Steven Bartlett Impersonators: How To Avoid Online Investment Scams

Table of Contents

- Identifying Steven Bartlett Impersonators

- Fake Social Media Profiles

- Misleading Website Domains

- Analyzing Communication Methods

- Recognizing the Red Flags of Online Investment Scams

- Unrealistic Returns

- High-Pressure Tactics

- Lack of Transparency

- Unregistered or Unlicensed Investments

- Protecting Yourself from Steven Bartlett Impersonators and Scams

- Verify Information Independently

- Consult Financial Advisors

- Report Suspicious Activity

- Educate Yourself

- Conclusion

Identifying Steven Bartlett Impersonators

Many scams leverage the popularity and reputation of successful individuals like Steven Bartlett. Understanding how these impersonators operate is crucial in protecting your finances.

Fake Social Media Profiles

Social media platforms are breeding grounds for fraudulent accounts. Impersonators create fake profiles to build trust and promote their scams. Look out for these warning signs:

- Unverified Accounts: Genuine profiles of public figures usually have official blue ticks or verification badges. Lack of verification is a major red flag.

- Low-Quality Images and Inconsistent Branding: Fake profiles often use low-resolution images, inconsistent branding, or images stolen from legitimate sources.

- Limited Follower Counts or Engagement: Legitimate accounts typically have a substantial and engaged following. A low follower count or lack of interaction suggests a fake profile.

- Suspicious URLs: Links provided in the bio or posts may lead to unofficial websites or phishing pages designed to steal your information. Always check the URL carefully before clicking.

- Grammatical Errors and Unprofessional Language: Poor grammar and unprofessional language are often telltale signs of a fake account created by someone lacking fluency in the language.

Misleading Website Domains

Scammers often create websites that closely mimic legitimate Steven Bartlett investment platforms. These websites are designed to appear authentic, but they are actually fraudulent. Pay close attention to:

- Domain Name Variations: Scammers use similar-sounding domain names, adding extra letters, numbers, or using slightly different spellings to deceive unsuspecting investors.

- Poor Website Design: Unprofessional graphics, broken links, and overall poor website design are common characteristics of fraudulent websites.

- Lack of Contact Information: Legitimate businesses usually provide clear and accessible contact information. A lack of contact details is a huge red flag.

- Missing Security Protocols (HTTPS): Secure websites always use HTTPS. The absence of HTTPS indicates a lack of security and increases the risk of data breaches.

Analyzing Communication Methods

Be wary of unsolicited messages, especially those promising high returns with little risk. These messages are often part of a broader scam. Check for:

- Emails from Unknown Addresses: Legitimate businesses will typically communicate from official email addresses. Unfamiliar email addresses should raise immediate suspicion.

- Urgent Action or Missed Opportunities: Pressure tactics to invest quickly, implying a limited-time offer or potential loss, are common scam tactics.

- High-Pressure Sales Tactics: Legitimate investment opportunities rarely involve high-pressure sales tactics.

- Requests for Personal Financial Information: Never provide personal financial information (bank details, passwords, etc.) unless you are absolutely certain of the recipient's legitimacy.

Recognizing the Red Flags of Online Investment Scams

Even without explicit impersonation, many online investment scams share common red flags. Recognizing these warning signs can save you from significant financial losses.

Unrealistic Returns

Promises of exceptionally high returns with minimal or no risk are a major red flag. All legitimate investments carry some level of risk. If it sounds too good to be true, it probably is.

High-Pressure Tactics

Legitimate investment opportunities allow time for research and due diligence. High-pressure tactics aimed at forcing quick decisions without allowing for thorough investigation are a clear sign of a scam.

Lack of Transparency

Legitimate investment opportunities provide clear and comprehensive information about fees, risks, and investment strategies. Vague or incomplete information should raise significant concerns.

Unregistered or Unlicensed Investments

Always verify if the investment opportunity is registered with the appropriate regulatory bodies. Unregistered or unlicensed investments are almost always scams.

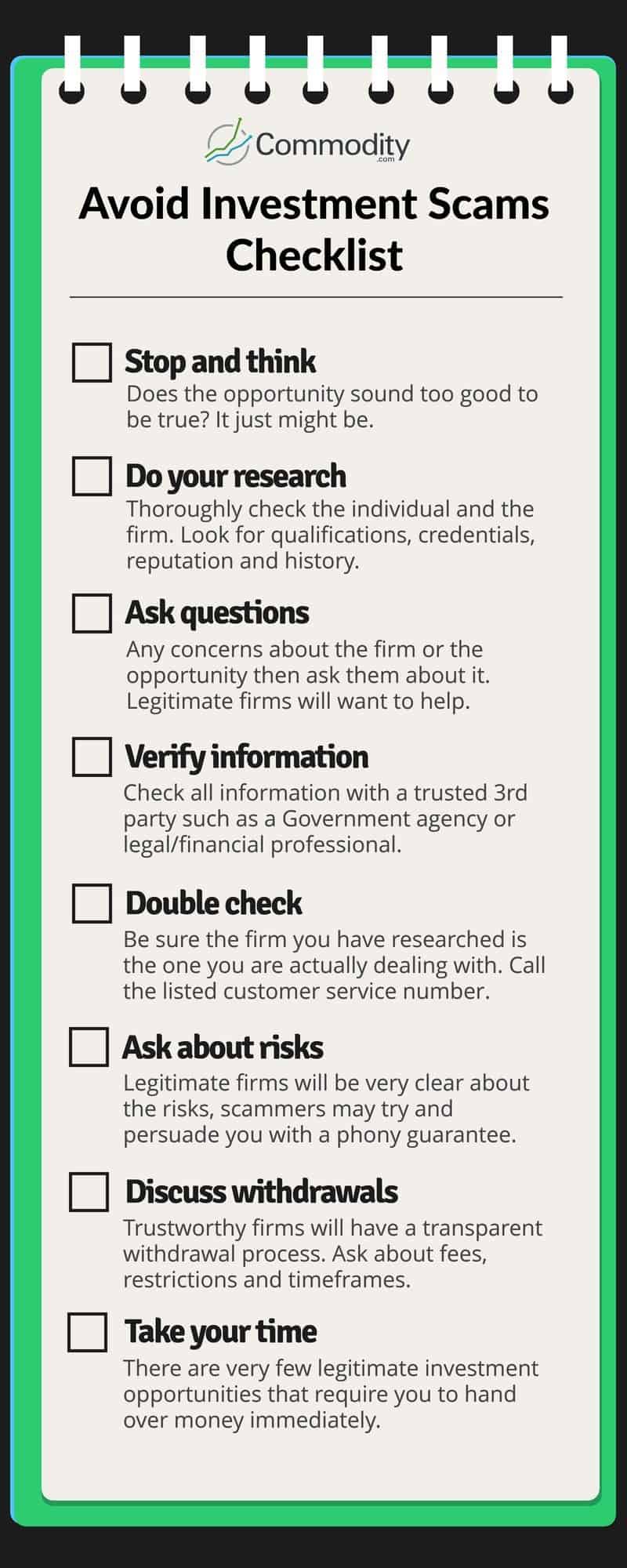

Protecting Yourself from Steven Bartlett Impersonators and Scams

Staying safe online requires vigilance and proactive measures. Here's how to protect yourself:

Verify Information Independently

Never rely solely on social media or unsolicited messages. Always verify information from multiple reputable sources, including the official Steven Bartlett website and other credible news outlets.

Consult Financial Advisors

Seek professional advice from a qualified financial advisor before making any investment decisions. They can help you assess risks, evaluate opportunities, and create a personalized investment strategy.

Report Suspicious Activity

Report suspected scams to the appropriate authorities (e.g., your country's financial regulatory body, the police) and the relevant online platforms (e.g., social media companies). This helps protect others from falling victim to the same scams.

Educate Yourself

Continuously learn about investment strategies and common scam tactics to stay ahead of fraudsters. Numerous reputable financial resources offer educational materials and insights into avoiding online investment scams.

Conclusion

Protecting yourself from online investment scams, particularly those involving Steven Bartlett impersonators, requires vigilance and due diligence. By learning to identify red flags, verifying information independently, and consulting with professionals, you can significantly reduce your risk. Don't fall for the allure of quick riches—protect your finances from Steven Bartlett impersonators and other online investment scams. Stay informed, stay vigilant, and invest wisely!

Michael Sheens Million Pound Giveaway A Review By Christopher Stevens

Michael Sheens Million Pound Giveaway A Review By Christopher Stevens

Coronation Streets Surprise Exit When Will It Happen

Coronation Streets Surprise Exit When Will It Happen

Palestinian Journalist Detained In West Bank Raid

Palestinian Journalist Detained In West Bank Raid

Slim Opladen Met Enexis In Noord Nederland Buiten De Piektijden

Slim Opladen Met Enexis In Noord Nederland Buiten De Piektijden

Alnsr W Jwanka Drast Larqam Mthyrt Lljdl

Alnsr W Jwanka Drast Larqam Mthyrt Lljdl