Stock Investors Defy Market Pain: A Risky Gamble?

Table of Contents

Analyzing the Current Market Landscape

The decision to defy market pain is heavily influenced by the prevailing economic climate. Understanding the current market landscape is crucial for assessing the risks and rewards involved.

Macroeconomic Factors Influencing Investor Decisions:

Several macroeconomic factors are currently shaping investor decisions. These include:

- High Inflation: Persistent inflation erodes purchasing power and increases uncertainty about future returns.

- Rising Interest Rates: Central banks raising interest rates to combat inflation can impact borrowing costs and slow economic growth, affecting stock valuations.

- Geopolitical Instability: Global conflicts and political uncertainty contribute to market volatility and investor apprehension.

These factors are reflected in the performance of major indices like the S&P 500 and the Dow Jones Industrial Average. Recent market performance indicates a degree of uncertainty, with indices experiencing both significant gains and losses. This volatility influences investor sentiment, leading some to adopt a wait-and-see approach while others remain steadfast in their investment strategies.

Understanding Market Volatility and Risk Tolerance:

Market volatility refers to the extent of price fluctuations in the stock market. Several types exist, including:

- Short-term volatility: Daily or weekly price swings.

- Long-term volatility: Fluctuations over months or years.

Understanding these variations is vital for developing an appropriate investment strategy. Risk tolerance, the ability to withstand potential investment losses, is a critical factor. Investors with high risk tolerance are more likely to hold their positions during market downturns, while those with low risk tolerance may opt to sell. The psychological aspect of investing during market downturns is crucial; emotions like fear and greed can heavily influence decision-making, sometimes leading to poor investment choices.

Strategies Employed by Investors Defying Market Pain

Investors defying market pain often utilize specific strategies to mitigate risks and potentially capitalize on long-term growth opportunities.

Dollar-Cost Averaging (DCA) and its Effectiveness:

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of the market price. This strategy reduces the impact of market volatility by averaging out purchase prices over time. While it doesn't guarantee profits, DCA can help mitigate losses during market downturns. However, it may also result in missing out on potential gains during periods of rapid market growth.

Value Investing and Long-Term Growth Strategies:

Value investing focuses on identifying undervalued companies with strong fundamentals and long-term growth potential. Value investors believe that market fluctuations create opportunities to buy quality stocks at discounted prices. This strategy requires patience and a long-term investment horizon, which is crucial for weathering market downturns. Companies with a history of resilience during economic downturns often attract value investors.

The Role of Diversification in Mitigating Risk:

Diversification is a fundamental risk-management strategy. By spreading investments across different asset classes (stocks, bonds, real estate, etc.), investors can reduce the impact of losses in any single asset. Understanding the correlation between different assets is key; diversification is most effective when assets are not highly correlated. Diversifying effectively requires careful planning and consideration of individual risk tolerance and financial goals.

The Risks Involved in Defying Market Pain

While defying market pain can potentially yield high rewards, it also carries significant risks.

Potential for Significant Losses:

Even the most well-researched investment strategies cannot eliminate the possibility of losses. Further market corrections or even crashes can lead to substantial portfolio losses. Maintaining realistic expectations is crucial to avoid emotional decision-making during periods of market decline.

Emotional Decision-Making and its Consequences:

Fear and greed can significantly impact investment decisions. Selling assets in panic during a downturn can lock in losses, while chasing high-performing assets during a bull market can lead to overexposure and subsequent losses. Rational decision-making based on sound investment principles is vital to avoid these pitfalls.

Ignoring Warning Signs and Market Signals:

Ignoring warning signs of potential market downturns can expose investors to significant risk. Analyzing market trends, economic indicators, and geopolitical events is crucial for making informed decisions. History offers many examples of market events that serve as cautionary tales, highlighting the importance of careful market analysis.

Conclusion: Weighing the Risks and Rewards – Stock Investors Defying Market Pain

Defying market pain as a stock investor can potentially lead to long-term gains, but it carries substantial risks. The decision to hold or sell during market downturns depends on individual circumstances, including risk tolerance, investment goals, and understanding of the current market landscape. Understanding and employing strategies like dollar-cost averaging, value investing, and diversification are crucial for mitigating risk. Before you make any decisions about defying market pain as a stock investor, carefully consider the risks and rewards. Conduct thorough research and seek professional advice when needed. Remember, a well-informed strategy is key to navigating market pain and achieving your investment objectives.

Featured Posts

-

Closer Security Links High Level Talks Between Chinese And Indonesian Officials

Apr 22, 2025

Closer Security Links High Level Talks Between Chinese And Indonesian Officials

Apr 22, 2025 -

Google Faces Doj In Court Fight Over Search Monopoly Continues

Apr 22, 2025

Google Faces Doj In Court Fight Over Search Monopoly Continues

Apr 22, 2025 -

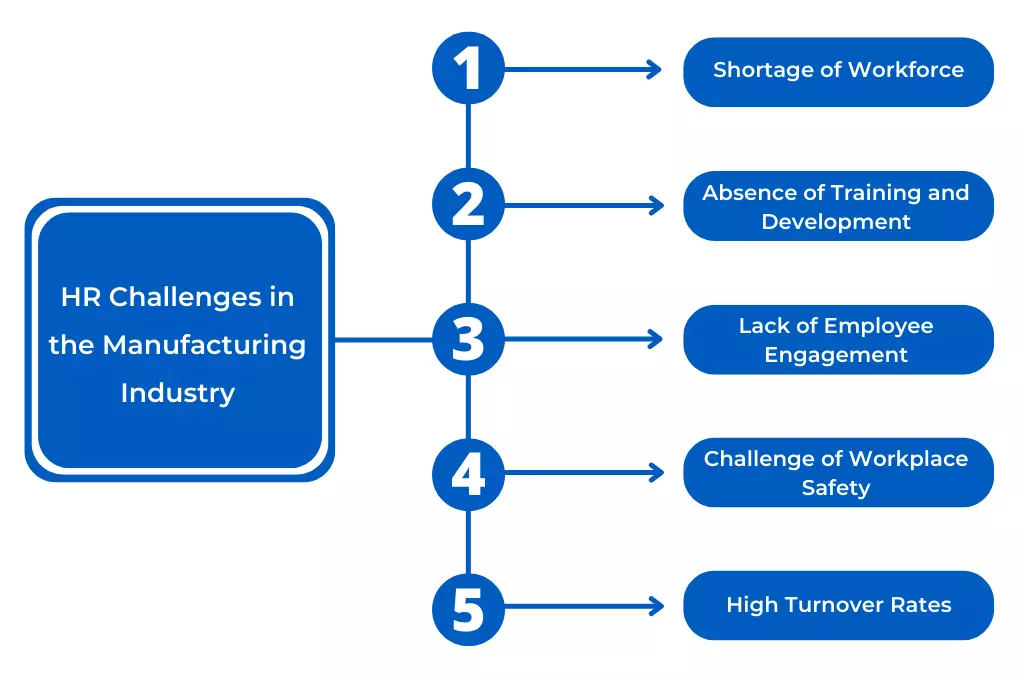

Robotics And Nike Sneakers An Examination Of Manufacturing Challenges

Apr 22, 2025

Robotics And Nike Sneakers An Examination Of Manufacturing Challenges

Apr 22, 2025 -

New Business Hot Spots A National Map And Analysis

Apr 22, 2025

New Business Hot Spots A National Map And Analysis

Apr 22, 2025 -

Middle Managers Bridging The Gap Between Leadership And Workforce

Apr 22, 2025

Middle Managers Bridging The Gap Between Leadership And Workforce

Apr 22, 2025