SSE's Revised Spending Plan: A £3 Billion Reduction In Investment

Table of Contents

Reasons Behind SSE's Investment Cut

Several interconnected factors contributed to SSE's decision to slash its investment plan by £3 billion. The current macroeconomic climate plays a significant role.

-

Inflation and Rising Interest Rates: Soaring inflation and increased interest rates have significantly increased the cost of borrowing, making large-scale energy projects less financially viable. This makes securing funding for projects considerably more challenging, forcing companies to reassess their investment strategies.

-

Supply Chain Disruptions: Global supply chain issues continue to plague various industries, including the energy sector. Delays in procuring essential materials and equipment for renewable energy projects have added to the overall cost and complexity, leading to budget overruns and project postponements.

-

Government Policies and Regulations: Changes in government policies and regulations regarding energy investment and subsidies can impact the profitability and attractiveness of certain projects. Uncertainty around future policy frameworks can deter investment and lead to a more cautious approach.

-

Internal Factors: SSE, like other energy companies, faces pressure to maintain profit margins and deliver shareholder value. The current economic uncertainty has likely compelled the company to prioritize projects with higher short-term returns, resulting in a reduction in long-term investments.

Impact on Renewable Energy Projects

The £3 billion investment cut will undoubtedly impact several renewable energy projects within SSE's portfolio.

-

Wind Farm Developments: Several planned wind farm projects, both onshore and offshore, are likely to face delays or cancellations. This could include postponements to crucial upgrades to existing infrastructure.

-

Solar Power Initiatives: Investments in large-scale solar power plants might be scaled back, affecting the UK's ambitious renewable energy targets.

-

Impact on UK Renewable Energy Targets: The reduction in investment jeopardizes the UK's commitment to achieving its net-zero targets. Delayed or cancelled projects will directly affect the country's renewable energy generation capacity.

-

Job Creation and Economic Growth: The reduced investment will have a knock-on effect on job creation within the renewable energy sector. Construction, engineering, and manufacturing jobs linked to these projects are at risk. This ripple effect could hinder broader economic growth in related sectors.

Consequences for Consumers and Energy Prices

The implications of SSE's revised spending plan extend to consumers and energy prices.

-

Increased Energy Prices: Reduced investment in new renewable energy capacity could constrain future energy supply, potentially leading to higher energy prices for consumers. This could disproportionately affect vulnerable households.

-

Energy Security and Supply Reliability: Delayed or cancelled projects could compromise the UK's energy security and supply reliability. A less diverse energy mix increases vulnerability to global energy price fluctuations.

-

Energy Independence Goals: The investment cut directly impacts the UK's ambition for greater energy independence. Reduced investment in domestic renewable energy sources makes the UK more reliant on imported energy.

-

Long-Term Impacts on Grid Modernization: A lack of investment in grid modernization will hinder the efficient integration of renewable energy sources into the national grid. This will ultimately limit the potential of renewable energy to meet future energy demand.

SSE's Future Investment Strategy

SSE needs to adapt its investment strategy to navigate the challenges posed by the £3 billion reduction.

-

Revised Investment Priorities: SSE is likely to prioritize projects with quicker returns and lower risk profiles. This could involve a shift in focus towards existing infrastructure upgrades or smaller-scale projects.

-

Stakeholder Communication: Open and transparent communication with stakeholders, including investors, government agencies, and consumers, is crucial to maintain confidence and support.

-

Potential Areas for Future Growth: SSE will likely explore new opportunities for investment and growth within the energy sector. This might involve strategic partnerships, exploring new technologies, or focusing on specific niche markets.

Conclusion: Assessing the Long-Term Effects of SSE's Revised Spending Plan

The £3 billion reduction in SSE's investment plan has far-reaching consequences. The impact on renewable energy projects, consumer energy prices, and the UK's energy independence goals is significant. Delayed or cancelled projects risk hindering the UK's transition to a low-carbon energy system. The long-term consequences of this decision need careful monitoring and analysis. Stay updated on the evolving situation with SSE's revised spending plan and its impact on future energy investment. The future of energy in the UK depends on informed decision-making and transparency in the energy sector.

Featured Posts

-

Moto Gp Inggris 2025 Jadwal Lengkap Siaran Langsung Trans7 And Spotv Dan Klasemen

May 26, 2025

Moto Gp Inggris 2025 Jadwal Lengkap Siaran Langsung Trans7 And Spotv Dan Klasemen

May 26, 2025 -

The Evolution Of David Hockneys Artistic Vision A Bigger Picture And Beyond

May 26, 2025

The Evolution Of David Hockneys Artistic Vision A Bigger Picture And Beyond

May 26, 2025 -

Russells Strategic Choice Overcoming Mercedes Key Weakness

May 26, 2025

Russells Strategic Choice Overcoming Mercedes Key Weakness

May 26, 2025 -

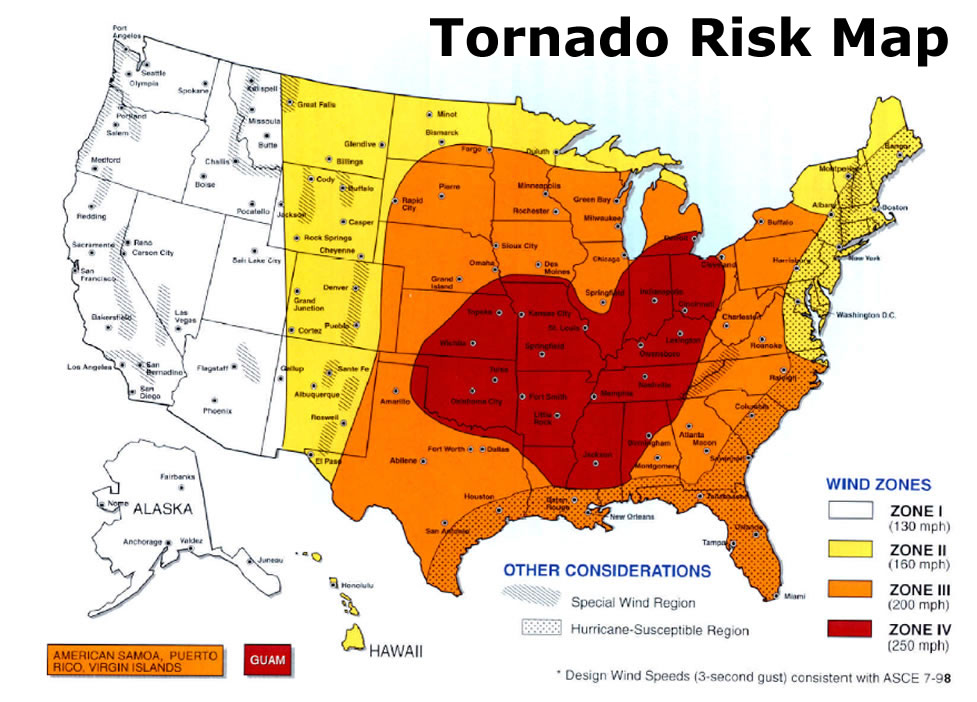

Flash Flood Warnings And April Tornado Count Update April 4 2025

May 26, 2025

Flash Flood Warnings And April Tornado Count Update April 4 2025

May 26, 2025 -

When Is The Saint On Itv 4 A Viewing Guide

May 26, 2025

When Is The Saint On Itv 4 A Viewing Guide

May 26, 2025