Stock Market Valuation Concerns? BofA Offers A Different Perspective

Table of Contents

BofA's Counterarguments to High Valuation Concerns

BofA's contrarian viewpoint on stock market valuation stems from several key factors, challenging the widespread pessimism.

The Role of Low Interest Rates

Historically low interest rates play a significant role in BofA's analysis. These low rates directly influence the discounted cash flow (DCF) models commonly used to determine intrinsic value.

- Mechanics of Low Interest Rates: Lower discount rates, resulting from low interest rates, inflate the present value of future cash flows. This means that the same future earnings stream appears more valuable today than it would under higher interest rate environments.

- BofA's Data: While specific data points may vary depending on the release date of BofA's research, the general principle holds true. Their analyses likely demonstrate a clear correlation between the decline in interest rates and the rise in valuation multiples across various asset classes. For example, compare the P/E ratios of the S&P 500 during periods of high interest rates (e.g., the early 1980s) versus the current low-rate environment. The difference is often stark.

Future Earnings Growth Projections

BofA maintains a positive outlook on future corporate earnings growth, a crucial element in their valuation arguments.

- Bullish Sectors: BofA likely highlights sectors poised for robust growth, such as technology (particularly AI and cloud computing), healthcare (driven by innovation and an aging population), and renewable energy (fueled by the global push for sustainability).

- Growth Forecasts: Specific growth forecasts vary depending on the time of analysis, but BofA's projections often demonstrate a belief that earnings will outpace current valuations, justifying the seemingly high multiples. This is underpinned by references to strong consumer spending, increased business investment, and supportive government policies in specific sectors.

Technological Innovation and Disruption

BofA incorporates the transformative impact of technological advancements into its valuation analysis. This is a critical differentiator.

- Innovative Sectors and Companies: Companies driving innovation justify higher valuations, in BofA's view. Examples might include leading AI developers, companies revolutionizing healthcare through technology, or firms spearheading the renewable energy transition.

- Productivity and Profitability: Technological innovation is viewed as a significant driver of increased productivity and profitability in the long term, supporting higher valuations relative to current earnings.

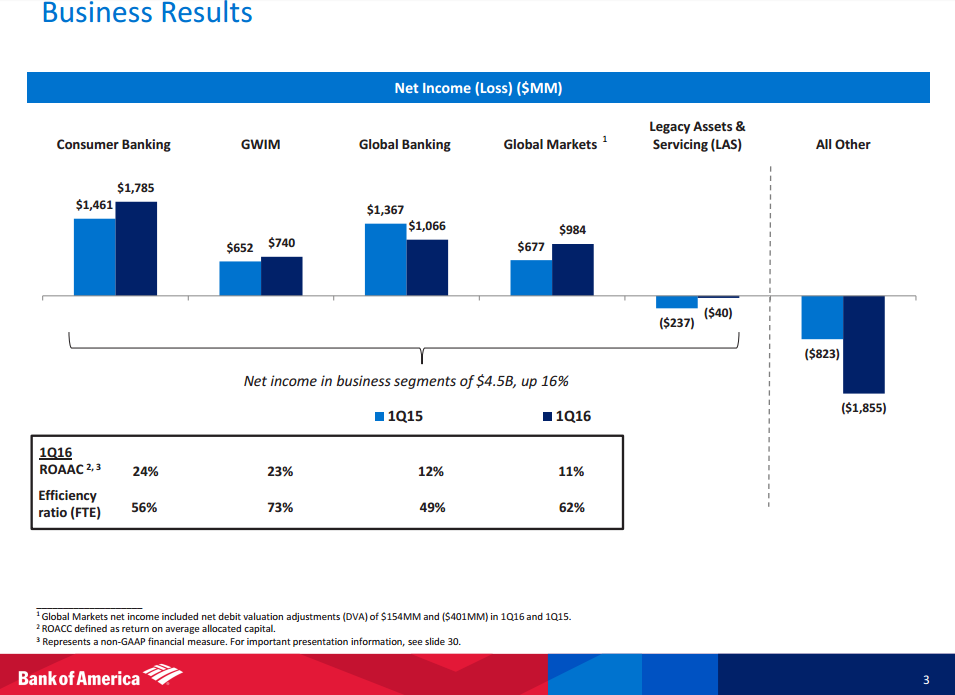

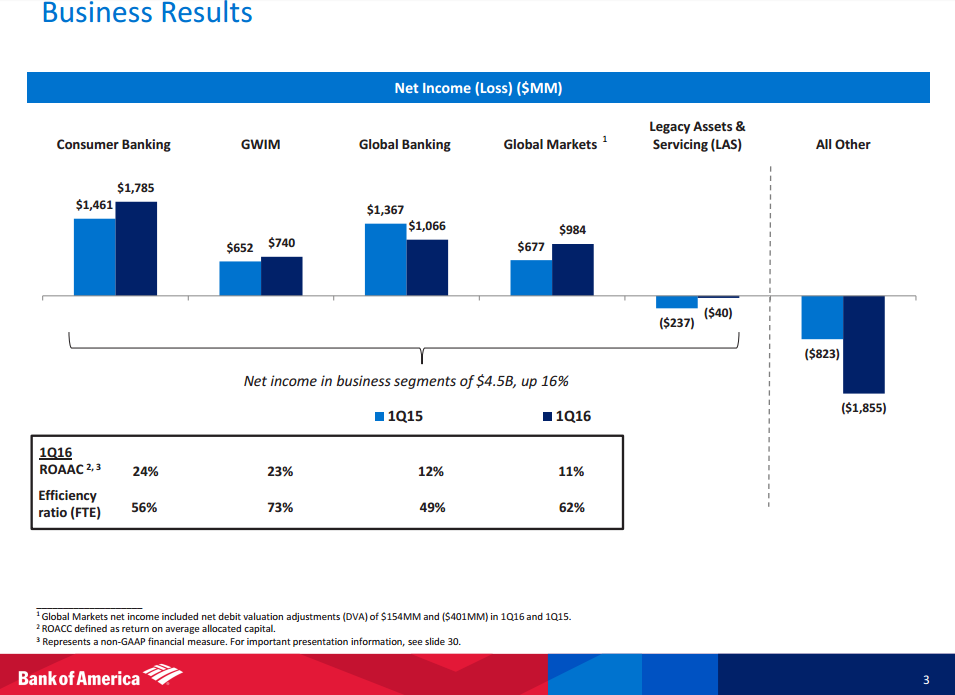

Addressing Specific Valuation Metrics

BofA's analysis challenges commonly cited concerns regarding specific valuation metrics.

Price-to-Earnings Ratio (P/E)

The often-cited high P/E ratios are a key focus of BofA's counterarguments.

- Counterarguments: BofA likely points to historical P/E ratios, demonstrating that current levels, while elevated, are not unprecedented, particularly within the context of low interest rates. They also emphasize the importance of focusing on forward-looking P/E ratios, reflecting future earnings expectations rather than trailing earnings. Strong future earnings growth can easily justify higher current P/E ratios.

- Sector-Specific Analysis: The analysis likely considers P/E ratios on a sector-by-sector basis, acknowledging that seemingly high ratios in certain sectors might be justified by exceptionally strong growth prospects.

Other Key Valuation Ratios

BofA's analysis extends beyond P/E ratios, examining other key valuation metrics.

- Price-to-Sales (P/S): This metric is less susceptible to earnings manipulation and can provide a valuable supplementary perspective on valuation. BofA might argue that low P/S ratios in certain growth sectors suggest undervaluation.

- Price-to-Book (P/B): This metric compares a company's market value to its book value. BofA's analysis might highlight instances where a seemingly high P/B ratio is justified by significant intangible assets (e.g., strong brands, intellectual property) that aren't fully captured in the book value.

BofA's Investment Strategy Recommendations

Based on their valuation analysis, BofA offers specific investment strategy recommendations.

Sector-Specific Opportunities

BofA identifies sectors with promising growth potential based on their valuation analysis.

- High-Growth Sectors: The sectors recommended are likely those discussed earlier – technology, healthcare, and renewable energy – but specific companies within those sectors should be identified in their research.

- Undervalued Opportunities: BofA's research might pinpoint specific companies or sub-sectors within broader industries deemed undervalued relative to their growth potential, based on their sophisticated valuation models.

Risk Management Considerations

While offering a positive outlook, BofA emphasizes the importance of risk management.

- Diversification: The need for diversified portfolios is a core recommendation to mitigate any potential downside risk.

- Asset Allocation: Appropriate asset allocation strategies, considering risk tolerance and investment goals, are vital.

- Limitations of Valuation Models: BofA will likely emphasize the inherent limitations of all valuation models and the importance of considering qualitative factors alongside quantitative analysis.

Conclusion: Navigating Stock Market Valuation Concerns with BofA's Insights

BofA's analysis presents a compelling counterpoint to the prevalent anxieties surrounding stock market valuations. By highlighting the significant impact of low interest rates and emphasizing positive future earnings growth projections, particularly within innovative sectors, BofA offers a more nuanced perspective. They successfully integrate technological advancements into their valuations, acknowledging their transformative potential. Remember to consider their insights when assessing your investment strategy. Learn more about BofA's insights on stock market valuation and understand the nuances of stock market valuation with BofA's expert analysis. (Insert link to relevant BofA resources here)

Featured Posts

-

Kitzbuehel Tgi Ag Begeht Meilenstein Mit Mitarbeiterfest

Apr 29, 2025

Kitzbuehel Tgi Ag Begeht Meilenstein Mit Mitarbeiterfest

Apr 29, 2025 -

Analysis Of Zombie Buildings And Their Effect On Chicagos Office Market

Apr 29, 2025

Analysis Of Zombie Buildings And Their Effect On Chicagos Office Market

Apr 29, 2025 -

Pwcs African Retreat Exit From Nine Countries

Apr 29, 2025

Pwcs African Retreat Exit From Nine Countries

Apr 29, 2025 -

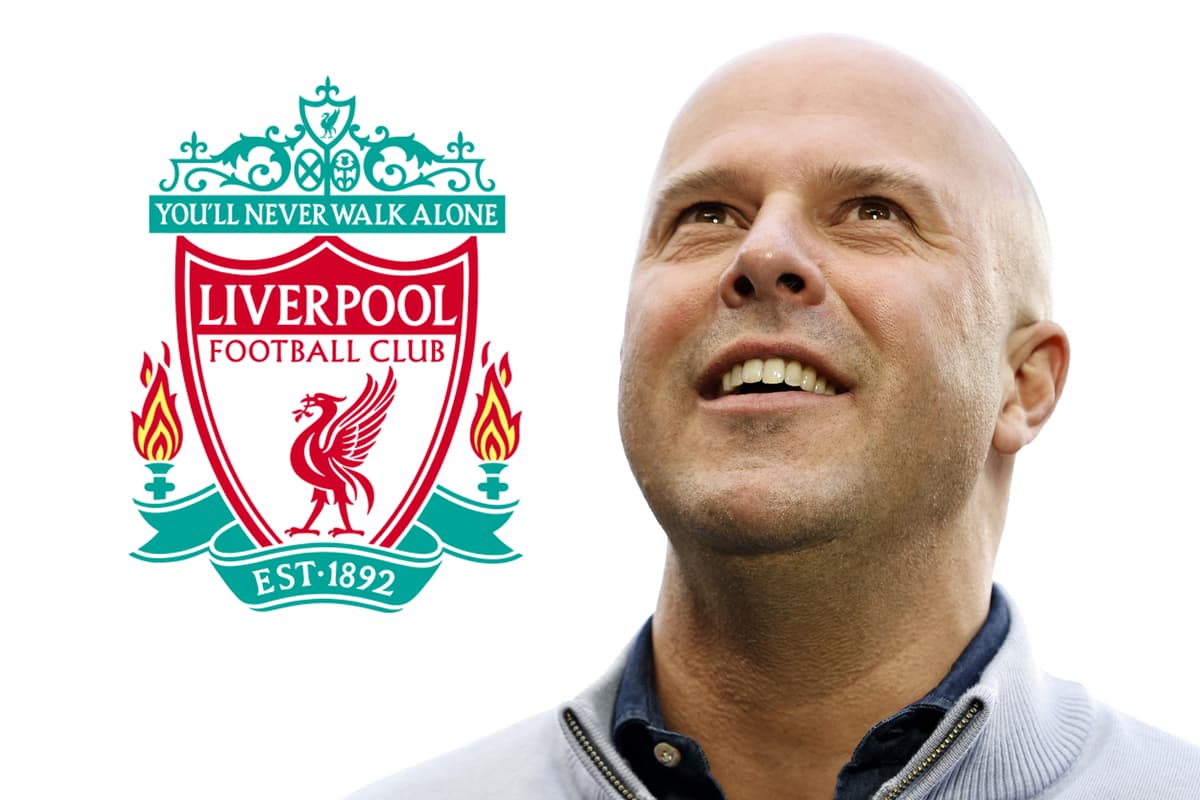

Arne Slot The Manager Who Nearly Won Liverpool The League

Apr 29, 2025

Arne Slot The Manager Who Nearly Won Liverpool The League

Apr 29, 2025 -

You Tube A New Home For Older Viewers Favorite Programs

Apr 29, 2025

You Tube A New Home For Older Viewers Favorite Programs

Apr 29, 2025