Stock Market Dip: Fears Over US Fiscal Policy

Table of Contents

The Debt Ceiling Debate and its Market Impact

The US debt ceiling is the legal limit on the amount of debt the federal government can accrue. Reaching this limit without raising it triggers a potential government default, a scenario with potentially catastrophic consequences for the global economy. The very real possibility of a default, or even a prolonged period of negotiation, introduces significant market uncertainty. This uncertainty is reflected in several key ways:

- Increased Treasury Yields: As the risk of default increases, investors demand higher yields on Treasury bonds to compensate for the perceived risk, driving up interest rates.

- Potential for a Government Shutdown: A failure to reach a debt ceiling agreement could lead to a government shutdown, halting essential government services and further disrupting economic activity.

- Negative Impact on Consumer and Business Confidence: The uncertainty surrounding the debt ceiling erodes confidence among both consumers and businesses, leading to reduced spending and investment.

- Flight to Safety: Investors often seek refuge in safer assets, such as gold and government bonds from countries perceived as less risky, during periods of heightened uncertainty. This flight to safety can further depress the stock market.

Inflation and the Federal Reserve's Response

Persistent inflation remains a major concern, forcing the Federal Reserve (the Fed) to implement aggressive monetary policy measures. The Fed's strategy of raising interest rates and engaging in quantitative tightening (reducing its balance sheet) aims to curb inflation, but these actions also carry significant implications for the stock market:

- Impact of Higher Interest Rates on Corporate Borrowing Costs and Profitability: Higher interest rates increase the cost of borrowing for corporations, potentially squeezing profit margins and slowing down economic growth.

- The Fed's Balancing Act: The Fed faces a difficult balancing act—controlling inflation without triggering a recession. This delicate task adds to overall market volatility.

- Influence of Inflation Expectations on Future Market Performance: Market participants' expectations regarding future inflation significantly influence asset pricing and overall market sentiment.

- Analysis of CPI Data and its Effect on Market Sentiment: The release of Consumer Price Index (CPI) data is a highly anticipated event, with any surprises potentially causing sharp market reactions.

Government Spending and its Economic Implications

Government spending plays a crucial role in shaping economic growth and influencing the stock market. The debate surrounding the appropriate level of government spending, and the specific allocation of funds, is a key driver of market volatility. Both increased and decreased spending carry potential consequences:

- Potential for Fiscal Stimulus to Boost Economic Growth and Market Performance: Government spending on infrastructure projects or social programs can stimulate economic activity and positively impact the stock market.

- Risks of Excessive Government Spending Leading to Higher Inflation and Debt: Uncontrolled government spending can fuel inflation and exacerbate the national debt, creating a negative feedback loop.

- Impact of Potential Spending Cuts on Various Sectors of the Economy: Spending cuts can have a disproportionate impact on certain sectors, leading to job losses and economic hardship.

- Debate Around the Effectiveness of Different Government Spending Approaches: Ongoing debate on the effectiveness of different approaches to government spending creates uncertainty and influences investor sentiment.

Analyzing Investor Sentiment and Market Behavior

Understanding investor sentiment and market behavior is critical during periods of heightened uncertainty. Several tools and techniques can help assess market health:

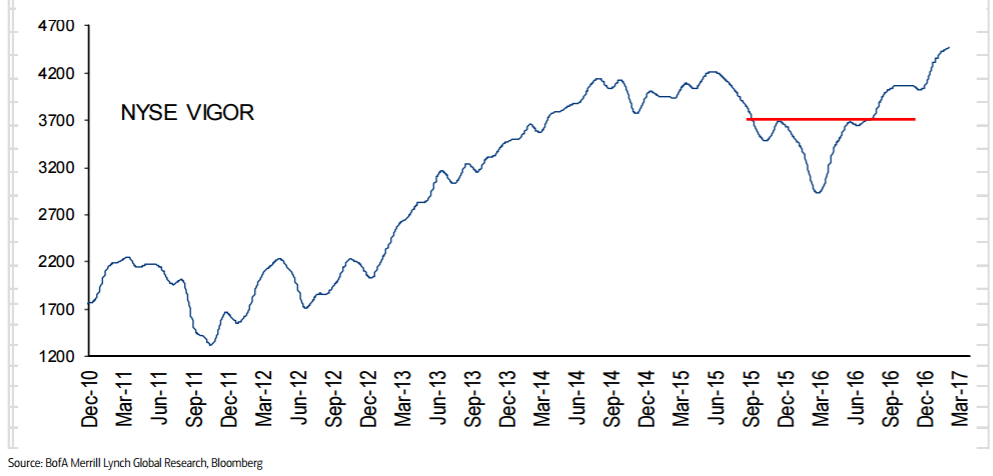

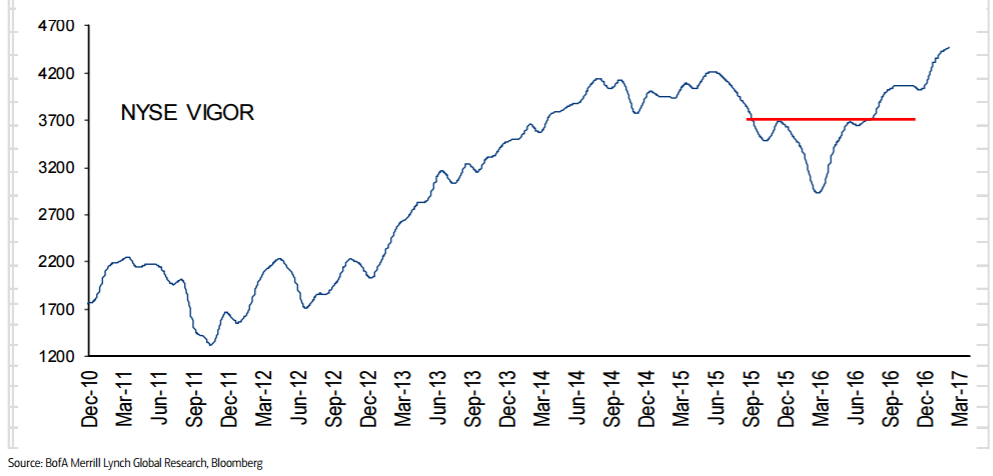

- Tracking Changes in Trading Volume and Market Breadth: Analyzing changes in trading volume and the number of stocks participating in a market move can provide insights into the strength and sustainability of market trends.

- Analyzing Investor Surveys and Sentiment Indicators: Various surveys and indicators gauge investor confidence and risk appetite, offering valuable clues about the market's direction.

- Examining the Performance of Different Market Sectors: Analyzing the performance of different sectors can reveal which areas are most vulnerable or resilient to economic headwinds.

- Using Technical Analysis to Identify Potential Market Turning Points: Technical analysis uses charts and historical data to identify potential market turning points and predict future price movements.

Conclusion

The recent stock market dip underscores the significant impact of US fiscal policy uncertainties on investor sentiment and market volatility. The debt ceiling debate, persistent inflation, and the ongoing debate about government spending all contribute to a complex and uncertain market landscape. Staying informed about these developments is crucial for making informed investment decisions. Conduct thorough research, consult reliable financial news sources, and consider seeking advice from a qualified financial advisor before making any investment decisions based on your understanding of the stock market dip and fears over US fiscal policy. Understanding the complexities of "Stock Market Dip: Fears Over US Fiscal Policy" is key to navigating this challenging environment successfully.

Featured Posts

-

A Week Of Cambridge And Somerville Events Viva Central Hot Sauce Fest And Open Studios

May 23, 2025

A Week Of Cambridge And Somerville Events Viva Central Hot Sauce Fest And Open Studios

May 23, 2025 -

The Big Rig Rock Report 3 12 A Comprehensive Overview Rock 106 1

May 23, 2025

The Big Rig Rock Report 3 12 A Comprehensive Overview Rock 106 1

May 23, 2025 -

Assessing The Landslide Threat To A Swiss Mountain Village

May 23, 2025

Assessing The Landslide Threat To A Swiss Mountain Village

May 23, 2025 -

Alkhbr Khsart Nady Qtr Amam Alkhwr Bmsharkt Ebd Alqadr

May 23, 2025

Alkhbr Khsart Nady Qtr Amam Alkhwr Bmsharkt Ebd Alqadr

May 23, 2025 -

10 Obscure Cult Horror Movies You Wont Believe Exist

May 23, 2025

10 Obscure Cult Horror Movies You Wont Believe Exist

May 23, 2025

Latest Posts

-

Ispovest Vanje Mijatovic Istina O Razvodu

May 23, 2025

Ispovest Vanje Mijatovic Istina O Razvodu

May 23, 2025 -

Vanja Mijatovic Demantira Glasine O Razvodu Prava Prica

May 23, 2025

Vanja Mijatovic Demantira Glasine O Razvodu Prava Prica

May 23, 2025 -

Efektivne Gospodaryuvannya Keruvannya Tov Z Odnim Uchasnikom

May 23, 2025

Efektivne Gospodaryuvannya Keruvannya Tov Z Odnim Uchasnikom

May 23, 2025 -

Gospodaryuvannya V Tov Z Odnim Uchasnikom Yuridichni Aspekti

May 23, 2025

Gospodaryuvannya V Tov Z Odnim Uchasnikom Yuridichni Aspekti

May 23, 2025 -

Optimizatsiya Gospodaryuvannya Poradi Dlya Tov Z Odnim Vlasnikom

May 23, 2025

Optimizatsiya Gospodaryuvannya Poradi Dlya Tov Z Odnim Vlasnikom

May 23, 2025