Stock Market Valuation Concerns: BofA Offers Reassurance

Table of Contents

BofA's Key Arguments for a Less-Pessimistic Outlook

BofA's relatively optimistic outlook on current stock market valuations rests on several key pillars. Their analysis considers a range of factors, leading them to conclude that, while risks exist, a catastrophic market downturn isn't necessarily imminent.

Moderate Price-to-Earnings Ratios

BofA's analysis of price-to-earnings (P/E) ratios is central to their argument. They have examined P/E ratios across various sectors and market segments, comparing them to historical averages and industry benchmarks. BofA analysts point to a median P/E ratio of 18 for the S&P 500, suggesting valuations are not excessively inflated compared to historical averages, particularly when considering the potential for future earnings growth. Certain sectors, such as technology and healthcare, show higher P/E ratios, reflecting higher growth expectations, while others, like utilities and consumer staples, exhibit lower P/E ratios reflecting more stable, albeit slower, growth profiles.

- Comparison to historical P/E ratios: BofA's research shows current P/E ratios are within the historical range of the past two decades, indicating that valuations are not unprecedentedly high.

- Sector-specific P/E ratio analysis: The analysis highlights variations in P/E ratios across sectors, reflecting differing growth prospects and risk profiles.

- Impact of interest rate changes on valuations: BofA acknowledges the impact of rising interest rates on valuations, but their analysis suggests that current valuations already incorporate a degree of this impact.

Strong Corporate Earnings Projections

BofA's projections for future corporate earnings growth form another cornerstone of their reassuring assessment. They predict continued, albeit moderated, earnings growth across various sectors in the coming years. This projected growth, they argue, justifies current stock valuations, as market prices reflect expectations of future profitability. Specific sectors highlighted for strong performance include technology companies benefiting from AI advancements and healthcare companies driven by an aging population and ongoing innovation.

- Projected earnings growth rates: BofA projects average annual earnings growth in the mid-single digits for the next few years, a rate deemed sustainable and supportive of current valuations.

- Key drivers of earnings growth: Key drivers cited include technological innovation, strong consumer spending (in certain sectors), and continued global economic expansion, albeit at a slower pace.

- Sectors with the most promising earnings potential: Technology, healthcare, and select segments of the consumer discretionary sector are highlighted as possessing strong earnings potential.

Consideration of Macroeconomic Factors

BofA's valuation assessment meticulously considers macroeconomic factors, acknowledging the inherent uncertainties in the global economy. Their analysis incorporates the potential impact of inflation, interest rates, and geopolitical events on stock prices. While acknowledging the challenges posed by these factors, their overall conclusion remains cautiously optimistic.

- Analysis of inflation's impact on earnings: BofA's economists have produced a detailed forecast for inflation, incorporating its potential impact on corporate profitability and consumer spending. Their models suggest that while inflation will impact profit margins, its effect will be manageable.

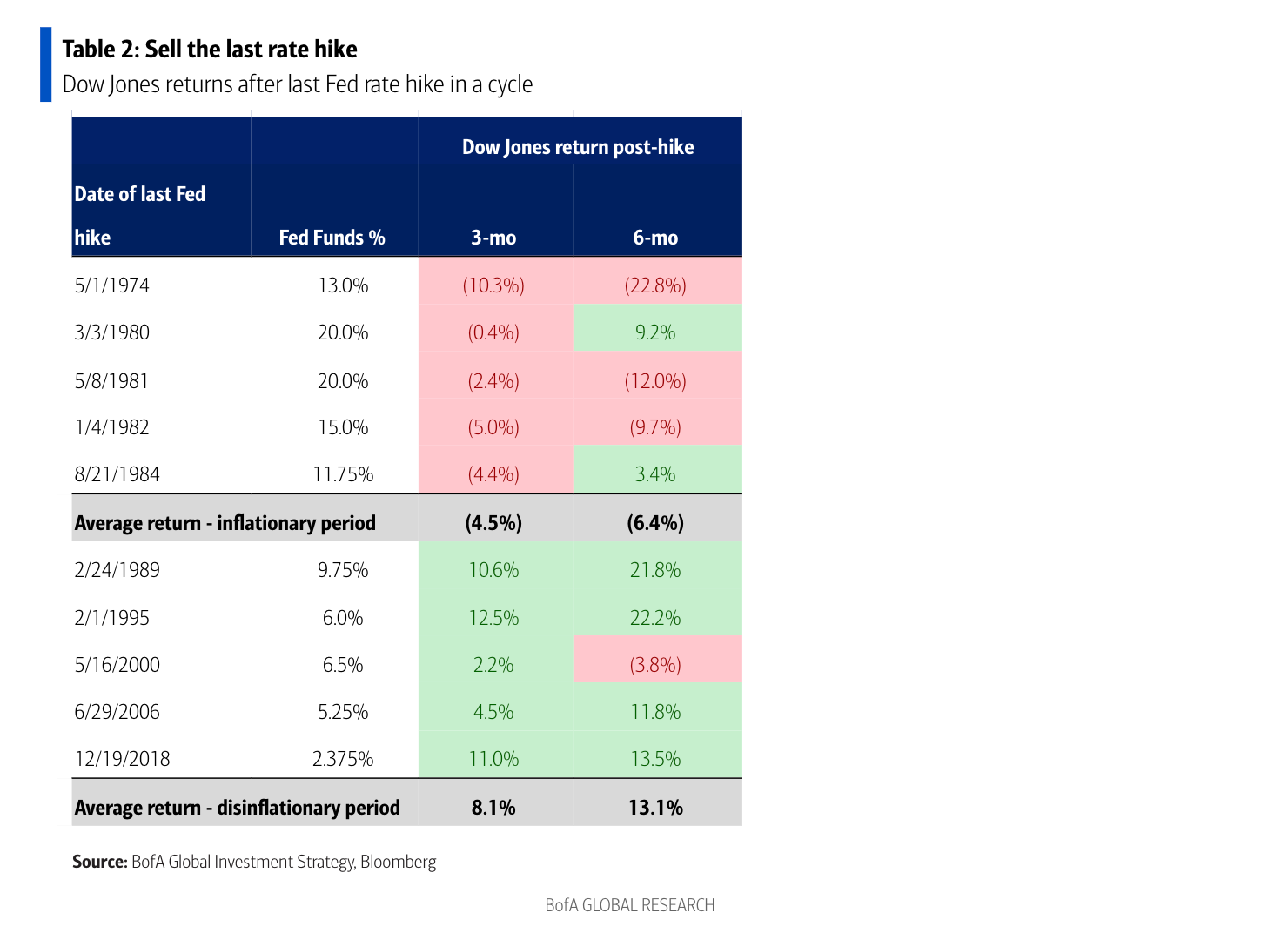

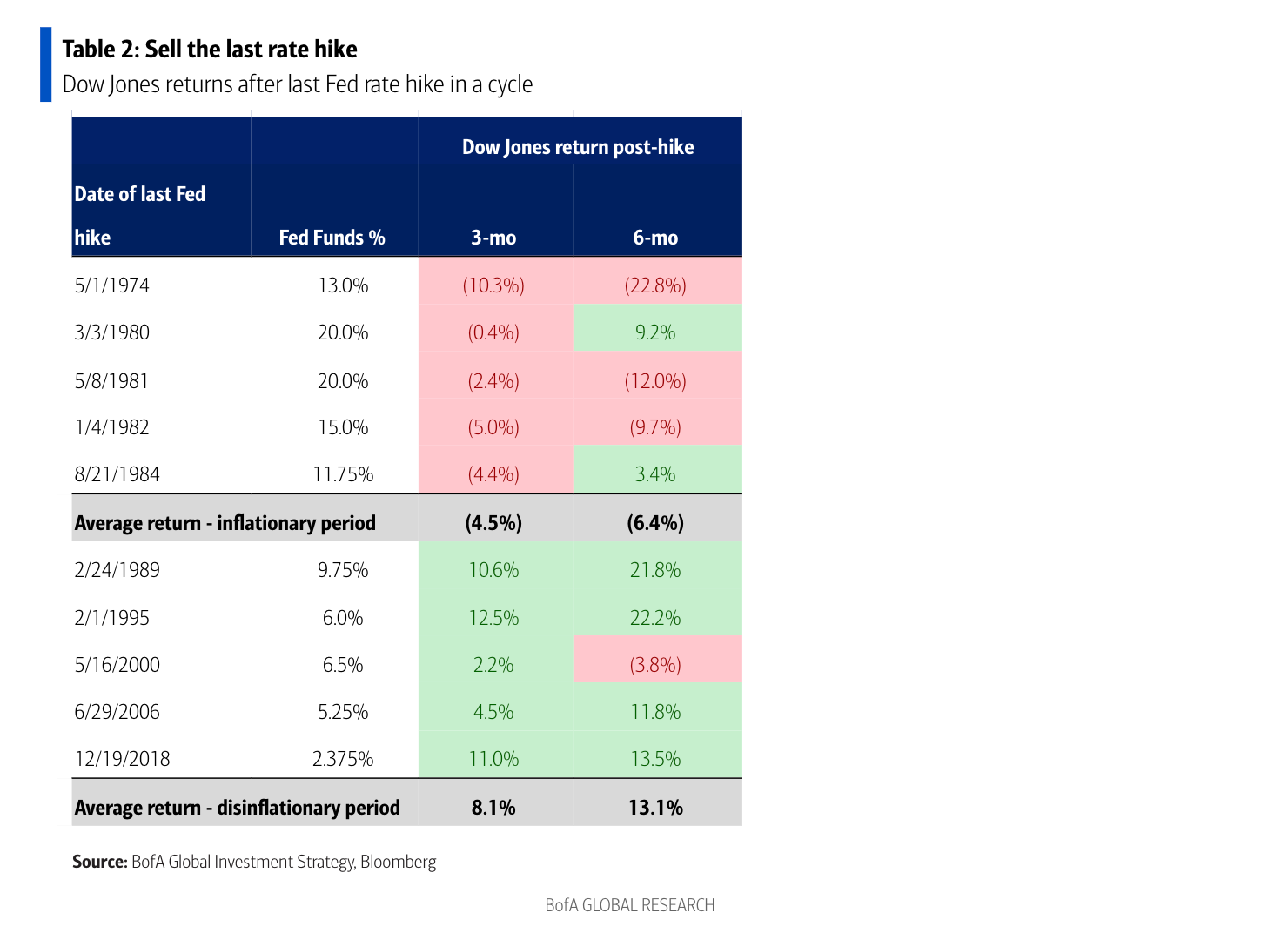

- Assessment of the Federal Reserve's monetary policy influence: BofA closely monitors the Federal Reserve's monetary policy and its potential impact on interest rates and economic growth. Their analysis incorporates various scenarios, including a "soft landing" for the economy.

- Evaluation of geopolitical risks and their market effects: BofA assesses geopolitical risks and their potential impact on the market, acknowledging uncertainties but also highlighting the resilience of the US economy and markets to previous geopolitical shocks.

Addressing Counterarguments and Concerns

While BofA presents a relatively positive outlook, it's crucial to address counterarguments and acknowledge legitimate concerns.

High Inflation and Interest Rate Hikes

High inflation and aggressive interest rate hikes remain significant concerns for many investors. These factors can negatively impact corporate earnings and reduce the present value of future cash flows, impacting stock valuations. BofA acknowledges these concerns, emphasizing that their valuation analysis explicitly incorporates these factors, using various scenarios to account for uncertainty in inflation and interest rate trajectories.

- BofA's inflation forecast and its implications: BofA forecasts inflation to gradually decrease over the coming years, although it acknowledges the possibility of further surprises.

- How interest rate hikes are factored into their valuation models: Their models account for the impact of higher interest rates on discount rates used to value future earnings.

- Potential scenarios and their respective market impacts: BofA lays out several scenarios, ranging from a soft landing to a more severe recession, and analyzes their implications for stock market valuations.

Geopolitical Uncertainty

Geopolitical instability, including the ongoing war in Ukraine and other international tensions, creates uncertainty in the market and can negatively impact investor sentiment. This instability can lead to market volatility and affect valuations. BofA's analysis acknowledges these uncertainties and incorporates various geopolitical scenarios in their models. They emphasize that while geopolitical risks exist, the resilience of the US economy and markets to external shocks remains significant.

- Specific geopolitical events affecting stock market valuations: The war in Ukraine and tensions in other regions are specifically mentioned as factors influencing market sentiment.

- BofA's assessment of the likelihood and impact of these events: BofA assesses the likelihood and potential impact of various geopolitical events, factoring these assessments into their valuation models.

- Strategies for mitigating geopolitical risks: BofA suggests diversification and a long-term investment approach as strategies for mitigating geopolitical risk.

Conclusion

Bank of America's analysis offers a degree of reassurance regarding current stock market valuations. While acknowledging legitimate concerns about inflation, interest rates, and geopolitical uncertainty, their assessment suggests that valuations are not excessively inflated when considering projected corporate earnings and macroeconomic factors. However, it's crucial for investors to conduct their own thorough research and consider their risk tolerance before making any investment decisions. Understanding the nuances of stock market valuation is vital for navigating the complexities of the market. Stay informed, conduct your due diligence, and make well-informed decisions regarding your investment portfolio. Careful consideration of stock market valuation metrics is key to successful investing.

Featured Posts

-

Is Gavin Newsoms Political Strategy Backfiring

Apr 26, 2025

Is Gavin Newsoms Political Strategy Backfiring

Apr 26, 2025 -

Charlotte Perriand Honored By Saint Laurent At Milan Design Week 2025

Apr 26, 2025

Charlotte Perriand Honored By Saint Laurent At Milan Design Week 2025

Apr 26, 2025 -

The Worlds Richest Man An American Battleground

Apr 26, 2025

The Worlds Richest Man An American Battleground

Apr 26, 2025 -

Jorgensons Paris Nice Victory A Dominant Performance

Apr 26, 2025

Jorgensons Paris Nice Victory A Dominant Performance

Apr 26, 2025 -

Contentious Town Halls Frustrated Voters Challenge Both Parties

Apr 26, 2025

Contentious Town Halls Frustrated Voters Challenge Both Parties

Apr 26, 2025

Latest Posts

-

Exploring The Mississippi Delta Through The Lens Of Sinners Cinematographer

Apr 26, 2025

Exploring The Mississippi Delta Through The Lens Of Sinners Cinematographer

Apr 26, 2025 -

The Visual Scope Of Sinners Cinematography And The Mississippi Deltas Landscape

Apr 26, 2025

The Visual Scope Of Sinners Cinematography And The Mississippi Deltas Landscape

Apr 26, 2025 -

The Unlikely Path Of Ahmed Hassanein Could He Be The First Egyptian In The Nfl

Apr 26, 2025

The Unlikely Path Of Ahmed Hassanein Could He Be The First Egyptian In The Nfl

Apr 26, 2025 -

Ahmed Hassanein An Egyptians Path To The Nfl Draft

Apr 26, 2025

Ahmed Hassanein An Egyptians Path To The Nfl Draft

Apr 26, 2025 -

Is Ahmed Hassanein Egypts Next Nfl Star A Look At His Draft Prospects

Apr 26, 2025

Is Ahmed Hassanein Egypts Next Nfl Star A Look At His Draft Prospects

Apr 26, 2025