providing context for their assessment of potential risk and reward. Deviations from historical averages are analyzed carefully, considering economic cycles and other relevant factors.

-

Mention any proprietary models or data sources used by BofA: While BofA relies on publicly available data, they often augment this with proprietary models and data sources to refine their analysis. These proprietary elements often incorporate factors not readily available to the general public, enhancing the sophistication and accuracy of their valuations. These proprietary aspects often remain confidential, giving BofA a competitive edge in market analysis.

Keywords: Valuation metrics, P/E ratio, CAPE ratio, Price-to-sales ratio, market capitalization, BofA research methodology.

Investor Confidence: Gauging the Market Sentiment

BofA assesses investor confidence through a variety of channels, combining quantitative and qualitative data for a holistic view of market sentiment. This multifaceted approach provides a richer understanding of investor psychology and its potential impact on market movements.

-

Examples of investor sentiment indicators tracked by BofA: BofA closely monitors the VIX (volatility index), which serves as a gauge of market fear and uncertainty. Higher VIX readings generally indicate increased investor anxiety and potential market volatility. They also analyze fund flows – money moving into or out of various asset classes – as an indicator of investor confidence and risk appetite. Finally, BofA incorporates data from investor surveys and polls, capturing the opinions and expectations of market participants.

-

Analysis of recent shifts in investor sentiment: BofA's analysts regularly assess recent shifts in investor sentiment, looking for correlations with changes in valuation metrics. For example, a rise in the VIX alongside a decline in P/E ratios might suggest a market correction driven by decreasing investor confidence. Their analyses often incorporate news events, economic data releases and geopolitical factors affecting investor decisions.

-

Mention any significant events impacting investor confidence (e.g., economic data releases, geopolitical events): Major economic announcements, such as inflation reports or interest rate decisions, significantly influence investor confidence. Geopolitical events, like international conflicts or unexpected policy shifts, also play a crucial role in shaping market sentiment and impacting BofA's analysis.

Keywords: Investor sentiment, market sentiment, volatility index (VIX), fund flows, investor surveys, market psychology, risk appetite.

BofA's Outlook and Investment Implications

BofA's overall outlook on the stock market is derived from their integrated analysis of valuations and investor confidence. Their conclusions influence the investment strategies they suggest to their clients.

-

BofA's predicted market performance (bullish, bearish, or neutral): Depending on their analysis, BofA might project a bullish (positive), bearish (negative), or neutral market outlook. This prediction is directly influenced by the interplay between their valuation metrics and the prevailing investor sentiment.

-

Specific sectors or asset classes identified as attractive or risky: BofA's analysis often pinpoints specific sectors or asset classes they deem attractive or risky based on their valuation and confidence assessment. For example, they might suggest a shift towards defensive sectors during periods of uncertainty or recommend exposure to growth stocks during periods of strong economic growth and high investor confidence.

-

Recommendations for adjusting investment portfolios based on BofA's analysis: Based on their findings, BofA may recommend adjustments to investment portfolios, such as sector rotation (shifting investments from one sector to another) or altering the overall risk profile of a portfolio based on risk appetite and market conditions.

Keywords: Investment strategy, portfolio allocation, sector rotation, risk management, growth stocks, value stocks, BofA investment recommendations.

Conclusion

BofA's analysis highlights the crucial interplay between stock market valuations and investor confidence. By meticulously analyzing valuation metrics like P/E ratios, CAPE, and P/S ratios, alongside investor sentiment indicators such as the VIX and fund flows, BofA provides valuable insights into market dynamics. Their findings inform their outlook on market performance and their recommendations for investment strategies, helping investors make more informed decisions.

Understanding stock market valuations and investor confidence is crucial for informed investment decisions. Stay informed on BofA's ongoing analysis and other reputable sources to make well-informed choices in the dynamic world of stock market investing. For a deeper dive into BofA's research and analysis on stock market valuations and investor confidence, visit [link to BofA's relevant resources].

Keywords: Stock market valuations, investor confidence, investment decisions, market analysis, BofA research, investment strategy, portfolio management.

Featured Posts

-

Stagecoach 2025 How To Access The Official Livestream

Apr 25, 2025

Stagecoach 2025 How To Access The Official Livestream

Apr 25, 2025 -

Dallas Cowboys Draft Prospects Focusing On Texas Wr Matthew Golden

Apr 25, 2025

Dallas Cowboys Draft Prospects Focusing On Texas Wr Matthew Golden

Apr 25, 2025 -

Experience Our Great Yorkshire Life Exploring The Countys Hidden Gems

Apr 25, 2025

Experience Our Great Yorkshire Life Exploring The Countys Hidden Gems

Apr 25, 2025 -

Cellnex Ceo Network Overhaul Complete By Years End Focusing On Uk Expansion

Apr 25, 2025

Cellnex Ceo Network Overhaul Complete By Years End Focusing On Uk Expansion

Apr 25, 2025 -

Hudsons Bay Closing Details From Court Filings On Remaining Stores

Apr 25, 2025

Hudsons Bay Closing Details From Court Filings On Remaining Stores

Apr 25, 2025

Latest Posts

-

Dijon Concarneau 0 1 Resume Du Match De National 2 28e Journee

May 09, 2025

Dijon Concarneau 0 1 Resume Du Match De National 2 28e Journee

May 09, 2025 -

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 09, 2025

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 09, 2025 -

Uk Immigration Policy Update Planned Visa Restrictions

May 09, 2025

Uk Immigration Policy Update Planned Visa Restrictions

May 09, 2025 -

Changes To Uk Visa Application Process Nationality Based Restrictions

May 09, 2025

Changes To Uk Visa Application Process Nationality Based Restrictions

May 09, 2025 -

Accident Mortel A Dijon Chute D Un Ouvrier Du 4e Etage

May 09, 2025

Accident Mortel A Dijon Chute D Un Ouvrier Du 4e Etage

May 09, 2025