Stock Market Defies Recession Fears: Investors See Continued Growth

Table of Contents

Strong Corporate Earnings Drive Market Growth

Robust corporate earnings reports are a significant driver of the current stock market growth. Companies across various sectors are exceeding expectations, fueling investor confidence and pushing stock prices higher. This positive trend indicates a level of economic resilience that many analysts had not predicted.

- Examples of exceeding expectations: Several technology giants, for instance, have recently reported unexpectedly strong earnings, driven by robust demand for their products and services. Similarly, the energy sector has seen significant profit growth due to increased global energy prices. This strong performance across different sectors demonstrates a broad-based economic strength.

- Key economic indicators: Strong consumer spending, despite inflationary pressures, is a major contributor to these impressive corporate earnings. Positive trends in employment figures and a relatively stable inflation rate, while still elevated, also contribute to this positive outlook.

- Exceptional performing sectors: Beyond technology and energy, sectors such as healthcare and consumer staples have also shown surprising strength, demonstrating that the market growth is not confined to a few specific industries. This broad-based strength offers further evidence that the stock market is, at least for now, defying recession fears.

Resilient Consumer Spending Supports Economic Optimism

Despite inflation and rising interest rates, consumer spending remains surprisingly resilient. This continued spending is a crucial factor supporting economic growth and, consequently, the stock market's performance. Consumer confidence indices, while fluctuating, haven't plummeted as dramatically as some economists predicted, suggesting a more optimistic outlook than initially anticipated.

- Consumer Confidence Indices: While consumer confidence has seen some dips, it remains relatively high compared to previous recessionary periods. This indicates that consumers are still willing to spend, albeit potentially more cautiously.

- Retail Sales Figures: Retail sales data continue to show positive growth in many key sectors. This suggests that consumers are still purchasing goods and services, demonstrating an underlying strength in the economy.

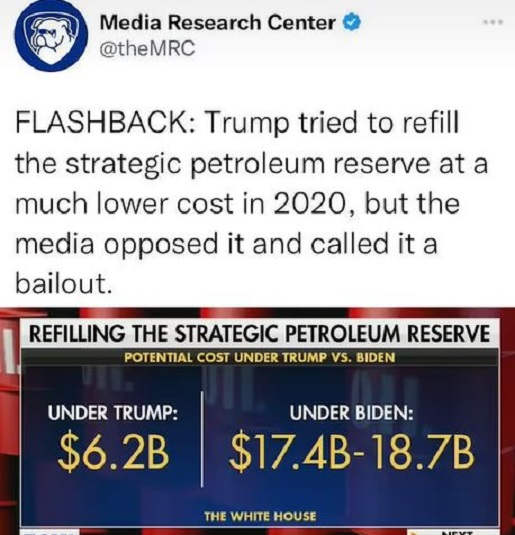

- Impact of Economic Policies: Government stimulus packages and other economic policies implemented in recent years have played a role in supporting consumer spending and overall economic resilience, partially offsetting the negative effects of inflation.

Innovative Investment Strategies Mitigate Recessionary Risks

Investors are adapting their strategies to navigate potential recessionary headwinds. Traditional approaches are being complemented by innovative tactics aimed at mitigating risk and preserving capital. This proactive approach shows a degree of sophistication in the market, suggesting that investors are not blindly optimistic but are instead employing strategies to protect their investments.

- Defensive Investment Strategies: Many investors are shifting towards more defensive investment strategies, including increasing their holdings in gold, government bonds, and dividend-paying stocks. These assets are generally considered more stable during economic downturns.

- Alternative Investment Options: Alternative investments, such as real estate and private equity, are also gaining popularity as investors seek diversification beyond traditional stocks and bonds. These alternative assets offer different risk-return profiles and can provide a cushion against market volatility.

- Portfolio Diversification: Diversification remains a cornerstone of effective risk management. Investors are increasingly focusing on creating well-diversified portfolios that spread their investments across different asset classes and sectors to reduce the impact of any single market downturn.

Inflation Concerns and the Stock Market's Response

Inflation remains a significant concern, and the stock market's reaction to rising prices and potential interest rate hikes is complex. While high inflation can negatively impact stock valuations, the market's current performance suggests that investors are, at least for now, factoring inflation into their investment decisions and adjusting their strategies accordingly.

- Inflation and Stock Market Performance: Historically, high inflation has been correlated with periods of market volatility. However, the current market's response has been more muted than some expected.

- Federal Reserve Policy: The Federal Reserve's actions in managing interest rates play a critical role in shaping the market’s response to inflation. The pace and extent of interest rate hikes will significantly influence stock prices and investor sentiment.

- Inflation-Hedging Strategies: Investors are increasingly employing inflation-hedging strategies, including investing in commodities, real estate, and inflation-protected securities, to mitigate the negative effects of inflation on their portfolios.

Conclusion: Navigating the Stock Market Amidst Recession Fears

The stock market's unexpected growth, despite prevalent recession fears, is a complex phenomenon driven by a confluence of factors: strong corporate earnings, resilient consumer spending, innovative investor strategies, and a nuanced response to inflation concerns. The market's resilience showcases a degree of underlying economic strength and adaptability. However, this doesn't negate the risk of a future recession.

This analysis highlights the importance of staying informed about market trends and adapting investment strategies accordingly. While the current market performance is positive, it's crucial to maintain a balanced approach, considering potential risks and employing appropriate risk management techniques. Stay informed about market trends and consider diversifying your portfolio to effectively manage risk in the face of potential recessionary headwinds. Learn more about recession-proof investments and how to protect your financial future. Understanding how the stock market defies recession fears, at least for now, is vital for making informed decisions about your investments.

Featured Posts

-

Following In Giant Footsteps Evaluating The Sequel To A Beloved Website

May 06, 2025

Following In Giant Footsteps Evaluating The Sequel To A Beloved Website

May 06, 2025 -

What It Takes To Win Or Lose In A Meeting With Trump A Strategic Guide

May 06, 2025

What It Takes To Win Or Lose In A Meeting With Trump A Strategic Guide

May 06, 2025 -

Gary Mar On Canadas West Unlocking Economic Potential Under Mark Carneys Leadership

May 06, 2025

Gary Mar On Canadas West Unlocking Economic Potential Under Mark Carneys Leadership

May 06, 2025 -

Venices Future A Proposed Engineering Marvel To Counter Flooding

May 06, 2025

Venices Future A Proposed Engineering Marvel To Counter Flooding

May 06, 2025 -

Watch Celtics Vs Knicks Live Free Streaming Guide And Tv Channel Info

May 06, 2025

Watch Celtics Vs Knicks Live Free Streaming Guide And Tv Channel Info

May 06, 2025

Latest Posts

-

Nba Conference Semifinals 2025 Full Schedule And Dates

May 06, 2025

Nba Conference Semifinals 2025 Full Schedule And Dates

May 06, 2025 -

Polski Nitro Chem Bezpieczenstwo I Jakosc Produkcji Trotylu

May 06, 2025

Polski Nitro Chem Bezpieczenstwo I Jakosc Produkcji Trotylu

May 06, 2025 -

2025 Nba Playoffs Conference Semifinals Schedule

May 06, 2025

2025 Nba Playoffs Conference Semifinals Schedule

May 06, 2025 -

Spak Banesa E Motrave Nikolli Nen Hetim

May 06, 2025

Spak Banesa E Motrave Nikolli Nen Hetim

May 06, 2025 -

Trotyl Polski Nitro Chem Europejski Potentat

May 06, 2025

Trotyl Polski Nitro Chem Europejski Potentat

May 06, 2025