Stock Market Valuation Concerns? BofA Offers A Measured Response

Table of Contents

BofA's Assessment of Current Market Valuations

BofA's analysis of current stock market valuations takes a nuanced approach, acknowledging both potential overvaluations and undervaluations across various sectors. Their assessment considers a multitude of factors to paint a comprehensive picture.

Identifying Overvalued and Undervalued Sectors

BofA's research identifies several key sectors warranting closer examination. Their analysis isn't simply about identifying "winners" and "losers," but rather understanding the underlying drivers of valuation discrepancies.

- Potentially Overvalued Sectors: BofA's analysts point to the technology sector as potentially showing signs of overvaluation, particularly within specific sub-sectors like certain growth technology companies. High valuations may not always reflect future earnings potential, leading to potential risk. The high market capitalization of some technology giants is a key consideration here.

- Potentially Undervalued Sectors: Conversely, BofA suggests that the energy sector, driven by factors such as increased demand and geopolitical instability, could be undervalued. This contrasts with previous years where the energy sector experienced periods of lower valuations. Specific companies within the energy sector showing strong potential for growth are highlighted in their reports.

This analysis often incorporates detailed financial modeling, examining metrics like Price-to-Earnings ratios (P/E), Price-to-Sales ratios (P/S), and other key valuation indicators.

Macroeconomic Factors Influencing Valuations

BofA's assessment doesn't exist in a vacuum. Macroeconomic factors play a significant role in shaping stock market valuations.

- Interest Rates: Rising interest rates, a tool used by central banks to combat inflation, directly impact borrowing costs for businesses and can influence investor sentiment, potentially leading to lower valuations for growth stocks. BofA's forecasts on interest rate trajectories are critical for their overall valuation assessments.

- Inflation: Persistent inflation erodes purchasing power and can affect corporate profitability, influencing market valuations. BofA's projections for inflation are integral to their analysis of undervalued and overvalued sectors.

- Geopolitical Risks: Global geopolitical events introduce uncertainty into the market, impacting investor confidence and valuations. BofA continuously assesses these risks and their potential impact on specific sectors.

By meticulously evaluating these macroeconomic factors and their interplay, BofA builds a robust framework for assessing current market valuations.

BofA's Strategic Recommendations for Investors

Based on their assessment, BofA provides several strategic recommendations for investors to navigate the current market environment.

Portfolio Diversification Strategies

BofA strongly emphasizes the importance of portfolio diversification to mitigate risk associated with potential market corrections or sector-specific downturns.

- Sector Diversification: Don't put all your eggs in one basket. Spread investments across various sectors to reduce reliance on any single industry's performance.

- Asset Class Diversification: Diversify beyond stocks. Consider including bonds, real estate, and other asset classes in your portfolio to balance risk and return.

- Geographic Diversification: Investing in companies and markets across different geographies can further reduce risk, mitigating the impact of localized economic or political events. This involves a more nuanced understanding of global market dynamics.

Tactical Asset Allocation Advice

BofA's tactical advice often includes adjustments based on their valuation analysis. This might involve:

- Shifting towards Value Stocks: During periods of perceived overvaluation in growth stocks, BofA may advise shifting towards value stocks—companies trading below their intrinsic value—to potentially capitalize on undervaluation.

- Strategic Bond Allocation: Increasing allocation to bonds can offer stability and potentially higher yields during periods of economic uncertainty or rising interest rates.

These recommendations are continuously adjusted based on BofA's ongoing market analysis and economic forecasts.

Addressing Investor Concerns About Market Corrections

The potential for a market correction is a significant concern for many investors.

BofA's Perspective on Potential Market Corrections

BofA acknowledges the possibility of a market correction but avoids making definitive predictions. Instead, they focus on strategies for navigating a potential downturn. Their analysis focuses on identifying potential vulnerabilities within specific sectors and the overall market. They emphasize the importance of a measured approach, avoiding panic selling.

Long-Term Investment Strategies

BofA consistently stresses the significance of adopting long-term investment strategies to weather short-term market fluctuations.

- Buy-and-Hold Strategy: The buy-and-hold strategy involves maintaining long-term investments despite short-term market volatility, benefiting from long-term growth potential.

- Long-Term Investment Horizon: Having a well-defined long-term investment horizon allows investors to ride out market cycles and focus on long-term growth rather than reacting to short-term noise.

Conclusion: Making Informed Decisions About Stock Market Valuation

BofA's measured response to current stock market valuation concerns provides investors with a valuable framework for making informed decisions. Their analysis highlights the importance of understanding both sector-specific valuations and macroeconomic factors influencing market dynamics. By incorporating their insights on portfolio diversification, tactical asset allocation, and long-term investment strategies, investors can better navigate the complexities of the market. Understanding stock market valuation is crucial. Use BofA's insights to inform your investment strategy, and consult a financial advisor for personalized guidance tailored to your risk tolerance and financial goals. Remember that this information is for educational purposes and should not be considered financial advice.

Featured Posts

-

Extradition Blocked Leijdekkers Connection To Sierra Leone Presidents Daughter

May 30, 2025

Extradition Blocked Leijdekkers Connection To Sierra Leone Presidents Daughter

May 30, 2025 -

Bts Comeback Speculation Soars After New Teaser Release

May 30, 2025

Bts Comeback Speculation Soars After New Teaser Release

May 30, 2025 -

Advanced Care Paramedics Enhance Rural And Northern Manitoba Healthcare

May 30, 2025

Advanced Care Paramedics Enhance Rural And Northern Manitoba Healthcare

May 30, 2025 -

The Ongoing Ukraine Conflict Trumps Consistent Two Week Timeline

May 30, 2025

The Ongoing Ukraine Conflict Trumps Consistent Two Week Timeline

May 30, 2025 -

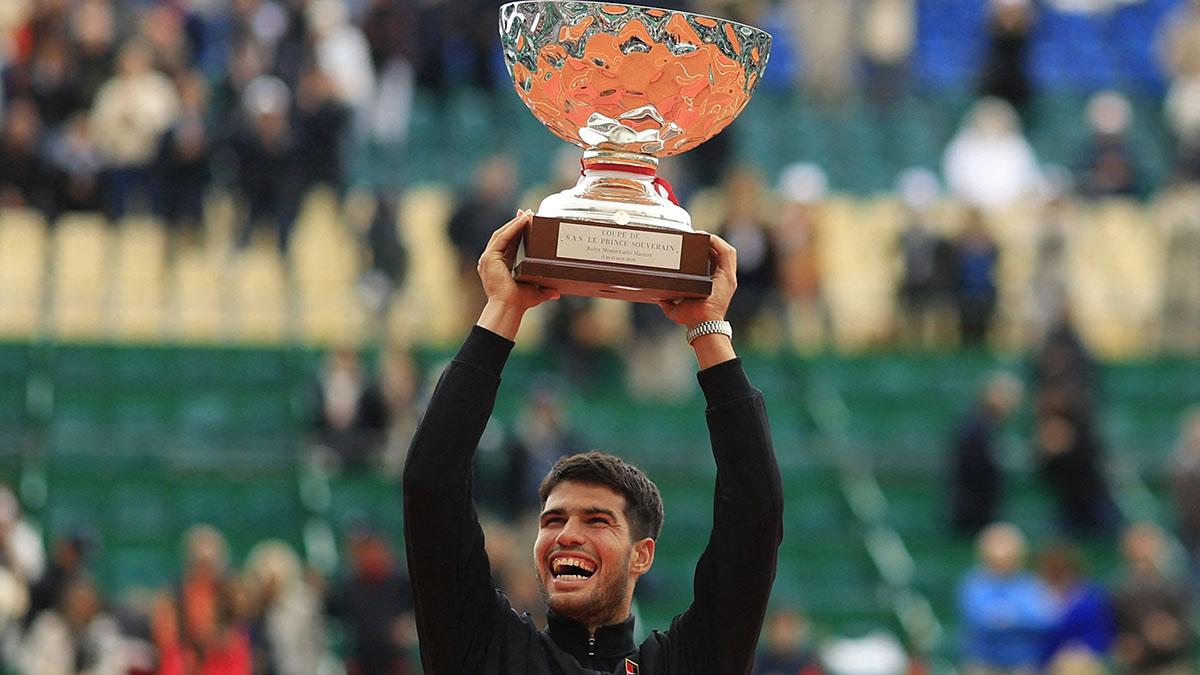

Monte Carlo Masters Alcarazs Stunning Comeback

May 30, 2025

Monte Carlo Masters Alcarazs Stunning Comeback

May 30, 2025