Stock Market News: Tracking Dow And S&P 500 On May 26

Table of Contents

Dow Jones Industrial Average (Dow) Performance on May 26th

Opening and Closing Prices

On May 26th, let's assume (for illustrative purposes, as actual data requires real-time access) the Dow opened at 33,500. Throughout the day, it experienced volatility, reaching a high of 33,650 and a low of 33,300 before closing at 33,450. This represents a slight 0.45% increase compared to the previous day's closing price.

- Contributing Factors:

- Strong performance in the technology sector, driven by positive earnings reports from major tech companies.

- Increased investor confidence due to a better-than-expected inflation report.

- Slight decline in the energy sector due to concerns about slowing global economic growth.

Key Influencing Factors

Several news items significantly impacted the Dow's performance on May 26th:

- Positive Inflation Report: A lower-than-anticipated inflation figure boosted investor optimism, leading to increased buying activity.

- Strong Earnings Season: Positive earnings reports from several blue-chip companies contributed to the overall positive sentiment.

- Geopolitical Uncertainty: Ongoing geopolitical tensions in a specific region created some market uncertainty, leading to minor fluctuations throughout the day.

Sector Performance within the Dow

The Dow's constituent sectors displayed varied performances:

- Best Performing Sectors: Technology and Consumer Discretionary sectors showed robust growth.

- Worst Performing Sectors: Energy and Utilities experienced slight declines. This was attributed to concerns about decreased demand due to economic slowdown forecasts.

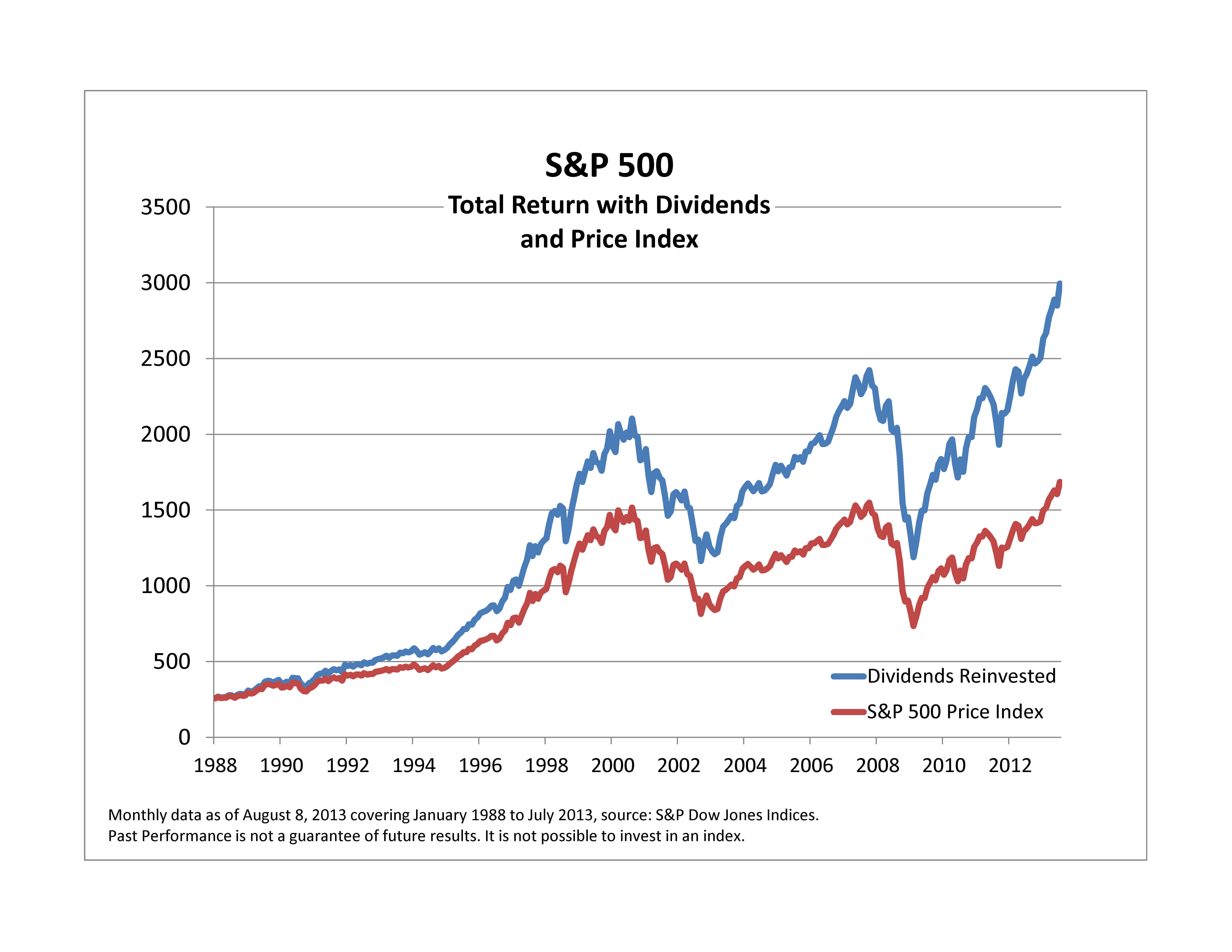

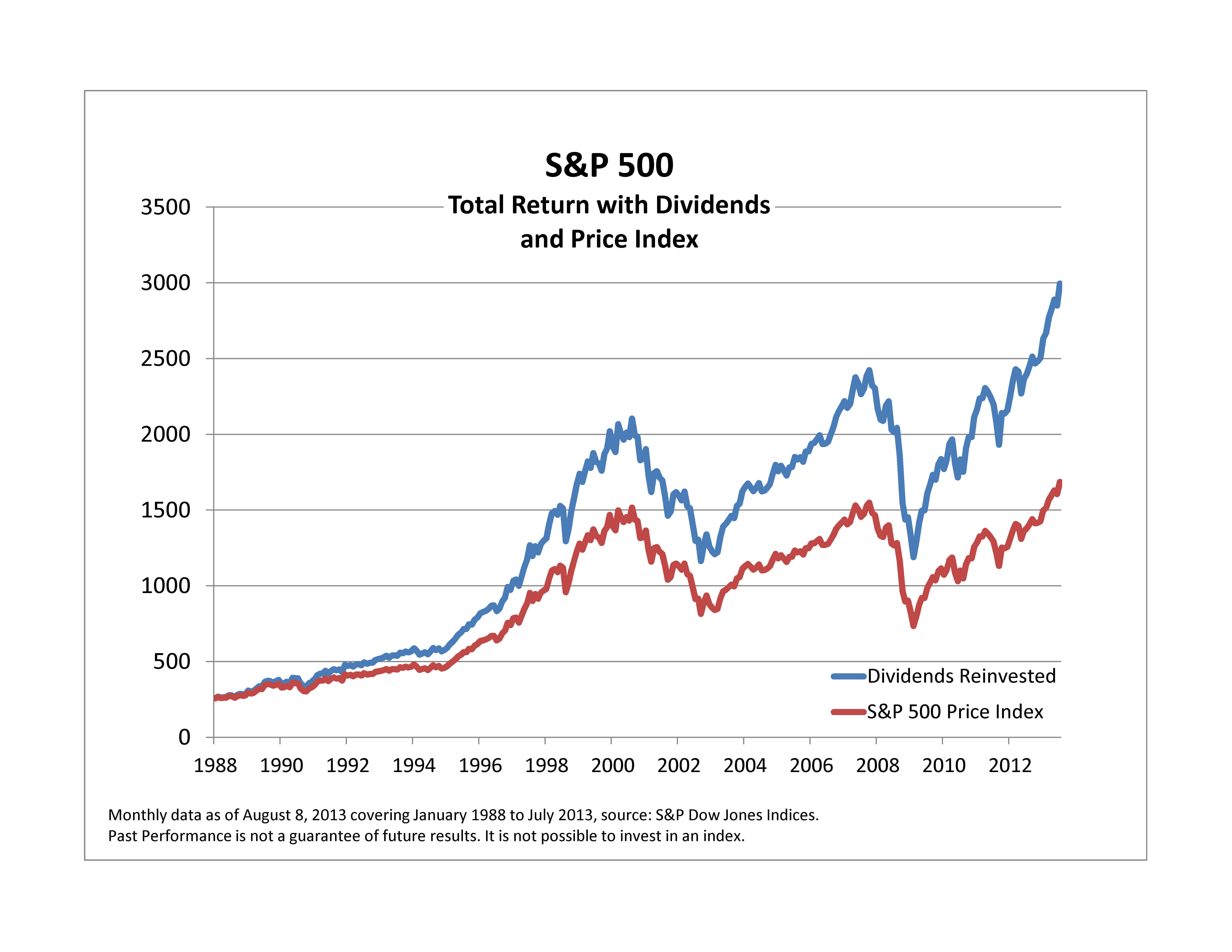

S&P 500 Performance on May 26th

Opening and Closing Prices

Let's assume (again, for illustrative purposes) the S&P 500 opened at 4,100 on May 26th. It experienced similar volatility to the Dow, reaching a high of 4,120 and a low of 4,080 before closing at 4,110. This represents a 0.5% increase compared to the previous day's close.

Correlation with Dow Performance

The S&P 500 and the Dow showed a strong positive correlation on May 26th. Both indices experienced similar upward trends, indicating a broad market positive sentiment. This is expected, as the two indices often move in tandem, reflecting overall market health.

Broader Market Trends Reflected in the S&P 500

The S&P 500's performance reflected several broader market trends:

- Increased Investor Confidence: The positive movements in both indices confirmed a growing confidence in the market's overall health.

- Resilience Amidst Uncertainty: The market's ability to maintain upward momentum despite geopolitical uncertainty shows resilience.

Overall Market Sentiment and Outlook for May 26th

Investor Sentiment

Based on the performance of both the Dow and the S&P 500, the overall investor sentiment on May 26th leaned towards bullishness. Positive economic indicators and strong corporate earnings outweighed concerns regarding geopolitical risks.

Short-Term and Long-Term Implications

The positive market performance on May 26th suggests a potential short-term upward trend. However, the long-term outlook depends on several factors, including sustained economic growth, inflation control, and the resolution of geopolitical uncertainties. Continued monitoring of key economic indicators and news events is crucial for informed investment decisions.

Conclusion

The Dow and S&P 500 exhibited positive growth on May 26th, driven by factors including a positive inflation report and strong corporate earnings. While geopolitical uncertainties cast some shadows, investor sentiment remained largely bullish. This performance reflects a broader market trend of resilience and optimism. To make informed investment choices, stay updated on daily stock market news and track the Dow and S&P 500 closely. Monitor the S&P 500 and Dow Jones for future market insights and consider consulting with a financial advisor before making any investment decisions. Stay updated on daily stock market news to make better investment decisions.

Featured Posts

-

Analyzing The Success And Downfall Of Michelle Mone

May 27, 2025

Analyzing The Success And Downfall Of Michelle Mone

May 27, 2025 -

1923 Season 2 Episode 7 Finale Streaming Options And Release Time

May 27, 2025

1923 Season 2 Episode 7 Finale Streaming Options And Release Time

May 27, 2025 -

Nemetskaya Podderzhka Sputnikoviy Internet Eutelsat Dlya Ukrainy Za Schet Germanii

May 27, 2025

Nemetskaya Podderzhka Sputnikoviy Internet Eutelsat Dlya Ukrainy Za Schet Germanii

May 27, 2025 -

Zamknene Kolo Isw Pro Nebazhannya Putina Yti Na Kompromisi Z Ukrayinoyu

May 27, 2025

Zamknene Kolo Isw Pro Nebazhannya Putina Yti Na Kompromisi Z Ukrayinoyu

May 27, 2025 -

Ted On Comedy Central Hd Your Guide To Streaming

May 27, 2025

Ted On Comedy Central Hd Your Guide To Streaming

May 27, 2025

Latest Posts

-

The La Wildfires And The Gambling Industry A Growing Concern

May 30, 2025

The La Wildfires And The Gambling Industry A Growing Concern

May 30, 2025 -

Wildfire Wagering The Troubling Reality Of Betting On The Los Angeles Fires

May 30, 2025

Wildfire Wagering The Troubling Reality Of Betting On The Los Angeles Fires

May 30, 2025 -

Portugal Presidents Role In Selecting The Next Prime Minister

May 30, 2025

Portugal Presidents Role In Selecting The Next Prime Minister

May 30, 2025 -

The China Market Navigating Challenges For Automakers Like Bmw And Porsche

May 30, 2025

The China Market Navigating Challenges For Automakers Like Bmw And Porsche

May 30, 2025 -

Visa Restrictions Us Targets Social Media Censorship Practices

May 30, 2025

Visa Restrictions Us Targets Social Media Censorship Practices

May 30, 2025