Stock Market News: Dow, S&P 500, And Nasdaq - May 29

Table of Contents

Main Points:

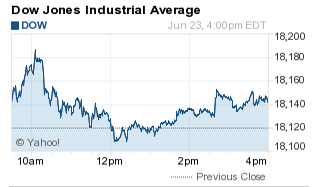

2.1 Dow Jones Industrial Average (DJIA) Performance on May 29

The Dow Jones Industrial Average (DJIA) closed on May 29th with a slight decrease of 0.25%, settling at 33,886. This relatively modest decline followed a period of uncertainty surrounding upcoming economic data releases.

- Key Factors Influencing the Dow: Concerns about persistent inflation and the potential impact of further interest rate hikes by the Federal Reserve weighed on investor sentiment. Reports of slowing manufacturing activity also contributed to the Dow's negative performance. Specific company earnings reports, particularly from the industrial sector, also played a role.

- Top Performing and Underperforming Dow Stocks: While the overall index dipped slightly, individual stocks showed varying performance. For example, [Insert Example: e.g., Company X saw a 2% increase due to strong quarterly earnings, while Company Y experienced a 1.5% decrease following disappointing sales figures].

- (Include Chart Here): A chart visually representing the Dow's movement throughout May 29th would enhance understanding.

2.2 S&P 500 Performance on May 29

The S&P 500, a broader measure of the U.S. stock market, mirrored the Dow's slightly negative trend, closing down 0.18% at 4207. However, the impact was not uniform across all sectors.

- Sector-Specific Performance: The technology sector experienced a modest decline, while the energy sector showed some resilience due to sustained high oil prices. The financial sector's performance was largely flat, reflecting mixed signals from recent economic data.

- Impact of Specific Economic Indicators: The release of [mention specific economic data, e.g., the Consumer Confidence Index] influenced investor sentiment and contributed to the overall market mood. Positive data may have offset the negative sentiments.

- (Include Chart Here): A chart displaying the S&P 500's intraday movement on May 29th.

2.3 Nasdaq Composite Performance on May 29

The Nasdaq Composite, heavily weighted in technology stocks, experienced a more significant drop compared to the Dow and S&P 500, closing down 0.8% at 12,960.

- Focus on Technology Sector Performance: The underperformance of several large technology companies following mixed earnings reports heavily influenced the Nasdaq's decline. Concerns about increased competition and a potential slowdown in technology spending also contributed to investor apprehension.

- Impact of Tech Company Earnings and Announcements: Specific earnings reports from major tech companies (mention specific examples if available) significantly influenced the market's reaction. Any major announcements impacting tech valuations played a critical role.

- (Include Chart Here): A chart showing the Nasdaq Composite's performance throughout the trading day.

2.4 Market Analysis and Outlook

Overall, the market sentiment on May 29th could be described as cautiously bearish. The mixed performance of the major indices reflects the ongoing uncertainty surrounding inflation, interest rates, and economic growth.

- Interrelation Between Dow, S&P 500, and Nasdaq Movements: The generally negative trend across all three indices suggests a broad market correction or consolidation, rather than a sector-specific issue. However, the greater decline in the Nasdaq highlights the tech sector's vulnerability to changing market conditions.

- Potential Short-Term and Long-Term Market Trends: The short-term outlook remains uncertain, depending heavily on upcoming economic data releases and corporate earnings reports. In the long term, the market's direction will likely be influenced by inflation control measures, geopolitical stability, and overall economic growth.

- Significant Upcoming Events: [Mention any significant upcoming economic events or data releases that could affect the market in the coming days or weeks, such as Federal Reserve meetings or important economic reports].

Conclusion: Stock Market News Recap and Next Steps

May 29th saw mixed performance across major U.S. stock market indices, with the Dow and S&P 500 experiencing slight declines and the Nasdaq experiencing a more significant drop. Concerns regarding inflation, interest rate hikes, and the tech sector's performance largely shaped the day's market sentiment. Understanding the interplay between these factors is crucial for informed investment strategies.

To stay ahead in the dynamic world of stock market investing, regularly reviewing stock market news, including Dow, S&P 500, and Nasdaq updates, is essential. Stay updated on the latest stock market news by bookmarking this page and checking back frequently for continuous market analysis and insights. Understanding daily market activity, as well as long-term trends, is critical for successful investing.

Featured Posts

-

Evaluating Marchs Rainfall Progress On Water Deficit Mitigation

May 30, 2025

Evaluating Marchs Rainfall Progress On Water Deficit Mitigation

May 30, 2025 -

Analise Do Desempenho De Bruno Fernandes No Manchester United

May 30, 2025

Analise Do Desempenho De Bruno Fernandes No Manchester United

May 30, 2025 -

Metallica Announces 2026 M72 Uk And European Tour Dates

May 30, 2025

Metallica Announces 2026 M72 Uk And European Tour Dates

May 30, 2025 -

Hollywoods Golden Age Unearthing A Lost Film Critic

May 30, 2025

Hollywoods Golden Age Unearthing A Lost Film Critic

May 30, 2025 -

A69 L Etat Saisit La Justice Pour Relancer Le Chantier Du Sud Ouest

May 30, 2025

A69 L Etat Saisit La Justice Pour Relancer Le Chantier Du Sud Ouest

May 30, 2025