Stock Market Today: Dow Futures Up, Strong Week Ahead?

Table of Contents

Dow Futures and Their Significance

Dow futures are contracts that obligate the buyer to purchase the Dow Jones Industrial Average (DJIA) at a specific price on a future date. They're crucial indicators because they offer a glimpse into investor sentiment before the regular trading session begins. Essentially, they act as a barometer of market expectations.

- Reflecting Pre-Market Sentiment: Dow futures contracts are actively traded throughout the night and early morning, providing a preview of how investors anticipate the market will perform once it opens. A rise in Dow futures often suggests optimism and potential upward movement.

- Relationship with the DJIA: While not a perfect predictor, there's generally a strong correlation between Dow futures performance and the actual DJIA's performance during the trading day. Significant discrepancies can, however, occur due to unexpected news or events.

- Limitations as a Sole Predictor: It's crucial to remember that Dow futures are just one piece of the puzzle. Relying solely on them to predict market movement is risky. Other economic indicators and geopolitical events play significant roles.

Analyzing Key Economic Indicators

Several key economic indicators influence the stock market's direction. Analyzing these indicators provides a more comprehensive understanding of the stock market outlook.

- Recent Economic Data Releases: Recent inflation reports, employment figures (like the non-farm payroll numbers), and consumer confidence indices are all critical factors. High inflation, for instance, can negatively impact investor confidence.

- Impact on Investor Confidence: Strong economic data generally boosts investor confidence, leading to increased buying activity and potential market growth. Conversely, weak data can trigger selling and market declines.

- Reputable Data Sources: It's essential to consult reliable sources for economic data, such as the Federal Reserve, the Bureau of Labor Statistics, and reputable financial news outlets. [Link to Federal Reserve Data] [Link to Bureau of Labor Statistics Data]

Inflation Concerns and Their Market Impact

Inflation is a major factor shaping the current stock market prediction. Persistently high inflation forces central banks, like the Federal Reserve, to take action.

- Federal Reserve Monetary Policy: To combat inflation, the Federal Reserve might raise interest rates. Higher interest rates make borrowing more expensive for businesses, potentially slowing economic growth and impacting corporate earnings.

- Impact on Corporate Earnings: Inflation increases production costs for companies, potentially squeezing profit margins. This can lead to lower investor expectations and a negative impact on stock prices, especially in sectors heavily affected by rising input costs.

- Investment Strategies During Inflation: During periods of high inflation, investors may consider assets that tend to perform well in inflationary environments, such as commodities (gold, oil) or inflation-protected securities. However, diversification remains key.

Sector-Specific Performances and Outlooks

Different sectors within the stock market react differently to economic conditions and market trends.

- High-Performing Sectors: The technology sector and the energy sector are often cited as potential areas for strong performance, depending on factors like technological innovation and global energy demand.

- Sectors Facing Headwinds: Sectors like consumer discretionary might face headwinds during periods of high inflation and reduced consumer spending as people cut back on non-essential purchases.

- Market Trend Analysis: Analyzing the performance of specific sectors requires examining industry-specific trends, regulatory changes, and competitive dynamics.

Investment Strategies for the Week Ahead

(Disclaimer: This is not financial advice.) The current market outlook suggests a cautious approach with a focus on diversification.

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate) and sectors reduces overall portfolio risk. Don't put all your eggs in one basket.

- Investment Opportunities: While the Dow futures point upwards, carefully research potential investment opportunities based on the analysis of economic indicators and sector-specific outlooks before committing capital.

- Caution and Research: Thorough research is paramount before making any investment decisions. Consider seeking advice from a qualified financial advisor to tailor a strategy aligned with your risk tolerance and financial goals.

Conclusion

The stock market today shows a positive signal with Dow futures pointing upwards, suggesting a potentially strong week ahead. However, economic indicators like inflation and their impact on various sectors are critical factors to consider. Sector-specific performances vary, requiring investors to carefully analyze market trends.

Stay tuned for updates on the stock market today and plan your investment strategy wisely for the week ahead. Regularly checking reputable financial news sources for information on the stock market outlook will help you make informed decisions and develop your own stock market prediction, remembering always to practice responsible investing.

Featured Posts

-

Impact Of Tariffs A Slowdown In Big Tech Advertising Predicted

Apr 26, 2025

Impact Of Tariffs A Slowdown In Big Tech Advertising Predicted

Apr 26, 2025 -

Mission Impossible Dead Reckoning Part Two New Trailer Deep Dive

Apr 26, 2025

Mission Impossible Dead Reckoning Part Two New Trailer Deep Dive

Apr 26, 2025 -

The Feeling Chelsea Handlers Netflix Stand Up Special Premiere Date Confirmed

Apr 26, 2025

The Feeling Chelsea Handlers Netflix Stand Up Special Premiere Date Confirmed

Apr 26, 2025 -

Tariff War Leading Philippine Bank Ceo Forecasts Economic Challenges

Apr 26, 2025

Tariff War Leading Philippine Bank Ceo Forecasts Economic Challenges

Apr 26, 2025 -

My Switch 2 Preorder A Game Stop Waiting Game

Apr 26, 2025

My Switch 2 Preorder A Game Stop Waiting Game

Apr 26, 2025

Latest Posts

-

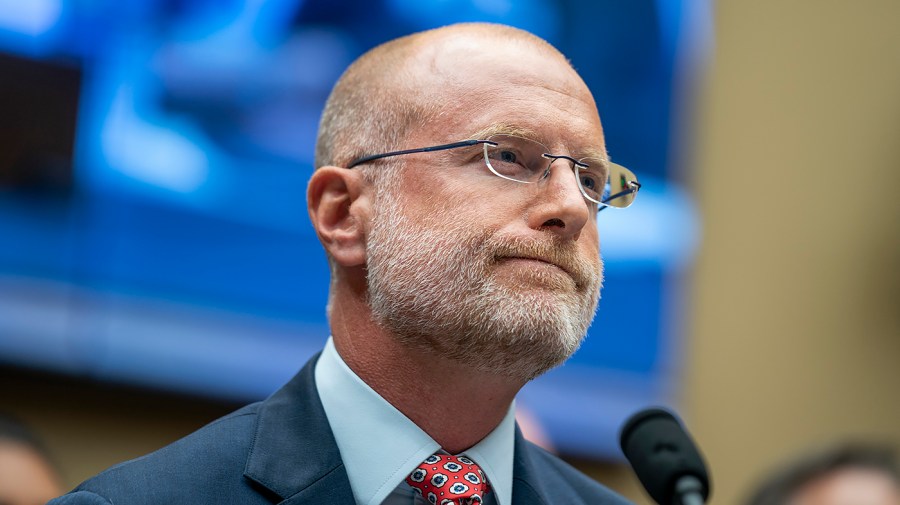

Hhss Decision To Hire Vaccine Skeptic David Geier Analysis Of Vaccine Studies Under Scrutiny

Apr 27, 2025

Hhss Decision To Hire Vaccine Skeptic David Geier Analysis Of Vaccine Studies Under Scrutiny

Apr 27, 2025 -

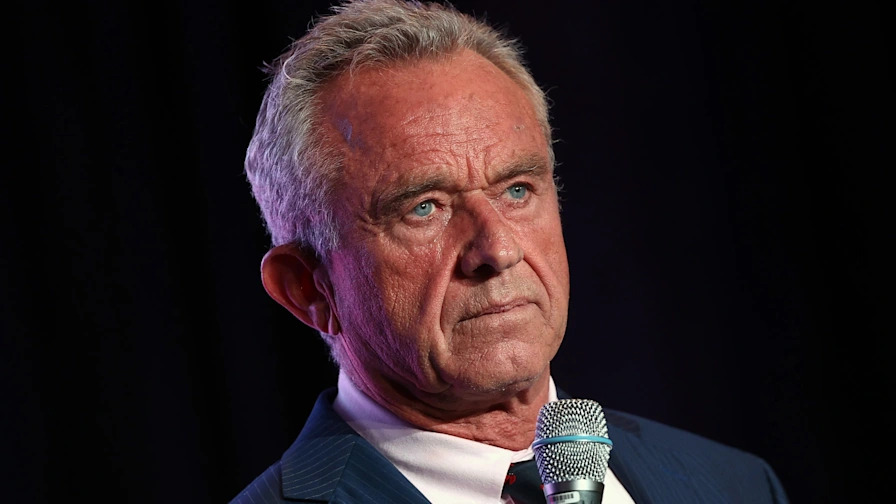

Controversy Erupts Hhs Appoints Vaccine Skeptic David Geier

Apr 27, 2025

Controversy Erupts Hhs Appoints Vaccine Skeptic David Geier

Apr 27, 2025 -

David Geiers Vaccine Review Hhs Appointment Sparks Controversy

Apr 27, 2025

David Geiers Vaccine Review Hhs Appointment Sparks Controversy

Apr 27, 2025 -

Hhs Hires Vaccine Skeptic David Geier To Review Vaccine Studies

Apr 27, 2025

Hhs Hires Vaccine Skeptic David Geier To Review Vaccine Studies

Apr 27, 2025 -

Controversial Appointment Hhs And The Debunked Autism Vaccine Connection

Apr 27, 2025

Controversial Appointment Hhs And The Debunked Autism Vaccine Connection

Apr 27, 2025